Statement of Changes in Beneficial Ownership (4)

August 20 2021 - 8:09AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

VANDERPLOEG MARTIN J. |

2. Issuer Name and Ticker or Trading Symbol

WORKIVA INC

[

WK

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

President & CEO |

|

(Last)

(First)

(Middle)

2900 UNIVERSITY BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/18/2021 |

|

(Street)

AMES, IA 50010

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 8/18/2021 | | S(1) | | 3775 | D | $134.47 (2) | 234776 | I | By living trust |

| Class A Common Stock | 8/18/2021 | | S(1) | | 12000 | D | $135.34 (3) | 222776 | I | By living trust |

| Class A Common Stock | 8/18/2021 | | S(1) | | 1725 | D | $136.04 (4) | 221051 | I | By living trust |

| Class A Common Stock | 8/19/2021 | | S(1) | | 4467 | D | $132.59 (5) | 216584 | I | By living trust |

| Class A Common Stock | 8/19/2021 | | S(1) | | 6939 | D | $133.55 (6) | 209645 | I | By living trust |

| Class A Common Stock | 8/19/2021 | | S(1) | | 3586 | D | $134.86 (7) | 206059 | I | By living trust |

| Class A Common Stock | 8/19/2021 | | S(1) | | 2508 | D | $135.41 (8) | 203551 | I | By living trust |

| Class A Common Stock | | | | | | | | 357701 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B Common Stock (9) | (9) | | | | | | | (9) | (9) | Class A Common Stock | 1177011.0 | | 1177011 | I | By living trust |

| Class B Common Stock (9) | (9) | | | | | | | (9) | (9) | Class A Common Stock | 889020.0 | | 889020 | I | By charitable remainder trust |

| Employee Stock Option to Purchase Class A Common Stock (10) | $12.4 | | | | | | | 2/1/2018 (11) | 1/31/2027 | Class A Common Stock | 200204.0 | | 200204 | D | |

| Employee Stock Option to Purchase Class A Common Stock (10) | $14.74 | | | | | | | 2/1/2017 (11) | 1/31/2026 | Class A Common Stock | 168421.0 | | 168421 | D | |

| Employee Stock Option to Purchase Class A Common Stock (12) | $15.83 | | | | | | | 8/12/2015 (13) | 8/11/2024 | Class A Common Stock | 133650.0 | | 133650 | D | |

| Explanation of Responses: |

| (1) | The sales reported in this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on March 16, 2021 in accordance with Rule 10b5-1 of Securities Exchange Act of 1934, as amended. This Rule 10b5-1 plan provides for fixed sales of a total of up to 315,000 shares of Class A Common Stock through January 2022. |

| (2) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $133.87 to $134.86. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (3) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $134.88 to $135.86. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (4) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $135.88 to $136.28. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (5) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $132.09 to $133.07. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (6) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $133.09 to $134.08. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (7) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $134.22 to $135.19. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (8) | The price reported in Column 4 is a weighted-average price. The price actually received ranges from $135.22 to $135.58. For all transactions reported in this Form 4 utilizing a weighted-average price, the reporting person undertakes to provide upon request by the SEC staff, the issuer, or a security holder of the issuer, full information regarding the number of shares sold at each separate price within the range. |

| (9) | Each share of Class B Common Stock is convertible, at any time at the election of the holder, into one share of Class A Common Stock. In addition, each share of Class B Common Stock will convert automatically into one share of Class A Common Stock upon (i) the date specified by the holders of at least 66 2/3% of the outstanding shares of Class B Common Stock, (ii) any transfer, except for certain "qualified transfers" (as defined in the Issuer's Certificate of Incorporation) or (iii) upon the death of a natural person holding shares of Class B Common Stock (subject to certain exceptions as defined in the Issuer's Certificate of Incorporation). |

| (10) | Grant of stock option pursuant to the 2014 Equity Incentive Plan. |

| (11) | Vests in three equal annual installments commencing on the first anniversary of the grant date. |

| (12) | Granted pursuant to 2009 Unit Incentive Plan. |

| (13) | Vests as to 25% of the shares on the first anniversary of the grant date and as to 6.25% of the shares at the end of each three-month period thereafter. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

VANDERPLOEG MARTIN J.

2900 UNIVERSITY BOULEVARD

AMES, IA 50010 | X |

| President & CEO |

|

Signatures

|

| /s/ Brandon E. Ziegler as attorney-in-fact for Martin J. Vanderploeg | | 8/20/2021 |

| **Signature of Reporting Person | Date |

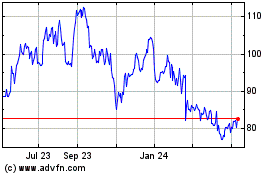

Workiva (NYSE:WK)

Historical Stock Chart

From Mar 2024 to Apr 2024

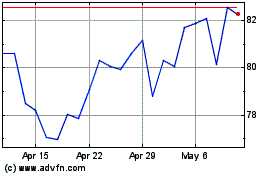

Workiva (NYSE:WK)

Historical Stock Chart

From Apr 2023 to Apr 2024