Winnebago Industries, Inc. (NYSE: WGO), a leading outdoor lifestyle

product manufacturer, today announced that it has entered into a

definitive agreement to acquire Barletta Pontoon Boats

(“Barletta”), the industry’s fastest-growing, premium pontoon boat

manufacturer, for an initial consideration of $255 million in cash

and newly-issued Winnebago Industries shares, plus up to $15

million in Winnebago Industries shares upon the achievement of

performance milestones at the end of calendar 2021. Certain growth

objectives, if achieved through calendar years 2022 and 2023,

provide the opportunity for up to $50 million in additional cash

consideration. The transaction extends Winnebago Industries’ marine

platform into one of the fastest-growing boating segments, advances

the Company’s ongoing evolution into a premier outdoor lifestyle

company, and is expected to drive significant financial accretion.

Barletta was founded in 2017 with a focus on high-quality,

innovative products, unrivaled service and strong dealer

relationships, which has allowed the company to grow rapidly in the

pontoon boat segment and establish a strong, differentiated

position in the market. The privately-owned company manufactures a

portfolio of premium pontoon boats and has a network of 125 dealer

locations across the U.S. and Canada with coast-to-coast coverage

and significant opportunity for regional expansion. Barletta

generated full-year 2020 revenues of $120.6 million and EBITDA of

$10.5 million, and expects to deliver full-year 2021 revenues of

approximately $214.6 million and EBITDA of $26.4 million.

Barletta’s growth trajectory is supported by a strong backlog of

orders. The company recently opened a new manufacturing facility in

Bristol, Indiana to add production capacity and scale to better

meet the demands of its continued growth.

"The acquisition of Barletta significantly expands Winnebago

Industries’ presence in the strong and growing marine market by

acquiring the fastest-growing brand within one of the most

rapidly-growing boating segments," said Winnebago Industries

President and Chief Executive Officer, Michael Happe. "Barletta's

premium, innovative pontoon boats are a natural fit with our

broader brand portfolio, with shared appeal among families looking

to create great experiences and memories on land or on water.

Barletta's commitment to quality, innovation and service – the same

golden threads that unite all Winnebago Industries brands – and

strong relationships with its dealer partners, has driven

tremendous growth, enabling Barletta to become a rising force in

the industry in a short period of time. We look forward to

leveraging our operational excellence, functional resources and

proven expertise in nurturing and growing outdoor lifestyle brands

to fuel the organic expansion of Barletta’s product line, market

share and margins. We are excited to welcome Barletta’s talented

employees to the Winnebago Industries team and believe this

transaction positions us well to deliver enhanced growth and

significant value creation for employees, customers and

shareholders.”

Barletta Pontoon Boats President and Founder Bill Fenech

commented, “Today is an exciting day for Barletta, as Winnebago

Industries’ track record of cultivating premium outdoor lifestyle

brands will allow us to further accelerate our growth, expand our

offerings, and gain greater share of the pontoon boat market

segment. Our shared values and dedication to creating exceptional

outdoor experiences make Winnebago Industries an ideal owner and

partner for us. We look forward to continuing to innovate and

deliver the highest-quality products, unrivaled customer

experience, and win-win partnerships with our dealers as Barletta

grows within the Winnebago Industries portfolio."

Following the close of the transaction, Barletta will operate as

a distinct business unit within Winnebago Industries. Winnebago

Industries’ public reporting will include the formation of new

Marine reporting segment comprised of Barletta and Chris-Craft.

Barletta’s manufacturing facilities will remain in Bristol,

Indiana. Bill Fenech will continue to lead the Barletta business

post-closing as its President.

Transaction Highlights

- Extends Winnebago Industries’ Marine Platform into the

Highly Attractive Pontoon Market Segment: The acquisition

of Barletta broadens Winnebago Industries’ presence in the

complementary and growing Marine market. Built on versatility,

value and accessibility, pontoon boats represent the largest and

one of the fastest-growing boating segments in North America,

growing at double-digit CAGR over the past 10 years. As the demand

for products by outdoor enthusiasts continues to grow, an expanded

marine platform will enable Winnebago Industries to grow its

customer reach and further balance its overall portfolio and

revenue profile beyond recreational vehicles (RVs). Barletta’s

premium pontoons are highly differentiated from Winnebago

Industries’ Chris-Craft brand and have very limited dealer overlap

with other Winnebago Industries brands. Additionally, the pontoon

boat market segment provides an opportunity for Winnebago

Industries to leverage the intersections between the RV and marine

lifestyles and customer demographics, enhance sales and share best

practices across the entire Winnebago Industries enterprise.

- Enhances Winnebago Industries’ Growth Profile with

Barletta’s Fast-Growing, High-Quality Brand: Recognized

for its quality and innovation in the premium pontoon boat

category, Barletta has achieved a 60+% revenue CAGR since its first

year of production in 2018 and is already ranked among the top ten

pontoon manufacturers by market share. Barletta’s three main tiers

of premium pontoons offer an extensive customer lifetime value

runway as consumers upgrade over time. Barletta will benefit from

Winnebago Industries’ proven framework for differentiation through

unique approaches to quality, innovation and service, and the

ability to leverage the Company’s operational expertise, supply

chain relationships and resources to fuel product line expansion

and broader geographic dealer penetration into untapped US

markets.

- Attractive Financial Impact: The transaction

is expected to be accretive to Winnebago Industries’ cash earnings

per share starting in the first year after closing and will also be

accretive to EBITDA margins. Barletta expects to generate

approximately $215 million in calendar 2021 revenue and has a

rapidly expanding margin profile – growing EBITDA margin from 8.7%

in 2020 to 9.5% for the last twelve months as of March 31, 2021 –

with opportunities for continued, meaningful expansion over

time.

- Deepens Winnebago

Industries’ Bench of Marine Talent and Expertise: The

addition of Barletta’s deeply experienced management team, led by

Bill Fenech, brings valuable marine expertise to Winnebago

Industries and enhances Winnebago Industries’ ability to develop

new opportunities for continued growth. The Barletta team shares

with Winnebago Industries an unwavering focus on building

high-quality products, serving as a true partner to dealers,

delivering an unparalleled customer experience, and fostering a

culture of teamwork and community for employees.

Transaction Details

- The initial transaction consideration of $255 million is

expected to be funded with $230 million in cash on hand and $25

million in newly-issued Winnebago Industries stock upon closing,

and Winnebago Industries will issue up to an additional $15 million

in Winnebago Industries stock to Barletta ownership upon the

achievement of performance milestones at the end of calendar

2021.

- The total $270 million expected initial consideration values

Barletta at approximately 8.5x Barletta’s estimated 2021 EBITDA,

including $29.7 million in acquired tax assets and excluding real

estate assets also included in the transaction valued at

approximately $15 million.

- Under the terms of the agreement, Barletta ownership is

entitled to receive further cash payments of up to $50 million upon

the achievement of certain performance milestones in calendar years

2022 and 2023.

- Following the close of the transaction, Winnebago Industries

expects to maintain its strong financial flexibility and balance

sheet with a pro forma net debt to Adjusted EBITDA ratio following

the acquisition of Barletta below the target range of 0.9 –

1.5x.

The transaction is expected to close early in Winnebago

Industries’ first quarter of Fiscal 2022, subject to regulatory

approvals and other customary closing conditions.

Lazard is serving as exclusive financial advisor to Winnebago

Industries and Faegre Drinker Biddle & Reath LLP is

serving as legal advisor.

Conference CallWinnebago Industries, Inc. will discuss the

transaction at 7:30 a.m. Central Time today. Members of the news

media, investors and the general public are invited to access a

live broadcast of the conference call via the Investor Relations

page of the Company's website at http://investor.wgo.net. The event

will be archived and available for replay for the next 90 days.

About Winnebago IndustriesWinnebago Industries, Inc. (NYSE:

WGO) is a leading North American manufacturer of outdoor lifestyle

products under the Winnebago, Grand Design, Chris-Craft and

Newmar brands, which are used primarily in leisure travel and

outdoor recreation activities. The Company builds quality

motorhomes, travel trailers, fifth wheel products, boats and

commercial community outreach vehicles. Winnebago

Industries has multiple facilities in Iowa, Indiana, Minnesota

and Florida. For access to Winnebago Industries' investor

relations material or to add your name to an automatic email list

for Company news releases,

visit http://investor.wgo.net.

About Barletta Pontoon BoatsHeadquartered in Bristol, Indiana,

Barletta Pontoon Boats is a premium pontoon boat manufacturer whose

focus on high-quality, innovative products, unrivaled customer

experience and strong dealer relationships have propelled its rapid

growth since it was founded in 2017. Today, Barletta is the

fastest-growing company in the pontoon segment with over 300

dedicated employees and an expansive network of dealer partners

across the United States and Canada. Visit barlettapontoonboats.com

for more information.

Forward Looking StatementsThis press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Investors are cautioned

that forward-looking statements are inherently uncertain and

involve potential risks and uncertainties. A number of factors

could cause actual results to differ materially from these

statements, including, but not limited to risks relating to the

Company’s proposed acquisition of Barletta Pontoon Boats and

related companies (“Barletta”), including the possibility that the

closing conditions to the contemplated transaction may not be

satisfied or waived, including that a governmental entity may

prohibit, delay or refuse to grant antitrust approval; delay in

closing the transaction or the possibility of non-consummation of

the transaction; the occurrence of any event that could give rise

to termination of the Purchase Agreement; risks inherent in the

achievement of expected financial results and cost synergies for

the acquisition and the timing thereof; risks that the pendency,

financing, and efforts to consummate the transaction may be

disruptive to the Company or Barletta or their respective

management teams; the effect of announcing the transaction on

Barletta’s ability to retain and hire key personnel and maintain

relationships with customers, suppliers and other third parties;

risks related to integration of the two companies and other

factors. Additional information concerning other risks and

uncertainties that could cause actual results to differ materially

from that projected or suggested is contained in the Company's

filings with the Securities and Exchange Commission (SEC) over the

last 12 months, copies of which are available from the SEC or from

the Company upon request. The Company disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained in this press release or to reflect

any changes in the Company's expectations after the date of this

press release or any change in events, conditions or circumstances

on which any statement is based, except as required by law.

Contact: Steve Stuber - Investor Relations - 952-828-8461 –

srstuber@wgo.net

Media Contact: Sam Jefson - Public Relations Specialist -

641-585-6803 - sjefson@wgo.net

Non-GAAP ReconciliationThe following information provides

reconciliations of non-GAAP financial measures relating to

Barletta, which are presented in the accompanying news release, to

the most comparable financial measures calculated and presented in

accordance with accounting principles generally accepted in the

U.S. ("GAAP"). The Company has provided non-GAAP financial

measures, which are not calculated or presented in accordance with

GAAP, as information supplemental and in addition to the financial

measures presented in the accompanying news release that are

calculated and presented in accordance with GAAP. Such non-GAAP

financial measures should not be considered superior to, as a

substitute for, or as an alternative to, and should be considered

in conjunction with, the GAAP financial measures presented in the

news release. The non-GAAP financial measures in the accompanying

news release may differ from similar measures used by other

companies. The following tables reconcile the non-GAAP measure of

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization ("EBITDA") referred to in this press release to the

most directly comparable GAAP measure.

Barletta Pontoon Boats Net Income to EBITDA Reconciliation

|

($ in millions) |

Barletta 2020 Actual* |

Barletta 2021 Estimates* |

|

Net Income |

$9.8 |

$24.7 |

|

Interest Expense |

0.0 |

0.0 |

|

Provision for Income Taxes |

0.0 |

0.0 |

|

Depreciation |

0.7 |

1.7 |

|

Amortization |

0.0 |

0.0 |

|

EBITDA |

$10.5 |

$26.4 |

* Data represents Barletta Pontoon Boats, LLC.

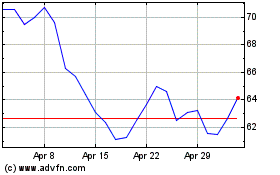

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

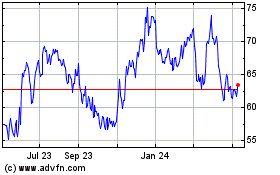

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Apr 2023 to Apr 2024