Current Report Filing (8-k)

March 24 2020 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 20, 2020

Whitestone REIT

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-34855

|

|

76-0594970

|

|

|

|

|

|

|

|

(State or Other Jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

2600 South Gessner, Suite 500

|

|

|

|

Houston, TX

|

|

77063

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

(713) 827-9595

|

|

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

Not Applicable

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common shares of beneficial interest, par value $0.001 per share

|

WSR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On March 20, 2020, Whitestone REIT (the “Company”), through its operating partnership, Whitestone REIT Operating Partnership, L.P. (the “Operating Partnership”), drew down approximately $30.0 million of its unsecured credit facility (the “2019 Facility”), which is governed by the Company’s previously disclosed Second Amended and Restated Credit Agreement, dated as of January 31, 2019, with the lenders party thereto, Bank of Montreal, as administrative agent, SunTrust Robinson Humphrey, as syndication agent, and BMO Capital Markets Corp., U.S. Bank National Association, SunTrust Robinson Humphrey and Regions Capital Markets, as co-lead arrangers and joint book runners, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 6, 2019 and is incorporated herein by reference. The Company expects that the funds will be used for working capital and general corporate purposes. Following the drawdown, subject to any potential future paydowns or increases in the borrowing base, there is no current remaining availability under the 2019 Facility.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Due to the emerging public health impact of the coronavirus outbreak (COVID-19), on March 20, 2020, the Company amended Article II, Section 1 of Company’s Bylaws (the “Bylaws” and, as amended and restated, the “Amended Bylaws”) to allow the Company to hold virtual shareholder meetings. A copy of the Amended Bylaws is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On March 24, 2020, the Company issued a press release relating to its response to the ongoing COVID-19 outbreak and crisis, which is furnished herewith as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Forward-Looking Statements

Certain statements contained in this Current Report on Form 8-K constitute forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends for all such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such information is subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of the Company’s performance in future periods. Such forward-looking statements can generally be identified by the Company’s use of forward-looking terminology, such as “may,” “will,” “plan,” “expect,” “intend,” “anticipate,” “believe,” “continue” or similar words or phrases that are predictions of future events or trends and which do not relate solely to historical matters , and include, without limitation: (a) the impact of the coronavirus (COVID-19) pandemic on macroeconomic conditions and economic conditions in the markets in which the Company operates, including, among others: (i) disruptions in, or a lack of access to, the capital markets or disruptions in the Company’s ability to draw amounts under its credit facility, (ii) adverse impacts to the Company’s tenants’ and other third parties’ businesses that adversely affect the ability and willingness of the Company’s tenants to satisfy their obligations to the Company, (iii) the ability and willingness of the Company’s tenants to continue to pay rent on time or at all, renew their leases with the Company upon expiration of the leases or to re-lease the Company’s properties on the same or better terms in the event of nonrenewal or early termination of existing leases, and (iv) federal and state government initiatives to mitigate the impact of the coronavirus pandemic, including additional restrictions on business activities and potential shelter-in-place other restrictions, either nationally or in Texas or the Phoenix, Arizona areas and the timing and amount of economic stimulus or other initiatives; (b) the Company’s ability to accurately assess and predict the impact of the coronavirus pandemic on its results of operations, financial condition, acquisition and disposition activities and growth opportunities; and (c) the information under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and in other filings the Company makes from time to time with the Securities and Exchange Commission.. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report on Form 8-K. The Company cannot guarantee the accuracy of any such forward-looking statements contained in this Current Report on Form 8-K, and the Company does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

|

|

Second Amended and Restated Credit Agreement, dated as of January 31, 2019, among Whitestone REIT Operating Partnership, L.P., Whitestone REIT, et al., as guarantors, the lenders party thereto, and Bank of Montreal, as Administrative Agent (previously filed and incorporated by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K, filed on February 6, 2019).

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Whitestone REIT

|

|

Date: March 24, 2020

|

|

By:

|

/s/ David K. Holeman

|

|

|

|

|

David K. Holeman

|

|

|

|

|

Chief Financial Officer

|

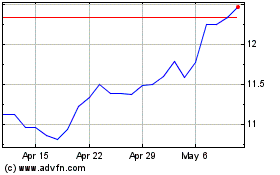

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Apr 2023 to Apr 2024