Legg Mason Partners Fund Advisor, LLC Announces Distributions for Certain Closed-End Funds Pursuant to their Managed Distribu...

December 11 2020 - 8:00AM

Business Wire

Legg Mason Partners Fund Advisor, LLC announced today that

certain closed-end funds have declared their distributions pursuant

to their managed distribution policy for the months of December

2020, January and February 2021.

The following dates apply to the distribution schedule

below:

Month

Record Date

Ex-Dividend Date

Payable Date

December (a)

12/23/2020

12/22/2020

12/31/2020

January

1/22/2021

1/21/2021

1/29/2021

February

2/19/2021

2/18/2021

2/26/2021

Ticker

Fund Name

Month

Amount

Change from Previous

Distribution

WIA

Western Asset Inflation-Linked Income

Fund

December

$0.02950

-

December

$0.40000

(a)

January

$0.02950

February

$0.02950

WIW

Western Asset Inflation-Linked

Opportunities & Income Fund

December

$0.03100

-

January

$0.03100

February

$0.03100

- Western Asset Inflation-Linked Income Fund (“WIA”) is

distributing a special dividend of $0.40000 per common share

payable December 31, 2020 to shareholders of record as of December

23, 2020 with an Ex-Dividend date of December 22, 2020.

Pursuant to its managed distribution policy, each Fund intends

to make regular monthly distributions to shareholders at a fixed

rate per common share, which rate may be adjusted from time to time

by the Fund’s Board of Trustees. Under each Fund’s managed

distribution policy, if, for any monthly distribution, the value of

the Fund’s net investment income and net realized capital gain is

less than the amount of the distribution, the difference will be

distributed from the Fund’s net assets (and may constitute a

“return of capital”). The Board of Trustees may modify, terminate

or suspend the managed distribution policy at any time. Any such

modification, termination or suspension could have an adverse

effect on the market price of the Funds’ shares.

The Funds’ distributions have been set based on the current

level of income generated from the Funds’ investment portfolio and

accumulated capital gains, if any. Based on the Funds’ tax

accounting records, which also factors in currency fluctuations,

each Fund’s estimated source of cumulative fiscal year-to-date

distributions is presented in the table below:

Fund

Fiscal Year End

Income

Short-Term Capital

Gains

Long-Term Capital

Gains

Return of Capital

WIA

Nov 30

-

60.00%

40.00%

-

(b)

WIW

Nov 30

100.00%

-

-

-

(b)

(b) Sources of cumulative fiscal year-to-date distributions are

estimated through February 28, 2021.

The updated estimated components of the distributions announced

today will be provided to shareholders of record in a separate

notice when the distributions are paid.

This press release is not for tax reporting purposes but is

being provided to announce the amount of each Fund’s distributions

that have been declared by the Board of Trustees. In early 2021 and

early 2022, after definitive information is available, each Fund

will send shareholders a Form 1099-DIV, if applicable, specifying

how the distributions paid by each Fund during the prior calendar

year should be characterized for purposes of reporting the

distributions on a shareholder’s tax return (e.g., ordinary income,

long-term capital gain or return of capital).

On July 31, 2020, Franklin Resources, Inc. (“Franklin

Resources”) acquired Legg Mason, Inc. (“Legg Mason”) in an all-cash

transaction. As a result of the transaction, Legg Mason Partners

Fund Advisor, LLC, previously a wholly-owned subsidiary of Legg

Mason, became a wholly-owned subsidiary of Franklin Resources.

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ web site at www.lmcef.com. Hard copies of the Funds’ complete

audited financial statements are available free of charge upon

request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Funds.

Category: Distribution Related

Source: Franklin Templeton

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201211005194/en/

Investor Contact: Fund Investor Services

1-888-777-0102

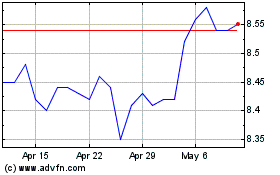

Western Asset Inflation ... (NYSE:WIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

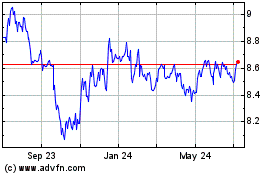

Western Asset Inflation ... (NYSE:WIW)

Historical Stock Chart

From Apr 2023 to Apr 2024