Amended Statement of Beneficial Ownership (sc 13d/a)

February 10 2021 - 4:04PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

(Rule

13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

§ 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment

No. 7) 1

Western

Asset Inflation - Linked Securities & Income Fund

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

95766Q106

(CUSIP

Number)

Jodi

Hedberg, Chief Compliance Officer

Karpus

Management, Inc.

d/b/a

Karpus Investment Management

183

Sully’s Trail

Pittsford,

New York 14534

(585)

586-4680

Adam

W. Finerman, Esq.

Olshan

Frome Wolosky LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

February

8, 2021

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☒

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties to whom copies are to be sent.

________________________

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP

No. 95766Q106

|

13D

|

Page

2 of 5 Pages

|

|

1.

|

|

NAME

OF REPORTING PERSON

Karpus

Investment Management

|

|

|

|

2.

|

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

(a)

☒

(b)

☐

|

|

3.

|

|

SEC

USE ONLY

|

|

|

|

4.

|

|

SOURCE

OF FUNDS

WC

|

|

|

|

5.

|

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

|

☐

|

|

6.

|

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

NEW YORK

|

|

|

|

|

|

|

|

|

|

NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

|

7.

|

|

SOLE

VOTING POWER

4,792,366

Shares

|

|

|

8.

|

|

SHARED

VOTING POWER

0

Shares

|

|

|

9.

|

|

SOLE

DISPOSITIVE POWER

5,042,772

Shares

|

|

|

10.

|

|

SHARED

DISPOSITIVE POWER

0

Shares

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,042,772

Shares

|

|

|

|

12.

|

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

|

☐

|

|

13.

|

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

21.62%

|

|

|

|

14.

|

|

TYPE

OF REPORTING PERSON

IA

|

|

|

|

CUSIP

No. 95766Q106

|

13D

|

Page

3 of 5 Pages

|

The following constitutes Amendment No. 7 to the Schedule 13D filed

by the undersigned (“Amendment No. 7”). This Amendment No. 7 amends the Schedule 13D as specifically set forth herein.

|

|

Item

2.

|

Identity

and Background.

|

Item

2 of the Schedule 13D is hereby amended and restated as follows:

(a)

This statement is filed by:

(i)

Karpus

Management, Inc., d/b/a Karpus Investment Management ("Karpus"). Karpus is a registered investment adviser under Section 203 of

the Investment Advisers Act of 1940. Karpus is controlled by City of London Investment Group plc (“CLIG”), which is

listed on the London Stock Exchange. However, in accordance with SEC Release No. 34-39538 (January 12, 1998), effective informational

barriers have been established between Karpus and CLIG such that voting and investment power over the subject securities is exercised

by Karpus independently of CLIG, and, accordingly, attribution of beneficial ownership is not required between Karpus and CLIG.

The shares to which this Amendment No. 7 relates are owned directly by the accounts managed by Karpus;

Set

forth on Schedule A annexed hereto ("Schedule A") is the name and present principal business, occupation

or employment and the name, principal business and address of any corporation or other organization in which such employment is

conducted of the executive officers and directors of Karpus. To the best of the Reporting Persons' knowledge, except as otherwise

set on Schedule A, none of the persons listed on Schedule A beneficially owns any securities of the

Issuer or is a party to any contract, agreement or understanding required to be disclosed herein.

(b)

The address of the principal office of Karpus is 183 Sully's Trail, Pittsford, New York

14534.

(c)

The principal business of Karpus is serving as a registered investment adviser that provides investment management for individuals,

pension plans, profit sharing plans, corporations, endowments, trusts, and others.

(d)

Karpus nor any person listed on Schedule A has, during the last five years, been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors).

(e)

Karpus nor any person listed on Schedule A has, during the last five years, been party to a civil

proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

(f)

Karpus is organized under the laws of the State of New York.

|

|

Item

3.

|

Source

and Amount of Funds or Other Consideration.

|

Item

3 is hereby amended and restated to read as follows:

Karpus

Management, Inc., d/b/a Karpus Investment Management ("Karpus"), an independent registered investment advisor, has accumulated

5,042,772 Shares on behalf of accounts that are managed by Karpus (the "Accounts") under limited powers of attorney, which represents

21.62% of the outstanding Shares. All funds that have been utilized in making such purchases for the Accounts (which are open

market purchases unless otherwise noted) are from such Accounts.

The

aggregate purchase price of the 5,042,772 Shares beneficially owned by Karpus is approximately $57,734,567, excluding brokerage

commissions. The Shares purchased by Karpus were purchased with working capital (which may at any given time, include margin loans

made by brokerage firms in the ordinary course of business) in open market purchases except as otherwise noted.

|

|

Item

5.

|

Interest

in Securities of the Issuer.

|

Items

5A. (a) – (c) are hereby amended and restated to read as follows:

The aggregate percentage of Shares reporting owned by Karpus is

based upon 23,322,256 Common Shares assumed to be outstanding as of December 31, 2020, based on the 29,152,820 Common Shares outstanding

as of May 31, 2020, as reported in the Issuer’s Form N-CSR filed on July 24, 2020, less the 5,830,564 Common Shares purchased

from tendering shareholders, as reported in the Issuer’s Schedule TO filed on December 31, 2020.

|

|

(a)

|

As

of the close of business on February 8, 2021, Karpus beneficially owned the 5,042,772 Shares held in the

Accounts.

|

Percentage:

Approximately 21.62%

|

|

(b)

|

1. Sole power to vote or direct vote: 4,792,366

|

|

|

2. Shared power to vote or direct vote: 0

|

|

|

3. Sole power to dispose or direct the disposition: 5,042,772

|

|

|

4. Shared power to dispose or direct the disposition: 0

|

|

|

(c)

|

The

transactions in the Shares by Karpus for the past 60 days are set forth in Schedule

B and

incorporated herein by reference.

|

The

filing of this Schedule 13D shall not be deemed an admission that Karpus is, for purposes of Section 13(d) of the Securities Exchange

Act of 1934, as amended, the beneficial owner of any securities of the Issuer that it does not directly own. Karpus specifically

disclaims beneficial ownership of the securities reported herein that it does not directly own.

|

CUSIP

No. 95766Q106

|

13D

|

Page

4 of 5 Pages

|

SIGNATURES

After

reasonable inquiry and to the best of its knowledge and belief, each of the undersigned certifies that the information set forth

in this statement is true, complete and correct.

|

|

KARPUS

MANAGEMENT, INC.

|

|

|

|

|

Dated: February

10, 2021

|

By:

|

/s/ Jodi

Hedberg

|

|

|

|

Name: Jodi Hedberg

Title: Chief Compliance Officer

|

|

|

|

|

|

CUSIP

No. 95766Q106

|

13D

|

Page

5 of 5 Pages

|

SCHEDULE A

Executive

Officers & Directors of Karpus Management, Inc., d/b/a Karpus Investment Management

|

Name

|

Position & Present Principal Occupation

|

Business Address

|

Shares Owned

|

|

|

|

|

|

|

Kathleen Finnerty Crane

|

Chief Financial Officer

|

183 Sully’s Trail, Pittsford, New York 14534

|

73 Shares

|

|

Dana R. Consler

|

Executive Vice President

|

183 Sully’s Trail, Pittsford, New York 14534

|

1,550 Shares

|

|

Thomas M. Duffy

|

Senior Vice President and

Director of Operations

|

183 Sully’s Trail, Pittsford, New York 14534

|

0 Shares

|

|

Sharon L. Thornton

|

Executive Vice President

|

183 Sully’s Trail, Pittsford, New York 14534

|

0 Shares

|

|

Jodi L. Hedberg

|

Chief Compliance Officer

|

183 Sully’s Trail, Pittsford, New York 14534

|

0 Shares

|

|

Daniel L. Lippincott

|

Chief

Investment Officer

|

183 Sully’s Trail, Pittsford, New York 14534

|

0 Shares

|

|

David D’Ambrosio

|

Senior Vice President

|

183 Sully’s Trail, Pittsford, New York 14534

|

722 Shares

|

|

Marijoyce Ryan

|

Senior Vice President

|

183 Sully’s Trail, Pittsford, New York 14534

|

0 Shares

|

|

Thomas

Wayne Griffin

|

Director

|

1125

Airport Road, Coatesville, PA 19320

|

0 Shares

|

|

Carlos

Manuel Yuste

|

Director

|

1125

Airport Road, Coatesville, PA 19320

|

0 Shares

|

SCHEDULE B

Transactions

in the Shares for the past sixty (60) days

|

Nature of the Transaction

|

Securities

Purchased/(Sold)

|

Price Per

Share($)

|

Date of

Purchase / Sale

|

KARPUS MANAGEMENT, INC., D/B/A/ KARPUS

INVESTMENT MANAGEMENT

(THROUGH THE ACCOUNTS)

|

Sale

of Common Stock

|

(19,775)

|

$13.31

|

12/10/2020

|

|

Sale

of Common Stock

|

(28,850)

|

$13.30

|

12/14/2020

|

|

Sale

of Common Stock

|

(6,000)

|

$13.48

|

12/15/2020

|

|

Sale

of Common Stock

|

(1,956,687)

|

$13.99

|

12/31/2020

|

|

Sale

of Common Stock

|

(1,081)

|

$13.13

|

1/6/2021

|

|

Sale

of Common Stock

|

(217)

|

$12.97

|

1/11/2021

|

|

Sale

of Common Stock

|

(8)

|

$12.73

|

1/12/2021

|

|

Sale

of Common Stock

|

(199)

|

$12.89

|

1/21/2021

|

|

Sale

of Common Stock

|

(1,388)

|

$12.94

|

2/5/2021

|

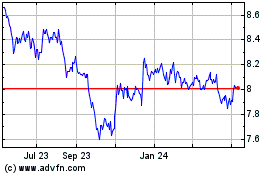

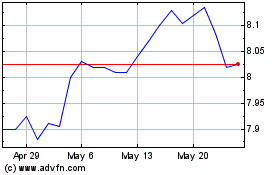

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Asset Inflation ... (NYSE:WIA)

Historical Stock Chart

From Apr 2023 to Apr 2024