Wells Fargo Profit Drops 89% as it Girds for Soured Loans -- Update

April 14 2020 - 9:21AM

Dow Jones News

By Ben Eisen

Wells Fargo & Co.'s first-quarter profit sank 89% and the

bank set aside billions of dollars to cover potential losses on

loans to borrowers hurt by the coronavirus pandemic.

The San Francisco-based bank made $653 million in profit

compared with $5.86 billion in the year-earlier period. Earnings

per share were 1 cent. Analysts polled by FactSet had forecast 38

cents.

Revenue of $17.72 billion was down 18% from $21.61 billion a

year ago. That missed analyst expectations of $19.4 billion.

The spread of the coronavirus hit banks hard in the first

quarter as it forced much of the country to stay home and

eliminated millions of jobs. Corporations drew down on bank credit

lines and consumers asked to pause debt payments.

The bank has begun setting aside money to cover losses on loans

to customers that were hurt by the coronavirus and may not be able

to pay their mortgages or commercial loans. Wells Fargo said it has

set aside $3.83 billion to cover potential loan losses, up more

than $3 billion from the previous quarter.

Before the crisis hit, Wells Fargo was already dealing with a

fake-accounts scandal that has battered its reputation. The bank

last year hired a new chief executive, Charles Scharf, an outsider

tasked with resolving outstanding regulatory issues.

The bank's business lines have been lagging. Profit in each of

its business units fell in the first quarter compared with the

year-earlier period.

Wells Fargo has leaned heavily on cost cuts. Expenses in the

first quarter totaled $13.05 billion, down 6% from $13.92 billion a

year ago.

Still, it could be harder for banks to cut costs in the current

health crisis. The coronavirus is forcing banks to spend money

giving bonuses to front-line workers, deep-cleaning offices and

setting up work-from-home capabilities.

In February, the bank reached a $3 billion settlement with the

Justice Department and Securities and Exchange Commission, closing

the door on a major portion of its legal problems.

However, the bank still faces regulatory problems, including a

restriction on its growth. The Federal Reserve temporarily lifted a

piece of that restriction after Wells Fargo said the sanction was

forcing it to limit small-business loans.

The bank's net interest income fell 8% to $11.31 billion. The

Federal Reserve last month cut rates to near zero, and lower rates

crimp what banks can charge on loans.

Noninterest income fell 31% to $6.41 billion.

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

April 14, 2020 09:06 ET (13:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

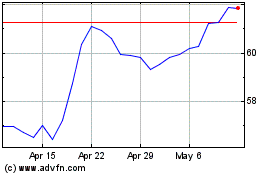

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

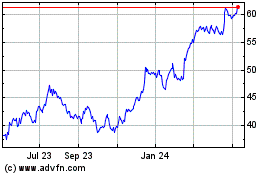

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024