Wells Fargo Reports Falling Profit

October 15 2019 - 8:46AM

Dow Jones News

By Rachel Louise Ensign

Wells Fargo & Co. said Tuesday that third-quarter profit

fell.

Quarterly profit at the San Francisco-based bank was $4.61

billion, compared with $6.01 billion a year ago. Per share,

earnings were 92 cents. Analysts polled by FactSet had expected

$1.24 per share.

Third-quarter revenue was $22.0 billion, up from $21.9 billion a

year ago. Analysts had expected $21.09 billion.

The company took a $1.6 billion charge for legal costs related

to its long-running sales-practices scandal, but also had a $1.1

billion gain related to the sale of a business.

The bank announced last month after a six-month search that it

would hire Bank of New York Mellon Corp. CEO Charles Scharf as

chief executive. He will be tasked with restoring the bank's

battered reputation and improving its standing with regulators. He

starts next week.

The bank's 2016 fake-account scandal badly damaged its

reputation and led to a morass of regulatory problems. Wells

Fargo's key business lines also have struggled in recent years.

What was once an aggressive, fast-growing lender whose profit

towered above those of rivals has become a firm with sluggish

revenues that is leaning heavily on cost cuts.

The bank now must also contend with falling interest rates,

which hurt profit. The Federal Reserve cut rates twice in the third

quarter.

Net-interest income fell 8% in the third quarter from a year

earlier.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

October 15, 2019 08:31 ET (12:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

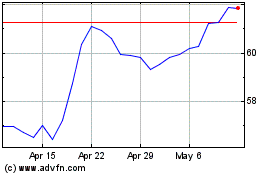

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

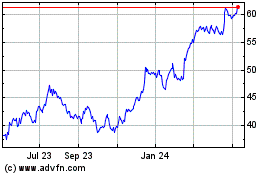

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024