Wells Fargo Names Charles Scharf President, CEO--2nd Update

September 27 2019 - 9:12AM

Dow Jones News

By Allison Prang and Colin Kellaher

Wells Fargo & Co. named Bank of New York Mellon Corp. Chief

Executive Charles Scharf as its new CEO, ending a six-month search

for a leader capable of restoring the bank's battered reputation

and improving its standing with regulators.

Wells Fargo said Mr. Scharf will join the bank as president and

CEO on Oct. 21. He succeeds C. Allen Parker, Wells Fargo's general

counsel, who has been serving as interim chief since Timothy Sloan

resigned in late March.

Mr. Scharf spent four years as the CEO of Visa before taking the

BNY Mellon job in July 2017. Prior to joining Visa, he was a top

lieutenant to JPMorgan Chase & Co. CEO James Dimon and spent

seven years running the bank's sprawling consumer operation.

Mr. Scharf has a tough job ahead of him at Wells Fargo, which

has been struggling to right itself since a fake-account scandal

erupted at the bank three years ago. Atop the agenda is getting

back in the good graces of regulators, who have been unsatisfied

with its response to problems exposed by the sales scandal. The

bank's operations also have suffered.

Mr. Scharf has experience with turnarounds. He was tasked with

overhauling BNY Mellon, a bank that handles much of Wall Street's

vital back-end work, such as tracking the value of securities. He

has slashed expenses but has been reluctant to set concrete targets

for the revamp. Revenue growth has been muted, and the stock has

fallen 9% in the past year.

Wells Fargo embarked on its own overhaul following the sales

scandal, reorganizing divisions and appointing new executives. Yet

problems continued to emerge throughout the bank over the past

three years. Nearly every one of its business lines is under

investigation by a government agency, including the Justice

Department and the Securities and Exchange Commission.

Until the 2016 scandal, Wells Fargo enjoyed a sterling

reputation as a bank that dodged the worst abuses of the financial

crisis. Mr. Sloan, a Wells Fargo veteran, took over as CEO at the

height of the scandal, following John Stumpf's resignation. By that

point, the bank's folksy image was in tatters.

Restoring it has proved difficult, especially where regulators

are concerned. In February 2018, the Federal Reserve took the

unprecedented step of capping the bank's growth, citing

risk-management deficiencies.

A few months later, the Consumer Financial Protection Bureau and

the Office of the Comptroller of the Currency imposed a $1 billion

fine on the bank for misconduct in its auto- and mortgage-lending

business. The OCC said it found risk-management deficiencies that

"constituted reckless, unsafe or unsound practices," leading to

improper charges to hundreds of thousands of consumers.

Regulators stepped up their pressure on the bank earlier this

year, leading to Mr. Sloan's resignation.

"I could not keep myself in a position where I was becoming a

distraction." Mr. Sloan said in a call with investors announcing

his resignation.

Dave Sebastian contributed to this article.

Write to Allison Prang at allison.prang@wsj.com and Colin

Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 27, 2019 08:57 ET (12:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

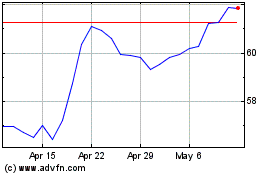

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

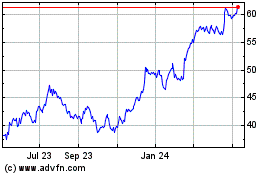

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024