Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-225349

The information in this preliminary prospectus

supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not

an offer to sell these securities, and we are not soliciting an offer to buy these securities, in any jurisdiction where the offer

or sale is not permitted.

SUBJECT TO COMPLETION,

DATED OCTOBER 5, 2020

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated June 1,

2018)

$

$ % Senior Notes due , 20

$ % Senior Notes due , 20

WEC

Energy Group, Inc. is offering $ aggregate principal amount of its %

senior notes due , 20 (the

“20 Notes”) and $ aggregate

principal amount of its % senior notes due ,

20 (the “20 Notes” and, together with the

20 Notes, the “Notes”). We will pay interest on the Notes semi-annually in

arrears on and

of each year, beginning on

, 2021. The Notes will be issued only in

denominations of $1,000 and integral multiples of $1,000.

We

may, at our option, redeem some or all of the Notes at any time prior to maturity at the applicable redemption

prices discussed under the caption “Certain Terms of the Notes — Redemption at Our Option.”

The

Notes will be unsecured and will rank equally with all of our other unsecured and unsubordinated debt and other obligations from

time to time outstanding.

Investing

in the Notes involves certain risks. See “Risk Factors” on page S-5 of this prospectus supplement.

We do not intend

to apply for listing of the Notes on any securities exchange or automated quotation system.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

|

|

|

Public

Offering Price(1)

|

|

Underwriting

Discount

|

|

Proceeds to

WEC Energy Group, Inc.

(before expenses)

|

|

Per 20 Note

|

|

%

|

|

%

|

|

%

|

|

Total

|

|

$

|

|

$

|

|

$

|

|

Per 20 Note

|

|

%

|

|

%

|

|

%

|

|

Total

|

|

$

|

|

$

|

|

$

|

(1) Plus accrued interest from October , 2020,

if settlement occurs after that date.

The underwriters

expect to deliver the Notes in book-entry form only through The Depository Trust Company on or about October , 2020.

Joint

Book-Running Managers

|

Barclays

|

J.P. Morgan

|

KeyBanc Capital Markets

|

|

TD Securities

|

US Bancorp

|

Wells Fargo Securities

|

Senior

Co-Manager

Goldman Sachs & Co. LLC

Co-Managers

|

Siebert Williams Shank

|

Comerica Securities

|

October

, 2020

You should rely

only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any

written communication from us or the underwriters specifying the final terms of the offering. We have not, and the underwriters

have not, authorized anyone to provide you with different information. Neither we nor the underwriters are making an offer of these

securities in any jurisdiction where the offer is not permitted. You should assume that the information contained in this prospectus

supplement, the accompanying prospectus or the documents incorporated by reference is accurate only as of their respective dates.

Our business, financial condition, results of operations and prospects may have changed since those dates.

TABLE

OF CONTENTS

Prospectus Supplement

Prospectus

|

SUMMARY

In this

prospectus supplement, unless the context requires otherwise, “WEC Energy Group,” “we,” “us”

and “our” refer to WEC Energy Group, Inc., a Wisconsin corporation, and not to the underwriters.

The information

below is only a summary of more detailed information included elsewhere or incorporated by reference in this prospectus supplement

and the accompanying prospectus. This summary may not contain all of the information that is important to you or that you should

consider before buying securities in this offering. Please read this entire prospectus supplement and the accompanying prospectus,

as well as the information incorporated herein and therein by reference, carefully.

WEC Energy Group,

Inc.

WEC Energy

Group, Inc. was incorporated in the State of Wisconsin in 1981 and became a diversified holding company in 1986. On June 29, 2015,

we acquired 100% of the outstanding common shares of Integrys Energy Group, Inc. and changed our name to WEC Energy Group, Inc.

Our wholly

owned subsidiaries are primarily engaged in the business of providing regulated electricity service in Wisconsin and Michigan and

regulated natural gas service in Wisconsin, Illinois, Michigan and Minnesota. We also have an approximately 60% equity interest

in American Transmission Company LLC (“ATC”), a regulated electric transmission company. Additionally, we own majority

interests in several wind generating facilities as part of our non-utility energy infrastructure business. At June 30, 2020, we

conducted our operations in the six reportable segments discussed below.

Wisconsin

Segment: The Wisconsin segment includes the electric and natural gas operations of Wisconsin Electric Power Company (“WE”),

Wisconsin Gas LLC (“WG”), Wisconsin Public Service Corporation (“WPS”), and Upper Michigan Energy Resources

Corporation (“UMERC”). At June 30, 2020, these companies served approximately 1,632,000 electric customers and 1,478,200

natural gas customers.

Illinois

Segment: The Illinois segment includes the natural gas operations of The Peoples Gas Light and Coke Company (“PGL”)

and North Shore Gas Company, which provide natural gas service to customers located in Chicago and the northern suburbs of Chicago,

respectively. At June 30, 2020, these companies served approximately 1,035,000 natural gas customers. PGL also owns and operates

a 38.8 billion cubic feet natural gas storage field in central Illinois.

Other

States Segment: The other states segment includes the natural gas operations of Minnesota Energy Resources Corporation,

which serves customers in various cities and communities throughout Minnesota, and Michigan Gas Utilities Corporation, which serves

customers in southern and western Michigan. These companies served approximately 421,400 natural gas customers at June 30, 2020.

Electric

Transmission Segment: The electric transmission segment includes our approximately 60% ownership interest in ATC, which

owns, maintains, monitors, and operates electric transmission systems primarily in Wisconsin, Michigan, Illinois, and Minnesota,

and our approximately 75% ownership interest in ATC Holdco, LLC, a separate entity formed to invest in transmission-related projects

outside of ATC’s traditional footprint.

Non-Utility

Energy Infrastructure Segment: The non-utility energy infrastructure segment includes the operations of W.E. Power, LLC,

which owns and leases electric power generating facilities to WE; Bluewater Natural Gas Holding, LLC, which owns underground natural

gas storage facilities in southeastern Michigan; and WEC Infrastructure LLC (“WECI”). At June 30, 2020, WECI held our

90% ownership interest in Bishop Hill Energy III LLC, a wind generating facility located in Henry County, Illinois; our 80% ownership

interest in Coyote Ridge Wind, LLC, a wind generating facility located in Brookings County, South Dakota; and our 90% ownership

interest in Upstream Wind Energy LLC, a wind generating facility located in Antelope County, Nebraska.

In August

2019, WECI signed an agreement to acquire an 80% ownership interest in Thunderhead Wind Energy LLC (“Thunderhead”),

an approximately 300 MW wind generating facility under construction in Antelope and Wheeler counties in Nebraska. In January 2020,

WECI signed an agreement to acquire an 80% ownership interest in Blooming Grove Wind Energy Center LLC (“Blooming Grove”),

an approximately 250 MW wind generating facility under construction in McLean County, Illinois. In February 2020, WECI agreed to

acquire an additional 10% ownership interest in both Thunderhead and Blooming Grove. In addition, in July 2020, WECI signed an

agreement to acquire an 85% ownership interest in Tatanka Ridge Wind, LLC (“Tatanka Ridge”), an approximately 155 MW

wind generating facility under construction in Deuel County, South Dakota. WECI's investments in Thunderhead, Blooming Grove and

Tatanka Ridge are expected to qualify for production tax credits and 100% bonus depreciation.

|

|

Corporate

and Other Segment: The corporate and other segment includes the operations of the WEC Energy Group holding company, the

Integrys Holding, Inc. holding company, the Peoples Energy, LLC holding company, Wispark LLC, WEC Business Services LLC, and WPS

Power Development, LLC. This segment also includes Wisvest LLC and Wisconsin Energy Capital Corporation, which no longer have significant

operations.

WEC Business

Services LLC is a wholly owned centralized service company that provides administrative and general support services to our regulated

utilities, as well as certain services to our nonregulated entities. WPS Power Development, LLC owns distributed renewable solar

projects. Wispark LLC develops and invests in real estate and had $32.3 million in real estate holdings at June 30, 2020.

For a further

description of our business and our corporate strategy, see our Annual Report on Form 10-K for the year ended December 31,

2019, as well as the other documents incorporated by reference.

Our

principal executive offices are located at 231 West Michigan Street, P.O. Box 1331, Milwaukee, Wisconsin 53201. Our

telephone number is (414) 221-2345.

|

|

The Offering

|

|

Issuer

|

WEC Energy Group, Inc.

|

|

Securities Offered

|

$ aggregate principal amount of senior notes, consisting

of the following:

·

$ of % Senior Notes due , 20 ; and

·

$ of % Senior Notes due , 20 .

|

|

Interest

|

The 20 Notes will accrue interest at a rate of % per

year from , 2020 until maturity or earlier redemption, as the case may be.

The 20 Notes will accrue interest at a rate of % per

year from , 2020 until maturity or earlier redemption, as the case may be.

|

|

Interest Payment Dates

|

and , beginning , 2021.

|

|

Optional Redemption

|

At any time prior to , 20 , in the case of the 20 Notes, and , 20 , in the case of the 20 Notes, we may redeem each series of the Notes, in whole or in part from time to time, at the applicable “make-whole” redemption prices determined as described under “Certain Terms of the Notes — Redemption at Our Option.” At any time on or after , 20 , in the case of the 20 Notes, and , 20 , in the case of the 20 Notes, we may redeem each series of the Notes, in whole or in part from time to time, at 100% of the principal amount of the Notes of such series being redeemed plus accrued and unpaid interest on such Notes to, but not including, the redemption date. We are not required to establish a sinking fund to retire the Notes prior to maturity.

|

|

Ranking

|

The Notes are unsecured and unsubordinated and will rank equally with all our other unsecured and unsubordinated indebtedness and other obligations from time to time outstanding. See “Description of Debt Securities — Ranking of Debt Securities” in the accompanying prospectus.

|

|

Covenants

|

For so long as any Notes remain outstanding,

we will not create or incur or allow any of our subsidiaries to create or incur any pledge or security interest on any of the

capital stock of WE or WG held by us or one of our subsidiaries on the issue date of the Notes. The indenture for the Notes also

limits our ability to enter into mergers, consolidations or sales of all or substantially all of our assets where we are not the

surviving corporation unless the successor company assumes all of our obligations under the indenture. These covenants are subject

to a number of important qualifications and limitations. See “Certain Terms of the Notes — Covenants.”

|

|

Use of Proceeds

|

We will use the estimated $ million in net proceeds from this offering to redeem the $600,000,000 aggregate principal amount outstanding of our 3.375% Senior Notes due June 15, 2021 and the $350,000,000 aggregate principal amount outstanding of our 3.10% Senior Notes due March 8, 2022, and for other general corporate purposes. See “Use of Proceeds.”

|

|

Trustee

|

The trustee under the indenture (the “Trustee”) is The Bank of New York Mellon Trust Company, N.A.

|

RISK

FACTORS

Investing in the

Notes involves risk. Please see the risk factors, including those related to the COVID-19 pandemic, under the heading “Risk

Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019 and Item 1A of our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, which are incorporated by reference in this prospectus

supplement and the accompanying prospectus. Before making an investment decision, you should carefully consider these risks as

well as other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

The risks and uncertainties described are not the only ones facing us. Additional risks and uncertainties not presently known to

us or that we currently deem immaterial may also impair our business operations, financial results and the value of our securities.

FORWARD-LOOKING

STATEMENTS AND CAUTIONARY FACTORS

We have included

or may include statements in this prospectus supplement and the accompanying prospectus (including documents incorporated by reference)

that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Any statements that

express, or involve discussions as to, expectations, beliefs, plans, objectives, goals, strategies, assumptions or future events

or performance may be forward-looking statements. Also, forward-looking statements may be identified by reference to a future period

or periods or by the use of forward-looking terminology such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “forecasts,” “goals,” “guidance,” “intends,”

“may,” “objectives,” “plans,” “possible,” “potential,” “projects,”

“seeks,” “should,” “targets,” “will” or similar terms or variations of these terms.

We caution you

that any forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to differ materially from the future results,

performance or achievements we have anticipated in the forward-looking statements.

In addition to

the assumptions and other factors referred to specifically in connection with those statements, factors that could cause our actual

results, performance or achievements to differ materially from those contemplated in the forward-looking statements include factors

we have described under the captions “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2020 and June 30, 2020, and under the caption “Factors Affecting Results, Liquidity, and Capital Resources”

in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of our

Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarters ended

March 31, 2020 and June 30, 2020, or under similar captions in the other documents we have incorporated by reference. Any forward-looking

statement speaks only as of the date on which that statement is made, and we do not undertake any obligation to update any forward-looking

statement to reflect events or circumstances, including unanticipated events, after the date on which that statement is made.

USE OF PROCEEDS

We estimate the net proceeds to us from

the offering to be approximately $ million, after deducting underwriting discounts and other offering expenses payable by us. We

intend to use the net proceeds from the offering to redeem the $600,000,000 aggregate principal amount outstanding of our 3.375%

Senior Notes due June 15, 2021 and the $350,000,000 aggregate principal amount outstanding of our 3.10% Senior Notes due March

8, 2022, and for other general corporate purposes.

Pending disposition, we may temporarily

invest the net proceeds of the offering not required immediately for the intended purposes in U.S. governmental securities and

other high quality U.S. securities.

CAPITALIZATION

The table below

shows our consolidated capitalization structure on an actual basis.

|

|

|

As of June 30, 2020

|

|

|

|

|

Actual Amount

(unaudited)

|

|

|

Percentage

|

|

|

|

|

(Dollars in Millions)

|

|

|

(Rounded to Tenths)

|

|

|

Short-term debt

|

|

$

|

1,211.5

|

|

|

|

5.2

|

%

|

|

Long-term debt(1)

|

|

|

11,616.6

|

|

|

|

50.0

|

%

|

|

Preferred stock of subsidiary

|

|

|

30.4

|

|

|

|

0.1

|

%

|

|

Common equity

|

|

|

10,383.7

|

|

|

|

44.7

|

%

|

|

Total

|

|

$

|

23,242.2

|

|

|

|

100.0

|

%

|

|

(1)

|

Includes current maturities.

|

On September 17, 2020, we issued

$700 million aggregate principal amount of 0.55% Senior Notes due September 15, 2023. We used the net proceeds to repay commercial

paper.

CERTAIN TERMS

OF THE NOTES

The following description

of the particular terms of the Notes supplements and, to the extent inconsistent therewith, replaces the description of the general

terms and provisions of the Notes set forth in the accompanying prospectus under “Description of Debt Securities.”

We will issue the

Notes under the indenture, dated as of March 15, 1999, between us and The Bank of New York Mellon Trust Company, N.A. (as successor

to The First National Bank of Chicago), as Trustee (as amended and supplemented, the “indenture”). The Notes will be

our direct unsecured general obligations. At June 30, 2020, the aggregate principal amount of debt securities outstanding under

the indenture was approximately $2.2 billion, including $500 million of junior subordinated notes. On September 17, 2020, we issued

$700 million aggregate principal amount of 0.55% Senior Notes due September 15, 2023. We used the net proceeds to repay commercial

paper.

General

The Notes will

be unsecured and unsubordinated and will rank equally with all of our other unsecured and unsubordinated indebtedness and other

obligations from time to time outstanding. At June 30, 2020, we had approximately $1.7 billion aggregate principal amount of unsecured

and unsubordinated long-term debt securities and approximately $752.5 million aggregate principal amount of commercial paper outstanding,

net of discount, as well as a $340 million 364-day term loan entered into on March 30, 2020 (the “Term Loan”).

Interest on

the Notes accrues at the rate of % per year for the 20

Notes and % per year

for the 20 Notes. Interest will accrue from October , 2020, or

from the most recent interest payment date to which interest has been paid or provided for. Interest is payable semi-annually

in arrears to holders of record at the close of business on the or immediately preceding the interest payment date. Interest

payment dates will be and of each year beginning on ,

2021. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months.

The

20 Notes will mature on

, 20 and the

20 Notes will mature on

, 20 .

The Notes will

be issued only in registered form in denominations of $1,000 and integral multiples of $1,000.

Redemption at Our Option

At any time

prior to the applicable Early Call Date, each of the 20 Notes and the

20 Notes will be redeemable in whole or in part from time to time, at our option, at a

“make-whole” redemption price for such series, calculated by us, equal to (a) the greater of (i) 100% of the

principal amount of the Notes of such series being redeemed or (ii) the sum of the present values of the remaining scheduled

payments of principal and interest on the Notes of such series being redeemed that would be due if such Notes matured on the

applicable Early Call Date but for the redemption (exclusive of interest accrued to the date of redemption) discounted to the

redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus

basis points in the case of the 20 Notes and basis points in the case

of the 20 Notes, plus (b) accrued and unpaid interest on

the Notes of such series being redeemed to, but not including, the redemption date.

At any time on

or after the applicable Early Call Date, we may redeem each of the 20 Notes and the 20 Notes, in whole or in part from time

to time, at 100% of the principal amount of the Notes of such series being redeemed plus accrued and unpaid interest on such Notes

to, but not including, the redemption date.

“Comparable

Treasury Issue” means, with respect to each series of the Notes, the United States Treasury security or securities selected

by the Independent Investment Banker as having an actual or interpolated maturity comparable to the remaining term of the Notes

of such series being redeemed (assuming, for this purpose, that the 20 Notes and the 20 Notes mature on the applicable Early Call

Date) that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues

of corporate debt securities of a comparable maturity to the remaining term of such Notes.

“Comparable

Treasury Price” means, with respect to each series of the Notes and any redemption date, (a) the average of the Reference

Treasury Dealer Quotations for such series and such redemption date, after excluding the highest and lowest such Reference Treasury

Dealer Quotations, or (b) if the Trustee obtains fewer than four such Reference Treasury Dealer Quotations, the average of

all such quotations.

“Early

Call Date” means, with respect to the 20

Notes, , 20

(the date that is months prior to the maturity date

for the 20 Notes) and, with respect to the 20

Notes, , 20 (the date that is

months prior to the maturity date for the 20 Notes).

“Independent

Investment Banker” means one of the Reference Treasury Dealers appointed by us.

“Reference

Treasury Dealer” means each of Barclays Capital Inc., J.P. Morgan Securities LLC, Wells Fargo Securities, LLC, and their

respective successors and one primary U.S. government securities dealer in the City of New York, New York (a “Primary Treasury

Dealer”) selected by each of KeyBanc Capital Markets Inc., TD Securities (USA) LLC, U.S. Bancorp Investments, Inc. and us.

If any Reference Treasury Dealer shall cease to be a Primary Treasury Dealer, we will select another Primary Treasury Dealer which

will be substituted for that dealer.

“Reference

Treasury Dealer Quotations” means, with respect to each Reference Treasury Dealer, each series of the Notes and any redemption

date, the average, as determined by the Trustee, of the bid and asked prices for the Comparable Treasury Issue for such series

(expressed in each case as a percentage of its principal amount) quoted in writing to the Trustee by such Reference Treasury Dealer

at 3:30 p.m., New York City time, on the third business day preceding such redemption date.

“Treasury

Rate” means, with respect to each series of the Notes and any redemption date, the rate per year equal to the semiannual

equivalent yield to maturity or interpolated (on a day count basis) of the Comparable Treasury Issue for such series, assuming

a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury

Price for such series and such redemption date; provided that, if the Independent Investment Banker shall determine that

there is no such Comparable Treasury Issue, such rate per year shall be equal to the estimated semiannual equivalent yield to maturity

that a United States Treasury security having a maturity comparable to the remaining term of the Notes of such series to be redeemed

(assuming, for this purpose, that the 20 Notes and the 20 Notes mature on the applicable Early Call Date) would bear, if such security

were available, such estimate to be made by the Reference Treasury Dealers on the basis of interpolation, extrapolation and other

accepted financial practices, taking into account (a) the yields to maturity of United States Treasury securities of other maturities,

(b) yields to maturity of other U.S. dollar denominated debt securities having a maturity comparable to the remaining term of

the Notes of such series to be redeemed (assuming, for this purpose, that the 20 Notes and the 20 Notes mature on the applicable

Early Call Date) and (c) applicable interest rate spreads between United States Treasury securities and such other debt securities,

all as of 5:00 p.m., New York City time, on the third business day preceding such redemption date.

We will mail notice

of any redemption at least 30 days, but not more than 60 days, before the redemption date to each holder of Notes to

be redeemed.

Unless we default

in payment of the redemption price, on and after the redemption date interest will cease to accrue on the Notes or portions of

the Notes called for redemption.

Except in the case

of a conditional redemption, as discussed below, once notice of redemption is given, the Notes called for redemption become due

and payable on the redemption date at the redemption price stated in the notice.

A notice of redemption

may be conditioned and provide that it is subject to the occurrence of any event described in the notice before the date fixed

for the redemption. A notice of conditional redemption will be of no effect unless all conditions to the redemption have occurred

before the redemption date or have been waived by us.

Covenants

Limitation on

Liens on Stock of Certain Subsidiaries

For so long as

any Notes remain outstanding, we will not create or incur or allow any of our subsidiaries to create or incur any pledge or security

interest on any of the capital stock of WE or WG held by us or one of our subsidiaries on the issue date of the Notes.

Limitation on

Mergers, Consolidations and Sales of Assets

The indenture provides

that we will not consolidate with or merge into another company in a transaction in which we are not the surviving company, or

transfer all or substantially all of our assets to another company, unless:

|

|

·

|

that company is organized under the laws of the United States or a

state thereof or is organized under the laws of a foreign jurisdiction and consents to the jurisdiction of the courts of the United

States or a state thereof;

|

|

|

·

|

that company assumes by supplemental indenture all of our obligations

under the indenture and the Notes;

|

|

|

·

|

all required approvals of any regulatory body having jurisdiction

over the transaction have been obtained; and

|

|

|

·

|

immediately after the transaction no default exists under the indenture.

|

The successor will

be substituted for us as if it had been an original party to the indenture, securities resolutions and the Notes. Thereafter, the

successor may exercise our rights and powers under the indenture and the Notes, and all of our obligations under those documents

will terminate.

Events of Default

In addition to

the events of default described in the accompanying prospectus under the heading “Description of Debt Securities —

Defaults and Remedies,” an event of default under the Notes will include our failure to pay when due principal, interest

or premium in an aggregate amount of $25 million or more with respect to any of our Indebtedness, or the acceleration of any of

our Indebtedness aggregating $25 million or more which default is not cured, waived or postponed pursuant to an agreement with

the holders of the Indebtedness within 60 days after written notice as provided in the indenture governing the Notes, or the acceleration

is not rescinded or annulled within 30 days after written notice as provided in the indenture governing the Notes. As used in this

paragraph, “Indebtedness” means the following obligations of WEC Energy Group, WE and WG (and specifically excludes

obligations of WEC Energy Group’s other subsidiaries and intercompany obligations):

|

|

·

|

all obligations for borrowed money;

|

|

|

·

|

all obligations evidenced by bonds, debentures, notes or similar instruments,

or upon which interest payments are customarily made;

|

|

|

·

|

all obligations under conditional sale or other title retention agreements

relating to property purchased by us to the extent of the value of the property (other than customary reservations or retentions

of title under agreements with suppliers entered into in the ordinary course of our business); and

|

|

|

·

|

all obligations issued or assumed as the deferred purchase price of

property or services purchased by us which would appear as liabilities on our balance sheet.

|

Other

The Notes will

be subject to defeasance under the conditions described in the accompanying prospectus.

We may from time

to time, without notice to, or the consent of, the holders of a series of the Notes, create and issue further notes of the same

series, equal in rank to the Notes in all respects (or in all respects except for the payment of interest accruing prior to the

issue date of the new notes or, if applicable, the first payment of interest following the issue date of the new notes) so that

the new notes may be consolidated and form a single series with the relevant series of Notes and have the same terms as to status,

redemption or otherwise as the relevant series of the Notes. In the event that we issue additional notes of the same series, we

will prepare a new offering memorandum or prospectus.

The indenture and

the Notes will be governed by the laws of the State of Wisconsin, unless federal law governs.

Book-Entry Only Issuance—The Depository Trust Company

The Depository Trust Company (“DTC”),

New York, NY, will act as the securities depository for the Notes. The Notes will be issued only as fully-registered securities

registered in the name of Cede & Co. (DTC’s partnership nominee) or such other name as may be requested by an authorized

representative of DTC. Upon issuance, each series of the Notes will be represented by one or more fully-registered global note

certificates, representing in the aggregate the total principal amount of such series of the Notes, and will be deposited with

the Trustee on behalf of DTC.

DTC, the world’s largest securities

depository, is a limited-purpose trust company organized under the New York Banking Law, a “banking organization” within

the meaning of the New York Banking Law, a member of the Federal Reserve System, a “clearing corporation” within the

meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to the provisions of Section

17A of the Exchange Act. DTC holds and provides asset servicing for over 3.5 million issues of U.S. and non-U.S. equity issues,

corporate and municipal debt issues and money market instruments from over 100 countries that DTC’s participants (“Direct

Participants”) deposit with DTC. DTC also facilitates the post-trade settlement among Direct Participants of sales and other

securities transactions in deposited securities, through electronic computerized book-entry transfers and pledges between Direct

Participants’ accounts. This eliminates the need for physical movement of securities certificates. Direct Participants include

both U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations.

DTC is a wholly-owned subsidiary of The Depository Trust & Clearing Corporation (“DTCC”). DTCC is the holding company

for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearing agencies.

DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system is also available to others such as both U.S.

and non-U.S. securities brokers and dealers, banks, trust companies and clearing corporations that clear through or maintain a

custodial relationship with a Direct Participant, either directly or indirectly (“Indirect Participants”). The DTC

Rules applicable to its Participants are on file with the Securities and Exchange Commission (“SEC”). More information

about DTC can be found at www.dtcc.com. The contents of such website do not constitute part of this prospectus supplement

or the accompanying prospectus.

Purchases of the Notes within the DTC system

must be made by or through Direct Participants, which will receive a credit for the Notes on DTC’s records. The ownership

interest of each actual purchaser of each Note (“Beneficial Owner”) is in turn to be recorded on the Direct and Indirect

Participants’ records. Beneficial Owners will not receive written confirmation from DTC of their purchases. Beneficial Owners,

however, are expected to receive written confirmations providing details of the transactions, as well as periodic statements of

their holdings, from the Direct or Indirect Participants through which the Beneficial Owners purchased Notes. Transfers of ownership

interests in the Notes are to be accomplished by entries made on the books of Direct and Indirect Participants acting on behalf

of Beneficial Owners. Beneficial Owners will not receive certificates representing their ownership interests in the Notes, except

in the event that use of the book-entry system for the Notes is discontinued.

To facilitate subsequent transfers, all

Notes deposited by Direct Participants with DTC are registered in the name of DTC’s partnership nominee, Cede & Co.,

or such other name as may be requested by an authorized representative of DTC. The deposit of the Notes with DTC and their registration

in the name of Cede & Co. or such other DTC nominee do not effect any changes in beneficial ownership. DTC has no knowledge

of the actual Beneficial Owners of the Notes. DTC’s records reflect only the identity of the Direct Participants to whose

accounts such Notes are credited, which may or may not be the Beneficial Owners. The Direct and Indirect Participants will remain

responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications

by DTC to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants

to Beneficial Owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be

in effect from time to time.

Redemption notices will be sent to DTC. If

less than all the Notes are being redeemed, DTC’s practice is to determine by lot the amount of the interest of each Direct

Participant in such Notes to be redeemed.

Neither DTC nor Cede & Co. (nor any

other DTC nominee) will consent or vote with respect to the Notes unless authorized by a Direct Participant in accordance with

DTC’s procedures. Under its usual procedures, DTC mails an Omnibus Proxy to us as soon as possible after the record date.

The Omnibus Proxy assigns Cede & Co.’s consenting or voting rights to those Direct Participants to whose accounts the

Notes are credited on the record date (identified in a listing attached to the Omnibus Proxy).

Payments on the Notes will be made

to Cede & Co., or such other nominee as may be requested by an authorized representative of DTC. DTC’s practice is

to credit Direct Participants’ accounts upon DTC’s receipt of funds and corresponding detail information from us

or the Trustee on the relevant payment date in accordance with their respective holdings shown on DTC’s records.

Payments by Participants to Beneficial Owners will be governed by standing instructions and customary practices, as is the

case with securities held for the account of customers registered in “street name,” and will be the

responsibility of such Participant and not of DTC or WEC Energy Group, subject to any statutory or regulatory requirements as

may be in effect from time to time. Payment to Cede & Co. (or such other nominee as may be requested by an authorized

representative of DTC) is the responsibility of WEC Energy Group, disbursement of such payments to Direct Participants is the

responsibility of DTC, and disbursement of such payments to the Beneficial Owners is the responsibility of Direct and

Indirect Participants.

Except as provided herein, a Beneficial

Owner of a global Note will not be entitled to receive physical delivery of a Note. Accordingly, each Beneficial Owner must rely

on the procedures of DTC to exercise any rights under the Notes. The laws of some jurisdictions require that certain purchasers

of securities take physical delivery of securities in definitive form. Such laws may impair the ability to transfer beneficial

interests in a global Note.

DTC may discontinue providing its services

as securities depository with respect to the Notes at any time by giving reasonable notice to us. Under such circumstances, in

the event that a successor securities depository is not obtained, Note certificates will be required to be printed and delivered

to the holders of record. Additionally, we may decide to discontinue use of the system of book-entry transfers through DTC (or

a successor securities depository) with respect to the Notes. We understand, however, that under current industry practices, DTC

would notify its Direct and Indirect Participants of our decision, but will only withdraw beneficial interests from a global Note

at the request of each Direct or Indirect Participant. In that event, certificates for the Notes will be printed and delivered

to the applicable Direct or Indirect Participant.

The information in this section concerning

DTC and DTC’s book-entry system has been obtained from sources that we believe to be reliable, but neither we nor any underwriter

takes any responsibility for the accuracy thereof. Neither we nor any underwriter has any responsibility for the performance by

DTC or its Direct or Indirect Participants of their respective obligations as described herein or under the rules and procedures

governing their respective operations.

UNDERWRITING

Subject to the

terms and conditions contained in an underwriting agreement dated the date of this prospectus supplement, the underwriters named

below, for whom Barclays Capital Inc., J.P. Morgan Securities LLC, KeyBanc Capital Markets Inc., TD Securities (USA) LLC, U.S.

Bancorp Investments, Inc., and Wells Fargo Securities, LLC are acting as representatives, have severally agreed to purchase, and

we have agreed to sell to them, severally, the principal amount of each series of the Notes indicated in the following table:

|

Underwriter

|

|

|

Principal Amount

of 20 Notes

|

|

|

|

Principal Amount

of 20 Notes

|

|

|

Barclays Capital Inc.

|

|

$

|

|

|

|

$

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

|

|

|

|

|

|

KeyBanc Capital Markets Inc.

|

|

|

|

|

|

|

|

|

|

TD Securities (USA) LLC

|

|

|

|

|

|

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

|

|

|

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

|

|

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

|

|

|

|

|

|

Siebert Williams Shank & Co., LLC

|

|

|

|

|

|

|

|

|

|

Comerica Securities, Inc.

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

|

|

|

$

|

|

|

The underwriters

are offering the Notes subject to their acceptance of the Notes from us and subject to prior sale. The underwriting agreement provides

that the obligations of the several underwriters to pay for and accept delivery of the Notes offered by this prospectus supplement

are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated

to take and pay for all of the Notes offered by this prospectus supplement if any are taken.

Notes sold by the

underwriters to the public will initially be offered at the initial public offering price set forth on the cover page of this prospectus

supplement. Any Notes sold by the underwriters to securities dealers may be sold at a discount from the initial public offering

price of up to % of the principal amount of the 20 Notes and % of the principal amount of the 20 Notes. Any such securities dealers

may resell any Notes purchased from the underwriters to certain other brokers or dealers at a discount from the initial public

offering price of up to % of the principal amount of the 20 Notes and % of the principal amount of the 20 Notes. After the initial

public offering of the Notes, the offering price and other selling terms may from time to time be varied by the representatives.

The offering of the Notes by the underwriters is subject to receipt and acceptance and subject to the underwriters’ right

to reject any order in whole or in part.

The following table

shows the underwriting discounts that we are to pay to the underwriters in connection with this offering (expressed as a percentage

of the principal amount of each series of the Notes).

|

|

|

|

Paid by

WEC Energy Group

|

|

|

Per 20 Note

|

|

|

|

%

|

|

Per 20 Note

|

|

|

|

%

|

In order to

facilitate the offering of the Notes, the underwriters may engage in transactions that stabilize, maintain or otherwise

affect the price of the Notes. Specifically, the underwriters may over-allot in connection with the offering, creating a

short position in the Notes for their own account. In addition, to cover over-allotments or to stabilize the price of the

Notes, the underwriters may bid for, and purchase, Notes on the open market. Short sales involve the sale by the underwriters

of a greater number of Notes than they are required to purchase in the offering. Stabilizing transactions consist of certain

bids or purchases made for the purpose of preventing or retarding a decline in the market price of the Notes while the

offering is in progress. Finally, the underwriters may reclaim selling concessions allowed to an underwriter or a dealer for

distributing the Notes in the offering, if the underwriters repurchase previously distributed Notes in transactions to cover

syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the

market price of the Notes above independent market levels. The underwriters are not required to engage in these activities

and may end any of these activities at any time. These

transactions may be effected in the over-the-counter market or otherwise.

The underwriters

also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting

discount received by it because the representatives have repurchased Notes sold by or for the account of such underwriter in stabilizing

or short covering transactions.

The Notes are a

new issue of debt securities with no established trading market. We have been advised by the underwriters that they intend to make

a market in the Notes, but they are not obligated to do so and may discontinue market making at any time without notice. We cannot

assure you as to the liquidity of the trading market for the Notes.

We estimate that

our total expenses for this offering, not including the underwriting discount, will be approximately $1.9 million.

We expect to

deliver the Notes against payment for the Notes on or about the date specified in the last paragraph on the cover page of

this prospectus supplement, which will be the business day following

the date of the pricing of the Notes (this settlement cycle being referred to as “T+ ”). Under

Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in two business

days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes on the

date of pricing or the next succeeding business days will be required, by virtue of the fact that

the Notes initially will settle in T+ , to specify alternate settlement arrangements to prevent a failed

settlement. Purchasers of Notes who wish to trade Notes on the date of pricing or the next

succeeding business days should consult their own advisors.

The underwriters

and their respective affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, principal investment, hedging, financing

and brokerage activities. In the ordinary course of their respective businesses, certain of the underwriters and their affiliates

have provided, currently provide and may in the future provide, investment banking, commercial banking, advisory and other services

for us and our affiliates, for which they received and will receive customary fees and expenses. Affiliates of several of the underwriters

are lenders under our existing $1.2 billion credit facility, WE’s existing $500 million credit facility, WPS’s existing

$400 million credit facility, WG’s existing $350 million credit facility and PGL’s existing $350 million credit facility.

In addition, KeyBanc Capital Markets Inc., TD Securities (USA) LLC, and U.S. Bancorp Investments, Inc. are lenders under the Term

Loan. In addition, certain of the underwriters hold some of the notes to be redeemed, as described under “Use of Proceeds.”

In the ordinary course

of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments,

including serving as counterparties to certain derivative hedging arrangements, and actively trade debt and equity securities (or

related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their

customers. Such investment and securities activities may involve securities and instruments of WEC Energy Group and its affiliates.

Certain of the underwriters or their respective affiliates that have a lending relationship with us routinely hedge, and certain

other of those underwriters or their respective affiliates may hedge, their credit exposure to us consistent with their customary

risk management policies. Typically, such underwriters and their affiliates would hedge such exposure by entering into transactions

which consist of either the purchase of credit default swaps or the creation of short positions in our securities, including potentially

the Notes offered hereby. Any such credit default swaps or short positions could adversely affect future trading prices of the

Notes offered hereby. The underwriters and their affiliates may also make investment recommendations and/or publish or express

independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they

acquire, long and/or short positions in such securities and instruments.

We have agreed

to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute

to payments that the underwriters may be required to make because of any of those liabilities.

Northern Trust

Securities, Inc., a member of the Financial Industry Regulatory Authority, Inc. and subsidiary of Northern Trust Corporation, is

being paid a referral fee by Siebert Williams Shank & Co., LLC. An affiliate of Northern Trust Securities, Inc. acts as the

trustee and custodian of WEC Energy Group’s pension and other post-retirement benefit plan trusts.

LEGAL MATTERS

Various legal matters

in connection with the Notes will be passed upon (a) for us by Mercer Thompson LLC, Atlanta, Georgia, and (b) for the

underwriters by Hunton Andrews Kurth LLP, New York, New York. Joshua M. Erickson, Director – Legal Services – Corporate

and Finance of WEC Energy Group, will pass upon the validity of the Notes, as well as certain other legal matters, on our behalf.

Mr. Erickson is the beneficial owner of less than 0.01% of WEC Energy Group’s common stock.

EXPERTS

The consolidated

financial statements, and the related financial statement schedules, incorporated in this prospectus supplement and the accompanying

prospectus by reference from our Annual Report on Form 10-K for the year ended December 31, 2019, and the effectiveness of our

internal control over financial reporting, have been audited by Deloitte & Touche LLP, an independent registered public

accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial statements

and financial statement schedules have been so incorporated in reliance upon the reports of such firm given upon their authority

as experts in accounting and auditing.

DOCUMENTS INCORPORATED

BY REFERENCE

We file annual,

quarterly and current reports, as well as registration and proxy statements and other information, with the SEC. Our SEC filings

(File No. 001-09057) are available to the public over the Internet at the SEC’s website at http://www.sec.gov as well

as on our website, www.wecenergygroup.com. The information contained on, or accessible from, our website is not a part of,

and is not incorporated in, this prospectus supplement or the accompanying prospectus.

The SEC allows

us to “incorporate by reference” into this prospectus supplement and the accompanying prospectus the information we

file with the SEC, which means we can disclose important information to you by referring you to those documents. Please refer to

“Where You Can Find More Information” in the accompanying prospectus. Any information referenced this way is considered

to be part of this prospectus supplement and the accompanying prospectus, and any information that we file later with the SEC will

automatically update and supersede this information. At the date of this prospectus supplement, we incorporate by reference the

following documents that we have filed with the SEC, and any future filings that we make with the SEC under Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act until we complete our sale of the securities to the public:

|

|

·

|

Our Current Reports on Form 8-K filed on January 31, 2020, March 25, 2020, March 31, 2020, April 2, 2020, April 20, 2020, May 8, 2020, May 21, 2020, July 2, 2020, and September 17, 2020.

|

Information furnished

under Items 2.02 or 7.01 of any Current Report on Form 8-K will not be incorporated by reference into this prospectus

supplement or the accompanying prospectus unless specifically stated otherwise. We will provide, at no cost, to each person, including

any beneficial owner, to whom this prospectus supplement and the accompanying prospectus are delivered, a copy of any or all of

the information that has been incorporated by reference into, but not delivered with, this prospectus supplement and the accompanying

prospectus, upon written or oral request to us at:

WEC Energy Group, Inc.

231 West Michigan Street

P. O. Box 1331

Milwaukee, Wisconsin 53201

Attn: Ms. Margaret C. Kelsey,

Executive Vice President, General Counsel and Corporate Secretary

Telephone: (414) 221-2345

PROSPECTUS

WEC ENERGY GROUP, INC.

Debt Securities

WEC Energy Group,

Inc. may issue and sell debt securities to the public from time to time in one or more offerings. We urge you to read this prospectus

and the applicable prospectus supplement carefully before you make your investment decision.

This prospectus

describes some of the general terms that may apply to these debt securities. The specific terms of any debt securities to be offered,

and any other information relating to a specific offering, will be set forth in a prospectus supplement that will describe the

interest rates, payment dates, ranking, maturity and other terms of any debt securities that we issue or sell.

We may offer and

sell these debt securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous

or delayed basis. The supplements to this prospectus will provide the specific terms of the plan of distribution. This prospectus

may not be used to offer and sell securities unless accompanied by a prospectus supplement.

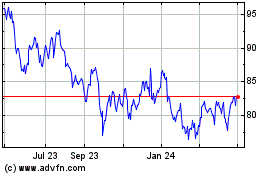

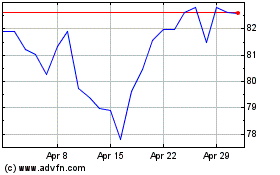

Our common stock

is quoted on the New York Stock Exchange under the symbol “WEC.”

See “Risk

Factors” on page 1 of this prospectus and “Risk Factors” contained in any applicable prospectus supplement

and documents incorporated by reference for information on certain risks related to the purchase of the debt securities.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is June 1, 2018.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

In

this prospectus, “we,” “us,” “our” and “WEC Energy Group” refer to WEC Energy Group,

Inc.

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) utilizing

a “shelf” registration process. Under this shelf process, we may issue and sell to the public the debt securities described

in this prospectus in one or more offerings.

This

prospectus provides you with only a general description of the debt securities we may issue and sell. Each time we offer debt securities,

we will provide a prospectus supplement to this prospectus that will contain specific information about the particular debt securities

and terms of that offering. In the prospectus supplement, we will describe the interest rate, payment dates, ranking, maturity

and other terms of any debt securities that we issue and sell.

The

prospectus supplement will also describe the proceeds and uses of proceeds from the debt securities, together with the names and

compensation of the underwriters, if any, through which the debt securities are being issued and sold, and other important considerations

for investors. The prospectus supplement may also add to, update or change information contained in this prospectus.

If

there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information

in the prospectus supplement. Please carefully read this prospectus and the applicable prospectus supplement, in addition to the

information contained in the documents we refer you to under the heading “WHERE YOU CAN FIND MORE INFORMATION.”

RISK FACTORS

Investing

in the securities of WEC Energy Group involves risk. Please see the “Risk Factors” described in Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference in this prospectus. Before

making an investment decision, you should carefully consider these risks as well as other information contained or incorporated

by reference in this prospectus. The risks and uncertainties described are not the only ones facing us. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also impair our business operations, financial results and the

value of our securities.

FORWARD-LOOKING

STATEMENTS AND CAUTIONARY FACTORS

We

have included or may include statements in this prospectus or in any prospectus supplement (including documents incorporated by

reference) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933, as amended (the “Securities Act of 1933”), and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act of 1934”). Any statements that express, or involve discussions as to, expectations, beliefs, plans,

objectives, goals, strategies, assumptions or future events or performance may be forward-looking statements. Also, forward-looking

statements may be identified by reference to a future period or periods or by the use of forward-looking terminology such as “anticipates,”

“believes,” “could,” “estimates,” “expects,” “forecasts,” “goals,”

“guidance,” “intends,” “may,” “objectives,” “plans,” “possible,”

“potential,” “projects,” “seeks,” “should,” “targets,” “will,”

or similar terms or variations of these terms.

We

caution you that any forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to differ materially from the future results,

performance or achievements we have anticipated in the forward-looking statements.

In

addition to the assumptions and other factors referred to specifically in connection with those statements, factors that could

cause our actual results, performance or achievements to differ materially from those contemplated in the forward-looking statements

include factors we have described under the captions “Cautionary Statement Regarding Forward-Looking Information” and

“Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, and under the caption “Factors

Affecting Results, Liquidity, and Capital Resources” in the “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” section of our Annual Report on Form 10-K for the year ended December 31, 2017,

or under similar captions in the other documents we have incorporated by reference. Any forward-looking statement speaks only as

of the date on which that statement is made, and we do not undertake any obligation to update any forward-looking statement to

reflect events or circumstances, including unanticipated events, after the date on which that statement is made.

WEC ENERGY GROUP,

INC.

WEC

Energy Group, Inc. was incorporated in the State of Wisconsin in 1981 and became a diversified holding company in 1986. On June

29, 2015, we acquired 100% of the outstanding common shares of Integrys Energy Group, Inc. and changed our name to WEC Energy Group,

Inc.

Our

wholly owned subsidiaries are primarily engaged in the business of providing regulated electricity service in Wisconsin and Michigan

and regulated natural gas service in Wisconsin, Illinois, Michigan and Minnesota. As of March 31, 2018, our regulated utility subsidiaries

served approximately 1.6 million electric customers and approximately 2.9 million natural gas customers. In addition, we have an

approximately 60% equity interest in American Transmission Company LLC (“ATC”), a regulated electric transmission company.

We conduct our operations in the six reportable segments discussed below.

Wisconsin

Segment: The Wisconsin segment includes the electric and natural gas operations of Wisconsin Electric Power Company (“WE”),

Wisconsin Gas LLC (“WG”), Wisconsin Public Service Corporation (“WPS”), and Upper Michigan Energy Resources

Corporation (“UMERC”). UMERC became operational effective January 1, 2017, and holds the electric and natural gas distribution

assets previously held by WE and WPS in the Upper Peninsula of Michigan. This segment also includes steam service to WE steam customers

in metropolitan Milwaukee, Wisconsin.

Illinois

Segment: The Illinois segment includes the natural gas operations of The Peoples Gas Light and Coke Company (“PGL”)

and North Shore Gas Company, which provide natural gas service to customers located in Chicago and the northern suburbs of Chicago.

PGL also owns and operates a 38.3 billion cubic feet natural gas storage field in central Illinois.

Other

States Segment: The other states segment includes the natural gas operations of Minnesota Energy Resources Corporation,

which serves customers in various cities and communities throughout Minnesota, and Michigan Gas Utilities Corporation (“MGU”),

which serves customers in southern and western Michigan.

Electric

Transmission Segment: The electric transmission segment includes our approximately 60% ownership interest in ATC, which

owns, maintains, monitors, and operates electric transmission systems primarily in Wisconsin, Michigan, Illinois, and Minnesota,

and our approximately 75% ownership interest in ATC Holdco, LLC, a separate entity formed in December 2016 to invest in transmission-related

projects outside of ATC’s traditional footprint.

Non-Utility

Energy Infrastructure Segment: The non-utility energy infrastructure segment includes the operations of W.E. Power, LLC

(“We Power”), which owns and leases electric power generating facilities to WE, and Bluewater Natural Gas Holding,

LLC (“Bluewater”), which owns underground natural gas storage facilities in southeastern Michigan.

On

April 30, 2018, we signed an agreement for the acquisition of an 80% ownership interest in a 202.5 megawatt wind generating facility

currently under construction known as the Upstream Wind Energy Center (“Upstream”) for $276 million. Upstream

is located in Antelope County, Nebraska, and will supply energy to the Southwest Power Pool. The transaction is expected to close

in the first quarter of 2019, after Upstream achieves commercial operation. Upstream has entered into an energy swap agreement

pursuant to which Upstream will receive a fixed payment in exchange for substantially all of its energy output for a period of

ten years.

Corporate

and Other Segment: The corporate and other segment includes the operations of the WEC Energy Group holding company, the

Integrys Holding, Inc. (“Integrys Holding”) holding company, the Peoples Energy, LLC holding company, Wispark LLC,

Bostco LLC, Wisvest LLC, Wisconsin Energy Capital Corporation, WEC Business Services LLC, and WPS Power Development, LLC. WEC Business

Services LLC is a wholly owned centralized service company that provides administrative and general support services to our regulated

utilities, as well as certain services to our nonregulated entities. WPS Power Development, LLC owns distributed renewable solar

projects. Wispark LLC develops and invests in real estate.

Our

principal executive offices are located at 231 West Michigan Street, P.O. Box 1331, Milwaukee, Wisconsin 53201. Our telephone

number is (414) 221-2345.

RATIO OF EARNINGS

TO FIXED CHARGES

Our historical

ratios of earnings to fixed charges are described below for the periods indicated.(1)

|

|

|

Three Months

Ended

March 31,

|

|

|

Year Ended December 31,

|

|

|

|

|

2018(2)

|

|

|

2017

|

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

Ratio of Earnings to Fixed Charges(3)

|

|

|

5.1

|

x

|

|

|

4.7

|

x

|

|

|

4.5

|

x

|

|

|

4.0

|

x

|

|

|

4.6

|

x

|

|

|

4.3

|

x

|

|

|

(1)

|

On June 29, 2015, we acquired Integrys Energy Group, Inc. Starting with the third quarter of 2015,

our results of operations reflect the impact of this acquisition.

|

|

|

(2)

|

The results of operations for the three months ended March 31, 2018, are not necessarily indicative

of the results that may be expected for the entire 2018 fiscal year because of seasonal variations and other factors.

|

|

|

(3)

|

These computations include us and our subsidiaries. For these ratios, “earnings” is

determined by adding (a) pre-tax income (less undistributed earnings of equity investees), (b) non-utility amortization

of capitalized interest and (c) fixed charges, and subtracting from the total, (x) non-utility capitalized interest and (y)

preferred stock dividends of subsidiaries. “Fixed charges” consists of interest charges on our long-term and short-term

debt (including the estimated interest component of rental expense), capitalized interest, amortization of debt expenses and preferred

stock dividends of subsidiaries.

|

USE OF PROCEEDS

Except

as otherwise described in the applicable prospectus supplement, we intend to use the net proceeds from the sale of our debt securities

(a) to fund, or to repay short-term debt incurred to fund, investments (including equity contributions and loans to affiliates),

(b) to repay and/or refinance debt, and/or (c) for other general corporate purposes. Pending disposition, we may temporarily invest

any proceeds of the offering not required immediately for the intended purposes in U.S. governmental securities and other

high quality U.S. securities. We expect to borrow money or sell securities from time to time, but we cannot predict the precise

amounts or timing of doing so. For current information, please refer to our current filings with the SEC. See “WHERE YOU

CAN FIND MORE INFORMATION.”

DESCRIPTION

OF DEBT SECURITIES

The

debt securities will be our direct unsecured general obligations. The debt securities will consist of one or more senior debt securities,

subordinated debt securities and junior subordinated debt securities. The debt securities will be issued in one or more series

under the indenture described below between us and The Bank of New York Mellon Trust Company, N.A. (as successor to The First National

Bank of Chicago), as trustee, dated as of March 15, 1999, and under a securities resolution (which may be in the form of a

resolution or a supplemental indenture) authorizing the particular series.

We

have summarized selected provisions of the indenture and the debt securities that we may offer hereby. This summary is not complete

and may not contain all of the information important to you. Copies of the indenture and a form of securities resolution are filed

or incorporated by reference as exhibits to the registration statement of which this prospectus is a part. The securities resolution

for each series of debt securities issued and outstanding also has been or will be filed or incorporated by reference as an exhibit

to the registration statement. You should read the indenture and the applicable securities resolution for other provisions that

may be important to you. In the summary below, where applicable, we have included references to section numbers in the indenture

so that you can easily find those provisions. The particular terms of any debt securities we offer will be described in the related

prospectus supplement, along with any applicable modifications of or additions to the general terms of the debt securities described

below and in the indenture. For a description of the terms of any series of debt securities, you should also review both the prospectus

supplement relating to that series and the description of the debt securities set forth in this prospectus before making an investment

decision.

General

The

indenture does not significantly limit our operations. In particular, it does not:

|

|

·

|

limit the amount of debt securities that we can issue under the indenture;

|

|

|

·

|

limit the number of series of debt securities that we can issue from time to time;

|

|

|

·

|

restrict the total amount of debt that we or our subsidiaries may incur; or

|

|

|

·

|

contain any covenant or other provision that is specifically intended to afford any holder of the

debt securities protection in the event of highly leveraged transactions or any decline in our ratings or credit quality.

|

The

ranking of a series of debt securities with respect to all of our indebtedness will be established by the securities resolution

creating the series.

Although

the indenture permits the issuance of debt securities in other forms or currencies, the debt securities covered by this prospectus

will only be denominated in U.S. dollars in registered form without coupons, unless otherwise indicated in the applicable

prospectus supplement.

Unless

we say otherwise in the applicable prospectus supplement, we may redeem the debt securities for cash.

Terms

A

prospectus supplement and a securities resolution relating to the offering of any new series of debt securities will include specific

terms relating to the offering. The terms will include some or all of the following:

|

|

·

|

the designation, aggregate principal amount, currency or composite currency and denominations of

the debt securities;

|

|

|

·

|

the price at which the debt securities will be issued and, if an index, formula or other method

is used, the method for determining amounts of principal or interest;

|

|

|

·

|

the maturity date and other dates, if any, on which the principal of the debt securities will be

payable;

|

|

|

·

|

the interest rate or rates, if any, or method of calculating the interest rate or rates, which

the debt securities will bear;

|

|

|

·

|

the date or dates from which interest will accrue and on which interest will be payable and the

record dates for the payment of interest;

|

|

|

·

|

the manner of paying principal and interest on the debt securities;

|

|

|

·

|

the place or places where principal and interest will be payable;

|

|

|

·

|

the terms of any mandatory or optional redemption of the debt securities by us, including any sinking

fund;

|

|

|

·

|

the terms of any conversion or exchange right;

|

|

|

·

|

the terms of any redemption of debt securities at the option of holders;

|

|

|

·

|

any tax indemnity provisions;

|

|

|

·

|

if payments of principal or interest may be made in a currency other than U.S. dollars, the manner

for determining those payments;

|

|

|

·

|

the portion of principal payable upon acceleration of any discounted debt security (as described

below);

|

|

|

·

|

whether and upon what terms debt securities may be defeased (which means that we would be discharged

from our obligations by depositing sufficient cash or government securities to pay the principal, interest, any premiums and other

sums due to the stated maturity date or a redemption date of the debt securities of the series);

|

|

|

·

|

whether any events of default or covenants in addition to or instead of those set forth in the

indenture apply;

|

|

|

·

|

provisions for electronic issuance of debt securities or for debt securities in uncertificated

form;

|

|

|

·

|

the ranking of the debt securities, including the relative degree, if any, to which the debt securities

of a series are subordinated to one or more other series of debt securities in right of payment, whether outstanding or not;

|

|

|

·

|

any provisions relating to extending or shortening the date on which the principal and premium,

if any, of the debt securities of the series is payable;

|

|

|

·

|

any provisions relating to the deferral of any interest; and

|

|

|

·

|

any other terms not inconsistent with the provisions of the indenture, including any covenants

or other terms that may be required or advisable under United States or other applicable laws or regulations or advisable in connection

with the marketing of the debt securities. (Section 2.01)

|

We

may issue debt securities of any series as registered debt securities, bearer debt securities or uncertificated debt securities.

(Section 2.01) We may issue the debt securities of any series in whole or in part in the form of one or more global securities

that will be deposited with, or on behalf of, a depositary identified in the prospectus supplement relating to the series. We may

issue global securities in registered, bearer or uncertificated form and in either temporary or permanent form. Unless and until