Company delivers strong revenue growth of 8.7% with strength across segments; Q3 FY23 GAAP EPS of ($0.66); Adjusted EPS of $1.50; Company raises full-year outlook on strong results for Q3

November 15 2022 - 7:08AM

Business Wire

Walmart Inc. (NYSE: WMT):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221114006112/en/

Third-quarter highlights:

- Company delivered strong revenue growth globally, with strength

in Walmart U.S., Sam’s Club U.S., Flipkart, and Walmex. Total

revenue was $152.8 billion, up 8.7%, or 9.8% in constant

currency.

- Walmart U.S. comp sales grew 8.2% and 17.4% on a two-year

stack. eCommerce growth was 16% and 24% on a two-year stack.

Continued to gain market share in grocery.

- Sam’s Club comp sales increased 10.0%, and 23.9% on a two-year

stack. Membership income increased 8.0% with member count reaching

an all-time high.

- Walmart International net sales were $25.3 billion, an increase

of $1.7 billion, or 7.1%, negatively affected by $1.5 billion from

currency fluctuations. Segment operating income led by double-digit

growth for Walmex.

- Global advertising business grew over 30%, led by 40% at

Walmart Connect in the U.S. and strength in Flipkart Ads.

- Consolidated gross profit rate declined 89 basis points,

primarily due to markdowns and mix of sales in the U.S., an

inflation-related LIFO charge at Sam’s Club, and the timing of

Flipkart’s annual event, The Big Billion Days.

- Consolidated operating expenses as a percentage of net sales

increased 144 basis points due to charges of $3.3 billion related

to opioid legal settlements. Adjusted operating expenses as a

percentage of net sales decreased 75 basis points, primarily due to

strong sales growth and lower Covid-related costs.

- Consolidated operating income was $2.7 billion, a decrease of

53.5%, including the legal charges described above. Adjusted

operating income was $6.0 billion, an increase of 3.9%.

- Adjusted EPS of $1.50 excludes the effects, net of tax, of

$1.11 from net losses on equity and other investments and $1.05

from charges related to opioid legal settlements.

- Subsequent to the third quarter the Company approved a new $20

billion share repurchase authorization replacing its existing

authorization, which had approximately $1.9 billion remaining at

the end of Q3.

The company will hold a live conference call with the Investment

Community at 7 a.m. CST Tuesday, Nov. 15, 2022, to discuss the

company’s third quarter earnings results for fiscal year 2023. The

event will be webcast live and is accessible by visiting

https://corporate.walmart.com/newsroom/financial-events and

selecting the Third Quarter Earnings Release event. The webcast

will be archived and available beginning at approximately noon CST

Nov. 15.

About Walmart

Walmart Inc. (NYSE: WMT) helps people around the world save

money and live better - anytime and anywhere - in retail stores,

online, and through their mobile devices. Each week, approximately

230 million customers and members visit more than 10,500 stores and

numerous eCommerce websites under 46 banners in 24 countries. With

fiscal year 2022 revenue of $573 billion, Walmart employs

approximately 2.3 million associates worldwide. Walmart continues

to be a leader in sustainability, corporate philanthropy and

employment opportunity. Additional information about Walmart can be

found by visiting https://corporate.walmart.com, on Facebook at

https://facebook.com/walmart, on Twitter at

https://twitter.com/walmart, and on LinkedIn at

https://www.linkedin.com/company/walmart/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221114006112/en/

Investor Relations Contacts Steph Wissink Senior Vice

President, Investor Relations Stephanie.Wissink@walmart.com

Kary Brunner Sr. Director II, Investor Relations

Kary.Brunner@walmart.com Media Relations Contact Jacquelyn

Cook Sr. Manager, Global Communications 800-331-0085

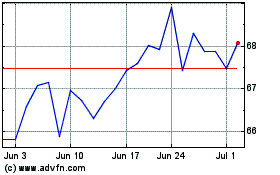

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

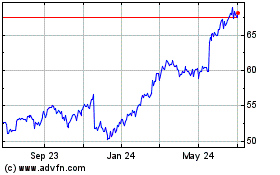

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024