Holiday Slump Hits Weaker Chains -- WSJ

January 10 2020 - 3:02AM

Dow Jones News

By Suzanne Kapner

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 10, 2020).

A strong U.S. economy and robust consumer spending weren't

enough to boost holiday sales at many department stores and

mall-based chains, as Americans continue to shift their purchases

online and to other retailers.

J.C. Penney Co., Kohl's Corp. and Victoria's Secret parent L

Brands Inc. all reported lower sales in the critical months of

November and December. All three companies entered the holiday

season on weak footing, with falling sales as they lost orders to

Amazon.com Inc. as well as traditional rivals such as T.J. Maxx and

Target Corp.

"Our customer data shows that a chunk of clothing spend from

Kohl's customers has migrated to other retailers, most notably to

Target and various off-price players," said Neil Saunders, managing

director of research firm GlobalData Retail. "This is reflective of

the weaker proposition at Kohl's but also underlines the success

Target has had in improving its own offer."

The sales updates came a day after Macy's Inc. reported its

comparable sales fell 0.6% in the holiday period and said it would

close 29 stores. Bed Bath & Beyond Inc. also reported a drop in

comparable sales for the third quarter. Comparable sales generally

include online sales and reflect stores open at least a year.

Not all traditional retailers are struggling. Walmart Inc. and

Target have reported rising sales and store traffic for much of the

past year, as they ramp up online ordering and in-store pickup

services. Off-price chains such as TJX Cos. have also logged

healthy sales.

Warehouse club operator Costco Wholesale Corp. reported

comparable sales jumped 9% in the five weeks ended Jan. 5. The

results include e-commerce sales and international stores. Costco

shares rose 1.6% Thursday, according to FactSet, and, like shares

of Walmart and Target, are trading near all-time highs.

J.C. Penney's comparable-store sales fell 7.5% during the

nine-week stretch that ended Jan. 4. Excluding appliances and

furniture, categories it exited last year, comparable sales fell

5.3% in the period. The retailer maintained its financial targets

for the fiscal year, which includes January.

Penney's shares, which have hovered around $1 apiece, fell

10.8%.

Chuck Grom, an analyst with Gordon Haskett Research Advisors,

said the continued decline in Penney's sales gives him little hope

the company will be able to turn things around this year.

Kohl's said its comparable sales for November and December

slipped 0.2%, citing weakness in its women's apparel business. It

also warned that profits would be at the low end of its prior

target range. Shares closed down 6.5%.

"We are managing the business with discipline and we expect to

deliver on our earnings guidance for the full year," Chief

Executive Michelle Gass said.

Department stores have been losing ground to other retailers for

decades. At the end of 2019, department stores accounted for 1.2%

of total retail sales, down from 5% in 2005 and 9.5% in 1980,

according to research firm Customer Growth Partners. Despite that

decline, the chains haven't closed stores fast enough, according to

Customer Growth data.

Adidas, Nike and Under Armour brands have become increasingly

important at Penney's and Kohl's in recent years. Those are the

three largest brands in Amazon's apparel and footwear category,

according to Stackline, which monitors online sales.

L Brands said comparable sales, which include sales from

company-owned stores in North America open at least a year and

digital sales, fell 3% for the nine weeks ended Jan. 4.

The company, which also owns Pink and Bath & Body Works,

said it now expects fourth-quarter earnings of $1.85 a share. It

had previously guided for earnings of $2.00 a share. Shares rose

about 4.5%.

Other retailers reporting holiday results included Urban

Outfitters Inc., which posted lackluster sales at its eponymous

brand. Following the news, shares of the company fell 9% in

after-hours trading.

Urban Outfitters, which also owns the Anthropologie and Free

People brands, said comparable retail sales at its namesake stores

fell 1% for the two-month period ended Dec. 31. Anthropologie fared

better with comparable retail sales up 5%.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

January 10, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

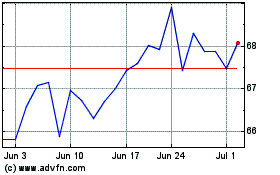

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

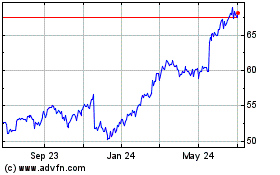

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024