Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 23 2021 - 2:46PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

September 2021

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x Form 40-F

¨

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes ¨

No x

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes ¨

No x

(Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.)

(Check One) Yes ¨

No x

(If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b). 82-_.)

|

|

1

COMPROMISSOS PÚBLICOS 2030

Vale ESG Webinar

Risk Management

September 23, 2021

Eduardo Bartolomeo

CEO

Carlos Medeiros

Executive Vice President of Safety and Operational Excellence

|

|

|

Agenda Disclaimer

“This

presentation

may

include

statements

that

present

Vale's

expectations

about

future

events

or

results

.

All

statements,

when

based

upon

expectations

about

the

future

involve

various

risks

and

uncertainties

.

Vale

cannot

guarantee

that

such

statements

will

prove

correct

.

These

risks

and

uncertainties

include

factors

related

to

the

following

:

(a)

the

countries

where

we

operate,

especially

Brazil

and

Canada

;

(b)

the

global

economy

;

(c)

the

capital

markets

;

(d)

the

mining

and

metals

prices

and

their

dependence

on

global

industrial

production,

which

is

cyclical

by

nature

;

(e)

global

competition

in

the

markets

in

which

Vale

operates

;

and

(f)

the

estimation

of

mineral

resources

and

reserves,

the

exploration

of

mineral

reserves

and

resources

and

the

development

of

mining

facilities,

our

ability

to

obtain

or

renew

licenses,

the

depletion

and

exhaustion

of

mines

and

mineral

reserves

and

resources

.

To

obtain

further

information

on

factors

that

may

lead

to

results

different

from

those

forecast

by

Vale,

please

consult

the

reports

Vale

files

with

the

U

.

S

.

Securities

and

Exchange

Commission

(SEC),

the

Brazilian

Comissão

de

Valores

Mobiliários

(CVM)

and

in

particular

the

factors

discussed

under

“Forward

-

Looking

Statements”

and

“Risk

Factors”

in

Vale’s

annual

report

on

Form

20

-

F

.

”

“Cautionary

Note

to

U

.

S

.

Investors

–

Vale

currently

complies

with

SEC

Industry

Guide

7

in

its

reporting

of

mineral

reserves

in

SEC

filings

.

SEC

Industry

Guide

7

permits

mining

companies,

in

their

filings

with

the

SEC,

to

disclose

only

those

mineral

deposits

that

a

company

can

economically

and

legally

extract

or

produce

.

We

present

certain

information

in

this

presentation

that

are

not

be

permitted

in

an

SEC

filing

.

These

materials

are

not

proven

or

probable

reserves,

as

defined

by

the

SEC,

and

we

cannot

assure

you

that

these

materials

will

be

converted

into

proven

or

probable

reserves,

as

defined

by

the

SEC

.

Starting

in

its

next

annual

report

on

Form

20

-

F,

Vale

will

comply

with

Subpart

1300

of

Regulation

S

-

K,

which

will

replace

SEC

Industry

Guide

7

.

Subpart

1300

of

Regulation

S

-

K

permits

mining

companies,

in

their

filings

with

the

SEC,

to

disclose

“mineral

reserves”,

“mineral

resources”

and

“exploration

targets”

that

are

based

upon

and

accurately

reflects

information

and

supporting

documentation

of

a

qualified

person

.

We

present

certain

information

in

this

presentation

that

are

not

based

upon

information

or

documentation

of

a

qualified

person,

and

that

will

not

be

permitted

in

an

SEC

filing

under

Subpart

1300

of

Regulation

S

-

K

.

These

materials

are

not

mineral

reserves,

mineral

resources

or

exploration

targets,

as

defined

by

the

SEC,

and

we

cannot

assure

you

that

these

materials

will

be

converted

into

mineral

reserves,

mineral

resources

or

exploration

targets,

as

defined

by

the

SEC

.

U

.

S

.

Investors

should

consider

closely

the

disclosure

in

our

Annual

Report

on

Form

20

-

K,

which

may

be

obtained

from

us,

from

our

website

or

at

http

:

//http

:

//us

.

sec

.

gov/edgar

.

shtml

.

”

|

|

|

De-risking Vale

through Safety and Operational Excellence

Re-rating

▪ Benchmark in Safety

▪ Best-in-class reliable

operator

▪ Talent-oriented organization

▪ Leader in low carbon mining

▪ Reference in value creation

and sharing

De-risking

▪ Brumadinho

▪ Dam safety

▪ Robust ESG practices

▪ Production resumption

Reshaping

▪ Focus on core business

▪ Control of cash drains

▪ Growth opportunities

Solid cash flow generation

Discipline in capital allocation

Reshaping

|

|

|

The cultural transformation

is keeping pace…

4

2019 2020 2021 2022

• Purpose defined by leaders

• Culture & VPS² integrated

• Senior Leadership activation

• Influencers network activation

• People Management Tools &

Targets

• D&I take-off

• Purpose fully reflected in

the strategy

• Frontline Leaders - Cultural

Transformation’s protagonists

• Site-centric approach –

tailored

•Measurement evolution

• Digital Inclusion

• Cultural Diagnosis

• Defined aspiration

• Leadership Awareness

• Review of key standards

• Exec Co. development to

model the change

• D&I¹ Statement

• Purpose activation

• Culture & VPS: single goal

• Reinforced communication

• Tailored transformation at VP

areas

• Measuring organizational and

individual impact

• D&I scaling up

The Pulse:

17,000 employees assessing

key behaviors across Vale

¹ D&I stands for Diversity & Inclusion. ² VPS stands for Vale Production System, Vale’s management model.

Learning together

|

|

|

… supported by

a strong governance for safety and risk management

Board of

Directors

Audit

Committee

Advisory

Committees

Compliance

Office

CEO

Executive Risk

Committees

Safety and

Operational

Excellence

Executive Office

Structures created

after Dam I collapse

▪ Operational Excellence & Risks

▪ Sustainability

▪ Finance

▪ People, Compensation and Governance

▪ Innovation

▪ Nomination ▪ Whistleblower

Channel

▪ Internal Audit

▪ Corporate Integrity

▪ Geotechnical Risks

▪ Operational Risks

▪ Strategic, Financial and Cyber Risks

▪ Compliance

▪ Sustainability and Reputation Risks

Executive compensation

35-60%

of short-term variable

compensation tied to Health &

Safety, Operational Risk and VPS

targets

The Safety and Operational

Excellence Office has NO TARGET

tied to production or financial metrics

|

|

|

6

Risk management model

Carlos Medeiros,

Executive Vice President of Safety and Operational

Excellence

|

|

|

An integrated risk map

supports the decision-making process

Risk categories

People

▪ Outsourcing and partnership

▪ Relationship with Unions

▪ Organizational structure and culture

▪ Abusive and discriminatory practices

▪ Training, recruitment and retention

▪ Staff dependency / successions

▪ Adherence to Labor Law

Sustainability and Reputation

▪ Reparation

▪ Climate Change

▪ Waste, effluents and emissions

▪ Socio-Environmental obligations

▪ Human Rights

▪ Relationship with communities

▪ Institutional relationship

▪ Disruptions, vandalism and terrorism

▪ Image and reputation

▪ Communication and disclosure

Strategic

▪ Demand and competition

▪ Budget and Planning

▪ Intellectual property

▪ Sales/Commercial

▪ Projects and investments

▪ Associated companies

▪ Merges, acquisitions and

divestments

▪ Innovation and new

technologies

Cybernetic

▪ Information theft

or leakage

▪ Unavailability of

technology

assets

▪ Loss of data

integrity

Finance

▪ Exchange and interest rates

▪ Commodities

▪ Freight

▪ Investor Relations

▪ Cash flow

▪ Capital availability

▪ Insurance coverage

▪ Credit granting and defaults

▪ Financial and accounting reports

▪ Compliance, fraud

Business Continuity

▪ Shortage of critical raw materials

▪ Water and energy availability

▪ Licenses, concessions and mining rights

▪ Mine, rail, road and port structure

▪ Shipping and inland waterway

▪ Waste and tailings disposal

▪ Availability and quality of mineral reserves

Operational

▪ Occupational Safety

▪ Occupational Health & Hygiene

▪ Compliance with H&S Norms

▪ Process Safety

▪ Production disruption / material

losses

Geotechnical

▪ Tailings dams

▪ Pile

▪ Embankments,

cuts and slopes

▪ Underground

mines

Compliance

▪ Anti-corruption

▪ Tax and Fiscal

▪ Sanctions

▪ Antitrust

▪ Data Protection

▪ Litigation

▪ Regulatory changes

|

|

|

1st Line of Defense

Operations and Business

The Safety and Operational Excellence Executive Office

was created in 2019…

Health and Safety and

Operational Risks

Asset

Management

Geotechnical

Structures

Safety and Operational

Excellence Executive Office

450 professionals

Operational

Excellence

3rd Line of Defense

Internal Audit 2nd Layer 1st Layer

2nd Line of Defense

Specialist

The risk management model based on 3 lines of defense

supports the office‘s independence

Business Unit

Maintenance

Engineering

Capital Projects

(Development)

Long-term Mine

Planning

“Asset Owner”

Operation &

Maintenance

Capital Projects

(Implementation)

Monitoring &

Inspection

Governance

Standards definition

Compliance check

Compliance with the

Company’s Policies and

standards

|

|

|

… to ensure an effective risk management

Office’s reporting routine

Half-year reports

to the Board of Directors

Monthly reports¹

to the Operational Excellence and Risk Committee,

which reports monthly to the Board of Directors

Weekly reports

to the Executive Board

Ad-hoc reports

whenever a risk out of the tolerable

limit is identified

Operations shutdown² as a result of more

stringent Health & Safety protocols

▪ Operations at Sossego

▪ Operations at Onça Puma

▪ Operations at Voisey’s Bay

▪ VNC Refinery

▪ Simões Filho Plant

▪ Mina Azul

▪ Project Salobo III

▪ Project VBME

▪ Port Colborne Refinery

¹Considers 26 thematic reports in 9 months w ithin a year. ²In 2020, temporary or definitive shutdow n.

Half-year reports

to the Fiscal Council

Non-exhaustive list

|

|

|

10

Occupational Health & Safety

|

|

|

We are building a sustainable performance

in Health & Safety …

Innovation to reduce risk exposure

▪ Digital workforce:

Eliminating at-site risks by accelerating

remote working

▪ Automation:

- Brucutu mine’s entire fleet is autonomous

- In Sudbury, 40 autonomous trucks

- Remotely controlled equipment for

decharacterization of critical dams

- Unmanned train operation at Timbopeba

site

¹ Total Recordable Injury Frequency Rate.

TRIFR¹

Peer 4 Vale Peer 3

1.98 1.84

Peer 1

2.65 2.14

Peer 2

3.21

TRIFR - 2020 comparison in mining

2018 2019 2020 2021

1.38 1.98 2.25

3.48

-39%

+62%

+34%

+8% -7%

Peer compared to Vale

|

|

|

… as we are making progress

with our commitments

Reduce by 50% employee

exposure to key health risks²

Eliminate very high-risk

scenarios³

Zero high-potential

recordable injuries (N2)¹

66 57 44

23

25

15 10 5 0

2018 2022 2025 2019 2024 2020 2021 2023

Target

N2

Reduction of high-potential recordable

injuries (N2 - absolute values4)

12.0

2020 2024 2018

21.0 23.0 17.9

2019

11.5

17.0

21.0

17.9

13.0

2021

15.0

2022 2023 2025

Target

Exposures

Reduction of exposures above the

Occupational Exposure Limit (OEL)

N2 (Jan-Sep 2021) Exposures (Jan-Sep 2021)

¹ Injuries w hich are considered a precursor to fatal accidents. ² Physical, chemical or biological risks. ³ According to Vale’s risk matrix, based on 2019. 4 Includes ow n employees and third parties.

Note: Commitments by 2025.

|

|

|

13

HIRA implementation

|

|

|

All sites are already

covered by HIRA¹ first cycle…

¹Hazard Identification and Risk Assessment. ²Includes New Caledonia, as the assessment was performed before Vale’s exit from the business.

Reassessments every 3 years (critical sites)

or 5 years (non-critical sites)

79 sites²

assessed since 2019 Identification

Assessment 824 material unwanted events

mapped

Treatment 2,039 immediate actions

implemented

Control &

Monitoring

7,250 critical controls

identified

Risk

|

|

|

HIRA for Dams and Tailings Storage Facilities

Number of dams

… with rollout to

our dam portfolio

60

24

10

21

Total 2022 2020

5

9M21 4Q21

▪ Focus on key tailings dams¹ operated by Vale

▪ Assess Material Unwanted Events

▪ Identify, design and implement Critical Controls

▪ Prioritize and implement Immediate Actions for risk

reduction

▪ Supported by external expert companies Implemented

Under implementation

¹ Includes facilities within Vale operations and excludes Non-operated Joint Ventures (JVs). Key tailings storage facilities based on the definition agreed by the International Council

on Mining and Metals Tailings Advisory Group in response to the Church of England information request, which may differ from Brazilian National Mining Agency definition.

|

|

|

16

Operational Excellence

|

|

|

Back to basics

▪ 5S, routine management

▪ Technical capacitation

▪ Maintenance strategy

▪ Structuring maintenance plans

and control

▪ Basic guidelines (maintenance,

operation, geotechnical)

▪ VPS Assessment

2019-2020

2021-2022

2023-2025

Structuring

✓ Simplification of the

management model

✓ Publication of the VPS Manual

and Rulers

✓ Structuring performance cycles

✓ Training of employees in VPS

Continuous improvement

and operational stability

▪ Standardization of priority tasks

▪ MICT² technical training

▪ Waste reduction and increased

productivity

▪ Problem exposure culture and

continuous improvement

▪ Consolidation of maintenance and

operation processes

¹Vale’s integrated management system. The acronym stands for “Vale Production System”. ²Vale’s integrated MICT stands for Integrated Model of Technical Training.

The VPS¹ is the vehicle

of our cultural transformation…

3 dimensions,

17 elements

with the minimum

compliance requirements

|

|

|

… and drives Vale

to become the best-in-class reliable operator

2020

2.43 1.52

2019

0.43

2021

-82%

2020 2019

67.7 95.2 93.5

2021

+41%

EFVM railway

Total recordable

injury frequency

rate - TRIFR

Adherence to

maintenance plan (%)

1.67

2020 2019

1.80

2021

1.58

-5%

69.9 54.6

2019

64.9

2020 2021

+28%

Itabira Complex

2020

4.23

2019

3.21

1.56

2021

-63%

49.0

2020 2019

73.6 81.8

2021

+67%

Tubarão Port

|

|

|

19

Asset Integrity

|

|

|

We promote the Safety and Integrity of our assets

throughout their life cycle

Engineering

Construction

Commissioning

Operation

Maintenance

Decommissioning

Asset

life cycle

Consequences Causes

Hazard

Material

unwanted

events

Preventive

control

Mitigate

control

PNRs¹ Barriers

Training /

Qualification

Technical support to

areas for implementation

Check

Process

P

DC

A

¹ Normative standards.

|

|

|

▪ Risk assessment

▪ Benchmarks

▪ International standards

▪ Best engineering practices

▪ Accident history

▪ Engineering companies

Our Asset Integrity technical standards are global

for critical assets

Systems,

layout and

structures

Rail

Ports and bridges

Pumping systems

Hazardous material handling

Explosives

Combustible dusts and solids

Plant layout, escape route

Fire Protection

& Fighting

Protection and firefighting systems

Detection and alarm systems

Equipment

Material handling systems

Structural integrity

Furnaces, reactors, off-gas systems

~50%

of standards

defined by the end of 2021

Electrical,

Automation,

Instrumentation

Instrumentation and control

Incident energy

Power station protection systems

+17,000

employees trained in

Asset Integrity standards

|

|

|

22

Dam management

|

|

|

23

Progress with

TDMS and the Decharacterization Program

Upstream² Dam³ Decharacterization Program

▪ 6 upstream dam eliminated since 2019

▪ 24 upstream dam to eliminate:

▪ Back-up dams for all level-3 dams

▪ No dam at emergency level 3 by 2025

▪ Program’s completion by 2029

1In Brazil. ²Same raising method deployed at B1 dam, collapsed in Brumadinho. ³Includes dams, dikes and waste piles.

Emergency

level

# of

dams

3 3

2 4

1 4

Tailings & Dams Management System

Risk assessment

Routine

▪ New dam management policy

▪ Responsibility assignment matrix revised

▪ 25 requirements and guidelines

▪ Periodic assessment by the assurance team

Performance

▪ 100% of dams¹ with Engineer of Record

▪ Continuous monitoring and inspections

▪ Periodic and immediate reports to upper

management

▪ 100% tailings dam portfolio covered by risk

assessment (HIRA) by the end of 2022

▪ Rigorous enforcement of updated

emergency level requirements

|

|

|

24

1st step – Self-Assessment

By the 1st Line of Defense

Completion by October 2021

A form-based tool for the

assessment of each TSF (with

supporting evidence). Cover all

77 auditable requirements.

Tailings storage facilities (TSF) operated by Vale will be in conformance with the GISTM:

▪ Those with “Extreme” or “Very high” potential consequences, by August 5th, 2023

▪ All other, not in a state of safe closure, by August 5th, 2025

Commitment to

comply with the GISTM

2nd step – Gap Assessment

By 2nd Line + external consulting

Completion by February 2022

Re-assessment of select TSFs

for full compliance

Key findings in December 2021

3rd step – External Audit

By independent, external party

Deadline for completion to be

defined

Depending on further guidance

by the ICMM

|

|

|

25

8B

2019

Decharacterization of

8B dam

Nova Lima (MG)

|

|

|

26

Dique Rio do Peixe

Decharacterization of

Dique Rio do Peixe

Itabira(MG)

|

|

|

27

Decharacterization of

Fernadinho dam

Vargem Grande Complex (MG)

|

|

|

28

ECJ Sul Superior

Sul Superior

back-up dam

Barão de Cocais, MG, Brazil

|

|

|

29

Forquilhas and Grupo

back-up dam

Ouro Preto and Itabirito(MG)

|

|

|

30

ECJ B3/B4

B3/B4

back-up dam

Nova Lima (MG)

|

|

|

31

Closing remarks

|

|

|

We are building

a safer and more reliable Vale

Geotechnical Monitoring Center

Parauapebas (PA)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/ Ivan Fadel

|

|

Date: September 23, 2021

|

|

Head of Investor Relations

|

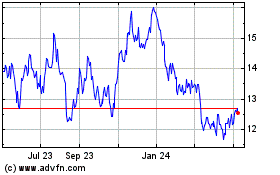

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

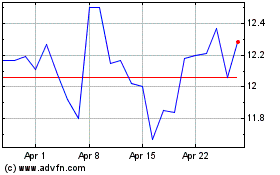

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024