Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 05 2021 - 10:12AM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington,

D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

April 2021

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x

Form 40-F ¨

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes ¨ No

x

(Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check

One) Yes ¨ No x

(Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.)

(Check One) Yes ¨

No x

(If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b). 82- .)

The Brazilian Federal Public Prosecutor's Office

shelved for archiving the allegations of Beny Steinmetz against Vale

Rio de Janeiro, April 5th 2021

- Vale S.A (“Vale”) informs that, on March 28, 2021, the Brazilian Federal Public Prosecutor's Office shelved for archiving

the allegations that had been presented by Benjamin Steinmetz falsely accusing Vale executives of illegal practices regarding the Simandou

mining project in the Republic of Guinea.

After classifying the request as “disturbingly

unspecific,” the Federal Public Prosecutor's Office concluded that the documents presented “do not contain elements that even

in theory indicate the occurrence of a crime of active corruption or international influence peddling,” and described as a “fallacious

and inconsistent conclusion” accusations that Vale executives had offered an undue advantage to George Soros in 2011.

Vale believes that the decision by the Federal

Public Prosecutor's Office corroborates the integrity of its actions in the market and remains confident that Brazilian authorities will

acknowledge that the clear purpose of Mr. Steinmetz is to divert the focus from the obligation to indemnify Vale for US$ 2 billion,

in accordance with arbitral award and court decisions that were unfavorable to him in England and the United States.

Luciano Siani Pires

Executive Officer of Investor Relations

Ever since the Covid-19 outbreak

began, our highest priority is the health and safety of our employees. Our IR team adopted work-from-home, and as we continue to face

these new circumstances, we strongly recommend you prioritize e-mail and online engagement.

For further information, please

contact:

Vale.RI@vale.com

Ivan Fadel: ivan.fadel@vale.com

Andre Werner:

andre.werner@vale.com

Mariana Rocha: mariana.rocha@vale.com

Samir Bassil: samir.bassil@vale.com

This press release may include statements

that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future,

involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties

include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy;

(c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical

by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead

to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission

(SEC), the Brazilian Comissão de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking

Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Vale S.A.

(Registrant)

|

|

|

|

|

|

Date: April 5, 2021

|

By:

|

/s/ Ivan Fadel

|

|

|

|

Head of Investor Relations

|

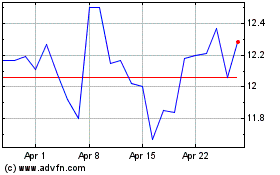

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

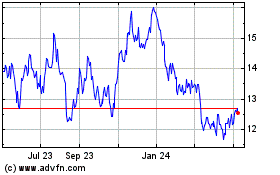

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024