United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

June 2020

Vale S.A.

Praia de Botafogo nº 186, 18º

andar, Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form

20-F x Form 40-F ¨

(Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

¨ No x

(Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check

One) Yes ¨ No x

(Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

(Check

One) Yes ¨ No x

(If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b). 82- ¨.)

Vale signs

definitive agreements with Inalum for the sale of a minority equity stake in PT Vale

Rio de Janeiro, June 19, 2020 - Vale SA

(“Vale”) informs that its subsidiary Vale Canada Limited (“VCL”) has signed, together with Sumitomo Metal

Mining Co., Ltd. ("SMM"), the definitive agreements (“Agreements”) for the sale of a 20% stake of PT Vale

Indonesia Tbk (“PT Vale”) to PT Indonesia Asahan Aluminium (Persero)1 ("Inalum”).

Transaction background

In October 2014, PT Vale signed the amendment

to its 1996 Contract of Work with the Government of the Republic of Indonesia, which is set to expire in December 2025. In order

for PT Vale to be entitled with the extension of its license to operate beyond 2025, certain requirements need to be fulfilled,

including the divestment of 20% of PT Vale shares to Indonesian participants.

Indonesia plays a major strategic role

within the global nickel industry. This transaction represents an important development in PT Vale’s long presence in Indonesia

and reinforces Vale’s commitment to keep investing in the region.

The transaction

Inalum is the Indonesian state-owned entity

for investments in the mining sector and its association with PT Vale significantly contributes to the continuous development and

operational expansion of its businesses in Indonesia.

The final terms and conditions were settled

in the Agreements and include, among others, (i) the secondary purchase of 20% of PT Vale shares by Inalum, and (ii) the maintenance

of financial and operational control of PT Vale by VCL, as well as the financial and production consolidation in its financial

statements.

After the closing of the transaction, Inalum

will have acquired 20% of PT Vale shares, being 14.9% from VCL and 5.1% from SMM. Vale and SMM will then have a stake of 44.3%2

and 15.0% in PT Vale, totalling a 59.3% participation.

For its stake, VCL will receive IDR 4,126

billion, approximately US$ 290 million3 in cash upon closing of the transaction, which is expected to happen by the

end of 2020, after the satisfaction of standard regulatory approvals.

Vale takes this opportunity to praise the

alliance with Inalum and SMM, reinforcing PT Vale’s long-standing commitment to the prosperity, sustainability and local

empowerment in Indonesia.

1 Recently renamed MIND ID.

2 The 44.3% stake Vale will have in PT Vale after

this transaction includes the participation through VCL (43.8%) and Vale Japan Limited (0.5%).

3 Considering IDR 14,234/USD and share price of

IDR 2,780/share.

Ever since the Covid-19

outbreak began, our highest priority is the health and safety of our employees. Our IR team adopted work-from-home, and as we continue

to face these new circumstances, we strongly recommend you prioritize e-mail and online engagement.

For further information,

please contact:

Vale.RI@vale.com

Ivan Fadel: ivan.fadel@vale.com

Andre Werner: andre.werner@vale.com

Mariana Rocha: mariana.rocha@vale.com

Samir Bassil: samir.bassil@vale.com

This press release may include

statements that present Vale’s expectations about future events or results. All statements, when based upon expectations

about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These

risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada;

(b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production,

which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on

factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities

and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM) and in particular the factors

discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale

S.A.

(Registrant)

|

|

|

By:

|

/s/

Ivan Fadel

|

|

Date: June 19, 2020

|

|

Director of Investor Relations

|

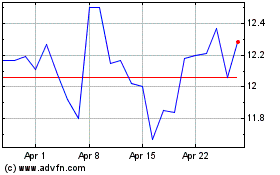

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

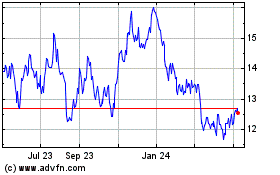

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024