Current Report Filing (8-k)

November 17 2020 - 4:37PM

Edgar (US Regulatory)

false000089462700008946272020-11-172020-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2020

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32167

|

|

76-0274813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

|

|

77042

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10

|

EGY

|

New York Stock Exchange

|

|

Common Stock, par value $0.10

|

EGY

|

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01Entry into a Material Definitive Agreement.

On November 17, 2020 (the “Execution Date”), VAALCO Gabon S.A. (“VAALCO Gabon”), a wholly owned subsidiary of VAALCO Energy, Inc. (the “Company”), entered into a sale and purchase agreement (the “SPA”) with Sasol Gabon S.A. (“Sasol”) for the purchase of a 27.8% working interest in oil and gas producing properties in the Etame Marin block offshore Gabon (the “Etame Acquisition”), bringing the Company’s total working interest in the Etame Marin block to 58.8%, and a 40% non-operated working interest in Block DE-8 offshore Gabon (the “Block DE-8 Acquisition”, and together with the Etame Acquisition, the “Acquisition”) for total cash consideration of $44.0 million, subject to customary purchase price adjustments in accordance with the SPA, including adjustments to account for estimated positive net cash flows attributable to the period from July 1, 2020 until the closing date. Pursuant to the SPA, the Company agreed to guarantee the full and complete performance of VAALCO Gabon’s obligations under the SPA.

Under the terms of the SPA, a contingent payment of $5 million will be payable to Sasol by the Company if Brent oil pricing averages greater than $60 per barrel for 90 consecutive days during the period from July 1, 2020 to June 30, 2022. There is an additional contingent payment of $1 million payable to Sasol by the Company if the Block DE-8 appraisal well is successful.

In connection with the execution of the SPA, VAALCO Gabon paid a cash deposit in the amount of $4.3 million (the “Deposit”) to Sasol. If the SPA is terminated under certain circumstances specified in the SPA, including by Sasol upon a breach by VAALCO Gabon of its warranties given in the SPA, then Sasol is entitled to retain the Deposit.

The consummation of the Acquisition is subject to various customary conditions, and the Acquisition is expected to close within 90 days of the Execution Date.

The SPA contains certain termination rights for VAALCO Gabon and Sasol, including, among others, (i) if either party is in breach of any of its warranties, (ii) the conditions precedent to closing have not been satisfied by a specified date, subject to certain notice requirements, (iii) in the event of certain insolvency events and (iv) the occurrence of a Material Adverse Change Event (as defined in the SPA) with respect to Sasol.

Item 7.01Regulation FD Disclosure.

On November 17, 2020, the Company issued a press release announcing the pending Acquisition. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in Item 7.01 of this report (including Exhibit 99.1 attached hereto) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

99.1

|

|

Press release, dated November 17, 2020, issued by VAALCO Energy, Inc. (furnished herewith pursuant to Item 7.01).

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

VAALCO Energy, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: November 17, 2020

|

|

|

|

|

By:

|

/s/ Elizabeth D. Prochnow

|

|

|

Name:

|

Elizabeth D. Prochnow

|

|

|

Title:

|

Chief Financial Officer

|

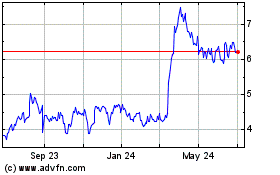

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

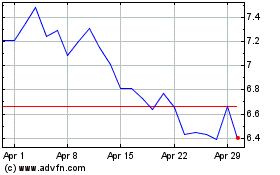

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024