As filed with the Securities and Exchange Commission

on September 3, 2021

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Utz Brands, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation or organization)

|

|

|

|

85-2751850

|

|

(I.R.S. Employer Identification Number)

|

900 High Street

Hanover, PA17331

(717) 637-6644

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Dylan B. Lissette

Chief Executive Officer

Utz Brands, Inc.

900 High Street

Hanover, PA17331

(717) 637-6644

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With copies to:

Larry P. Laubach, Esq.

Jeremiah G. Garvey, Esq.

Cozen O’Connor P.C.

One Liberty Place

1650 Market Street

Suite 2800

Philadelphia, Pennsylvania 19103

(215) 665-2000

Approximate date of commencement of proposed

sale to the public: From time to time on or after the effective date of this registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

x

|

|

Non-accelerated filer

|

¨

|

|

Smaller reporting company

|

¨

|

|

|

|

|

Emerging growth company

|

x

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered(1)(2)

|

|

|

Proposed

Maximum

Offering Price

per Unit(1)(2)

|

|

|

Proposed

Maximum

Aggregate

Offering Price(1)

|

|

|

Amount of

Registration

Fee(8)

|

|

|

Class A Common Stock, par value $0.0001 per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depositary Stock(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Guarantees of Debt Securities(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Purchase Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units(6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

750,000,000

|

|

|

|

(7)

|

|

|

$

|

750,000,000

|

|

|

$

|

81,825

|

|

|

|

(1)

|

Information with respect to each class of securities to be registered is omitted pursuant to General Instruction II.D of Form S-3

under the Securities Act of 1933, as amended (the “Securities Act”). There is being registered hereby such indeterminate number

or amount, as the case may be, of the securities of each identified class as may from time to time be offered and sold at indeterminate

prices, which together shall have a maximum aggregate offering price not to exceed $750,000,000 or the equivalent thereof in one or more

foreign currencies, foreign currency units or composite currencies. The securities covered by this registration statement may be sold

or otherwise distributed separately, together or as units with other securities covered by this registration statement.

|

|

|

(2)

|

This registration statement also covers an indeterminate amount of each identified class of securities as may be issued upon conversion

of, or in exchange for, or upon exercise of, or pursuant to, convertible or exchangeable securities that provide for exercise or conversion

into or purchase of such securities of Utz Brands, Inc. Separate consideration may or may not be received for securities that are

issuable on exercise, conversion or exchange of other securities or that are represented by depositary stock.

|

|

|

(3)

|

The depositary stock being registered will be evidenced by depositary receipts issued under a

deposit agreement. If the registrant elects to offer fractional interests in preferred stock (the “preferred stock”) to

the public, depositary receipts will be distributed to the investors purchasing the fractional interests, and the preferred stock

will be issued to the depositary under the deposit agreement.

|

|

|

|

|

|

|

(4)

|

Utz Brands, Inc. or one or more of its subsidiaries may

guarantee debt securities. No separate consideration will be paid in respect of the guarantees. Pursuant to

Rule 457(n) under the Securities Act, no separate fee is payable with respect to the guarantees of debt

securities.

|

|

|

|

|

|

|

(5)

|

The warrants covered by this registration statement may be warrants for debt securities, Class A Common

Stock, preferred stock or units consisting of two or more of the foregoing classes of securities.

|

|

|

|

|

|

|

(6)

|

Each unit will be issued

under a unit agreement or indenture and will represent an interest in two or more other securities registered hereunder, which may

or may not be separable from one another.

|

|

|

|

|

|

|

(7)

|

Omitted pursuant to Rule 457(o) under the Securities Act.

|

|

|

|

|

|

|

(8)

|

Calculated

pursuant to Rule 457(o) under the Securities Act.

|

The Registrant hereby amends

this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

SEPTEMBER 3, 2021

PRELIMINARY PROSPECTUS

Utz Brands, Inc.

$750,000,000

Class A Common Stock

Preferred Stock

Depositary Stock

Debt Securities

Guarantees of Debt Securities

Warrants

Subscription Rights

Stock Purchase Contracts and

Units

This prospectus relates to the offer and sale

from time to time by Utz Brands, Inc. of up to $750,000,000 of the following securities, in one or more series or classes, separately

or together:

|

|

·

|

Guarantees of Debt Securities;

|

|

|

·

|

Stock Purchase Contracts; and

|

We will offer our securities in amounts, at prices

and on terms to be determined at the time we offer those securities. We will provide the specific terms of these securities in supplements

to this prospectus when we offer these securities.

The securities may be offered on a delayed or

continuous basis directly by us, through agents, underwriters or dealers as designated from time to time, through a combination of these

methods or any other method as provided in the applicable prospectus supplement. We provide more information in the section entitled “Plan

of Distribution.”

Our registration of the securities covered by

this prospectus does not mean that we will issue, offer or sell, as applicable, any of the securities.

You should read this prospectus and any prospectus

supplement or amendment carefully before you invest in our securities.

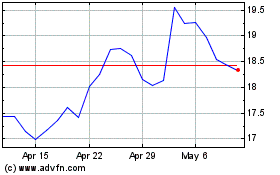

Our Class A Common Stock is traded on the

New York Stock Exchange (“NYSE”) under the symbols “UTZ”. On September 2, 2021, the closing price

of our Class A Common Stock was $19.97 per share.

We are an “emerging growth company,”

as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing

in our securities involves risks. See “Risk Factors” beginning on page 3 and in any applicable

prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2021.

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus,

as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. We have not authorized

anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is

not permitted. You should not assume that the information in this prospectus, any applicable prospectus supplement or any documents incorporated

by reference is accurate as of any date other than the date of the applicable document. Since the respective dates of this prospectus

and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects

may have changed.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process.

By using this shelf registration process, we may sell any of our Class A Common Stock, preferred stock, depositary stock, debt securities,

guarantees of debt securities, warrants, subscription rights, stock purchase contracts and units, in each case from time to time in one

or more offerings, as described in this prospectus. This prospectus only provides you with a general description of the securities we

may offer and such description is not meant to be a complete description of each security. Each time we sell securities, we will, if required,

provide a prospectus supplement that will contain specific information about the terms of the offering and the securities being offered.

The prospectus supplement or a free writing prospectus may also add to, update or change information contained in this prospectus. Any

statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that

a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to

constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this

prospectus. If there is any inconsistency between information in this prospectus and any prospectus supplement or free writing prospectus,

you should rely on the information in the prospectus supplement or free writing prospectus. Before purchasing any securities, you should

carefully read both this prospectus and any supplement or free writing prospectus, together with the information described under the headings

“Where You Can Find More Information” and “Information Incorporated by Reference.”

We have not authorized anyone to provide any information

or to make any representations other than those contained in, or incorporated by reference into, this prospectus, any accompanying prospectus

supplement or any free writing prospectus we have prepared. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under

circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus.

This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the

offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate

only as of the date on the front of those documents and that information incorporated by reference is accurate only as of the date of

the document incorporated by reference, unless we indicate otherwise, regardless of the time of delivery of this prospectus or any applicable

prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed

since those dates.

This prospectus contains or incorporates by reference

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred

to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this

prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information”

and “Information Incorporated by Reference.”

On August 28, 2020 (the “Closing

Date”), Utz Brands, Inc. (formerly known as Collier Creek Holdings), consummated its business combination pursuant to

that certain Business Combination Agreement, dated as of June 5, 2020 (the “Business Combination Agreement”),

among the Company, Utz Brands Holdings, LLC, a Delaware limited liability company (“Utz Brands Holdings”), Series U

of UM Partners, LLC, a series of a Delaware limited liability company (“Series U”) and Series R of UM Partners,

LLC, a series of a Delaware limited liability company (“Series R” and together with Series U, the “Continuing

Members”). As contemplated by the Business Combination Agreement, on the Closing Date, Collier Creek Holdings domesticated

into a Delaware corporation (the “Domestication”) and consummated the acquisition of certain company units of Utz

Brands Holdings, the parent of Utz Quality Foods, LLC (“Utz Quality Foods”), as a result of a new issuance by Utz

Brands Holdings and purchases from Utz Brands Holdings’ existing equityholders pursuant to the Business Combination Agreement (the

“Business Combination”).

Unless the context indicates otherwise, references

to “the Company,” “we,” “us” and “our” refer to Utz Brands, Inc.,

a Delaware corporation, and its consolidated subsidiaries following the Business Combination. “Collier Creek” refers

to Collier Creek Holdings prior to the Business Combination. “Utz” refers to Utz Brands Holdings and its subsidiaries

prior to the Business Combination.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

We own or license numerous domestic and foreign

trademarks and other proprietary rights that are important to our businesses. These include the U.S. trademark registrations, which protect

certain rights in the following brands: Utz, Zapp’s, ON THE BORDER, Golden Flake, Good Health,

Boulder Canyon, Hawaiian, TORTIYAHS!, Tim’s Cascade, Snyder of Berlin, “Dirty”,

Kitchen Cooked, Bachman, and Jax, among others. We own or have rights to use the trademarks, service marks and trade

names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights

to use that appear in this prospectus may be registered in the U.S. and other jurisdictions. Each trademark, trade name or service mark

of any other company appearing in this prospectus is owned or used under license by such company.

INFORMATION INCORPORATED BY REFERENCE

This registration

statement incorporates by reference important business and financial information about our Company that is not included in or delivered

with this document. The information incorporated by reference is considered to be part of this prospectus, and the SEC allows us to “incorporate

by reference” the information we file with it, which means that we can disclose important information to you by referring you to

those documents instead of having to repeat the information in this prospectus. Any statement contained in any document incorporated or

deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent

that a statement contained in or omitted from this prospectus or any accompanying prospectus supplement, or in any other subsequently

filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate

by reference:

|

|

·

|

Our

Annual Report on Form 10-K

for the fiscal year ended January 3, 2021, filed on March 18, 2021, as amended

by our Form 10-K/A, filed on May 13, 2021 (our “Annual Report”);

|

|

|

·

|

Our Current Reports on Form 8-K, filed on December 14,

2020, as amended by our Form 8-K/A, filed on February 23,

2021, January 11,

2021, January 20, 2021, February 4, 2021, May 4, 2021 (only with respect to Item 4.02 therein), May 5, 2021,

May 21, 2021 and July 26, 2021; and

|

|

|

·

|

The

description of our securities filed as an exhibit to our Annual Report.

|

We also

incorporate by reference into this prospectus any further filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than portions of those made pursuant to

Item 2.02 or Item 7.01 of Form 8-K or other information “furnished” and not filed with the SEC),

including all filings filed after the date hereof and prior to the completion of an offering of securities under this prospectus.

We have

filed with the SEC this registration statement under the Securities Act of 1933, as amended, covering the securities to be offered and

sold by this prospectus and any applicable prospectus supplement. This prospectus does not contain all of the information included in

the registration statement, some of which is contained in exhibits to the registration statement. The registration statement, including

the exhibits, can be read at the SEC website referred to below under “Where You Can Find More Information.” Any statement

made in this prospectus or any prospectus supplement concerning the contents of any contract, agreement or other document is only a summary

of the actual contract, agreement or other document. If we have filed any contract, document, agreement or other document as an exhibit

to the registration statement or any other document incorporated herein by reference, you should read the exhibit for a more complete

understanding of the document or matter involved. Each statement regarding a contract, agreement or other document is qualified in its

entirety by reference to the actual document.

Our

filings with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K and amendments to those reports, are available free of charge on our website at www.utzsnacks.com as

soon as reasonably practicable after they are filed with, or furnished to, the SEC. Our website and the information contained on that

site, or connected to that site, are not incorporated into and are not a part of this prospectus. Copies of all documents incorporated

by reference in this prospectus, other than exhibits to those documents unless such exhibits are specially incorporated by reference in

this prospectus, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus on

the written or oral request of that person made to: :

Utz Brands, Inc.

900 High Street

Hanover, PA17331

Attention: Investor Relations

Telephone: (717) 637-6644

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement

under the Securities Act with respect to the securities offered by this prospectus. This prospectus, which forms a part of such registration

statement, does not contain all of the information included in the registration statement. For further information pertaining to us and

our securities, you should refer to the registration statement and to its exhibits. The registration statement has been filed electronically

and may be obtained in any manner listed below. Whenever we make reference in this prospectus to any of our contracts, agreements or other

documents, the references are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement

or a report we file under the Exchange Act, you should refer to the copy of the contract or document that has been filed. Each statement

in this prospectus relating to a contract or document filed as an exhibit to a registration statement or report is qualified in all respects

by the filed exhibit.

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at www.sec.gov and on our website at www.utzsnacks.com. The information found on, or that can be accessed from or that is hyperlinked

to, our website is not part of this prospectus (except for the SEC filings expressly incorporated by reference herein). You

should not rely on any such information in making your decision whether to purchase the securities. You may inspect a copy of the

registration statement through the SEC’s website, as provided herein.

FREQUENTLY USED TERMS

Unless otherwise stated in this prospectus or

the context otherwise requires, references to:

“2020 LTIP” means the Utz Quality

Foods, LLC 2020 Long-Term Incentive Plan, a sub-plan under the Equity Incentive Plan.

“2020 LTIP RSU” means a restricted

stock unit awarded under the 2020 LTIP, which represents an unfunded and unsecured promise by us to pay a participant one share of Class A

Common Stock, and in the aggregate may settle into shares of Class A Common Stock plus such number of shares the Company may deliver,

in its discretion, to satisfy certain tax gross-up obligations.

“Amendment No. 2” means

Amendment No. 2 to the Credit Agreement, dated January 20, 2021, among Utz Quality Foods, Utz Brands Holdings, and Bank of America,

N.A., as administrative agent and collateral agent and each lender from time to time party thereto.

“ASC” means the Accounting

Standards Codification.

“Bankruptcy Law” means Title

11, United States Code or any similar federal or state or foreign law for the relief of debtors.

“Bylaws” mean the bylaws of

the Company in effect as of August 28, 2020.

“Cayman Islands Companies Law”

refers to the Companies Law (2020 Revision) of the Cayman Islands.

“Certificate of Incorporation”

means the certificate of incorporation of the Company filed with the Secretary of State of the State of Delaware on August 28, 2020.

“Class A

Common Stock” means the Class A Common Stock of the Company, par value $0.0001 per share.

“Class A

Ordinary Shares” means the Class A ordinary shares of Collier Creek, par value $0.0001 per share, prior to the Domestication.

“Class B

Common Stock” means the Class B Common Stock of the Company, par value $0.0001 per share.

“Class B

Ordinary Shares” means the Class B ordinary shares of Collier Creek, par value $0.0001 per share, prior to the Domestication.

“Class V

Common Stock” means the Class V Common Stock of the Company, par value $0.0001 per share.

“Closing”

means the closing of the Business Combination.

“Code” means the Internal Revenue

Code of 1986, as amended.

“Collier Creek” or “CCH”

means Collier Creek Holdings (which, prior to the Domestication, was an exempted company incorporated under the laws of the Cayman Islands

and after the Domestication became a corporation incorporated under the laws of the State of Delaware and changed its name to “Utz

Brands, Inc.”).

“Collier Creek’s independent directors”

means Collier Creek’s independent directors prior to the Domestication.

“Common

Company Units” means common units representing limited liability company interests of Utz Brands Holdings following

the Business Combination, which are non-voting, economic interests in Utz Brands Holdings.

“Common Stock” means, without

duplication, the Class A Common Stock and the Class V Common Stock of the Company.

“Company” means Collier Creek

as a Delaware corporation by way of continuation following the Domestication and the Business Combination. In connection with the Domestication

and simultaneously with the Business Combination, Collier Creek changed its corporate name to “Utz Brands, Inc.”

“Company Board” means the board

of directors of the Company subsequent to the Domestication.

“Continuing Member Nominees”

means the board members of the Company nominated by the Continuing Members pursuant to the Investor Rights Agreement.

“Custodian” means any custodian,

receiver, trustee, assignee, liquidator or other similar official under any Bankruptcy Law.

“DGCL” means the Delaware General

Corporation Law, as amended.

“Domestication” means the continuation

of Collier Creek by way of domestication of Collier Creek into a Delaware corporation, pursuant to which the ordinary shares of Collier

Creek became shares of Common Stock of the Delaware corporation under the applicable provisions of the Cayman Islands Companies Law and

the DGCL; the term includes all matters and necessary or ancillary changes in order to effect such Domestication, including the adoption

of the Certificate of Incorporation consistent with the DGCL and changing the name and registered office of Collier Creek.

“DTC” means the Depository

Trust Company.

“Equity Incentive Plan” means

the Utz Brands, Inc. 2020 Omnibus Equity Incentive Plan, which became effective on the Closing Date.

“Exchange Act” means the Securities

Exchange Act of 1934, as amended.

“Family Member” means with

respect to any individual, a spouse, lineal descendant (whether natural or adopted) or spouse of a lineal descendant of such individual

or any trust created for the benefit of such individual or of which any of the foregoing is a beneficiary.

“FDA” means the U.S. Food and

Drug Administration.

“First Lien Term Loan” means

that certain loan in an initial principal amount of $535.0 million pursuant to that certain First Lien Term Loan Credit Agreement, dated

November 21, 2017 (the “Credit Agreement”), by and among Utz Quality Foods, Utz Brands Holdings, Bank of America,

N.A. and the lenders party thereto, as amended from time to time.

“Forward Purchase Agreements”

means the Forward Purchase Agreements, dated as of September 7, 2018, among Collier Creek, the Sponsor and Collier Creek’s

independent directors, as applicable, pursuant to which the Sponsor and Collier Creek’s independent directors each agreed to purchase

the Forward Purchase Shares and Forward Purchase Warrants in a private placement, which occurred concurrently with the Closing of the

Business Combination.

“Forward Purchase Shares” means

Collier Creek’s 3,500,000 Class A Ordinary Shares purchased pursuant to the Forward Purchase Agreements.

“Forward Purchase Warrants”

means 1,166,666 redeemable warrants purchased pursuant to the Forward Purchase Agreements. Following the Domestication, each Forward Purchase

Warrant was exercisable for one share of Class A Common Stock of the Company at a price of $11.50 per share. On December 14,

2020, the Company announced the redemption of all of its outstanding Public Warrants and Forward Purchase Warrants to purchase shares

of its Class A Common Stock that were issued under the Warrant Agreement on the redemption date of January 14, 2021 (the “Warrant

Redemption Date”). Prior to the Warrant Redemption Date, an aggregate of 15,802,379 Public Warrants and Forward Purchase Warrants

were exercised, resulting in gross proceeds to the Company of $181.7 million, including 4,976,717 Public Warrants and Forward Purchase

Warrants which were exercised during fiscal year 2021, resulting in gross proceeds of $57.2 million.

“Forward Purchases” means the

purchases of the Forward Purchase Shares and Forward Purchase Warrants pursuant to the Forward Purchase Agreements.

“Founder Holders” means Chinh

E. Chu, Jason K. Giordano and Roger K. Deromedi, and certain of their respective affiliates and Family Members.

“FTC” means the Federal Trade

Commission.

“Heron” means Heron Holding

Corporation, a Delaware corporation.

“Investor Rights Agreement”

means the Investor Rights Agreement, dated August 28, 2020, entered into between the Company, the Continuing Members, the Sponsor

Parties and the Sponsor Representative in connection with the Closing of the Business Combination.

“IPO” means Collier Creek’s

initial public offering of its Units, Public Shares and Public Warrants pursuant to the IPO registration statement and completed on October 10,

2018.

“IPO registration statement”

means the registration statement filed for Collier Creek’s IPO on Form S-1 declared effective by the SEC on October 4,

2018 (SEC File Nos. 333-227295 and 333-227703).

“IP Purchase” means the purchase

and acquisition of the OTB IP by UQF on December 14, 2020, pursuant to an Asset Purchase Agreement, dated November 11, 2020

among UQF, Truco Seller and OTB Acquisition, LLC.

“JOBS Act” means the Jumpstart

Our Business Startups Act of 2012, as amended.

“Local Laws” and the laws of

the various states and localities where we operate and sell products.

“Organizational Documents”

means the Bylaws and Certificate of Incorporation of the Company.

“OTB” refers to ON THE BORDER®.

“OTB IP” means certain intellectual

property acquired from OTB Acquisition, LLC, including all rights to the OTB trademarks for use in the manufacture, sale and distribution

of snack food products in the United States and certain other international markets.

“Preferred Stock” means the

shares of Preferred Stock, par value $0.0001, authorized for future issuance by the Company under the Certificate of Incorporation.

“Private Placement” means the

private placement by Collier Creek of 7,200,000 Private Placement Warrants to the Sponsor simultaneously with the closing of the IPO.

“Private Placement Warrants”

means Collier Creek’s 7,200,000 warrants sold to the Sponsor simultaneously with the closing of the IPO in a Private Placement at

a price of $1.50 per warrant. Following the Domestication, each Private Placement Warrant is exercisable for one share of Class A

Common Stock of the Company at a price of $11.50 per share.

“Public Shares” means Collier

Creek’s Class A Ordinary Shares sold in the IPO (whether they were purchased in the IPO or thereafter in the open market),

which converted into shares of the Company’s Class A Common Stock in connection with the Domestication.

“Public Warrants” means the

warrants sold by Collier Creek in the IPO (whether they were purchased in the IPO or thereafter in the open market). Following the Domestication,

each Public Warrant was exercisable for one share of Class A Common Stock of the Company at a price of $11.50 per share. On December 14,

2020, the Company announced the redemption of all of its outstanding Public Warrants and Forward Purchase Warrants to purchase shares

of its Class A Common Stock that were issued under the Warrant Agreement on the Warrant Redemption Date. Prior to the Warrant Redemption

Date, an aggregate of 15,802,379 Public Warrants and Forward Purchase Warrants were exercised, resulting in gross proceeds to the Company

of $181.7 million, including 4,976,717 Public Warrants and Forward Purchase Warrants which were exercised during fiscal year 2021, resulting

in gross proceeds of $57.2 million. 30,928 Public Warrants remained unexercised on the Warrant Redemption Date and were redeemed for $0.01

per warrant.

“Related Agreements” means

certain additional agreements entered into in connection with the Business Combination Agreement as further described in this prospectus.

“Sarbanes-Oxley Act” means

the Sarbanes-Oxley Act of 2002, as amended.

“SEC” means the U.S. Securities

and Exchange Commission.

“Second Lien Term Loan” means

that certain loan in an initial principal amount of $125.0 million pursuant to that certain Second Lien Term Loan Credit Agreement, dated

November 21, 2017, by and among Utz Quality Foods, Utz Brands Holdings, Bank of America, N.A. and the lenders party thereto, as amended

from time to time.

“Securities Act” means the

Securities Act of 1933, as amended.

“Series B-1 Common Stock”

means the Series B-1 non-voting common stock of the Company, par value $0.0001 per share.

“Series B-2 Common Stock”

means the Series B-2 non-voting common stock of the Company, par value $0.0001 per share.

“Series R” means Series R

of UM Partners, LLC, a series of a Delaware limited liability company.

“Series U” means Series U

of UM Partners, LLC, a series of a Delaware limited liability company.

“Sponsor” means Collier Creek

Partners LLC, a Delaware limited liability company. The Sponsor dissolved in October 2020.

“Sponsor Parties” means the

Sponsor (prior to its dissolution), the Founder Holders and Collier Creek’s independent directors.

“Sponsor Representative” means

one of Chinh E. Chu, Jason K. Giordano and Roger K. Deromedi or one of their controlled affiliates selected by the Founder Holders

to act as the Sponsor’s representative in connection with the Business Combination.

“Sponsor Side Letter Agreement”

means the Sponsor Side Letter Agreement, dated June 5, 2020, entered into by Collier Creek and the Sponsor Parties upon the signing

of the Business Combination Agreement.

“Standstill Agreement” means

the Standstill Agreement, dated August 28, 2020, entered into between the Company, the Continuing Members, the Sponsor, the Founder

Holders and certain beneficial owners and related parties of the Continuing Members.

“Tax Receivable Agreement”

or “TRA” means the Tax Receivable Agreement, dated August 28, 2020, entered into between the Company and the Continuing

Members upon the completion of the Business Combination.

“Term Loans” means, collectively,

the First Lien Term Loan and the Second Lien Term Loan.

“Third Amended and Restated Limited Liability

Company Agreement” means the Third Amended and Restated Limited Liability Company Agreement of Utz Brands Holdings, dated August 28,

2020, in place upon the completion of the Business Combination.

“Truco” means Truco Holdco Inc.,

a Delaware corporation.

“Truco Acquisition” means our

purchase, through our subsidiary, Heron, of all of the issued and outstanding shares of common stock of Truco from Truco Seller.

“Truco Seller” means Truco

Holdings LLC, a Delaware limited liability company.

“Trust Account” means the trust

account of Collier Creek, which prior to the Closing held the net proceeds from the IPO and certain of the proceeds from the sale of the

Private Placement Warrants, together with interest earned thereon, less amounts released to pay taxes.

“USDA” means United States

Department of Agriculture.

“Utz Brands Holdings” or “UBH”

means Utz Brands Holdings, LLC, a Delaware limited liability company.

“Utz Quality Foods” or “UQF”

means Utz Quality Foods, LLC, a Delaware limited liability company.

“Warrant Agreement” means that

Warrant Agreement, dated as of October 4, 2018, by and between the Company Continental Stock Transfer & Trust Company, as

warrant agent.

“Warrants” means the Public

Warrants, the Private Placement Warrants and Forward Purchase Warrants.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus (including the documents incorporated

by reference herein) contains forward-looking statements. These forward-looking statements relate to expectations for future financial

performance, business strategies or expectations for our business. Specifically, forward-looking statements may include statements relating

to:

|

|

·

|

the financial position, capital structure, indebtedness, business strategy and plans and objectives of management for future operations;

|

|

|

·

|

the benefits of the Business Combination and subsequent acquisitions, dispositions and similar transactions;

|

|

|

·

|

the future performance of, and anticipated financial impact on, the Company;

|

|

|

·

|

expansion plans and opportunities; and

|

|

|

·

|

other statements preceded by, followed by or that include the words “may,” “can,” “should,” “will,”

“estimate,” “plan,” “project,” “forecast,” “intend,” “expect,”

“anticipate,” “believe,” “seek,” “target” or similar expressions.

|

These forward-looking statements are based on

information available as of the date of this prospectus and our management’s current expectations, forecasts and assumptions, and

involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside our control and

the control of our directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing

our views as of any subsequent date. We do not undertake any obligation to update, add or to otherwise correct any forward-looking statements

contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events,

inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks

and uncertainties, our results or performance may be materially different from those expressed or implied by these forward-looking statements.

Some factors that could cause actual results to differ are set forth under the heading “Risk Factor Summary” below

and those described under the section of this prospectus entitled “Risk Factors” or otherwise disclosed in our SEC

reports, including those set forth in our Annual Report, which is incorporated by reference into this prospectus. We do not undertake

or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any

change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as otherwise

required by law.

RISK FACTOR SUMMARY

Our business involves significant risks and uncertainties

that make an investment in it speculative and risky. The following is a summary list of the principal risk factors that could materially

adversely affect our business, financial condition, liquidity and results of operations. These are not the only risks and uncertainties

we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors”,

together with the other information in this prospectus and any prospectus supplement or free writing prospectus we may prepare.

Risks

Related to Our Business:

|

|

·

|

Our gross profit margins may be impacted by a variety of factors, including but not limited to variations in raw materials pricing,

retail customer requirements and mix, sales velocities and required promotional support.

|

|

|

·

|

Consumers’ loyalty to our brands may change due to factors beyond our control, which could have a material adverse effect on

our business and operating results.

|

|

|

·

|

Demand for our products may be adversely affected by changes in consumer preferences and tastes or if we are unable to innovate or

market our products effectively.

|

|

|

·

|

We must expend resources to create consumer awareness, build brand loyalty and generate interest in our products. In addition, competitors

may offer significant price reductions and consumers may not find our products suitably differentiated from products of our competitors.

|

|

|

·

|

Fluctuations in our results of operations from quarter to quarter because of changes in our promotional activities may impact, and

may have a disproportionate effect on, our overall financial condition and results of operations.

|

|

|

·

|

Our reputation or brand image might be impacted as a result of issues or concerns relating to the quality and safety of our products,

ingredients or packaging, and other environmental, social or governance matters, which in turn could negatively impact our operating results.

|

|

|

·

|

If our products become adulterated or are mislabeled, we might need to recall those items, and we may experience product liability

claims and damage to our reputation.

|

|

|

·

|

Slotting fees and customer charges or charge-backs for promotion allowances, cooperative advertising, and product or packaging damages,

as well as undelivered or unsold food products may have a significant impact on our operating results and may disrupt our customer relationships.

|

|

|

·

|

We operate in the highly competitive snack food industry, which may reduce our ability to sell our products to our customers or consumers

if we are unable to compete effectively.

|

|

|

·

|

We face competition in our business from private label, generic or store branded products which may result in price point pressures,

leading to decreased demand for our products.

|

|

|

·

|

Changes in retail distribution arrangements can result in the temporary loss of retail shelf space and disrupt sales of food products,

causing our sales to fall.

|

|

|

·

|

Our direct-to-warehouse delivery network system relies on a significant number of brokers, wholesalers and logistics companies. Such

reliance could affect our ability to effectively and profitably distribute and market products, maintain existing markets and expand business

into other geographic markets.

|

|

|

·

|

Our direct-store-delivery network system and regional third-party distributor network relies on a significant number of independent

operators and third-party distributors, and such reliance could affect our ability to effectively and profitably distribute and market

products, maintain existing markets and expand business into other geographic markets.

|

|

|

·

|

A disruption in the operation of the DSD network, regional third-party distributor network or DTW system could negatively affect our

results of operations, financial condition and cash flows.

|

|

|

·

|

The evolution of e-commerce sales channels may adversely affect our business, financial condition or results of operations.

|

|

|

·

|

The rapid expansion of hard discounters may adversely affect our business, financial condition or results of operations.

|

|

|

·

|

Disruption to our manufacturing operations, supply chain or distribution channels could impair our ability to produce or deliver finished

products and negatively impact our operating results.

|

|

|

·

|

The loss of, or a significant reduction in sales to, any key customer can adversely affect our business, financial condition or results

of operations.

|

|

|

·

|

Our business, financial condition or results of operations may be adversely affected by increased costs, disruption of supply or shortages

of raw materials, energy, water and other supplies.

|

|

|

·

|

Pandemics, epidemics or other disease outbreaks, such as COVID-19, may change or disrupt consumption and trade patterns, supply chains,

and production processes, which could materially affect our operations and results of operations.

|

|

|

·

|

Our financial position may be adversely affected by an unexpected event carrying an insurance obligation for which we have inadequate

coverage.

|

|

|

·

|

Changes in the legal and regulatory environment could limit our business activities, increase our operating costs, reduce demand for

our products or result in litigation.

|

|

|

·

|

As a food manufacturing company, all of our products must be compliant with regulations by, among others, the FDA, the FTC, the USDA,

and the Local Laws. In addition, a number of our products rely on independent certification that they are non-GMO, gluten-free, organic

or Kosher. Any non-compliance with the FDA, or USDA, or the loss of any such certification could harm our business.

|

|

|

·

|

Potential liabilities and costs from litigation, claims, legal or regulatory proceedings, inquiries or investigations can have an

adverse impact on our business, financial condition or results of operations.

|

|

|

·

|

We may be unable to successfully identify and execute or integrate acquisitions.

|

|

|

·

|

The geographic concentration of our markets may adversely impact us if we are unable to effectively diversify the markets in which

we participate.

|

|

|

·

|

We may not be able to attract and retain the highly skilled people we need to support our business.

|

|

|

·

|

A portion of our workforce is represented by unions. Failure to successfully negotiate collective bargaining agreements, or strikes

or work stoppages, could cause our business to suffer.

|

|

|

·

|

We license certain trademarks to sell branded specialty products under popular household names, such as T.G.I. Friday’s®,

which may require us to pay minimum annual royalty payments to the licensor.

|

|

|

·

|

We may not be successful in implementing our growth strategy, including without limitation, increasing distribution of our products,

attracting new consumers to our brands, driving repeat purchase of our products, enhancing our brand recognition, and introducing new

products and product extensions, in each case in a cost-effective manner, on a timely basis, or at all.

|

|

|

·

|

Impairment in the carrying value of goodwill or other intangible assets could have an adverse impact on our financial results.

|

|

|

·

|

Our performance may be impacted by general economic conditions or an economic downturn.

|

|

|

·

|

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brands.

|

Risks Related to the Ownership of our Securities

|

|

·

|

Resales of shares of our Class A Common Stock could cause the market price of our Class A Common Stock to drop significantly,

even if our business is doing well.

|

|

|

·

|

We are a holding company and our only material asset after the Closing of the Business Combination are our interest in UBH, and we

are accordingly dependent upon distributions made by our subsidiaries to pay taxes, make payments under the TRA and pay dividends.

|

|

|

·

|

Pursuant to the TRA, we are required to pay to Continuing Members and/or the exchanging holders of Common Company Units, as applicable,

85% of the tax savings that we realized as a result of increases in tax basis in UBH’s assets as a result of the sale of Common

Company Units for the cash consideration in the Business Combination, the purchase and redemption of the common units and preferred units

in the Continuing Members and the future exchange of the Common Company Units for shares of Class A Common Stock (or cash) pursuant

to the Third Amended and Restated Limited Liability Company Agreement and certain other tax attributes of UBH and tax benefits related

to entering into the TRA, including tax benefits attributable to payments under the TRA, and those payments may be substantial. In certain

cases, payments under the TRA may exceed the actual tax benefits we realize or be accelerated.

|

|

|

·

|

The NYSE may delist our Class A Common Stock from trading on its exchange, which could limit investors’ ability to make

transactions in shares of our Class A Common Stock and subject us to additional trading restrictions.

|

|

|

·

|

Reports published by analysts, including projections in those reports that differ from our actual results, could adversely affect

the price and trading volume of our Class A Common Stock.

|

|

|

·

|

Delaware law, the Certificate of Incorporation and Bylaws contain certain provisions, including anti-takeover provisions that limit

the ability of stockholders to take certain actions and could delay or discourage takeover attempts that stockholders may consider favorable.

|

|

|

·

|

The Certificate of Incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain

types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain

a favorable judicial forum for disputes with us or our directors, officers or other employees.

|

|

|

·

|

Certain of our significant stockholders and Utz Brands Holdings members whose interests may differ from those of our other stockholders

will have the ability to significantly influence our business and management.

|

|

|

·

|

The Certificate of Incorporation does not limit the ability of the successors to the Sponsor to compete with us.

|

|

|

·

|

Our business and operations could be negatively affected if it becomes subject to any securities litigation or shareholder activism,

which could cause us to incur significant expense, hinder execution of business and growth strategy and impact our stock price.

|

|

|

·

|

We may not have sufficient funds to satisfy indemnification claims of our directors and executive officers.

|

|

|

·

|

The valuation of our Private Placement Warrants could increase the volatility in our net income (loss) in our consolidated statements

of earnings (loss).

|

|

|

·

|

The grant of registration rights to certain of our stockholders and holders of our Warrants and the future exercise of such rights

may adversely affect the market price of our Class A Common Stock.

|

|

|

·

|

Our Private Placement Warrants may have an adverse effect on the market price of our Class A Common Stock.

|

|

|

·

|

We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure

requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more

difficult to compare our performance with other public companies.

|

|

|

·

|

Compliance obligations under the Sarbanes-Oxley Act require substantial financial and management resources.

|

|

|

·

|

Our Warrants are required to be accounted for as liabilities rather than as equity and such requirement resulted in a restatement

of our previously issued financial statements.

|

|

|

·

|

The restatement of our financial statements in May 2021 has subjected us to additional risks and uncertainties, including increased

professional costs and increased possibility of legal proceedings.

|

We are also subject to other risks and uncertainties

indicated in, or incorporated by reference into, this prospectus, including those set forth under the section of this prospectus entitled

“Risk Factors” or otherwise disclosed in our SEC reports, including those set forth in our Annual Report, which is

incorporated by reference into this prospectus. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak

and there may be additional risks that we consider immaterial or which are unknown. It is not possible to predict or identify all such

risks. We caution that the foregoing list of factors is not exclusive and investors should not place undue reliance upon any forward-looking

statements, which speak only as of the date made.

|

THE COMPANY

This summary of the Company highlights

certain significant aspects of our business and is a summary of information contained elsewhere in this prospectus. This summary is not

complete and does not contain all of the information that you should consider before making your investment decision. You should carefully

read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary

Note Regarding Forward Looking Statements,” and “Unaudited Pro Forma Condensed Combined Financial Information,”

included elsewhere in this prospectus and the information incorporated by reference, before making an investment decision. The definition

of some of the terms used in this prospectus are set forth under the section “Frequently Used Terms.”

Overview

We are a leading manufacturer, marketer,

and distributor of high-quality, branded snacking products in the United States. We produce a broad offering of salty snacks, including

potato chips, pretzels, cheese snacks, veggie snacks, pork skins, pub/party mixes, and other snacks. As of January 3, 2021, we operate

14 manufacturing facilities with a broad range of capabilities, and our products are distributed nationally to grocery, mass, club, convenience,

drug and other retailers through direct shipments, distributors, and more than 1,600 direct store delivery (“DSD”)

routes. Our company was founded in 1921 in Hanover, Pennsylvania, and benefits from nearly 100 years of brand awareness and heritage

in the salty snacks industry.

Business Combination with Collier Creek Holdings

On the Closing Date, we consummated

the Business Combination with Utz Brands Holdings pursuant to the terms of the Business Combination Agreement. Pursuant to the terms of

the Business Combination Agreement, among other things, we domesticated into the State of Delaware from the Cayman Islands by filing a

Certificate of Domestication and Certificate of Incorporation with the Secretary of State of the State of Delaware, upon which we changed

our name to “Utz Brands, Inc.” and effected the Business Combination.

At the Closing, we (i) acquired

certain common and preferred interests of the Continuing Members from third party members, and the Continuing Members then redeemed such

common and preferred interests for, and we received, an equivalent value of Common Company Units of UBH, (ii) contributed cash in

exchange for additional Common Company Units of UBH, and (iii) purchased additional Common Company Units and 100% of the managing

interests of UBH from the Continuing Members. As part of the Business Combination, the Continuing Members (a) received certain cash

considerations for the Common Company Units that they sold to us, (b) received such number of shares of newly issued non-economic

Class V Common Stock in the Company equal to the Common Company Units that the Continuing Members retained in UBH, and a Common Company

Units of UBH and a share of Class V Common Stock are exchangeable for one share of Class A Common Stock of we, (c) were

entitled to receive certain restricted Common Company Units in UBH that would be vested under certain market conditions, which vested

as of the Closing, and (d) entered into the Tax Receivable Agreement that requires us to pay to the Continuing Members 85% of the

applicable cash savings, if any, in U.S. federal and state income tax determined based on certain attributes as defined in the TRA. On

the Closing Date, we also entered into certain other Related Agreements, including the Third Amended and Restated Limited Liability Company

Agreement, the Investor Rights Agreement, the Standstill Agreement and an employment offer letter with our Chief Executive Officer, Dylan

Lissette.

Emerging Growth Company

We are an “emerging growth company,” as defined

in Section 2(a) of the Securities Act, as modified by the JOBS Act, and we may take advantage of certain exemptions from various

reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation

and stockholder approval of any golden parachute payments not previously approved.

|

|

Further, section 102(b)(1) of

the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until

private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class

of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS

Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging

growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which

means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging

growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison

of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting

standards used.

We will remain an emerging growth company

until the earlier of: (1) the last day of the fiscal year (a) following the fifth anniversary of the closing of the IPO,

(b) in which we have total annual gross revenue of at least $1.07 billion or (c) in which we are deemed to be a large accelerated

filer, which means the market value of our common equity that is held by non-affiliates exceeds $700 million as of the end of the

prior fiscal year’s second fiscal quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible

debt securities during the prior three-year period. Since the aggregate worldwide market value of our Class A Common Stock held by

non-affiliates exceeded $700.0 million as of the last business day of our most recently completed second fiscal quarter, we will not be

an emerging growth company commencing on the last day of fiscal year 2021.

References herein to “emerging

growth company” shall have the meaning associated with it in the JOBS Act.

Corporate Information

We were incorporated under the name “Collier Creek

Holdings” on April 30, 2018 as a Cayman Islands exempted company for purposes of effecting a merger, share exchange, asset

acquisition, share purchase, reorganization or similar business combination with one or more businesses. On August 28, 2020, we domesticated

into a Delaware corporation and changed our name to “Utz Brands, Inc.” in connection with the Domestication. Our principal

executive offices are located at 900 High Street, Hanover, Pennsylvania, 17331, and our telephone number is (717) 637-6644. Our website

is www.utzsnacks.com. The information found on, or that can be accessed from or that is hyperlinked to, our website is not part of this

prospectus.

|

RISK FACTORS

An investment in our securities involves risks

and uncertainties. You should carefully consider the risks set forth under “Risk Factors” in any applicable prospectus, under

“Risk Factor” under Item 1A of Part I of our Annual Report incorporated by reference herein, and all of the other information

contained or incorporated by reference in this prospectus, before investing in our securities. We operate in a changing environment that

involves numerous known and unknown risks and uncertainties that could materially adversely affect our operations. Any of the following

risks could materially and adversely affect our business, financial condition, results of operations or prospects. However, the selected

risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently

view to be immaterial may also materially and adversely affect our business, financial condition, results of operations or prospects.

In such a case you may lose all or part of your investment in us. In addition, much of the business

information, as well as the financial and operational data contained in our risk factors, are updated by our periodic reports filed with

the SEC pursuant to the Exchange Act, which are also incorporated by reference into this prospectus. For more information, see “Where

You Can Find More Information” and “Information Incorporated by Reference.”

USE OF PROCEEDS

Unless otherwise indicated in any applicable prospectus

supplement, we intend to use the net proceeds we receive from the offering of securities under this prospectus for general corporate purposes,

which may include funding our investment and acquisition activity, capital expenditures, repayment of indebtedness and working capital.

The net proceeds may be invested temporarily in short-term securities until they are used for their stated purpose. Further details relating

to the use of net proceeds we receive from the offering of securities under this prospectus will be set forth in any applicable prospectus

supplement.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL

INFORMATION

Introduction

The following unaudited pro forma condensed combined

balance sheet as of January 3, 2021 gives effect to the Warrant Exercises, the Warrants Redemption, and the Term Loan Refinancing,

each as defined below, as if they were completed on January 3, 2021. The unaudited pro forma condensed combined statement of operations

for the year ended January 3, 2021 gives pro forma effect to all of the following, as if they were completed on December 30,

2019, the first day of fiscal year 2020:

|

|

·

|

the Business Combination;

|

|

|

·

|

the Truco Acquisition and the IP Purchase (collectively, with the Truco Acquisition, the “Truco Transactions”);

and

|

|

|

·

|

the exercise of certain of the outstanding Public Warrants and Forward Purchase Warrants (collectively, the “Warrant Exercises”)

prior to the redemption of any Public Warrants and Forward Purchase Warrants remaining outstanding on January 14, 2021 (the “Warrants

Redemption”) and the refinancing of the Company’s existing term loans and the Bridge Credit Agreement on January 20,

2021 related to the Truco Acquisition (the “Term Loan Refinancing”).

|

The unaudited pro forma condensed combined balance

sheet does not purport to represent, and is not necessarily indicative of, what the actual financial condition of the combined entity

resulting from the combinations of the Company, UBH, Truco and the OTB IP (collectively, the “Combined Entity”) would

have been had the Warrant Exercises, the Warrants Redemption, and the Term Loan Refinancing taken place on January 3, 2021, nor are

they indicative of the results of operations of the Combined Entity for any future period. The unaudited pro forma condensed combined

balance sheet adjustments reflect only the Warrant Exercises, Warrants Redemption, and the Term Loan Refinancing, as the Business Combination

and the Truco Transactions are already reflected in our historical audited consolidated balance sheet as of January 3, 2021. The

unaudited pro forma condensed combined statement of operations does not purport to represent, and is not necessarily indicative of, what

the actual results of operations of the Combined Entity would have been had the Business Combination, the Truco Transactions, the Warrant

Exercises, the Warrants Redemption, and the Term Loan Refinancing taken place on December 30, 2019, nor are they indicative of the

results of operations of the Combined Entity for any future period. The unaudited pro forma condensed combined financial information should

be read in conjunction with the following:

|

|

·

|

the accompanying notes to the unaudited pro forma condensed combined financial information;

|

|

|

·

|

the historical unaudited financial statements of CCH as of, and for the six months ended, June 30, 2020, included in the Quarterly

Report on Form 10-Q filed by Collier Creek with the SEC on August 10, 2020;

|

|

|

·

|

the historical unaudited financial statements of Truco Holdco Inc. as of, and for the nine months ended, September 30, 2020,

incorporated by reference into this prospectus; and

|

|

|

·

|

the historical audited financial statements for the predecessor and successor reporting of Utz Brands, Inc. as of, and for the

fiscal periods ended, January 3, 2021 and August 28, 2020, incorporated by reference into this prospectus.

|

On May 20, 2020, the SEC adopted Release

No. 33-10786, Amendments to Financial Disclosures about Acquired and Disposed Businesses (the “New Rules”). The

New Rules amend, among other things, the SEC’s “significance” tests under which a registrant determines whether

a business disposition or acquisition is “significant,” thereby requiring the filing of related Rule 3-05 financial information

and pro forma financial information. The New Rules are effective January 1, 2021 for transactions consummated on or after such

date, but the New Rules permit voluntary early compliance provided that a registrant applies the New Rules in their entirety

from the date of early compliance. Utz adopted the New Rules effective as of, and has applied the New Rules in their entirety,

as reasonably applied prior to the effective date of the New Rules, from and since, December 14, 2020.

The adjustments presented in the unaudited pro

forma condensed combined financial information have been identified and presented to provide relevant information necessary for an understanding

of the Combined Entity upon completion of the Business Combination, the Truco Transactions, the Warrant Exercises, the Warrants Redemption

and the Term Loan Refinancing. The pro forma adjustments set forth in the unaudited pro forma condensed combined financial information

and described in the notes thereto reflect, among other things, the completion of the Business Combination, the Truco Transactions, the

Warrant Exercises, the Warrants Redemption and the Term Loan Refinancing, and the impact of certain pro forma adjustments (and their tax

effect at the estimated effective income tax rate applicable to such adjustments).

The unaudited pro forma condensed combined financial

information has been prepared in accordance with Article 11 of Regulation S-X as amended by the New Rules and is for informational

purposes only and is subject to a number of uncertainties and assumptions as described in the accompanying notes. The historical financial

statements have been adjusted in the unaudited pro forma condensed combined financial information to give effect to pro forma events that

are (1) directly attributable to the Business Combination, the Truco Transactions, the Warrant Exercises, the Warrants Redemption

and the Term Loan Refinancing, and (2) factually supportable. The unaudited pro forma condensed combined financial information should

not be relied on as being indicative of the historical results that would have been achieved had the transactions occurred on the dates

indicated or the future results that the Company will experience. Utz has not had any historical relationship with CCH prior to the Business

Combination, or with Truco Seller or the seller of the OTB IP prior to the Truco Transactions. Accordingly, no transaction accounting

adjustments were required to eliminate activities between the parties.

UNAUDITED PRO FORMA CONDENSED

COMBINED BALANCE SHEET

AS OF JANUARY 3, 2021

|

(amounts in thousands, except for share information)

|

|

Utz Brands, Inc.

(Successor)

as of 1/3/2021

(as restated)

|

|

|

Term Loan

Refinancing

Transaction

Accounting

Adjustments

|

|

|

|

Pro Forma

Combined

Total

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

46,831

|

|

|

(11,135

|

)(aaa)

|

|

|

35,696

|

|

|

Accounts receivable, net

|

|

|

118,305

|

|

|

|

|

|

|

118,305

|

|

|

Inventories

|

|

|

59,810

|

|

|

|

|

|

|

59,810

|

|

|

Prepaid and other assets

|

|

|

11,573

|

|

|

|

|

|

|

11,573

|

|

|

Current portion of notes receivable

|

|

|

7,666

|

|

|

|

|

|

|

7,666

|

|

|

Total current assets

|

|

|

244,185

|

|

|

(11,135

|

)

|

|

|

233,050

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

270,416

|

|

|

|

|

|

|

270,416

|

|

|

Goodwill

|

|

|

862,183

|

|

|

|

|

|

|

862,183

|

|

|

Intangible assets, net

|

|

|

1,171,709

|

|

|

|

|

|

|

1,171,709

|

|

|

Non-current portion of notes receivable