Filed Pursuant to Rule 424(B)(3)

Registration Statement No. 333-248954

Utz Brands, Inc.

SUPPLEMENT NO. 1 TO

PROSPECTUS DATED MAY 19, 2021

THE DATE OF THIS SUPPLEMENT IS MAY 21, 2021

This prospectus supplement (this “Supplement No. 1”) is part of the prospectus of Utz Brands, Inc. (the “Company”), dated May 19, 2021 (the “Prospectus”). This Supplement No. 1 supplements, modifies or supersedes certain information contained in the Prospectus, with the information contained in the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on May 21, 2021 (the “Current Report”). Accordingly, the Company has attached the Current Report to this prospectus supplement. Any statement in the Prospectus that is modified or superseded is not deemed to constitute a part of the Prospectus, except as modified or superseded by this Supplement No. 1. Except to the extent that the information in this Supplement No. 1 modifies or supersedes the information contained in the Prospectus, this Supplement No. 1 should be read, and will be delivered, with the Prospectus. This Supplement No. 1 is not complete without, and may not be utilized except in connection with, the Prospectus.

The Company’s Class A Common Stock is traded on the New York Stock Exchange under the symbols “UTZ”. On May 20, 2021 the closing price of the Company’s Class A Common Stock was $23.24.

Investing in the Company’s securities involves risks. See “Risk Factors” beginning on page 8 of the Prospectus and any applicable prospectus supplement to read about factors you should consider before buying the Company’s Class A Common Stock.

The Company is an “emerging growth company” as defined under the federal securities laws and, as such, the Company intends to comply with reduced disclosure and regulatory requirements.

Neither the SEC nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy of this Supplement No. 1 or the Prospectus. Any representation to the contrary is a criminal offense.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 20, 2021

Utz Brands, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38686

|

|

85-2751850

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

900 High Street

Hanover, PA 17331

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (717) 637-6644

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

UTZ

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Utz Brands, Inc. (the “Company”) was convened and immediately adjourned on May 6, 2021 to allow the Company’s stockholders sufficient time to review the amended annual report on Form 10-K for the year ended January 3, 2021. The adjourned Annual Meeting was reconvened on May 20, 2021.

Proxies for the meeting were solicited pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended. At the Annual Meeting, the Company’s stockholders voted on three proposals. The proposals are described in detail in the Company’s Proxy Statement on Schedule 14A, which was filed with the Securities and Exchange Commission on March 26, 2021.

Present at the Annual Meeting in person or by proxy were holders representing 131,269,628 shares of the Company's Class A Common Stock and Class V Common Stock (the “Common Stock”), representing approximately 95.93% of the eligible votes, constituting a quorum. A brief description and the final vote results for the proposals follow.

1.To elect three Class I directors on the Company’s Board of Directors until the 2024 Annual Meeting of Stockholders or until their successors are elected and qualified.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

John W. Altmeyer

|

119,258,172

|

5,647,556

|

81,474

|

6,282,426

|

|

Jason K. Giordano

|

102,753,207

|

22,153,068

|

80,927

|

6,282,426

|

|

B. John Lindeman

|

124,790,771

|

114,537

|

81,894

|

6,282,426

|

As a result, each nominee was elected to serve as a director for a term expiring at the 2024 Annual Meeting of Stockholders or until their successors are elected and qualified.

2.To approve and adopt the Utz Brands, Inc. 2021 Employee Stock Purchase Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

124,914,706

|

55,234

|

17,262

|

6,282,426

|

As a result, the Company’s stockholders approved and adopted the 2021 Employee Stock Purchase Plan.

3.To ratify the selection by our audit committee of Grant Thornton, LLP to serve as our independent registered public accounting firm for the year ending January 2, 2022.

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

Votes Against

|

Abstentions

|

|

129,536,609

|

1,707,282

|

25,737

|

As a result, the Company’s stockholders ratified the selection of Grant Thornton, LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 2, 2022.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Utz Brands, Inc.

Dated: May 21, 2021

By: /s/ Cary Devore

Name: Cary Devore

Title: Executive Vice President, Chief Financial Officer

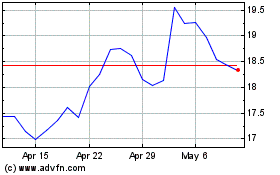

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024