Current Report Filing (8-k)

April 16 2021 - 11:11AM

Edgar (US Regulatory)

0000821130false00008211302021-04-132021-04-130000821130us-gaap:CommonClassBMember2021-04-132021-04-130000821130usm:SixPointNineFivePercentSeniorNotesMember2021-04-132021-04-130000821130usm:SevenPointTwoFivePercent2063SeniorNotesMember2021-04-132021-04-130000821130usm:SevenPointTwoFivePercent2064SeniorNotesMember2021-04-132021-04-130000821130usm:SixPointTwoFivePercent2069SeniorNotesMember2021-04-132021-04-130000821130usm:FivePointFivePercent2070SeniorNotesMember2021-04-132021-04-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 13, 2021

UNITED STATES CELLULAR CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-09712

|

|

62-1147325

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

8410 West Bryn Mawr, Chicago, Illinois 60631

(Address of principal executive offices and zip code)

Registrant's telephone number, including area code: (773) 399-8900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Shares, $1 par value

|

|

USM

|

|

New York Stock Exchange

|

|

6.95% Senior Notes due 2060

|

|

UZA

|

|

New York Stock Exchange

|

|

7.25% Senior Notes due 2063

|

|

UZB

|

|

New York Stock Exchange

|

|

7.25% Senior Notes due 2064

|

|

UZC

|

|

New York Stock Exchange

|

|

6.25% Senior Notes due 2069

|

|

UZD

|

|

New York Stock Exchange

|

|

5.50% Senior Notes due 2070

|

|

UZE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

☐

|

Emerging growth company

|

|

|

|

|

|

|

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

This Current Report on Form 8-K is being filed by United States Cellular Corporation (UScellular) to describe and file as an Exhibit the UScellular 2021 Officer Annual Incentive Plan (the 2021 Plan) with respect to "named executive officers" of UScellular as specified in paragraph (e) of Item 5.02 of Form 8-K.

As of April 13, 2021, the 2021 Plan was approved both by UScellular’s Chairman and by UScellular’s President and Chief Executive Officer (CEO). The 2021 Plan covers all UScellular officers, including the President and CEO. The UScellular Chairman does not participate in the 2021 Plan.

The purposes of the 2021 Plan are: to provide incentive for the officers of UScellular to extend their best efforts towards achieving superior results in relation to key performance targets; to reward UScellular officers in relation to their success in meeting and exceeding the performance targets; and to attract and retain talented leaders in positions of critical importance to the success of UScellular.

The following performance measures will be considered for the purposes of the 2021 Plan:

|

|

|

|

|

|

|

|

|

|

|

Performance Measures

|

Component Weighting

|

Overall Plan Weighting

|

|

Consolidated Total Service Revenues

|

50%

|

35%

|

|

Consolidated Operating Cash Flow

|

40%

|

28%

|

|

Consolidated Capital Expenditures

|

10%

|

7%

|

|

Company Performance

|

|

70%

|

|

Chairman Assessment on Strategic Initiatives

|

|

10%

|

|

Individual Performance

|

|

20%

|

Under the provisions of the 2021 Plan, no bonus is due unless an officer remains employed through the bonus payout date except that an officer who separates due to retirement or death is eligible for a pro-rated bonus. The President and CEO may approve a bonus, or a pro-rated bonus, for an officer who is not employed through the bonus payout date.

The foregoing description is qualified by reference to the 2021 Plan which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description of Exhibits

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

UNITED STATES CELLULAR CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

April 16, 2021

|

By:

|

/s/ Douglas W. Chambers

|

|

|

|

|

Douglas W. Chambers

|

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

|

|

|

|

(principal financial officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

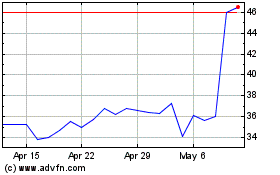

US Cellular (NYSE:USM)

Historical Stock Chart

From Mar 2024 to Apr 2024

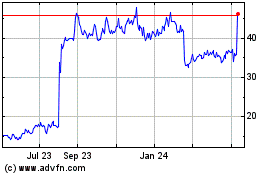

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2023 to Apr 2024