UnitedHealth Likely to Record Higher Sales -- Earnings Preview

October 14 2019 - 2:16PM

Dow Jones News

By Dave Sebastian

UnitedHealth Group Inc. (UNH) is scheduled to report results for

its fiscal third-quarter premarket on Tuesday. Here's what you need

to know.

EARNINGS FORECAST: Analysts polled by FactSet expect profit of

$3.55 a share. They expect UnitedHealth to report adjusted earnings

of $3.75 a share. In July, UnitedHealth raised its per-share

earnings targets to between $13.95 and $14.15 from between $13.80

and $14.05. The company will hold its investor call at 8:45

a.m.

REVENUE FORECAST: Analysts polled by FactSet expect sales of

$59.76 billion, compared with $56.56 billion in the year-ago

period.

MEDICAL COST RATIO: The ratio, which is a comparison of an

insurer's costs to its revenues, is expected to be 82.4% during the

quarter, according to analysts polled by FactSet. A higher ratio

indicates the company is putting less toward non-medical costs such

as profits and reinvestment.

WHAT TO WATCH:

MEDICARE: The company earlier this month introduced its 2020

Medicare Advantage and prescription drug plans, and said almost 2

million people would pay zero dollars on Medicare Advantage

premiums. Managed-care stocks tanked when Sen. Bernie Sanders (I.,

Vt.) in April introduced the Medicare for All Act. Sen. Elizabeth

Warren (D, Mass.), a proponent of the bill, is among the

frontrunners for the Democratic presidential nomination, according

to the latest WSJ/NBC News Poll. "There's been the medical overhang

of the Medicare primary debate," Evercore analyst Michael Newshel

told WSJ.

HEALTH INSURER FEE: Health insurance companies in 2020 face a

tax bill of more than $15.5 billion after the fee was suspended for

2019. "It's the biggest headwind for next year," Mr. Newshel said

of the fee's return.

COMPETITION: The company also faces more competition as Anthem

Inc. (ANTM) strives to regain market share in the commercial group

risk market, which Jefferies analyst David Windley, in a note

earlier this month, said is gaining traction. Mr. Windley

downgraded UnitedHealth's rating to "hold" from "buy," and lowered

its price target to $235 from $300.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 14, 2019 14:01 ET (18:01 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

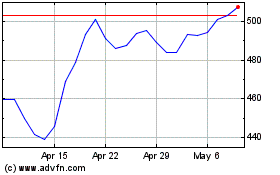

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024