Today's Logistics Report: Amazon's Investing Strategy; Bending Metal Tariffs; Retooling Supply Chains

July 24 2020 - 9:59AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The walls between Amazon.com Inc.'s venture-capital investment

fund and its commercial business don't appear to be very high.

Entrepreneurs, investors and deal advisers say in interviews that

Amazon has appeared to use the investment and deal-making process

to help develop competing products, the WSJ's Dana Mattioli and

Cara Lombardo report. In some cases, Amazon's decision to launch a

competing product devastated the business in which it invested. In

other cases, Amazon met with startups about potential takeovers,

studied their technology, then declined to invest and later

introduced similar Amazon-branded products. Amazon says it doesn't

use confidential information from companies to build competing

products. The e-commerce giant is facing scrutiny in Washington

over whether it unfairly uses its size and platform against

competitors and third-party sellers. Amazon has the money and

appetite and for innovation that attracts entrepreneurs, but it

looks like dealing with Amazon can be a double-edged sword.

QUOTABLE

ECONOMY & TRADE

U.S. tariffs on imported aluminum are triggering a rift in the

metal's domestic supply chain. Aluminum customers are getting

exclusions from the levies on billions of pounds of imported metal,

the WSJ's Bob Tita reports, prompting protests from operators of

U.S. mills who say the actions undermine the domestic market that

the duties were supposed to revive. The exclusions granted by the

Commerce Department have grown this year as manufacturers of

aluminum cans and other packaging have claimed they can't get

products like particular types of rolled sheet metal that they need

from domestic suppliers. Aluminum producers say imports are

growing, however, and helping drive down their pricing and margins.

Both sides are being buffeted by changing consumer tastes, which

have prompted new products and packaging, a commercial trend that

appears to be outpacing the Commerce Department's attempt to

intercede in aluminum markets.

SUPPLY CHAIN STRATEGIES

Rapidly retooling its supply chain is paying off for Unilever

PLC. The consumer-goods supplier aggressively expanded its

previously small hand-sanitizer business, the WSJ's Saabira

Chaudhuri reports, and emerged from a tumultuous second quarter

with profits and revenues largely intact despite dramatic shifts in

its business lines. Unilever's sales at its restaurant-focused

food-service arm declined nearly 40% over the first six months of

the year. The company combined its global scale with a swift

response to the coronavirus-driven lockdowns and upheaval in

consumer demand, expanding manufacturing sites making sanitizer

from just two to more than 60. It pushed monthly production from

about 700,000 units of sanitizer to around 100 million units by

repurposing manufacturing lines and in one case kitting out a

factory in Vietnam in just 25 days. With forecasts for consumer

markets still uncertain, the supplier will have to remain just as

nimble for the foreseeable future.

IN OTHER NEWS

A purchasing managers survey shows eurozone economic activity

rose in July at the fastest pace in more than two years. (WSJ)

Filings by Americans for weekly unemployment benefits rose for

the first time in nearly four months. (WSJ)

Second-quarter profit at warehousing giant Prologis Inc. rose

5.4% to $404.5 million as net effective rent jumped 22%.

(MarketWatch)

Blackstone Group Inc. is buying a nearly $1 billion

infrastructure investment portfolio from Alaska Permanent Fund.

(WSJ)

American Airlines Group Inc. will pare back flights again after

restoring operations at an aggressive pace earlier this summer.

(WSJ)

U.S. regulators suggest broader reporting requirements for

meatpacking companies as they investigate pricing gyrations in

cattle markets. (WSJ)

Ann Taylor and Lane Bryant parent Ascena Retail Group Inc. filed

for bankruptcy with plans to close roughly 1,100 stores. (WSJ)

Coal miner Rhino Resource Partners filed for bankruptcy

protection with a plan to sell its business to lenders. (WSJ)

Quarterly sales at rural lifestyle retailer Tractor Supply Co.

rose 35% and net income jumped 54.5%. (WSJ)

Intel Corp.'s second-quarter profit rose 22% but the

semiconductor maker signaled a delay in its development of

superfast chips. (WSJ)

Hershey Co. says subdued Halloween celebrations as a result of

the coronavirus pandemic could hurt candy demand. (WSJ)

Ford Motor Co. says a protest blocking rail traffic in northern

Mexico is affecting nearby factory operations and hindering

cross-border shipments. (Reuters)

Supply-chain backlogs are pushing deliveries of Whirlpool Corp.

appliances out as long as six months. (Bloomberg)

Autonomous truck maker TuSimple has minimal revenues that fall

far short of the company's earlier projections. (The

Information)

Alternative-fuel truck maker Nikola Corp. broke ground on a

factory in Arizona. (Barron's)

Paccar's North American Class 8 truck deliveries fell to 9,300

in the second quarter from 30,000 a year ago. (Transport Dive)

Several cargo vessels are anchored in quarantine off Hong Kong

after crew members infected with Covid-19 were found on board.

(Lloyd's List)

Maersk Line will start charging shippers that make manual

booking and documentation amendments starting Sept. 1. (Journal of

Commerce)

Cargo throughput at the Port of Rotterdam fell 9.1% in the first

half of 2020, including a 7.1% drop in container volume. (Port

Technology)

Autonomous shipping technology provider Sea Machines Robotics

raised $15 million in a Series B funding round. (VentureBeat)

Union Pacific Corp. is calling furloughed employees back to work

after rail volumes began improving during the second quarter.

(Associated Press)

CSX Corp. second-quarter volumes fell 25% but recovered strongly

in June. (Jacksonville Daily Record)

Canadian Pacific Railway Ltd. trimmed its operating ratio as

cost cuts helped offset a 12% drop in second-quarter volume. (Globe

and Mail)

DHL Express will have Boeing Co. convert four 767-300 passenger

jets to freighter configuration as it accelerates a capacity

expansion. (The Loadstar)

A San Francisco produce-delivery entrepreneur known as "Fruit

Jesus" pivoted to home delivery after demand from corporate

customers evaporated during lockdown. (SFGate)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

July 24, 2020 09:44 ET (13:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

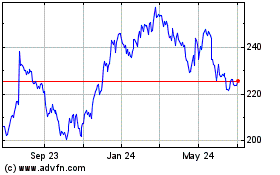

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

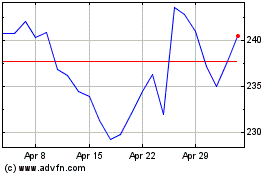

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024