Union Pacific Corp. Down Nearly 5%, on Pace for Largest Percent Decrease Since November 2018 -- Data Talk

July 17 2019 - 12:01PM

Dow Jones News

Union Pacific Corporation (UNP) is currently at $166.42, down

$8.73 or 4.98%

-- Would be lowest close since June 27, 2019, when it closed at

$166.01

-- On pace for largest percent decrease since Nov. 20, 2018,

when it fell 6.03%

-- CSX Corp.'s weak guidance Tuesday cast a dark cloud over

other railway companies as the sector deals with pressure from

trade tensions and weakening parts of the industrial economy

-- Executives at CSX Corp., Union Pacific Corp. and other

railroads started the year confident that a strong economy would

lead to more goods for them to move across their network. But since

then, North America's freight railroads have dealt with severe

weather and flooding, escalating trade disputes and cooling pockets

of the U.S. economy. The railroads may not have enough time in the

second half of the year to hit their earlier projected volume

goals, according to analysts

-- Down 1.59% month-to-date

-- Up 20.39% year-to-date

-- Down 7.13% from its all-time closing high of $179.20 on May

3, 2019

-- Up 17.82% from 52 weeks ago (July 18, 2018), when it closed

at $141.25

-- Down 7.13% from its 52-week closing high of $179.20 on May 3,

2019

-- Up 29.8% from its 52-week closing low of $128.21 on Dec. 25,

2018

-- Fourth-worst performer in the S&P 500 today

All data as of 11:21:53 AM

Source: Dow Jones Market Data, FactSet

(END) Dow Jones Newswires

July 17, 2019 11:46 ET (15:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

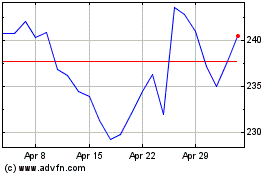

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

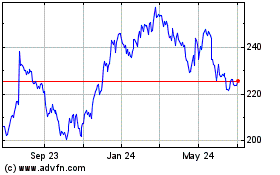

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024