Union Pacific Says Uncertainty, Harsh Weather Driving Down Rail Shipments

June 19 2019 - 6:49PM

Dow Jones News

By Jennifer Smith

Freight rail giant Union Pacific Corp. says its volumes are

declining this quarter amid poor weather and customer concern over

trade uncertainty.

"We're down about 4%," tracking with declines across the broader

industry, Union Pacific Chief Executive Lance Fritz said in an

interview Wednesday.

Mr. Fritz said he views the economy as fundamentally healthy but

that recent flooding in the Midwest and increased caution among

industrial shippers are weighing on Union Pacific's top line.

"We can see that when it comes to restocking and inventories, we

can see it when it comes to dialogues I have with customers about

their capital investment plans," he said. "And I think that's in

part driven by the uncertainties surrounding trade."

Shipping volumes across the railroad sector have been falling

this year. Carloads fell 2.1% in May compared with the prior year,

and then declined 9.1% and 4.6% in the first two weeks of June,

according to the American Association of Railroads, an industry

trade group. Volumes of key commodities including coal, forest

products and metals used in manufacturing have been tumbling at a

steep rate, and a decline in intermodal truck-rail loads has

accelerated this month.

The falloff in rail business comes as the U.S. freight transport

sector shows signs of weaker demand.

The Cass Freight Index of North American shipments by truck and

rail declined 6% in May, the sixth straight month in negative

territory. Cass Information Systems Inc., which handles freight

payments for companies and produces the monthly index, says the

downturn is "signaling an economic contraction" and "strengthens

our concerns about the economy and the risk of ongoing trade policy

disputes."

Coal shipments, the single biggest commodity on U.S. freight

rail networks, have declined 5.3% so far this year from a year ago,

according to the AAR, and the business has fallen at a steeper rate

this month.

"We believe coal is not going to grow back to what it was

historically," Mr. Fritz said. Union Pacific's "franchise is so

broad and diverse," he said, "that there's always something

percolating, there's almost always something that's doing well.

Right now, it's the Gulf Coast chemical franchise."

Carloads of petroleum and petroleum products rose 25.9% last

month compared with May 2018, according to the AAR, one of the few

bright spots in a declining market for commodities.

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

June 19, 2019 18:34 ET (22:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

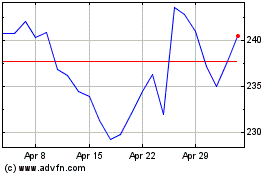

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

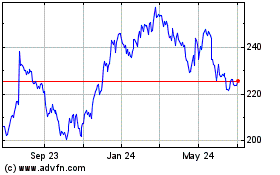

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024