Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

August 05 2021 - 8:12AM

Edgar (US Regulatory)

false2021-06-300000217410--12-312021Q2The share-based payment credit relates to the non-cash charge recorded against operating profit in respect of the fair value of share options and awards granted to employees. Includes purchases and sales of treasury stock, and transfer from treasury stock to retained profit of share-settled schemes arising from prior years and differences between exercise and grant price of share options. Repurchase of shares reflects the cost of acquiring ordinary shares as part of the share buyback programmes announced on 29 April 2021.2021 includes a hyperinflation adjustment of €137 million and €83 million related to the Welly acquisition. 2020 includes €163 million paid for purchase of the non-controlling interest in Unilever Malaysia. Remeasurement of defined benefit pension plans in 2021 is driven by positive investment returns and increase in interest rates.Non-underlying items after tax is calculated as non-underlying items within operating profit after tax plus non-underlying items not in operating profit but within net profit after tax.Includes €115 million (31 December 2020: €78 million, 30 June 2020: €103 million) derivatives, reported within trade receivables, that hedge trading activities. Includes €(87) million (31 December 2020: € (103) million, 30 June 2020: €(111) million) derivatives, reported within trade payables, that hedge trading activities. 2021 gain is primarily due to strengthening of the US Dollar, British Pound, Brazilian Real and Indian Rupee against the Euro. 2020 loss is due to weakening of the Brazilian Real, Mexican Peso, Indian Rupee, South Korean Won and Russian Ruble against the Euro. Consideration for the Main Horlicks Acquisition included the issuance of shares in a group subsidiary, Hindustan Unilever Limited, which resulted in a net gain being recognised within equity. Underlying price growth in excess of 26% per year in hyperinflationary economies has been excluded when calculating the price growth in the tables above, and an equal and opposite amount is shown as extreme price growth in hyperinflationary markets.Short-term deposits typically have maturity of up to 3 months. Current financial assets at amortised cost include short term deposits with banks with maturities longer than three months excluding deposits which are part of a recognised cash management process and loans to joint venture entities. Non-current financial assets at amortised cost include judicial deposits of €107 million (31 December 2020: €101 million, 30 June 2020: €94 million). Included within non-current financial assets at fair value through other comprehensive income are equity investments of €408 million (31 December 2020: €356 million, 30 June 2020: €284 million). Current other financial assets at fair value through profit or loss include A- or higher rated money and capital market instruments. Included within non-current financial assets at fair value through profit or loss are assets in a trust to fund benefit obligations in the US, an option over non-controlling interest in a subsidiary in Hong Kong and investments in a number of companies and financial institutions in North America, North Asia, South Asia and Europe. Financial assets exclude trade and other current receivables. Share premium has been adjusted to reflect the legal share capital of the PLC company, which reduced by £18,400 million following court approval on 15 June 2021. 0000217410 2021-01-01 2021-06-30 0000217410 2020-01-01 2020-06-30 0000217410 2020-06-30 0000217410 2021-06-30 0000217410 2020-12-31 0000217410 2021-04-29 2021-04-29 0000217410 2021-05-06 2021-05-06 0000217410 2021-06-15 2021-06-15 0000217410 2019-12-31 0000217410 ul:FoodsAndRefreshmentMember 2020-01-01 2020-06-30 0000217410 ul:HomeCareMember 2020-01-01 2020-06-30 0000217410 ul:BeautyAndPersonalCareMember 2020-01-01 2020-06-30 0000217410 ul:UnileverMalaysiaMember 2020-01-01 2020-06-30 0000217410 ifrs-full:OtherReservesMember 2020-01-01 2020-06-30 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember 2020-01-01 2020-06-30 0000217410 ifrs-full:NoncontrollingInterestsMember 2020-01-01 2020-06-30 0000217410 srt:EuropeMember 2020-01-01 2020-06-30 0000217410 ul:TheAmericasMember 2020-01-01 2020-06-30 0000217410 ul:AsiaAfricaMiddleEastTurkeyRussiaUkraineAndBelarusMember 2020-01-01 2020-06-30 0000217410 ifrs-full:RetainedEarningsMember 2020-01-01 2020-06-30 0000217410 ifrs-full:SharePremiumMember 2020-01-01 2020-06-30 0000217410 ul:FoodsAndRefreshmentMember 2021-01-01 2021-06-30 0000217410 ul:HomeCareMember 2021-01-01 2021-06-30 0000217410 ul:BeautyAndPersonalCareMember 2021-01-01 2021-06-30 0000217410 ifrs-full:OtherReservesMember 2021-01-01 2021-06-30 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember 2021-01-01 2021-06-30 0000217410 ifrs-full:NoncontrollingInterestsMember 2021-01-01 2021-06-30 0000217410 srt:EuropeMember 2021-01-01 2021-06-30 0000217410 ul:TheAmericasMember 2021-01-01 2021-06-30 0000217410 ul:AsiaAfricaMiddleEastTurkeyRussiaUkraineAndBelarusMember 2021-01-01 2021-06-30 0000217410 ifrs-full:RetainedEarningsMember 2021-01-01 2021-06-30 0000217410 ifrs-full:SharePremiumMember 2021-01-01 2021-06-30 0000217410 ul:WellyHealthMember 2021-01-01 2021-06-30 0000217410 ul:OnnitLabIncMember 2021-01-01 2021-06-30 0000217410 ul:QuarterlyDividendForQ22021Member 2021-01-01 2021-06-30 0000217410 ul:QuarterlyDividendForQ32021Member 2021-01-01 2021-06-30 0000217410 ul:ShareRepurchaseProgrammeTwoThousandAndTwentyOneMember 2021-01-01 2021-06-30 0000217410 ul:PaulasChoiceMember 2021-01-01 2021-06-30 0000217410 ifrs-full:DisposalGroupsClassifiedAsHeldForSaleMember 2021-01-01 2021-06-30 0000217410 ul:WellyAcquisitionMember 2021-01-01 2021-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level1OfFairValueHierarchyMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level2OfFairValueHierarchyMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level3OfFairValueHierarchyMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember 2020-06-30 0000217410 ul:CarryingValueMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:DerivativesMember 2020-06-30 0000217410 ul:CarryingValueMember ifrs-full:DerivativesMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember ul:OtherFinancialAssetMember 2020-06-30 0000217410 ul:CarryingValueMember ul:OtherFinancialAssetMember 2020-06-30 0000217410 ul:NonCurrentFinancialAssetsAtAmortisedCostMember ul:JudicialDepositsMember 2020-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level1OfFairValueHierarchyMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level2OfFairValueHierarchyMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level3OfFairValueHierarchyMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember 2020-12-31 0000217410 ul:CarryingValueMember 2020-12-31 0000217410 ifrs-full:NoncurrentAssetsHeldForSaleMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember ifrs-full:DerivativesMember 2020-12-31 0000217410 ul:CarryingValueMember ifrs-full:DerivativesMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember ul:OtherFinancialAssetMember 2020-12-31 0000217410 ul:CarryingValueMember ul:OtherFinancialAssetMember 2020-12-31 0000217410 ifrs-full:DisposalGroupsClassifiedAsHeldForSaleMember 2020-12-31 0000217410 ul:NonCurrentFinancialAssetsAtAmortisedCostMember ul:JudicialDepositsMember 2020-12-31 0000217410 ul:UnileverNVMember ifrs-full:OrdinarySharesMember 2020-12-31 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember 2020-12-31 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level1OfFairValueHierarchyMember 2021-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level2OfFairValueHierarchyMember 2021-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:Level3OfFairValueHierarchyMember 2021-06-30 0000217410 ifrs-full:AtFairValueMember 2021-06-30 0000217410 ul:CarryingValueMember 2021-06-30 0000217410 ifrs-full:NoncurrentAssetsHeldForSaleMember 2021-06-30 0000217410 ifrs-full:AtFairValueMember ifrs-full:DerivativesMember 2021-06-30 0000217410 ul:CarryingValueMember ifrs-full:DerivativesMember 2021-06-30 0000217410 ifrs-full:AtFairValueMember ul:OtherFinancialAssetMember 2021-06-30 0000217410 ul:CarryingValueMember ul:OtherFinancialAssetMember 2021-06-30 0000217410 ifrs-full:DisposalGroupsClassifiedAsHeldForSaleMember 2021-06-30 0000217410 ul:WellyHealthMember 2021-06-30 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember ul:TradedOnTheLondonStockExchangeMember 2021-06-30 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember ul:TradedOnEuronextInAmsterdamMember 2021-06-30 0000217410 ul:UnileverPLCMember ul:AmericanDepositaryReceiptsMember 2021-06-30 0000217410 ul:NonCurrentFinancialAssetsAtAmortisedCostMember ul:JudicialDepositsMember 2021-06-30 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember 2021-06-30 0000217410 ul:UnileverNVMember ifrs-full:OrdinarySharesMember 2021-06-30 0000217410 ul:ShareRepurchaseProgrammeTwoThousandAndTwentyOneMember 2021-06-30 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember ul:TradedOnTheLondonStockExchangeMember 2021-03-31 0000217410 ul:UnileverPLCMember ifrs-full:OrdinarySharesMember ul:TradedOnEuronextInAmsterdamMember 2021-03-31 0000217410 ul:UnileverPLCMember ul:AmericanDepositaryReceiptsMember 2021-03-31 0000217410 ul:ShareRepurchaseProgrammeTwoThousandAndTwentyOneMember 2021-08-27 0000217410 ul:ShareRepurchaseProgrammeTwoThousandAndTwentyOneMember 2021-08-27 2021-08-27 0000217410 ul:UnileverPLCMember 2020-11-30 2020-11-30 0000217410 ul:SharesIssuedToNVShareholdersMember ul:UnileverPLCMember 2020-11-30 0000217410 ifrs-full:IssuedCapitalMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:SharePremiumMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:OtherReservesMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:RetainedEarningsMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:NoncontrollingInterestsMember ul:PreviouslyReported1Member 2019-12-31 0000217410 ul:PreviouslyReported1Member 2019-12-31 0000217410 ifrs-full:IssuedCapitalMember 2020-06-30 0000217410 ifrs-full:SharePremiumMember 2020-06-30 0000217410 ifrs-full:OtherReservesMember 2020-06-30 0000217410 ifrs-full:RetainedEarningsMember 2020-06-30 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember 2020-06-30 0000217410 ifrs-full:NoncontrollingInterestsMember 2020-06-30 0000217410 ifrs-full:IssuedCapitalMember 2020-12-31 0000217410 ifrs-full:SharePremiumMember 2020-12-31 0000217410 ul:UnificationReservesMember 2020-12-31 0000217410 ifrs-full:OtherReservesMember 2020-12-31 0000217410 ifrs-full:RetainedEarningsMember 2020-12-31 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember 2020-12-31 0000217410 ifrs-full:NoncontrollingInterestsMember 2020-12-31 0000217410 ifrs-full:IssuedCapitalMember 2021-06-30 0000217410 ifrs-full:SharePremiumMember 2021-06-30 0000217410 ul:UnificationReservesMember 2021-06-30 0000217410 ifrs-full:OtherReservesMember 2021-06-30 0000217410 ifrs-full:RetainedEarningsMember 2021-06-30 0000217410 ifrs-full:EquityAttributableToOwnersOfParentMember 2021-06-30 0000217410 ifrs-full:NoncontrollingInterestsMember 2021-06-30 iso4217:EUR xbrli:pure xbrli:shares utr:Month iso4217:GBP iso4217:EUR xbrli:shares iso4217:GBP xbrli:shares iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2021

(Translation of registrant’s name into English)

UNILEVER HOUSE, BLACKFRIARS, LONDON, ENGLAND

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

UNILEVER PLC

|

|

|

|

|

|

|

|

|

BY

|

|

R SOTAMAA

|

|

|

|

CHIEF LEGAL OFFICER AND GROUP SECRETARY

|

2021 FIRST HALF YEAR RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying sales growth (USG)

|

|

|

|

|

|

|

5.4

|

%

|

|

Turnover

|

|

€

|

25.8bn

|

|

|

|

0.3

|

%

|

Underlying operating margin

|

|

|

18.8

|

%

|

|

|

(100

|

)bps

|

|

Operating margin

|

|

|

17.2

|

%

|

|

|

(100

|

)bps

|

Underlying earnings per share

|

|

€

|

1.33

|

|

|

|

(2.0

|

)%

|

|

Diluted earnings per share

|

|

€

|

1.19

|

|

|

|

(5.0

|

)%

|

|

|

|

|

|

Quarterly dividend payable in September 2021

|

|

|

|

|

|

|

|

|

|

€0.4268 per share

|

|

|

|

•

|

|

Underlying sales growth of 5.4%, with 4.0% volume and 1.3% price. Price growth stepped up in Q2

|

|

|

•

|

|

Turnover increased 0.3% including a positive impact of 1.4% from acquisitions net of disposals and negative impact of 6.1% from currency related items

|

|

|

•

|

|

Underlying operating margin of 18.8%, a decrease of 100bps driven by investment behind our brands and input cost inflation

|

|

|

•

|

|

Underlying earnings per share down 2.0%, including a negative impact of 6.3% from currency

|

|

|

•

|

|

Free cash flow of €2.4 billion, compared to €2.9 billion in the first half of 2020

|

|

|

•

|

|

Quarterly shareholder dividend of €0.4268 per share and share buyback programme of up to €3 billion underway

|

Alan Jope: Chief Executive Officer statement

“Unilever has delivered a strong first half, with underlying sales growth of 5.4% driven by our continued focus on operational excellence.

We are making good progress against the strategic choices outlined earlier this year, including the development of our portfolio into high growth spaces. Prestige Beauty and Functional Nutrition grew strongly and we recently announced the acquisition of digitally-native skin care brand Paula’s Choice. The operational separation of our Tea business is substantially complete. Our ecommerce business grew 50% and the channel now represents 11% of sales.

Competitive growth is our priority, and we are confident that we will deliver underlying sales growth in 2021 well within our multi-year framework of

3-5%,

despite more challenging comparators in the second half. We have seen further cost inflation emerge through the second quarter. Cost volatility and the timing of landing price actions create a higher than normal range of likely year end margin outcomes. We are managing this dynamically and expect to maintain underlying operating margin for 2021 around flat.”

FIRST HALF OPERATIONAL REVIEW: DIVISIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half 2021

|

|

|

|

|

Turnover

|

|

|

USG

|

|

|

UVG

|

|

|

UPG

|

|

|

Change in

underlying

operating

margin

|

|

|

|

|

|

€bn

|

|

|

|

%

|

|

|

|

%

|

|

|

|

%

|

|

|

|

bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4

|

|

|

|

3.3

|

|

|

|

1.8

|

|

|

|

1.4

|

|

|

|

(220

|

)

|

|

|

|

|

5.2

|

|

|

|

4.5

|

|

|

|

4.8

|

|

|

|

(0.3

|

)

|

|

|

(130

|

)

|

|

|

|

|

10.2

|

|

|

|

8.1

|

|

|

|

5.8

|

|

|

|

2.1

|

|

|

|

60

|

|

The operating environment across our markets has seen some improvements but remains volatile. Restrictions on daily life continue around the world, impacting channel dynamics, sales mix and consumer behaviour. Although renewed restrictions in India impacted the market in the second quarter, they were less severe than in the same period last year. In China, normalisation has continued, but market growth is still below

levels. The North America and Europe markets declined in the second quarter as we lapped the surge in demand for

in-home

food and hygiene products in the same period of 2020. In difficult macroeconomic conditions, markets are growing in Latin America but market conditions in South East Asia remain challenging. In Indonesia, large parts of the country have entered lock-down following a sharp rise in

Covid-19

cases.

Unilever overall performance:

We continue to be guided by our five strategic choices:

|

|

•

|

|

develop our portfolio into higher growth spaces;

|

|

|

•

|

|

win with our brands as a force for good, powered by purpose and innovation;

|

|

|

•

|

|

accelerate in the USA, India and China and leverage our emerging markets strength;

|

|

|

•

|

|

lead in the channels of the future; and

|

|

|

•

|

|

build a

purpose-led,

future-fit

organisation and growth culture.

|

These strategic choices and our sharp focus on operational excellence have delivered first half underlying sales growth of 5.4%, with volume growth of 4.0% and 1.3% from price.

Emerging markets grew 8.3%, driven by continued recovery in China and strong performance in South Asia, both growing double digit. Performance in South East Asia was mixed, with Indonesia declining high single digit. Latin America grew high single digit, led by price growth. Developed markets grew 1.5%, as North America and Europe each grew low single digit. In North America, food solutions and Prestige Beauty contributed to growth as the out of home eating and health and beauty channels reopened. We saw a relative decline in food consumed at home and flat growth in hygiene products, as we lapped the spike in demand in the prior year. In Europe, volume growth was supported by a recovery in out of home ice cream. Price declined in Europe as we lapped a period of lower promotional intensity in some markets. Ecommerce grew 50% and is now 11% of sales.

Turnover increased 0.3% including a positive impact of 1.4% from acquisitions net of disposals and negative impact of 6.1% from currency related items.

We continue to develop our portfolio into higher growth spaces. In Prestige Beauty we signed an agreement in June to acquire the leading

digital-led

skin care brand

, which has pioneered jargon-free science, high performing ingredients and cruelty-free products. Underlying sales in functional nutrition grew double digit, which includes vitamins, minerals & supplements brands

and

and, for the second quarter, our South Asian nutrition brands

and

.

The operational separation of our tea business is substantially complete and is due to conclude in October 2021. We are now focused on the next phase for this business, which we expect to be either an IPO, sale or partnership. This business generated revenues of around €2 billion in 2020 and excludes our hot tea businesses in India and Indonesia and our partnership interests in

tea.

As we announced in April, a number of smaller beauty and personal care brands have been separated with a dedicated management team under the name Elida Beauty. The brands include

,

,

,

,

and

with combined revenues of around €0.6 billion in 2020. We are exploring options for these brands with a focus on maximising value creation.

Underlying operating margin declined by 100bps to 18.8%. After conserving spend at the peak of the global pandemic in the prior year we have stepped up investment in our brands and marketing campaigns, increasing spend by 80bps. Gross margin was 60bps lower, impacted by an increase in raw material, packaging and distribution costs globally. There was a slightly negative incremental impact on gross margin in the first half from adverse mix related to

Covid-19.

Overheads improved by 40bps. Productivity programmes and ongoing

Covid-19

related savings in areas like travel and facilities continued.

Beauty and Personal Care underlying sales grew 3.3% with 1.8% from volume and 1.4% from price, helped by increased personal care consumption occasions as living restrictions were eased in some of our markets.

Skin care grew double digit and deodorants returned to growth. In skin care

and

each grew double digit. We launched

refillable deodorant innovation in the USA, one of many

projects exploring sustainable packaging solutions. Skin cleansing declined as we lapped the sharp increase in demand in the prior year related to

Covid-19.

Hair grew

mid-single

digit. Wash and care and styling both grew and we saw good growth in China, India and Brazil. Premium brand

grew double digit in the USA. Oral care grew

mid-single

digit, led by volume from South Asia and Africa.

freshness innovation is driving growth in Brazil. Our Prestige Beauty brands grew double digit, with higher

in-store

footfall. We increased pricing in response to commodity inflation across categories, particularly in Latin America and South Asia. Turnover declined 1.9% including 2.2% contribution from acquisitions and an adverse 7.1% currency related impact.

Underlying operating margin declined 220bps as we stepped up brand and marketing investment compared to the prior year and as gross margin declined as a result of high cost inflation.

Home Care underlying sales grew 4.5% with 4.8% from volume and negative price of 0.3%.

Fabric cleaning grew

mid-single

digit driven by recovery in India and

price-led

growth in Brazil. In Latin America growth was helped by our

dilutable laundry liquid innovation, which launched in 2020. Fabric enhancers grew

mid-single

digit led by China, where our

fragrance boosters innovation with dual-colour beads and luxury-inspired fragrances performed well. Home & hygiene declined low single digit. There was good growth in dishwash in emerging markets, whilst household cleaners declined as we lapped a prior year spike in growth. We expanded our

brand into home hygiene products in the UK and Germany, launching the new Botanitech range of cleaning products with naturally-derived ingredients.

Price declined overall as we lapped a period of lower promotional intensity in some markets and as the impact of rising input costs was more muted in fabric cleaning through the first half. Pricing was slightly positive in the second quarter as we started to take pricing action in markets including Brazil and Turkey to respond to rising input costs. Turnover declined 2.7% including adverse impacts of 0.2% and 6.8% from disposals and currency movements respectively.

Underlying operating margin declined 130bps as we increased brand and marketing investment compared to the prior year. Gross margin declined as a result of high cost inflation, whilst overheads decreased.

Foods and Refreshment underlying sales grew 8.1% with 5.8% from volume and 2.1% from price.

Ice cream sales grew across both in home and out of home products, with double digit performances in Turkey, China and India. Out of home ice cream in Europe grew double digit as living restrictions began to ease, although sales have not returned to

levels.

and

both grew double digit.

launched the Miley in Layers campaign with Miley Cyrus.

has seen innovation success with its ‘Topped’ product range, with larger chunks and unique patterns and layers.

Food solutions grew double digit. Sales in China were above

levels, however in most other markets turnover has not yet recovered to 2019 levels as out of home channel restrictions remained in place.

In-home

foods grew low single digit even as we lapped a spike in demand in the prior year.

and

grew double digit led by volume with campaigns such as Make Taste Not Waste in

and the rollout of innovations such as

flavour rich, low salt bouillon. We took pricing action across food and ice cream to counter rising input costs. Turnover increased 4.4% including 1.4% contribution from acquisitions and disposals and an adverse 4.8% currency related impact.

Tea grew high single digit through both price and volume, with growth in North America, Turkey, Europe and India. Price was driven by India, following significant raw material inflation.

Underlying operating margin increased 60bps. There was an increase in brand marketing investment and a decrease in overheads as we benefitted from turnover leverage.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half 2021

|

|

|

|

|

Turnover

|

|

|

USG

|

|

|

UVG

|

|

|

UPG

|

|

|

Change in

underlying

operating

margin

|

|

|

|

|

€bn

|

|

|

%

|

|

|

%

|

|

|

%

|

|

|

bps

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.1

|

|

|

|

7.7

|

|

|

|

6.4

|

|

|

|

1.2

|

|

|

|

(30

|

)

|

|

|

|

|

8.0

|

|

|

|

5.1

|

|

|

|

1.7

|

|

|

|

3.3

|

|

|

|

(190

|

)

|

|

|

|

|

5.7

|

|

|

|

1.1

|

|

|

|

2.2

|

|

|

|

(1.1

|

)

|

|

|

(130

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half 2021

|

|

|

|

|

Turnover

|

|

|

USG

|

|

|

UVG

|

|

|

UPG

|

|

|

|

|

€bn

|

|

|

%

|

|

|

%

|

|

|

%

|

|

|

|

|

|

10.8

|

|

|

|

1.5

|

|

|

|

1.4

|

|

|

|

0.2

|

|

|

|

|

|

15.0

|

|

|

|

8.3

|

|

|

|

5.9

|

|

|

|

2.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.1

|

|

|

|

2.6

|

|

|

|

1.0

|

|

|

|

1.6

|

|

|

|

|

|

2.9

|

|

|

|

9.5

|

|

|

|

3.1

|

|

|

|

6.3

|

|

Underlying sales grew 7.7% with 6.4% from volume and 1.2% from price. South Asia grew double digit as we lapped a period of strict lock-down measures in India in the prior year, although growth slowed from the first to the second quarter as regional restrictions were put in place. We increased prices across categories in response to commodity inflation. China grew double digit, with broad based growth across divisions and a recovery to

turnover levels in our food solutions business. In Turkey double digit growth was balanced between price and volume, helped by strong ice cream performance. Indonesia declined high single digit in difficult market conditions, whilst Thailand grew

mid-single

digit as we lapped a period of heavy decline in the second quarter of 2020. Turnover increased 2.0% including 1.4% contribution from acquisitions and an adverse 6.6% currency related impact.

Underlying operating margin declined 30bps as a result of increased brand and marketing investment compared to the prior year, and a lower gross margin due to higher input costs. This was mostly offset by lower overheads due to turnover leverage. .

Underlying sales growth in North America was 2.6%, with 1.6% from price and 1.0% from volume. Our food solutions and Prestige Beauty businesses grew double digit as channels reopened.

In-home

foods declined low single digit as we lapped a period of surge demand and beauty and personal care saw low single digit growth. Underlying price growth was delivered across all divisions.

Latin America delivered underlying sales growth of 9.5%, with 6.3% from price and 3.1% from volume. Growth was balanced across all divisions. We took strong pricing action in response to high commodity inflation and currency devaluation. Brazil grew double digit and Mexico grew

mid-single

digit, both led by price. Argentina delivered

mid-single

digit volume growth. Turnover decreased 2.5% including 2.6% favourable contribution from acquisitions and disposals and an adverse 9.6% from currency related impact.

Underlying operating margin decreased by 190bps with greater brand and marketing investment compared to the prior year and a lower gross margin due to higher input costs. The input costs were partially offset through pricing particularly in Latin America. There was a benefit in overheads.

Underlying sales grew 1.1% with volume of 2.2% and negative pricing of 1.1%. Volume growth was led by a recovery in out of home ice cream, particularly in Italy and Spain, as the channel started to

re-open.

Food solutions returned to growth, as out of home eating outlets reopened. The UK and Germany sales declined as we lapped a spike in growth in 2020. Price declined and we lapped a period of lower promotional intensity in some markets. Turnover increased 0.9% including an adverse 0.3% impact from disposals and a favourable 0.1% contribution from currency movements.

Underlying operating margin declined 130bps driven by lower gross margin as high levels of input cost inflation outweighed pricing in a challenging retail environment. We increased brand and marketing investment compared to the prior year.

ADDITIONAL COMMENTARY ON THE FINANCIAL STATEMENTS – FIRST HALF 2021

Net finance costs decreased by €96 million to €153 million in the first half of 2021. The decrease was largely driven by a lower cost of debt and a

one-off

foreign exchange gain. This was partially offset by lower interest income driven by interest on tax credits in Brazil in the prior year. The interest rate on average net debt decreased to 1.4% from 2.0% in 2020.

The underlying effective tax rate for H1 2021 decreased to 21.9% from 22.6% in H1 2020 due to favourable tax audit settlements and provision releases, as well as the restatement of deferred tax balances for changes in tax rates. The effective tax rate for H1 2021 was 22.7% compared with 22.3% in H1 2020.

Joint ventures, associates and other income from

non-current

investments

Net profit from joint ventures and associates was €91 million, consistent with the prior year. Other income from

non-current

investments was €34 million.

Underlying earnings per share decreased by 2.0%, including a negative impact of 6.3% from currency. Constant underlying earnings per share increased by 4.3%. The increase was mainly driven by underlying sales growth, lower tax and finance costs, partially offset by an increase in profit attributable to minority interests following the Horlicks acquisition in India. Diluted earnings per share decreased 5.0% at €1.19.

Free cash flow in the first half of 2021 was €2.4 billion, down from the €2.9 billion delivered in the first half of 2020. This was primarily a result of lower operating profit. We have maintained the enhanced working capital discipline that improved our free cash flow in 2020 at the start of the pandemic.

Closing net debt increased to €22.4 billion compared with €20.9 billion at 31 December 2020. The increase was driven by dividends paid and our share buyback programme, partially offset by free cash flow delivery.

Pension assets net of liabilities were in surplus of €1.9 billion at the end of June 2021 versus €0.3 billion as at 31 December 2020. The increase was driven by positive investment returns on pension assets, and lower liabilities as interest rates increased.

In February 2021 $1,000 million 4.25% fixed rate notes matured and were repaid. In March 2021 $400 million 2.75% fixed rate notes matured and were repaid.

On 30 June 2021 Unilever had undrawn revolving

364-day

bilateral credit facilities of $7,965 million in aggregate with a

364-day

term out.

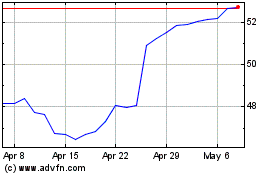

On 29 April 2021 we announced our intention to start a share buyback programme of up to €3 billion. On 6 May 2021 we announced we would commence the first tranche of this buyback programme for an aggregate market value equivalent to €1.5 billion. As at 30 June 2021 the Group had repurchased 17,973,091 ordinary shares. Total consideration for the repurchase of shares was €0.9 billion which is recorded within other reserves. The first tranche for an aggregate market value of €1.5 billion will end on or before 27 August 2021.

On 15 June 2021 the UK court approved a capital reduction of £18.4 billion (€20.6 billion). The impact of this was to transfer €20.6 billion from share premium to retained earnings.

COMPETITION INVESTIGATIONS

As previously disclosed, Unilever is involved in a number of ongoing investigations and cases by national competition authorities, including those within Italy, Greece, South Africa and Turkey. These proceedings and investigations are at various stages and concern a variety of product markets. Where appropriate, provisions are made and contingent liabilities disclosed in relation to such matters.

Ongoing compliance with competition laws is of key importance to Unilever. It is Unilever’s policy to

co-operate

fully with competition authorities whenever questions or issues arise. In addition, the Group continues to reinforce and enhance its internal competition law training and compliance programme on an ongoing basis.

Certain discussions and analyses set out in this announcement include measures which are not defined by generally accepted accounting principles (GAAP) such as IFRS. We believe this information, along with comparable GAAP measurements, is useful to investors because it provides a basis for measuring our operating performance, ability to retire debt and invest in new business opportunities. Our management uses these financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance and value creation.

Non-GAAP

financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Wherever appropriate and practical, we provide reconciliations to relevant GAAP measures.

Unilever uses ‘constant rate’, and ‘underlying’ measures primarily for internal performance analysis and targeting purposes. We present certain items, percentages and movements, using constant exchange rates, which exclude the impact of fluctuations in foreign currency exchange rates. We calculate constant currency values by translating both the current and the prior period local currency amounts using the prior year average exchange rates into euro, except for the local currency of entities that operate in hyperinflationary economies. These currencies are translated into euros using the prior year closing exchange rate before the application of IAS 29. The table below shows exchange rate movements in our key markets.

|

|

|

|

|

|

|

|

|

|

|

|

|

First half average

rate in 2021

|

|

|

First half average

rate in 2020

|

|

Brazilian Real (€1 = BRL)

|

|

|

6.492

|

|

|

|

5.323

|

|

|

|

|

|

7.800

|

|

|

|

7.743

|

|

|

|

|

|

88.365

|

|

|

|

81.535

|

|

Indonesia Rupiah (€1 = IDR)

|

|

|

17231

|

|

|

|

16055

|

|

Philippine Peso (€1 = PHP)

|

|

|

58.153

|

|

|

|

55.823

|

|

UK Pound Sterling (€1 = GBP)

|

|

|

0.868

|

|

|

|

0.873

|

|

|

|

|

|

1.206

|

|

|

|

1.102

|

|

Underlying sales growth (USG)

Underlying sales growth (USG) refers to the increase in turnover for the period, excluding any change in turnover resulting from acquisitions, disposals, changes in currency and price growth in excess of 26% in hyperinflationary economies. Inflation of 26% per year compounded over three years is one of the key indicators within IAS 29 to assess whether an economy is deemed to be hyperinflationary. We believe this measure provides valuable additional information on the underlying sales performance of the business and is a key measure used internally. The impact of acquisitions and disposals is excluded from USG for a period of 12 calendar months from the applicable closing date. Turnover from acquired brands that are launched in countries where they were not previously sold is included in USG as such turnover is more attributable to our existing sales and distribution network than the acquisition itself. The reconciliation of changes in the GAAP measure turnover to USG is provided in notes 3 and 4.

Underlying price growth (UPG)

Underlying price growth (UPG) is part of USG and means, for the applicable period, the increase in turnover attributable to changes in prices during the period. UPG therefore excludes the impact to USG due to (i) the volume of products sold; and (ii) the composition of products sold during the period. In determining changes in price we exclude the impact of price growth in excess of 26% per year in hyperinflationary economies as explained in USG above. The measures and the related turnover GAAP measure are set out in notes 3 and 4.

Underlying volume growth (UVG)

Underlying volume growth (UVG) is part of USG and means, for the applicable period, the increase in turnover in such period calculated as the sum of (i) the increase in turnover attributable to the volume of products sold; and (ii) the increase in turnover attributable to the composition of products sold during such period. UVG therefore excludes any impact on USG due to changes in prices. The measures and the related turnover GAAP measure are set out in notes 3 and 4.

Several

non-GAAP

measures are adjusted to exclude items defined as

non-underlying

due to their nature and/or frequency of occurrence.

|

|

•

|

|

Non-underlying

items within operating profit

are: gains or losses on business disposals, acquisition and disposal related costs, restructuring costs, impairments and other items within operating profit classified here due to their nature and frequency.

|

|

|

•

|

|

Non-underlying

items not in operating profit but within net profit

are: net monetary gain/(loss) arising from hyperinflationary economies and significant and unusual items in net finance cost, share of profit/(loss) of joint ventures and associates and taxation.

|

|

|

•

|

|

are: both

non-underlying

items within operating profit and those

non-underlying

items not in operating profit but within net profit.

|

Underlying operating profit (UOP) and underlying operating margin (UOM)

Underlying operating profit and underlying operating margin mean operating profit and operating margin before the impact of

non-underlying

items within operating profit. Underlying operating profit represents our measure of segment profit or loss as it is the primary measure used for making decisions about allocating resources and assessing performance of the segments. The reconciliation of operating profit to underlying operating profit is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

Non-underlying

items within operating profit (see note 2)

|

|

|

421

|

|

|

|

412

|

|

|

|

|

|

|

|

|

|

|

|

Underlying operating profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,791

|

|

|

|

25,714

|

|

|

|

|

|

17.2

|

|

|

|

18.2

|

|

Underlying operating margin (%)

|

|

|

18.8

|

|

|

|

19.8

|

|

|

|

|

|

|

|

|

|

|

|

Underlying effective tax rate

The underlying effective tax rate is calculated by dividing taxation excluding the tax impact of

non-underlying

items by profit before tax excluding the impact of

non-underlying

items and share of net (profit)/loss of joint ventures and associates. This measure reflects the underlying tax rate in relation to profit before tax excluding

non-underlying

items before tax and share of net profit/(loss) of joint ventures and associates. Tax impact on

non-underlying

items within operating profit is the sum of the tax on each

non-underlying

item, based on the applicable country tax rates and tax treatment. This is shown in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

972

|

|

|

|

991

|

|

|

|

|

|

|

|

|

|

|

|

Non-underlying

items within operating profit

(a)

|

|

|

97

|

|

|

|

109

|

|

Non-underlying

items not in operating profit but within net profit

(a)

|

|

|

(34

|

)

|

|

|

(7

|

)

|

|

|

|

|

|

|

|

|

|

|

Taxation before tax impact of

non-underlying

items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,369

|

|

|

|

4,533

|

|

Non-underlying

items within operating profit before tax

(a)

|

|

|

421

|

|

|

|

412

|

|

Non-underlying

items not in operating profit but within net profit before tax

(a)

|

|

|

29

|

|

|

|

(21

|

)

|

Share of net (profit)/loss of joint ventures and associates

|

|

|

(91

|

)

|

|

|

(89

|

)

|

|

|

|

|

|

|

|

|

|

|

Profit before tax excluding

non-underlying

items before tax and share of net profit/(loss) of joint ventures and associates

|

|

|

4,728

|

|

|

|

4,835

|

|

|

|

|

|

|

|

|

|

|

|

Underlying effective tax rate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Refer to note 2 for further details on these items.

|

NON-GAAP MEASURES (continued)

Underlying earnings per share

Underlying earnings per share (underlying EPS) is calculated as underlying profit attributable to shareholders’ equity divided by the diluted average number of ordinary shares. In calculating underlying profit attributable to shareholders’ equity, net profit attributable to shareholders’ equity is adjusted to eliminate the

post-tax

impact of

non-underlying

items. This measure reflects the underlying earnings for each share unit of the Group. Refer to note 6 for reconciliation of net profit attributable to shareholders’ equity to underlying profit attributable to shareholders equity.

Constant underlying earnings per share (constant underlying EPS) is calculated as underlying profit attributable to shareholders’ equity at constant exchange rates and excluding the impact of both translational hedges and price growth in excess of 26% per year in hyperinflationary economies divided by the diluted average number of ordinary shares. This measure reflects the underlying earnings for each share unit of the Group in constant exchange rates.

The reconciliation of underlying profit attributable to shareholders’ equity to constant underlying earnings attributable to shareholders’ equity and the calculation of constant underlying EPS is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

(unaudited)

|

|

2021

|

|

|

2020

|

|

Underlying profit attributable to shareholders’ equity (see note 6)

|

|

|

3,488

|

|

|

|

3,559

|

|

Impact of translation from current to constant exchange rates and translational hedges

|

|

|

133

|

|

|

|

(103

|

)

|

Impact of price growth in excess of 26% per year in hyperinflationary economies

|

|

|

(16

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Constant underlying earnings attributable to shareholders’ equity

|

|

|

3,605

|

|

|

|

3,456

|

|

|

|

|

|

|

|

|

|

|

|

Diluted average number of share units (millions of units)

|

|

|

2,627.2

|

|

|

|

2,627.2

|

|

|

|

|

|

|

|

|

|

|

|

Constant underlying EPS (€)

|

|

|

1.37

|

|

|

|

1.32

|

|

|

|

|

|

|

|

|

|

|

|

Net debt is a measure that provides valuable additional information on the summary presentation of the Group’s net financial liabilities and is a measure in common use elsewhere. Net debt is defined as the excess of total financial liabilities, excluding trade payables and other current liabilities, over cash, cash equivalents and other current financial assets, excluding trade and other current receivables, and

non-current

financial asset derivatives that relate to financial liabilities.

The reconciliation of total financial liabilities to net debt is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at

30 June

2021

|

|

|

As at

31 December

2020

|

|

|

As at

30 June

2020

|

|

|

|

Total financial liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

Current financial liabilities

|

|

|

(6,720

|

)

|

|

|

(4,461

|

)

|

|

|

(4,792

|

)

|

Non-current

financial liabilities

|

|

|

(20,822

|

)

|

|

|

(22,844

|

)

|

|

|

(24,013

|

)

|

Cash and cash equivalents as per balance sheet

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents as per cash flow statement

|

|

|

4,072

|

|

|

|

5,475

|

|

|

|

4,722

|

|

Add bank overdrafts deducted therein

|

|

|

110

|

|

|

|

73

|

|

|

|

133

|

|

Other current financial assets

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current

financial assets derivatives that relate to financial liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP MEASURES (continued)

Within the Unilever Group, free cash flow (FCF) is defined as cash flow from operating activities, less income taxes paid, net capital expenditure and net interest payments. It does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from FCF. FCF reflects an additional way of viewing our liquidity that we believe is useful to investors because it represents cash flows that could be used for distribution of dividends, repayment of debt or to fund our strategic initiatives, including acquisitions, if any.

The reconciliation of cash flow from operating activities to FCF is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

|

|

2021

|

|

|

2020

|

|

Cash flow from operating activities

|

|

|

|

|

|

|

|

|

|

|

|

|

(917

|

)

|

|

|

(899

|

)

|

|

|

|

|

(386

|

)

|

|

|

(422

|

)

|

|

|

|

|

(227

|

)

|

|

|

(256

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flow (used in)/from investing activities

|

|

|

(570

|

)

|

|

|

(581

|

)

|

Net cash flow (used in)/from financing activities

|

|

|

(4,097

|

)

|

|

|

(2,088

|

)

|

|

|

|

|

|

|

|

|

|

|

On 13 August 2020, Unilever N.V. (NV) and Unilever Capital Corporation (UCC) filed a US Shelf registration, which was unconditionally and fully guaranteed, jointly and severally, by NV, Unilever PLC (PLC) and Unilever United States, Inc. (UNUS) and that updated the NV and UCC US Shelf registration filed on 27 July 2017, which was unconditionally and fully guaranteed, jointly and severally, by NV, PLC and UNUS.

As a result of Unification, PLC assumed NV’s liabilities in relation to debt issued under the US shelf registration programme. UCC and UNUS are each indirectly 100% owned by PLC and consolidated in the financial statements of the Unilever Group. In relation to the US Shelf registration, US$10.1 billion of Notes were outstanding at 30 June 2021 (2020: US$11.6 billion; 2019: US$11.0 billion) with coupons ranging from 0.375% to 5.900%. These Notes are repayable between 7 March 2022 and 15 November 2032.

All debt securities issued by UCC are senior, unsecured, and unsubordinated and are fully and unconditionally guaranteed, on a joint and several basis, by PLC and UNUS.

In March 2020, the SEC amended Rule

3-10

of Regulation

S-X

and created Rule

13-01

to simplify disclosure requirements related to certain registered securities, which we have adopted effective immediately. As noted above UCC and UNUS are 100% subsidiaries of Unilever PLC and are consolidated in the financial statements of the Unilever Group. In addition, there are no material assets in the guarantor entities apart from intercompany investments and balances. Therefore, as allowed under Rule

13-01,

we have excluded the summarised information for each issuer and guarantor.

The guarantees provide that, in case of the failure of the relevant issuer to punctually make payment of any principal, premium or interest, each guarantor agrees to ensure such payment is made when due whether at the stated maturity or by declaration of acceleration, call for redemption or otherwise. The guarantees also provide that the Trustee shall be paid any and all amounts due to it under the guarantee upon which the debt securities are endorsed.

On pages 46 to 50 of our 2020 Annual Report and Accounts on Form

20-F

we set out our assessment of the principal risk issues that would face the business under the headings: brand preference; portfolio management; climate change; plastic packaging; customer; talent; supply chain; safe and high quality products; systems and information; business transformation; economic and political instability; treasury and tax; ethical; and legal and regulatory. In our view, the nature and potential impact of such risks remain essentially unchanged as regards our performance over the second half of 2021.

This announcement may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Unilever Group (the ‘Group’). They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which could cause actual results to differ materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; the effect of climate change on Unilever’s business; Unilever’s ability to find sustainable solutions to its plastic packaging; significant changes or deterioration in customer relationships; the recruitment and retention of talented employees; disruptions in our supply chain and distribution; increases or volatility in the cost of raw materials and commodities; the production of safe and high quality products; secure and reliable IT infrastructure; execution of acquisitions, divestitures and business transformation projects; economic, social and political risks and natural disasters; financial risks; failure to meet high and ethical standards; and managing regulatory, tax and legal matters. A number of these risks have increased as a result of the current

Covid-19

pandemic. These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Annual Report on Form

20-F

2020 and the Unilever Annual Report and Accounts 2020 available on our corporate website.

|

|

|

|

|

|

|

|

|

Media Relations Team

|

|

Investor Relations Team

|

|

|

|

|

|

|

UK

|

|

+44 78 2527 3767

|

|

lucila.zambrano@unilever.com

|

|

+44 20 7822 6830

investor.relations@unilever.com

|

|

Or

|

|

+44 77 7999 9683

|

|

Jsibun@tulchangroup.com

|

|

|

|

NL

|

|

+31 10 217 4844

|

|

els-de.bruin@unilever.com

|

|

|

|

Or

|

|

+31 62 375 8385

|

|

marlous-den.bieman@unilever.com

|

|

|

There will be a web cast of the results presentation available at:

www.unilever.com/investor-relations/results-and-presentations/latest-results

CONSOLIDATED INCOME STATEMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

|

|

|

|

|

|

|

|

Increase/

(Decrease)

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Current

rates

|

|

|

Constant

rates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Which includes

non-underlying

items credits/(charges) of

|

|

|

(421

|

)

|

|

|

(412

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

68

|

|

|

|

139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(216

|

)

|

|

|

(378

|

)

|

|

|

|

|

|

|

|

|

Pensions and similar obligations

|

|

|

(5

|

)

|

|

|

(10

|

)

|

|

|

|

|

|

|

|

|

Non-underlying

item net monetary gain/(loss) arising from hyperinflationary economies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share of net profit/(loss) of joint ventures and associates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income/(loss) from

non-current

investments and associates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Which includes tax impact of

non-underlying

items of

|

|

|

63

|

|

|

|

102

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling

interests

|

|

|

276

|

|

|

|

258

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,121

|

|

|

|

3,284

|

|

|

|

(5.0

|

)%

|

|

|

4.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Combined earnings per share

|

|

|

|

Basic earnings per share (euros)

|

|

|

1.19

|

|

|

|

1.25

|

|

|

|

(5.0

|

)%

|

|

|

4.4

|

%

|

Diluted earnings per share (euros)

|

|

|

1.19

|

|

|

|

1.25

|

|

|

|

(5.0

|

)%

|

|

|

4.4

|

%

|

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

Items that will not be reclassified to profit or loss, net of tax:

|

|

|

|

|

|

|

|

|

Gains/(losses) on equity instruments measured at fair value through other comprehensive income

|

|

|

55

|

|

|

|

20

|

|

Remeasurements of defined benefit pension plans

(a)

|

|

|

968

|

|

|

|

(201

|

)

|

Items that may be reclassified subsequently to profit or loss, net of tax:

|

|

|

|

|

|

|

|

|

Gains/(losses) on cash flow hedges

|

|

|

137

|

|

|

|

43

|

|

Currency retranslation gains/(losses)

(b)

|

|

|

617

|

|

|

|

(1,481

|

)

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling

interests

|

|

|

299

|

|

|

|

177

|

|

|

|

|

|

4,875

|

|

|

|

1,746

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Remeasurement of defined benefit pension plans in 2021 is driven by positive investment returns and increase in interest rates.

|

|

(b)

|

2021 gain is primarily due to strengthening of the US Dollar, British Pound, Brazilian Real and Indian Rupee against the Euro. 2020 loss is due to weakening of the Brazilian Real, Mexican Peso, Indian Rupee, South Korean Won and Russian Ruble against the Euro.

|

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Called up

share

capital

|

|

|

Share

premium

account

|

|

|

Unification

reserve

|

|

|

Other

reserves

|

|

|

Retained

profit

|

|

|

Total

|

|

|

Non-controlling

interest

|

|

|

Total

equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

92

|

|

|

|

73,472

|

|

|

|

(73,364

|

)

|

|

|

(7,482

|

)

|

|

|

22,548

|

|

|

|

15,266

|

|

|

|

2,389

|

|

|

|

17,655

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit or loss for the period

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

3,121

|

|

|

|

3,121

|

|

|

|

276

|

|

|

|

3,397

|

|

Other comprehensive income, net of tax:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

67

|

|

|

|

—

|

|

|

|

67

|

|

|

|

(12

|

)

|

|

|

55

|

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

136

|

|

|

|

—

|

|

|

|

136

|

|

|

|

1

|

|

|

|

137

|

|

Remeasurements of defined benefit pension plans

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

968

|

|

|

|

968

|

|

|

|

—

|

|

|

|

968

|

|

Currency retranslation gains/(losses)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

576

|

|

|

|

7

|

|

|

|

583

|

|

|

|

34

|

|

|

|

617

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

779

|

|

|

|

4,096

|

|

|

|

4,875

|

|

|

|

299

|

|

|

|

5,174

|

|

Dividends on ordinary capital

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(2,252

|

)

|

|

|

(2,252

|

)

|

|

|

—

|

|

|

|

(2,252

|

)

|

Share capital reduction

(a)

|

|

|

|

|

|

|

(20,626

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

20,626

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(897

|

)

|

|

|

—

|

|

|

|

(897

|

)

|

|

|

—

|

|

|

|

(897

|

)

|

Other movements in treasury shares

(c)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

78

|

|

|

|

(101

|

)

|

|

|

(23

|

)

|

|

|

—

|

|

|

|

(23

|

)

|

Share-based payment credit

(d)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

82

|

|

|

|

82

|

|

|

|

—

|

|

|

|

82

|

|

Dividends paid to

non-controlling

interests

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(258

|

)

|

|

|

(258

|

)

|

Currency retranslation gains/(losses) net of tax

|

|

|

—

|

|

|

|

(3

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(3

|

)

|

|

|

—

|

|

|

|

(3

|

)

|