By Suzanne Kapner and Esther Fung

Outlet stores had long been immune to pressures weighing on

traditional malls, including the shift to online shopping that has

sapped customers from physical stores.

Shoppers often were willing to trek miles to outlet centers,

located far away because brands didn't want their reduced-priced

goods to be too close to their full-priced stores. For that reason,

outlet merchandise, typically last season's goods sold at steep

discounts, hasn't been widely available online. Until now.

Simon Property Group Inc., one of the largest mall owners, in

conjunction with Rue Gilt Groupe, which operates flash-sale

websites, has launched shoppremiumoutlets.com, where brands from

Vince to Under Armour offer their outlet goods for sale online. It

is one of the first curated websites to feature merchandise from

outlet stores.

Simon Chief Executive David Simon said he isn't worried the

website will siphon shoppers away from his company's outlet malls,

which include Woodbury Commons Premium Outlets, a sprawling complex

in Central Valley, N.Y., with 250 stores ranging from Gucci to Nike

that does more than $1.4 billion in annual sales.

"When you can't make that trip to Woodbury, knowing you can get

outlet pricing online makes sense," he said. "We think the two will

feed off each other to generate higher sales."

Outlet stores were long a source of growth for retailers, which

have been hard hit by the shift to online shopping and competition

from startups. Shoppers flocked to these centers for bargains they

couldn't traditionally get at malls, but now outlets are showing

the same signs of stress as traditional stores.

There are only about 400 U.S. outlet centers compared with more

than 1,100 traditional malls, according to the International

Council of Shopping Centers. That means outlet centers aren't

struggling against the oversupply that has plagued traditional

malls, which have seen dozens of their retail tenants close stores

or go out of business as more shoppers buy online.

But outlets are feeling the effects of retail bankruptcies and

the shift to online shopping, too. Chains including Gymboree and

Charlotte Russe have closed locations in outlet centers, and

Forever 21, which filed for bankruptcy protection this week, plans

to close around a dozen outlet stores.

Outlet centers are also facing stiffer competition from

off-price chains such as T.J. Maxx and Nordstrom Rack, which are

located closer to where most people live, as well as from regular

stores that have cut prices to remain competitive.

"The proposition of driving (typically) much further distances

to get to an outlet center seems that much less attractive," Paul

Lejuez, a Citi analyst, wrote in a recent research note.

Retailers including Ralph Lauren and Kate Spade have recently

called out softness in their outlet stores, a sign, according to

Mr. Lejuez, that they may have opened too many locations.

"We continue to clearly see challenges with brick-and-mortar

traffic, both full price and outlet," Ralph Lauren Corp. Chief

Executive Patrice Louvet told analysts in July when he laid out

plans to address the issue. Victor Luis, the former chief executive

of Kate Spade parent Tapestry Inc., told analysts in August that a

decline in foot traffic led to higher-than-expected promotions

among outlet retailers.

Just as with traditional malls, not all outlet centers are

created equal. The best ones, typically with higher-end retailers,

continue to draw shoppers by the busload while others struggle.

Tanger Factory Outlet Centers Inc., which owns 39 outlet

centers, posted a 0.3% decline in net operating income in the first

half of the year because of the effect of retailer bankruptcies,

lease modifications and store closures. The landlord posted 96%

occupancy at the end of June, down from 97.7% at the end of 2016.

Over the past year, shares of Tanger have fallen by 34%.

Simon Property, which operates 107 malls and 69 outlet centers

among other properties, doesn't disclose the difference in sales

and rent metrics between its malls and outlet centers.

Outlet retailers are among the last to venture online, in part

because some of these chains are high-end and don't want consumers

to be able to easily search the internet for discounts that could

tarnish their brand. Shoppremiumoutlets.com is launching with just

24 brands, but Mr. Simon said he is in discussions with dozens

more.

"We're looking at where the market is going," and increasingly

that is online, said Michael Rubin, the chief executive of Kynetic,

which owns Rue Gilt Groupe.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Esther

Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

October 05, 2019 09:15 ET (13:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

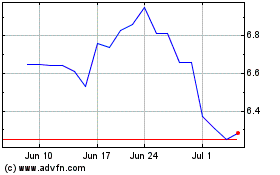

Under Armour (NYSE:UA)

Historical Stock Chart

From Mar 2024 to Apr 2024

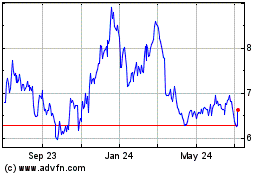

Under Armour (NYSE:UA)

Historical Stock Chart

From Apr 2023 to Apr 2024