Tutor Perini Announces Refinancing and New Credit Agreement

August 19 2020 - 4:33PM

Business Wire

- $425 million term loan B

- $175 million revolving credit facility

- Termination of 2017 credit facility, including elimination

of spring-forward maturity provision

- Repurchased $130.1 million of convertible notes

Tutor Perini Corporation (NYSE: TPC) (the “Company”), a leading

civil, building and specialty construction company, announced today

a refinancing and new credit agreement. The agreement includes a

$425 million 7-year term loan B and a $175 million 5-year revolving

credit facility.

The Company will use the proceeds from the term loan to repay

outstanding amounts under its 2017 credit facility and to

repurchase or retire at maturity its 2.875% convertible senior

notes due June 15, 2021. It will use the proceeds from the

revolving credit facility for working capital and other general

corporate purposes. The 2017 credit facility, including its

spring-forward provision that would have accelerated the maturity

of the facility to December 2020 if the convertible notes remained

outstanding, has been terminated.

"We are pleased with the successful execution of the new credit

agreement and especially with the removal of market uncertainties

associated with the spring-forward maturity provision in our

previous credit facility," said Gary Smalley, Executive Vice

President and Chief Financial Officer. "We have capitalized on the

attractive debt markets to further strengthen our balance sheet,

extend our maturities and provide additional financial flexibility

and liquidity. We experienced very strong market interest and

demand for this transaction, demonstrating the confidence that

lenders, investors and other financial participants have in Tutor

Perini’s current and long-term outlook."

The applicable interest rates, at the Company’s option, are

based on LIBOR or a base rate, plus an applicable margin, depending

on leverage. The applicable margin range on the term loan is 4.50%

- 4.75% for LIBOR and 3.50% - 3.75% for base rate. The applicable

margin range on the revolving credit facility is 4.25% - 4.75% for

LIBOR and 3.25% - 3.75% for base rate.

The credit facility is guaranteed by certain of the Company’s

wholly-owned subsidiaries and secured by substantially all of the

Company’s and each guarantor’s assets.

The Company also announced that on August 19, 2020 it

repurchased $130.1 million aggregate principal amount of its

convertible notes pursuant to separate, privately negotiated

arrangements with certain holders of the notes for an aggregate

purchase price of $132.4 million (including accrued and unpaid

interest to the repurchase date). Following the repurchases, $69.9

million aggregate principal amount of the convertible notes remain

outstanding.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private clients and public

agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget while adhering to strict quality control measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200819005720/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations and Corporate Communications

www.tutorperini.com

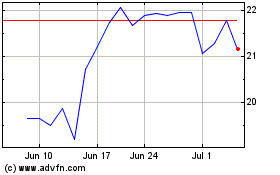

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

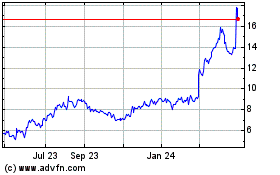

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Apr 2023 to Apr 2024