TEN, Ltd (TEN) (NYSE: TNP) (the “Company”) today reported results

(unaudited) for the quarter ended March 31, 2019.

Q1 2019 Summary

ResultsFollowing the strong fourth quarter of 2018, TEN

continues to enjoy positive results in the first quarter of 2019

with a net income of $11.2 million as a result of improved rate

conditions, following the healthy market recovery experienced at

the end of 2018.

Gross revenues totaled $147.0 million, 17.0%

higher than in the 2018 first quarter due to improved rates, full

employment at 97% and the positioning of suezmax and aframax

tankers in the spot market that generated an additional $18.4

million in revenue over that achieved, by the same vessels, in the

first quarter of 2018.

As market conditions improved, profit share

arrangements were activated and generated a further $4.3 million in

revenue. In addition, the two LNG carriers produced almost $3.0

million more in revenues compared to the first quarter of 2018 due

to the significant rise in their long-term employment rates.

TEN’s fleet averaged $21,054 per day in time

charter equivalent earnings compared to $17,771 per day in the

first quarter of 2018, an 18.5% increase.

During the first quarter of 2019, 73% of the

fleet was employed on secured revenue contracts, again generating

enough cash to cover operating expenses, charter-in costs, overhead

and finance expenses for all the vessels in the fleet.

Operating Income was at $27.8 million, five

times greater than in the 2018 first quarter and EBITDA (Earnings

before interest, taxes, depreciation and amortization) was $64.1

million, nearly 53% higher over the same period.

Overall, vessel expenses fell significantly by

$4.2 million, a 9% drop, while daily operating expenses per vessel

also fell by 7% to $7,522, due to savings on stores and repairs, in

line with the Company’s proactive management practices, as well as

the strengthening of the US dollar. G&A costs also experienced

a reduction by 6%.

Interest and finance costs were reduced by 2% to

$17.6 million from the 2018 first quarter. Although global interest

rates have increased over the preceding twelve months, the average

outstanding debt over that period has fallen by $150 million,

keeping overall loan interest at similar levels from the 2018 first

quarter.

Total cash balances amounted to $192 million

with net debt to capital at March 31, 2019 at a healthy 47.9%. TEN

is servicing its debt impeccably while sustaining a healthy

dividend.

Dividend – Common

SharesFollowing the $0.05 per share dividend paid on May

30, 2019, the Company’s Board of Directors approved the

reintroduction of semi-annual dividend payments to be made on the

second and fourth quarter of each calendar year. The Company’s

existing dividend payout policy will remain unchanged.

Corporate Strategy & OutlookTEN’s

employment strategy aims to outperform the market at high and low

cycles. In 2018, the Company’s average time-charter revenues

exceeded the spot market by 40% and in the first quarter of 2019

already by 5%. At the same time, immense attention is being paid in

maintaining costs under control with a further 9% decrease of

operating expenses in the first quarter of 2019.

Debt reduction remains on the forefront of TEN’s

priorities. Compared to the first quarter of 2018, total debt has

been reduced by $150 million, equivalent to $2 per share value

creation.

TEN is in the final stages of its 19-vessel

growth program undertaken at competitive levels during the low

levels of the cycle. Of these, 15 ships have been successfully

delivered, financed and employed on long-term accretive charters to

first class end-users. Within this year and 2020, the remaining

four vessels, all fully financed and chartered to major oil

concerns for a minimum of five years, will complete the Company’s

current expansion and secure revenues going forward.

Concurrently with the above, our strong balance

sheet allows management to explore further accretive opportunities

in the LNG and Shuttle tanker sector.

The market prospects going forward due to the

declining orderbook and IMO 2020 disruptions, places TEN in an

ideal position to take advantage of the positive environment that

is shaping up.

“With cash flow generation clearly better

compared to the 2018 first quarter and market dynamics shaping

favorably, TEN’s ability to capture the expected market upside

remains strong,” Mr. George Saroglou, COO of TEN commented. “TEN’s

employment strategy resulting to almost full fleet utilization

coupled with the second phase of our fully financed fully employed

organic growth, allow us to remain confident for the future and to

continue rewarding our shareholders with attractive dividends,” Mr.

Saroglou concluded.

TEN’s Growth Program

|

# |

Name |

Type |

Delivery |

Built |

Financed |

Employment |

|

1 |

HN5033 |

Aframax |

Oct. 2019 |

South Korea |

Yes |

Yes |

|

2 |

HN5036 |

Aframax |

2020 |

South Korea |

Yes |

Yes |

|

3 |

HN8041 |

Suezmax |

2020 |

South Korea |

Yes |

Yes |

|

4 |

HN8042 |

Suezmax |

2020 |

South Korea |

Yes |

Yes |

Conference Call: As previously

announced, today, Thursday, June 6, 2019 at 09:00 a.m. Eastern

Time, TEN will host a conference call to review the results as well

as management's outlook for the business. The call, which will be

hosted by TEN's senior management, may contain information beyond

that which is included in the earnings press release.

Conference Call details:

Participants should dial into the call 10 minutes before the

scheduled time using the following numbers: 1 877 55 39962 (US Toll

Free Dial In), 0808 2380 669 (UK Toll Free Dial In) or +44 (0)2071

928592 (Standard International Dial In). Please quote "Tsakos" to

the operator.

A telephonic replay of the conference call will

be available until Thursday June 13, 2019 by dialing 1 866 331 1332

(US Toll Free Dial In), 0808 2380 667 (UK Toll Free Dial In) or +44

(0)3333 00 9785 (Standard International Dial In). Access Code:

90295809#

Simultaneous Slides and Audio

Webcast:There will also be a simultaneous live, and then

archived, slides webcast of the conference call, available through

TEN's website (www.tenn.gr). The slides webcast will also provide

details related to fleet composition and deployment and other

related company information. This presentation will be available on

the Company's corporate website reception page at www.tenn.gr.

Participants for the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

ABOUT TSAKOS ENERGY

NAVIGATIONTEN, founded in 1993 and celebrating this year

26 years as a public company, is one of the first and most

established public shipping companies in the world. TEN’s

diversified energy fleet currently consists of 68 double-hull

vessels, including two aframax and two suezmax tankers under

construction, constituting a mix of crude tankers, product tankers

and LNG carriers, totaling 7.5 million dwt. Of the proforma fleet

today, 48 vessels trade in crude, 15 in products, three are shuttle

tankers and two are LNG carriers.

CompanyTsakos Energy Navigation

Ltd. George Saroglou, COO+30210 94 07 710gsaroglou@tenn.gr

Investor Relations /

MediaCapital Link, Inc.Nicolas Bornozis Markella Kara+212

661 7566ten@capitallink.com

| |

| |

|

TSAKOS ENERGY NAVIGATION LIMITED AND

SUBSIDIARIES |

|

Selected Consolidated Financial and Other Data |

|

(In Thousands of U.S. Dollars, except share, per share and fleet

data) |

|

|

|

|

|

|

|

| |

|

Three months ended |

| |

|

March 31 (unaudited) |

| STATEMENT OF

OPERATIONS DATA |

|

2019 |

|

|

2018 |

| |

|

|

|

|

|

|

Voyage revenues |

$ |

147,046 |

|

|

$ |

125,725 |

|

| |

|

|

|

|

|

| Voyage expenses |

|

31,566 |

|

|

|

27,276 |

|

| Charter hire expense |

|

2,669 |

|

|

|

2,678 |

|

| Vessel operating expenses |

|

43,324 |

|

|

|

47,535 |

|

| Depreciation and

amortization |

|

35,285 |

|

|

|

35,811 |

|

| General and administrative

expenses |

|

6,436 |

|

|

|

6,831 |

|

| Total expenses |

|

119,280 |

|

|

|

120,131 |

|

| |

|

|

|

|

|

|

Operating income |

|

27,766 |

|

|

|

5,594 |

|

| |

|

|

|

|

|

| Interest and finance costs,

net |

|

(17,593 |

) |

|

|

(17,945 |

) |

| Interest income |

|

774 |

|

|

|

321 |

|

| Other, net |

|

(29 |

) |

|

|

(335 |

) |

| Total other expenses, net |

|

(16,848 |

) |

|

|

(17,959 |

) |

|

Net income (loss) |

|

10,918 |

|

|

|

(12,365 |

) |

| |

|

|

|

|

|

|

Less: Net loss attributable to the noncontrolling

interest |

|

311 |

|

|

|

450 |

|

| Net income (loss)

attributable to Tsakos Energy Navigation Limited |

$ |

11,229 |

|

|

$ |

(11,915 |

) |

| |

|

|

|

|

|

| Effect of preferred

dividends |

|

(10,204 |

) |

|

|

(6,642 |

) |

| Net income (loss)

attributable to common stockholders of Tsakos Energy Navigation

Limited |

$ |

1,025 |

|

|

$ |

(18,557 |

) |

| |

|

|

|

|

|

| Income (Loss) per share, basic

and diluted |

$ |

0.01 |

|

|

$ |

(0.21 |

) |

| |

|

|

|

|

|

| Weighted average number of

common shares, basic and diluted |

|

87,604,645 |

|

|

|

86,324,241 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET

DATA |

|

March 31 |

|

|

December 31 |

| |

|

2019 |

|

|

2018 |

| Cash |

|

191,754 |

|

|

|

220,526 |

|

| Other assets |

|

165,152 |

|

|

|

138,924 |

|

| Vessels, net |

|

2,797,040 |

|

|

|

2,829,447 |

|

| Advances for vessels

under construction |

|

36,782 |

|

|

|

16,161 |

|

|

Total assets |

$ |

3,190,728 |

|

|

$ |

3,205,058 |

|

| |

|

|

|

|

|

| Debt, net of deferred finance

costs |

|

1,559,696 |

|

|

|

1,595,601 |

|

| Other liabilities |

|

131,573 |

|

|

|

102,680 |

|

| Stockholders' equity |

|

1,499,459 |

|

|

|

1,506,777 |

|

|

Total liabilities and stockholders' equity |

$ |

3,190,728 |

|

|

$ |

3,205,058 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Three months ended |

| OTHER FINANCIAL

DATA |

|

March 31 |

| |

|

2019 |

|

|

2018 |

| Net cash from operating

activities |

$ |

39,238 |

|

|

$ |

24,582 |

|

| Net cash used in investing

activities |

$ |

(20,830 |

) |

|

$ |

(441 |

) |

| Net cash used in financing

activities |

$ |

(47,179 |

) |

|

$ |

(48,538 |

) |

| |

|

|

|

|

|

| TCE per ship per day |

$ |

21,054 |

|

|

$ |

17,771 |

|

| |

|

|

|

|

|

| Operating expenses per ship

per day |

$ |

7,522 |

|

|

$ |

8,126 |

|

| Vessel overhead costs per ship

per day |

$ |

1,117 |

|

|

$ |

1,168 |

|

| |

|

8,639 |

|

|

|

9,294 |

|

| |

|

|

|

|

|

| FLEET

DATA |

|

|

|

|

|

| |

|

|

|

|

|

| Average number of vessels

during period |

|

64.0 |

|

|

|

65.0 |

|

| Number of vessels at end of

period |

|

64.0 |

|

|

|

65.0 |

|

| Average age of fleet at end of

period |

Years |

8.5 |

|

|

|

8.0 |

|

| Dwt at end of period (in

thousands) |

|

6,936 |

|

|

|

7,237 |

|

| |

|

|

|

|

|

| Time charter employment -

fixed rate |

Days |

2,393 |

|

|

|

2,407 |

|

| Time charter employment -

variable rate |

Days |

1,674 |

|

|

|

1,732 |

|

| Period employment (coa) at

market rates |

Days |

180 |

|

|

|

354 |

|

| Spot voyage employment at

market rates |

Days |

1,328 |

|

|

|

1,131 |

|

|

Total operating days |

|

5,575 |

|

|

|

5,624 |

|

|

Total available days |

|

5,760 |

|

|

|

5,850 |

|

|

Utilization |

|

96.8 |

% |

|

|

96.1 |

% |

| |

|

|

|

|

|

|

The Company reports its financial results in accordance with U.S.

generally accepted accounting principles (GAAP). However,

management believes that certain non-GAAP measures used within the

financial community may provide users of this financial

information additional meaningful comparisons between current

results and results in prior operating periods as well as

comparisons between the performance of Shipping Companies.

Management also uses these non-GAAP financial measures in making

financial, operating and planning decisions and in evaluating the

Company’s performance. We are using the following Non-GAAP

measures: |

| (i) TCE which

represents voyage revenues less voyage expenses divided by the

number of operating days less 90 days lost as a result of

calculating revenue on a loading to discharge basis for the first

quarter of 2019 and 84 days for the first quarter of 2018. |

| (ii) Vessel

overhead costs are General & Administrative expenses, which

also include Management fees, Stock compensation expense and

Management incentive award. |

|

(iii) Operating expenses per ship per day which exclude Management

fees, General & Administrative expenses, Stock compensation

expense and Management incentive award. |

| Non-GAAP financial

measures should be viewed in addition to and not as an alternative

for, the Company’s reported results prepared in accordance with

GAAP. |

| |

|

|

|

|

|

| The Company does not incur

corporation tax. |

|

|

|

|

|

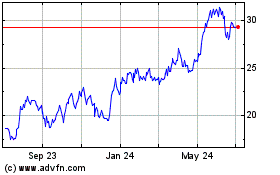

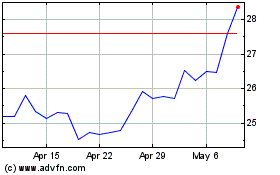

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Apr 2023 to Apr 2024