$66m EBITDA in Profitable Fourth Quarter

Before Non-Cash Impairment

TEN, Ltd. (TEN) (NYSE: TNP) (the “Company”) reports results

(unaudited) for the fourth quarter and year ended December 31,

2018.

FOURTH QUARTER 2018

RESULTSIn the fourth quarter of 2018, TEN Ltd.

generated positive operating income of $26.3 million and net income

of $2.8 million, before non-cash impairment charges, and including

a $10.8 million non-cash bunker hedging charge that has already

reversed as described below.

Total gross revenues increased by 14.3% to

$153.8 million compared to the fourth quarter of 2017 due to a

much-improved crude tanker market as global oil demand continued to

strengthen and oil supplies, especially from the U.S., increased

while the additions of new vessels to the global fleet slowed

down.

As a result, 33 tankers operating on

spot-related charters during the quarter, including vessels on

profit-sharing contracts, were able to generate increased freight

income. In particular, eight suezmaxes on such profit-sharing

charters earned twice the amount of the agreed minimum hire-rate.

These factors helped increase the average daily TCE per vessel in

the fleet by 17% to $21,439 in the quarter.

In addition, the two LNG carriers also earned

higher rates in the fourth quarter of 2018 than in the 2017 fourth

quarter. Since the beginning of 2019, the hire-rates for our LNG

vessels have increased substantially.

Adjusted EBITDA amounted to $66.3 million, 25.3%

higher than the 2017 fourth quarter, with almost all vessels

generating positive adjusted EBITDA. Compared to the third quarter

of 2018, the fleet generated close to $26 million more adjusted

EBITDA, a 64% increase.

In line with the Company’s operating model,

vessels on fixed term time charters alone continued to generate

enough gross revenue to cover the entire fleet’s operating,

overhead and cash finance expenses while the spot vessels added a

further $22 million revenue, net of voyage expenses.

Depreciation and amortization costs were at

$37.2 million, a small increase over the fourth quarter of 2017

mainly due to higher dry-docking amortization.

Fleet operating expenses, despite a larger

number of vessels during the quarter, fell by 2.5% compared with

the fourth quarter of 2017 assisted by tight cost controls, lower

insurance and lubricant expenses and a strengthening of the U.S.

dollar. On a per vessel basis, such expenses translate to $7,715

per day, a decrease from the fourth quarter of 2017.

Finance and interest costs were at $26.2

million, partly as a result of a $10.8 million non-cash decrease in

valuations of bunker hedges due to a sudden decline in oil prices

at the very end of the year, offsetting on the bottom line the

actual cash gains of about $10.0 million earned in 2018 on these

hedges. In addition, interest rates increased in the year, but were

offset to an extent by the impact of a rapidly declining

outstanding debt.

2018 YEAR

RESULTSIn 2018, TEN produced total voyage

revenues of $529.9 million, slightly higher than in 2017. The first

three quarters of the year saw a difficult market with healthier

rates evident only in the fourth quarter, as the market at last

benefited from a positive turn-around instigated by a fast

declining orderbook, increased scrapping and a surge in US oil

exports which in large part nullified the renewed production cuts

by OPEC.

In this challenging and unpredictable

environment and as a result of TEN’s solid employment strategy, the

Company generated $38.2 million in operating income, before

non-cash charges, and adjusted EBITDA of $190.7 million.

The average daily time charter equivalent rate

per vessel per day was $18,226 with fleet utilization again at a

high 96.2% as a result of the Company’s time-charter policy and the

excellent and long-standing relationship with many high-end

charterers across the globe.

Average daily operating expenses per vessel in

2018 remained at about the same level as in 2017 at $7,745 per day.

Vessel overhead costs (mainly G&A expenses and management fees)

per ship per day averaged $1,152, similar to that of 2017 despite

the higher number of vessels in the fleet.

Interest and finance costs increased to $76.8

million due to higher interest rates and a decline in non-cash

bunker hedge valuations of $10.8 million that have since been

reversed.

TEN continues to retain strong cash liquidity

with $220.5 million on the balance sheet at December 31, 2018.

Net debt to capital at the end of 2018 was at a

healthy 47.9%. In 2018, total debt was reduced by $156 million, the

equivalent of $2.0 extra value per share.

Dividend – Common SharesThe

Company will pay a dividend of $0.05 per common share on May 30,

2019 to shareholders of record as of May 24, 2019. Inclusive of

this payment, TEN has paid $10.81 in total dividends since its

listing on the NYSE in 2002.

Corporate StrategyThe Company

continues its long-term repeat employment model having concluded

its 30th time charter in the last 15 months. Inclusive of the two

recently announced LNG fixtures, which are expected to generate

cash inflows of about $60 million, the minimum contracted revenue

backlog of TEN currently stands at $1.2 billion. The nine vessels

with time charters that expire in 2019 are already in negotiations

for extensions at higher rates, reflecting today’s improved market

prospects.

Five vessels, the Silia T, the Bosporos, the

Byzantion, the Salamina and the Selini have incurred non-cash

impairment charges totaling $66 million as they have become

potential candidates for sale. This impairment will reduce by $1.0

million TEN’s future quarterly depreciation charges.

In addition to replacement tonnage, management

continues to actively explore investments in the LNG and shuttle

tanker space aiming, as always, at industrial opportunities with

long accretive charters. In 2019 four such contracts for aframax

and suezmax tankers to major end-users have been concluded.

“With global oil consumption on the rise, driven

by Chinese and Indian demand, and the US becoming a leading force

in global crude oil exports, freight rates should maintain their

upward trajectory by the second half of 2019 and beyond. The low

orderbook and the high scrapping levels spurred, to a large extent

by the upcoming IMO 2020 regulations, will further support the

market to attain higher profitability. As a result, vessels in spot

and profit-sharing charters are expected to capture the firming

freight market and solidify further the Company’s bottom line,” Mr.

George Saroglou, COO of TEN, commented. “The increased appetite of

major oil companies for long-term charters in the crude and product

sectors, is a strong indicator of a sustainable improvement in

market conditions going forward,” Mr Saroglou concluded.

TEN’s Growth Program

|

# |

Name |

Type |

Delivery |

Status |

Employment |

|

1 |

HN5033 |

Aframax |

2019 |

Under Construction |

Yes |

|

2 |

HN5036 |

Aframax |

2020 |

Under Construction |

Yes |

|

3 |

HN8041 |

Suezmax |

2020 |

Under Construction |

Yes |

|

4 |

HN8042 |

Suezmax |

2020 |

Under Construction |

Yes |

| |

|

|

|

|

|

ABOUT FORWARD-LOOKING

STATEMENTS Except for the historical information contained

herein, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those

predicted by such forward-looking statements. TEN undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

ABOUT TSAKOS ENERGY

NAVIGATIONTEN, founded in 1993 and celebrating this year

26 years as a public company, is one of the first and most

established public shipping companies in the world. TEN’s

diversified energy fleet currently consists of 68 double-hull

vessels, including two aframax and two suezmax tankers under

construction, constituting a mix of crude tankers, product tankers

and LNG carriers, totaling 7.5 million dwt. Of the proforma fleet

today, 48 vessels trade in crude, 15 in products, three are shuttle

tankers and two are LNG carriers.

For further information please contact:

CompanyTsakos Energy Navigation Ltd. George

Saroglou, COO+30210 94 07 710gsaroglou@tenn.gr

Investor Relations / MediaCapital Link,

Inc.Nicolas Bornozis Markella Kara+212 661

7566ten@capitallink.com

| |

|

|

|

|

|

|

|

|

|

|

|

| TSAKOS ENERGY NAVIGATION LIMITED AND

SUBSIDIARIES |

| Selected Consolidated Financial and Other Data |

| (In Thousands of U.S. Dollars, except share, per share

and fleet data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended |

| |

|

December 31 (unaudited) |

|

|

December 31 (unaudited) |

| STATEMENT OF

OPERATIONS DATA |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Voyage

revenues |

$ |

153,755 |

|

|

$ |

134,517 |

|

|

$ |

529,879 |

|

|

$ |

529,182 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Voyage expenses |

|

34,790 |

|

|

|

27,873 |

|

|

|

125,350 |

|

|

|

113,403 |

|

| Charter hire

expense |

|

2,719 |

|

|

|

311 |

|

|

|

10,822 |

|

|

|

311 |

|

| Vessel operating

expenses |

|

45,428 |

|

|

|

46,579 |

|

|

|

181,693 |

|

|

|

173,864 |

|

| Depreciation and

amortization |

|

37,225 |

|

|

|

36,518 |

|

|

|

146,798 |

|

|

|

139,020 |

|

| General and

administrative expenses |

|

7,261 |

|

|

|

7,300 |

|

|

|

27,032 |

|

|

|

26,324 |

|

| Total expenses |

|

127,423 |

|

|

|

118,581 |

|

|

|

491,695 |

|

|

|

452,922 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

26,332 |

|

|

|

15,936 |

|

|

|

38,184 |

|

|

|

76,260 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Interest and finance

costs, net |

|

(26,226 |

) |

|

|

(13,693 |

) |

|

|

(76,809 |

) |

|

|

(56,839 |

) |

| Interest income |

|

832 |

|

|

|

268 |

|

|

|

2,507 |

|

|

|

1,082 |

|

| Other, net |

|

1,730 |

|

|

|

598 |

|

|

|

1,405 |

|

|

|

1,464 |

|

| Total other expenses,

net |

|

(23,664 |

) |

|

|

(12,827 |

) |

|

|

(72,897 |

) |

|

|

(54,293 |

) |

|

Net income (loss) |

|

2,668 |

|

|

|

3,109 |

|

|

|

(34,713 |

) |

|

|

21,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net

loss (income) attributable to the noncontrolling interest |

|

148 |

|

|

|

(413 |

) |

|

|

1,839 |

|

|

|

(1,573 |

) |

| Net income

(loss) attributable to Tsakos Energy Navigation

Limited |

$ |

2,816 |

|

|

|

2,696 |

|

|

$ |

(32,874 |

) |

|

$ |

20,394 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss on sale of

vessels |

|

- |

|

|

|

(3,860 |

) |

|

|

(364 |

) |

|

|

(3,860 |

) |

| Vessel impairment

charge |

|

(65,965 |

) |

|

|

(8,922 |

) |

|

|

(65,965 |

) |

|

|

(8,922 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Effect of preferred

dividends |

|

(10,204 |

) |

|

|

(6,642 |

) |

|

|

(33,763 |

) |

|

|

(23,776 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

attributable to common stockholders of Tsakos Energy Navigation

Limited |

$ |

(73,353 |

) |

|

$ |

(16,728 |

) |

|

$ |

(132,966 |

) |

|

$ |

(16,164 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss per share, basic

and diluted |

$ |

(0.84 |

) |

|

$ |

(0.19 |

) |

|

$ |

(1.53 |

) |

|

$ |

(0.19 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of common shares, basic and diluted |

|

87,604,645 |

|

|

|

85,884,192 |

|

|

|

87,111,636 |

|

|

|

84,713,572 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET

DATA |

|

December 31 |

|

|

December 31 |

|

|

|

|

|

|

| |

|

2018 |

|

|

2017 |

|

|

|

|

|

|

| Cash |

|

220,526 |

|

|

|

202,673 |

|

|

|

|

|

|

|

| Other assets |

|

138,924 |

|

|

|

140,909 |

|

|

|

|

|

|

|

| Vessels, net |

|

2,829,447 |

|

|

|

3,028,404 |

|

|

|

|

|

|

|

| Advances for vessels

under construction |

|

16,161 |

|

|

|

1,650 |

|

|

|

|

|

|

|

|

Total assets |

$ |

3,205,058 |

|

|

$ |

3,373,636 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of deferred

finance costs |

|

1,595,601 |

|

|

|

1,751,869 |

|

|

|

|

|

|

|

| Other liabilities |

|

102,680 |

|

|

|

113,629 |

|

|

|

|

|

|

|

| Stockholders'

equity |

|

1,506,777 |

|

|

|

1,508,138 |

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

3,205,058 |

|

|

$ |

3,373,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended |

| OTHER FINANCIAL

DATA |

|

December 31 |

|

|

December 31 |

| |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

| Net cash from operating

activities |

$ |

39,000 |

|

|

$ |

31,259 |

|

|

$ |

73,945 |

|

|

$ |

170,827 |

|

| Net cash (used in)

provided by investing activities |

$ |

(5,552 |

) |

|

$ |

15,522 |

|

|

$ |

(179 |

) |

|

$ |

(241,797 |

) |

| Net cash (used in)

provided by financing activities |

$ |

(45,490 |

) |

|

$ |

(69,993 |

) |

|

$ |

(55,913 |

) |

|

$ |

75,870 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| TCE per ship per

day |

$ |

21,439 |

|

|

$ |

18,343 |

|

|

$ |

18,226 |

|

|

$ |

18,931 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses per

ship per day |

$ |

7,715 |

|

|

$ |

7,823 |

|

|

$ |

7,745 |

|

|

$ |

7,688 |

|

| Vessel overhead costs

per ship per day |

$ |

1,233 |

|

|

$ |

1,226 |

|

|

$ |

1,152 |

|

|

$ |

1,152 |

|

| |

|

8,948 |

|

|

|

9,049 |

|

|

|

8,897 |

|

|

|

8,840 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| FLEET

DATA |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average number of

vessels during period |

|

64.0 |

|

|

|

62.7 |

|

|

|

64.3 |

|

|

|

62.6 |

|

| Number of vessels at

end of period |

|

64.0 |

|

|

|

65.0 |

|

|

|

64.0 |

|

|

|

65.0 |

|

| Average age of fleet at

end of period |

Years |

8.2 |

|

|

|

7.7 |

|

|

|

8.2 |

|

|

|

7.7 |

|

| Dwt at end of period

(in thousands) |

|

6,936 |

|

|

|

7,237 |

|

|

|

6,936 |

|

|

|

7,237 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Time charter employment

- fixed rate |

Days |

2,660 |

|

|

|

2,499 |

|

|

|

9,600 |

|

|

|

9,109 |

|

| Time charter employment

- variable rate |

Days |

1,288 |

|

|

|

1,810 |

|

|

|

6,464 |

|

|

|

6,357 |

|

| Period employment (coa)

at market rates |

Days |

224 |

|

|

|

276 |

|

|

|

1,215 |

|

|

|

1,093 |

|

| Spot voyage employment

at market rates |

Days |

1,501 |

|

|

|

1,229 |

|

|

|

5,294 |

|

|

|

5,536 |

|

| Total

operating days |

|

5,673 |

|

|

|

5,814 |

|

|

|

22,573 |

|

|

|

22,095 |

|

| Total

available days |

|

5,888 |

|

|

|

5,954 |

|

|

|

23,460 |

|

|

|

22,850 |

|

|

Utilization |

|

96.3 |

% |

|

|

97.6 |

% |

|

|

96.2 |

% |

|

|

96.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Measures |

| Reconciliation of Net income (loss) to

Adjusted EBITDA |

| |

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended |

| |

|

December 31 |

|

|

December 31 |

| |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to Tsakos Energy Navigation Limited |

|

2,816 |

|

|

|

2,696 |

|

|

|

(32,874 |

) |

|

|

20,394 |

|

| Depreciation and

amortization |

|

37,225 |

|

|

|

36,518 |

|

|

|

146,798 |

|

|

|

139,020 |

|

| Interest Expense |

|

26,226 |

|

|

|

13,693 |

|

|

|

76,809 |

|

|

|

56,839 |

|

| Adjusted EBITDA |

$ |

66,267 |

|

|

$ |

52,907 |

|

|

$ |

190,733 |

|

|

$ |

216,253 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| The Company reports its financial results in

accordance with U.S. generally accepted accounting principles

(GAAP). However, management believes that certain non-GAAP measures

used within the financial community may provide users of this

financial information additional meaningful comparisons between

current results and results in prior operating periods as well as

comparisons between the performance of Shipping Companies.

Management also uses these non-GAAP financial measures in making

financial, operating and planning decisions and in evaluating the

Company’s performance. We are using the following Non-GAAP

measures: |

|

|

| (i) TCE

which represents voyage revenues less voyage expenses divided by

the number of operating days less 378 days lost as a result of

calculating revenue on a loading to discharge basis for the year

ended December 31, 2018 and 124 days for the fourth quarter of

2018. |

| (ii)

Vessel overhead costs are General & Administrative expenses,

which also include Management fees, Stock compensation expense and

Management incentive award. |

| (iii) Operating expenses per ship per day which exclude

Management fees, General & Administrative expenses, Stock

compensation expense and Management incentive award. |

| (iv) EBITDA. See above for reconciliation to net income

(loss). |

| Non-GAAP

financial measures should be viewed in addition to and not as an

alternative for, the Company’s reported results prepared in

accordance with GAAP. |

|

|

| The

Company does not incur corporation tax. |

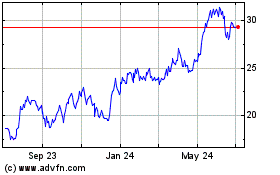

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

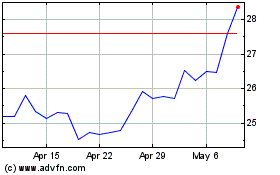

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Apr 2023 to Apr 2024