TrueBlue (NYSE:TBI) today announced its second quarter results

for 2019.

Second quarter revenue was $589 million, a decrease of 4

percent, compared to revenue of $614 million in the second quarter

of 2018. Net income per diluted share was $0.49, an increase of 11

percent, compared to $0.44 in the second quarter of 2018. Adjusted

net income1 per diluted share was $0.64, an increase of 12 percent,

compared to $0.57 in the second quarter of 2018.

“We experienced a slower pace of demand this quarter,

attributable to lower volumes within the businesses of our

clients,” said Patrick Beharelle, CEO of TrueBlue. “I’m pleased

that we were able to effectively manage costs, resulting in net

income and EPS growth, while making progress on our digital growth

initiatives.

“The second quarter also marks the five-year anniversary of our

acquisition of Seaton and the one-year anniversary of our

acquisition of TMP Holdings,” Mr. Beharelle continued. “The Seaton

acquisition transformed the company into a diversified workforce

solutions company and provided entry into the RPO market that now

represents 30 percent of the company’s segment profit.2 The TMP

acquisition bolstered our global RPO growth strategy, providing

entry into the U.K. and accelerating our ability to compete for

multi-continent deals.”

2019 Outlook

TrueBlue estimates revenue for the third quarter of 2019 will

range from $613 million to $638 million. The company also estimates

net income per diluted share will range from $0.50 to $0.60 and

adjusted net income per diluted share will range from $0.61 to

$0.71.

Management will discuss second quarter 2019 results on a webcast

at 2 p.m. PDT (5 p.m. EDT), today, Monday, Jul. 29, 2019. The

webcast can be accessed on TrueBlue’s website: www.trueblue.com.

About TrueBlue

TrueBlue (NYSE: TBI) is a leading provider of specialized

workforce solutions that help clients achieve business growth and

improve productivity. In 2018, TrueBlue connected approximately

730,000 people with work. Its PeopleReady segment offers industrial

staffing services, PeopleManagement offers contingent and

productivity-based on-site industrial staffing services, and

PeopleScout offers recruitment process outsourcing (RPO) and

managed service provider (MSP) solutions to a wide variety of

industries. Learn more at www.trueblue.com.

1 See the financial statements accompanying the release and the

company’s website for more information on non-GAAP terms.

2 Segment profit calculations based on the trailing twelve

months ended June 2019. Segment profit includes revenue, related

cost of services, and ongoing operating expenses directly

attributable to the reportable segment. Segment profit excludes

goodwill and intangible impairment charges, depreciation and

amortization expense, unallocated corporate general and

administrative expense, interest, other income and expense, income

taxes, and other adjustments not considered to be ongoing.

Forward-looking statements

This document contains forward-looking statements relating to

our plans and expectations, all of which are subject to risks and

uncertainties. Such statements are based on management’s

expectations and assumptions as of the date of this release and

involve many risks and uncertainties that could cause actual

results to differ materially from those expressed or implied in our

forward-looking statements including: (1) national and global

economic conditions, (2) our ability to attract and retain clients,

(3) our ability to attract sufficient qualified candidates and

employees to meet the needs of our clients, (4) our ability to

maintain profit margins, (5) new laws and regulations that could

affect our operations or financial results, (6) our ability to

successfully complete and integrate acquisitions, (7) our ability

to successfully execute on business strategies to further digitize

our business model, and (8) any reduction or change in tax credits

we utilize, including the Work Opportunity Tax Credit. Other

information regarding factors that could affect our results is

included in our Securities Exchange Commission (SEC) filings,

including the company's most recent reports on Forms 10-K and 10-Q,

copies of which may be obtained by visiting our website at

www.trueblue.com under the Investor Relations section or the SEC's

website at www.sec.gov. We assume no obligation to update or revise

any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by

law. Any other reference to future financial estimates are included

for informational purposes only and subject to risk factors

discussed in our most recent filings with the SEC.

In addition, we use several non-GAAP financial measures when

presenting our financial results in this document. Please refer to

the reconciliations between our GAAP and non-GAAP financial

measures in the appendix to this document and on our website at

www.trueblue.com under the Investor Relations section for

additional information on both current and historical periods. The

presentation of these non-GAAP financial measures is used to

enhance the understanding of certain aspects of our financial

performance. It is not meant to be considered in isolation,

superior to, or as a substitute for the directly comparable

financial measures prepared in accordance with U.S. GAAP, and may

not be comparable to similarly titled measures of other

companies.

TRUEBLUE, INC.

SUMMARY CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

13 Weeks Ended

26 Weeks Ended

(in thousands, except per share

data)

Jun 30, 2019

Jul 1, 2018

Jun 30, 2019

Jul 1, 2018

Revenue from services

$

588,594

$

614,301

$

1,140,946

$

1,168,689

Cost of services

430,277

448,717

834,253

859,837

Gross profit

158,317

165,584

306,693

308,852

Selling, general and administrative

expense

127,599

134,207

257,260

259,970

Depreciation and amortization

9,827

10,101

19,779

20,191

Income from operations

20,891

21,276

29,654

28,691

Interest and other income (expense),

net

827

(968

)

1,380

1,236

Income before tax expense

21,718

20,308

31,034

29,927

Income tax expense

2,312

2,576

3,352

3,440

Net income

$

19,406

$

17,732

$

27,682

$

26,487

Net income per common share:

Basic

$

0.50

$

0.44

$

0.71

$

0.66

Diluted

$

0.49

$

0.44

$

0.70

$

0.65

Weighted average shares

outstanding:

Basic

39,163

40,227

39,264

40,335

Diluted

39,554

40,469

39,619

40,576

TRUEBLUE, INC.

SUMMARY CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

Jun 30, 2019

Dec 30, 2018

ASSETS

Cash and cash equivalents

$

23,124

$

46,988

Accounts receivable, net

335,488

355,373

Other current assets

33,730

27,466

Total current assets

392,342

429,827

Property and equipment, net

58,647

57,671

Restricted cash and investments

222,556

235,443

Goodwill and intangible assets, net

318,484

328,695

Operating lease right-of-use assets

37,978

—

Other assets, net

64,880

63,208

Total assets

$

1,094,887

$

1,114,844

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

$

212,718

$

225,526

Long-term debt

24,700

80,000

Operating lease long-term liabilities

25,995

—

Other long-term liabilities

216,467

217,879

Total liabilities

479,880

523,405

Shareholders’ equity

615,007

591,439

Total liabilities and shareholders’

equity

$

1,094,887

$

1,114,844

TRUEBLUE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

26 Weeks Ended

(in thousands)

Jun 30, 2019

Jul 1, 2018

Cash flows from operating

activities:

Net income

$

27,682

$

26,487

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation and amortization

19,779

20,191

Provision for doubtful accounts

3,761

5,571

Stock-based compensation

5,260

5,983

Deferred income taxes

2,393

1,373

Non-cash lease expense

6,934

—

Other operating activities

(2,072

)

102

Changes in operating assets and

liabilities:

Accounts receivable

16,162

888

Income tax receivable

(6,347

)

(3,641

)

Other assets

(4,472

)

(3,522

)

Accounts payable and other accrued

expenses

(16,542

)

3,468

Accrued wages and benefits

(4,667

)

(1,528

)

Workers’ compensation claims reserve

(7,109

)

(9,235

)

Operating lease liabilities

(6,957

)

—

Other liabilities

3,174

3,304

Net cash provided by operating

activities

36,979

49,441

Cash flows from investing

activities:

Capital expenditures

(11,064

)

(6,468

)

Acquisition of business

—

(22,742

)

Divestiture of business

—

8,800

Purchases of restricted investments

(11,315

)

(10,730

)

Maturities of restricted investments

19,685

13,044

Net cash used in investing

activities

(2,694

)

(18,096

)

Cash flows from financing

activities:

Purchases and retirement of common

stock

(9,077

)

(19,065

)

Net proceeds from employee stock purchase

plans

700

757

Common stock repurchases for taxes upon

vesting of restricted stock

(1,631

)

(2,403

)

Net change in revolving credit

facility

(55,300

)

21,300

Payments on debt

—

(22,856

)

Other

(119

)

—

Net cash used in financing

activities

(65,427

)

(22,267

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

560

(919

)

Net change in cash, cash equivalents,

and restricted cash

(30,582

)

8,159

Cash, cash equivalents and restricted

cash, beginning of period

102,450

73,831

Cash, cash equivalents and restricted

cash, end of period

$

71,868

$

81,990

TRUEBLUE, INC.

SEGMENT DATA

(Unaudited)

13 Weeks Ended

(in thousands)

Jun 30, 2019

Jul 1, 2018

Revenue from services:

PeopleReady

$

369,261

$

377,460

PeopleManagement

153,530

178,839

PeopleScout

65,803

58,002

Total company

$

588,594

$

614,301

Segment profit (1):

PeopleReady

$

21,795

$

23,198

PeopleManagement

4,128

4,712

PeopleScout

11,223

11,320

37,146

39,230

Corporate unallocated expense

(3,634

)

(5,868

)

Total company Adjusted EBITDA

(2)

33,512

33,362

Work Opportunity Tax Credit processing

fees (3)

(240

)

(264

)

Acquisition/integration costs (4)

(673

)

(457

)

Other adjustments (5)

(1,881

)

(1,264

)

EBITDA (2)

30,718

31,377

Depreciation and amortization

(9,827

)

(10,101

)

Interest and other income (expense),

net

827

(968

)

Income before tax expense

21,718

20,308

Income tax expense

(2,312

)

(2,576

)

Net income

$

19,406

$

17,732

(1)

We evaluate performance based on segment

revenue and segment profit. Segment profit includes revenue,

related cost of services, and ongoing operating expenses directly

attributable to the reportable segment. Segment profit excludes

goodwill and intangible impairment charges, depreciation and

amortization expense, unallocated corporate general and

administrative expense, interest, other income and expense, income

taxes, and other adjustments not considered to be ongoing.

(2)

See the Non-GAAP Financial Measures table

on the next page for definitions of EBITDA and Adjusted EBITDA.

(3)

These third-party processing fees are

associated with generating the Work Opportunity Tax Credits, which

are designed to encourage employers to hire workers from certain

targeted groups with higher than average unemployment rates.

(4)

Acquisition/integration costs relate to

the acquisition of TMP Holdings LTD completed on June 12, 2018.

(5)

Other adjustments for the 13 weeks ended

June 30, 2019 include implementation costs for cloud-based systems

of $1.1 million, amortization of software as a service assets of

$0.5 million which is reported in selling, general and

administrative expense, a workforce reduction charge primarily

associated with employee reductions in the PeopleReady business of

$0.5 million, and reduced costs associated with the CEO transition

of $0.2 million. Other adjustments for the 13 weeks ended July 1,

2018 include implementation costs for cloud-based systems of $1.3

million.

TRUEBLUE, INC.

NON-GAAP FINANCIAL MEASURES AND NON-GAAP

RECONCILIATIONS

In addition to financial measures presented in accordance with

U.S. GAAP, we monitor certain non-GAAP key financial measures. The

presentation of these non-GAAP financial measures is used to

enhance the understanding of certain aspects of our financial

performance. It is not meant to be considered in isolation,

superior to, or as a substitute for the directly comparable

financial measures prepared in accordance with U.S. GAAP, and may

not be comparable to similarly titled measures of other

companies.

Non-GAAP Measure

Definition

Purpose of Adjusted

Measures

EBITDA and Adjusted EBITDA

EBITDA excludes from net income:

- interest and other income (expense),

net,

- income taxes, and

- depreciation and amortization.

Adjusted EBITDA, further excludes:

- Work Opportunity Tax Credit third-party

processing fees,

- acquisition/integration costs and

- other adjustments.

- Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business.

- Used by management to assess performance

and effectiveness of our business strategies.

- Provides a measure, among others, used

in the determination of incentive compensation for management.

Adjusted net income and Adjusted net

income, per diluted share

Net income and net income per diluted

share, excluding:

- amortization of intangibles of acquired

businesses,

- acquisition/integration costs,

- gain on divestiture,

- other adjustments,

- tax effect of each adjustment to U.S.

GAAP net income, and

- adjust income taxes to the expected

effective tax rate.

- Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business. - Used by management to assess

performance and effectiveness of our business strategies.

Organic revenue

Organic revenue excludes the first 12

months of operations of acquired businesses.

- Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business. - Used by management to assess

performance and effectiveness of our business strategies.

Free cash flow

Net cash provided by operating activities,

minus cash purchases for property and equipment.

- Used by management to assess cash

flows.

1. RECONCILIATION OF U.S. GAAP NET

INCOME TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME, PER DILUTED

SHARE

(Unaudited)

Q2 2019

Q2 2018

Q3 2019 Outlook*

13 Weeks Ended

13 Weeks Ended

13 Weeks Ended

(in thousands, except for per share

data)

Jun 30, 2019

Jul 1, 2018

Sep 29, 2019

Net income

$

19,406

$

17,732

$ 19,800 — $ 23,700

Gain on divestiture (1)

—

290

—

Amortization of intangible assets of

acquired businesses (2)

4,957

5,174

3,900

Acquisition/integration costs (3)

673

457

400

Other adjustments (4)

1,881

1,264

700

Tax effect of adjustments to net income

(5)

(1,052

)

(1,150

)

(700)

Adjustment of income taxes to normalized

effective rate (6)

(729

)

(673

)

—

Adjusted net income

$

25,136

$

23,094

$ 24,100 — $ 28,000

Adjusted net income, per diluted

share

$

0.64

$

0.57

$ 0.61 — $ 0.71

Diluted weighted average shares

outstanding

39,554

40,469

39,400

*Totals may not sum due to rounding

2. RECONCILIATION OF U.S. GAAP NET

INCOME TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

Q2 2019

Q2 2018

Q3 2019 Outlook*

13 Weeks Ended

13 Weeks Ended

13 Weeks Ended

(in thousands)

Jun 30, 2019

Jul 1, 2018

Sep 29, 2019

Net income

$

19,406

$

17,732

$ 19,800 — $ 23,700

Income tax expense

2,312

2,576

3,200 — 3,900

Interest and other (income) expense,

net

(827

)

968

(700)

Depreciation and amortization

9,827

10,101

8,700

EBITDA

30,718

31,377

31,100 — 35,600

Work Opportunity Tax Credit processing

fees (7)

240

264

200

Acquisition/integration costs (3)

673

457

400

Other adjustments (4)

1,881

1,264

700

Adjusted EBITDA

$

33,512

$

33,362

$ 32,400 — $ 36,900

* Totals may not sum due to rounding

3. RECONCILIATION OF U.S. GAAP REVENUE

TO ORGANIC REVENUE

(Unaudited)

Total company

PeopleScout

Q2 2019

Q2 2018

Q2 2019

Q2 2018

13 Weeks Ended

13 Weeks Ended

13 Weeks Ended

13 Weeks Ended

(in thousands)

Jun 30, 2019

Jul 1, 2018

Jun 30, 2019

Jul 1, 2018

Revenue from services

$

588,594

$

614,301

$

65,803

$

58,002

Acquisition revenue excluded (3)

(10,324

)

—

(10,324

)

—

Organic revenue

$

578,270

$

614,301

$

55,479

$

58,002

4. RECONCILIATION OF NET CASH PROVIDED

BY OPERATING ACTIVITIES TO FREE CASH FLOWS

(Unaudited)

Q2 2019

2018

2017

2016

26 Weeks Ended

52 Weeks Ended

52 Weeks Ended

53 Weeks Ended

(in thousands)

Jun 30, 2019

Dec 30, 2018

Dec 31, 2017

Jan 1, 2017

Net cash provided by operating

activities

$

36,979

$

125,692

$

100,134

$

260,703

Capital expenditures

(11,064

)

(17,054

)

(21,958

)

(29,042

)

Free cash flows

$

25,915

$

108,638

$

78,176

$

231,661

(1)

Gain on the divestiture of our PlaneTechs

business sold mid-March 2018.

(2)

Amortization of intangible assets of

acquired businesses.

(3)

Acquisition/integration costs for the

acquisition of TMP Holding LTD ("TMP") completed on June 12, 2018.

Organic revenue excludes the first 12 months of operations of

TMP.

(4)

Other adjustments for the 13 weeks ended

June 30, 2019 include implementation costs for cloud-based systems

of $1.1 million, amortization of software as a service assets of

$0.5 million which is reported in selling, general and

administrative expense, a workforce reduction charge primarily

associated with employee reductions in the PeopleReady business of

$0.5 million, and reduced costs associated with the CEO transition

of $0.2 million. Other adjustments for the 13 weeks ended July 1,

2018 include implementation costs for cloud-based systems of $1.3

million. Other adjustments for the 13 weeks ended September 29,

2019 include estimated implementations costs for cloud-based

systems of $0.4 million and amortization of software as a service

assets of $0.3 million.

(5)

Total tax effect of each of the

adjustments to U.S. GAAP net income using the expected ongoing rate

of 14 percent for 2019 and 16 percent for 2018.

(6)

Adjustment of the effective income tax

rate to the expected ongoing rate of 14 percent for 2019 and 16

percent for 2018.

(7)

These third-party processing fees are

associated with generating the Work Opportunity Tax Credits, which

are designed to encourage employers to hire workers from certain

targeted groups with higher than average unemployment rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190729005608/en/

Derrek Gafford, Executive Vice President and CFO

253-680-8214

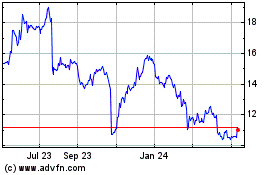

TrueBlue (NYSE:TBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

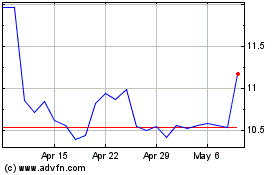

TrueBlue (NYSE:TBI)

Historical Stock Chart

From Apr 2023 to Apr 2024