Current Report Filing (8-k)

February 22 2021 - 4:11PM

Edgar (US Regulatory)

falseTronox Holdings plcX0263 TRESSER BLVD., SUITE 1100STAMFORD000153080400015308042021-02-222021-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2021

TRONOX HOLDINGS PLC

(Exact Name of Registrant as Specified in Its Charter)

|

England and Wales

|

001-35573

|

98-1467236

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

263 Tresser Boulevard, Suite 1100

Stamford, Connecticut 06901

|

|

Laporte Road, Stallingborough

Grimsby, North East Lincolnshire, DN40 2PR, UK

|

(Address of Principal Executive Offices) (Zip Code)

(203) 705-3800

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Ordinary shares, par value $0.01 per share

|

TROX

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Tronox Finance LLC, a wholly owned indirect subsidiary of Tronox Holdings plc (the “Company”), intends to refinance (the “Refinancing”) its (a) First

Lien Term Loan Credit Agreement, dated as of September 22, 2017 (as amended, the “Existing Term Loan Facility” ), with a new seven-year term loan facility (the “New Term Loan Facility”) in an aggregate initial principal amount of approximately

$1,300,000,000, and (b) Revolving Syndicated Facility Agreement, dated as of September 22, 2017 (as amended, the “Existing ABL Facility” and, together with the Exiting Term Loan Facility, the “Existing Facilities”), with a new five-year cash flow

revolving facility providing initial revolving commitments of approximately $350,000,000 (the “New Revolving Facility” and, together with the New Term Loan Facility, the “New Facilities”). The New Facilities are intended to receive the benefit of

(x) guarantees from substantially the same subsidiaries that guarantee the Existing Facilities, and (y) substantially the same collateral that secures the obligations under the Existing Facilities.

While the Refinancing is anticipated to occur in early March 2021, there can be no assurances that the New Facilities will be obtained or consummated. It

is intended that the net proceeds from the New Term Loan Facility plus cash on hand will be used to, among other things, pay down debt under the Existing Term Loan Facility and payoff all debt, and terminate all commitments, under the Existing ABL

Facility.

In addition, we intend to, in the near term, launch an unregistered

offering of senior unsecured notes (the “New Notes”). The New Notes will be offered pursuant to a separate offering memorandum and nothing contained in this filing shall constitute an offer to sell or a solicitation of an offer to buy our New

Notes. If successful, we plan to use the net proceeds from the offering of the New Notes to redeem all of our outstanding Senior Notes due 2026 (the “2026 Notes”) and to repay accrued interest and expenses. This statement is not a notice of

redemption with respect to the 2026 Notes.

We cannot give any assurance that these transactions will be consummated on the terms proposed, or at all.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

TRONOX HOLDINGS PLC

|

|

|

|

|

|

Date: February 22, 2021

|

By:

|

/s/ Jeffrey Neuman

|

|

|

|

|

Name:

|

Jeffrey Neuman

|

|

|

|

Title:

|

Senior Vice President, General Counsel and Secretary

|

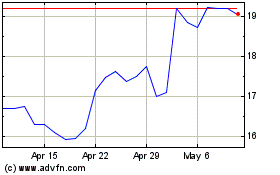

Tronox (NYSE:TROX)

Historical Stock Chart

From Mar 2024 to Apr 2024

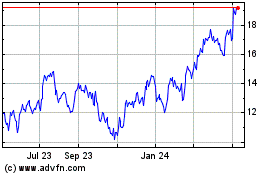

Tronox (NYSE:TROX)

Historical Stock Chart

From Apr 2023 to Apr 2024