UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities and Exchange Act of 1934

For August 16, 2019

Commission file number: 1-13.396

Transportadora de Gas del Sur S.A.

Don Bosco 3672, Fifth Floor

1206 Capital Federal

Argentina

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to the Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No

X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

![[TGS001.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS001.JPG)

TRANSPORTADORA DE GAS DEL SUR S.A.

FINANCIAL STATEMENTS AS OF JUNE 30, 2019

INDEX

01.

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE SIX-MONTH PERIOD ENDED JUNE 30, 2019

02.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

Statements of comprehensive income

Statements of financial position

Statements of changes in equity

Statements of cash flows

Notes to the condensed interim consolidated financial statements

03.

AUDITORS´LIMITED REVIEW REPORT

*

Information required under sect. No. 1 of Chapter III – Title IV of the National Securities Commission Standards:

|

|

|

Exhibit A. Property, Plant and Equipment

|

Note 13 (interim consolidated financial statements)

|

|

Exhibit B. Intangible Assets

|

Not applicable.

|

|

Exhibit C. Investment in other companies

|

Note 10 (interim consolidated financial statements)

|

|

Exhibit D. Other Investments

|

Note 9.c (interim consolidated financial statements)

|

|

Exhibit E. Allowances

|

Note 9.b (interim consolidated financial statements)

|

|

Exhibit F. Cost of Sales

|

Note 9.i (interim consolidated financial statements)

|

|

Exhibit G. Assets and Liabilities in foreign currency

|

Note 18 (interim consolidated financial statements)

|

|

Exhibit H. Information required under section 64, subsection i. B) of Law N 19,550 (Expenses Exhibit)

|

Note 9.j (interim consolidated financial statements)

|

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

TRANSPORTADORA DE GAS DEL SUR S.A.

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE SIX-MONTH PERIOD ENDED JUNE 30, 2019

(1)

The following discussion of the financial condition and results of operations of the Company should be read in conjunction with the Company's consolidated financial statements as of June 30, 2019 and December 31, 2018, and for the six-month periods ended June 30, 2019 and 2018. These condensed interim consolidated financial statements have been prepared in accordance with and complied with IAS 34 issued by the International Accounting Standards Board (“IASB”) adopted by the Comisión Nacional de Valores ("CNV") through the provisions of Title IV, Chapter I, Section I, Article 1 – B.1 of the Rules of the CNV ("New Text 2013" or "NT 2013"), with the exception of the application of IAS 29 – Financial Reporting in Hyperinflationary Economies, which was excluded from the CNV accounting framework.

The condensed interim consolidated financial statements of the Company for the six-month periods ended June 30, 2019 and 2018 have been subject to a jointly limited review performed by Price Waterhouse & Co. S.R.L. ("Price") and Pistrelli, Henry Martin and Asociados S.R.L. The Company’s consolidated financial statements for the six-month periods ended June 30, 2017, 2016 and 2015 have been subject to limited reviews performed by Price.

Effects of inflation

On December 3, 2018, Law No. 27,468 was enacted, sanctioned on November 15, 2018 by the National Argentine Congress. Among other measures, this law abolishes Decree N ° 1,269/02 —amended by Decree No. 664/2003 — through which the controlling entities (among them the CNV) had been instructed not to accept inflation adjusted financial statements. On December 28, 2018, the CNV issued Resolution No. 777/2018, by virtue of which it instructs companies that offer their shares to the public to apply the financial statements restatement method to a stable currency in line with the provisions of IAS 29 “Financial Reporting in Hyperinflationary Economies”.

In accordance with such standards, the restatement of financial statements was restarted as from January 1, 2018. In line with the restatement method, non-currency assets and liabilities are restated by an overall price index issued by the Argentine Federation of Professional Councils in Economic Sciences (“Argentine Federation”) since their acquisition date or last inflation adjustment (March 1, 2003).

Likewise, comparative information included in the financial statements has also been restated, but this fact has not modified the decisions based on the financial information corresponding to those fiscal years.

For further information see “Note 4. Significant Accounting Policies – d) Restatement to constant currency – Comparative Information” to the consolidated financial statements as of December 31, 2018.

()

Not covered by Auditor’s Report on Review of Interim Financial Information, except for items 4 , 5, 6 and 8.

1

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

1.

Results of operations

The following table presents a summary of the consolidated results of operations for the six-month period ended June 30, 2019 (“1S2019”) and June 30, 2018 (“1S2018”):

![[TGS004.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS004.GIF)

Activities of the Company in 1S2019 and 1S2018

Revenues

Revenues for 1S2019 increased by Ps. 734.1 million from the same period last year. This increase is mainly due to the increase in revenues of the Natural Gas Transportation and Liquids Production and Commercialization business segments.

Natural Gas Transportation

The Natural Gas Transportation business segment represented approximately 45.9% of TGS’ total net revenues during 1S2019 (46.8% for 1S2018). 82.9% of the total revenues correspond to firm contracted capacity services (78.7% for 1S2018).

Revenues from the Natural Gas Transportation segment during 1S2019 increased by Ps. 148.1 million compared to 1S2018. The positive variation was mainly due to the tariff increase authorized by ENARGAS in nominal values. This effect was partially offset by the lower volume transported by interruptible services.

On June 21, 2019, Resolution No. 336/2019 issued by the Secretary of Energy of the Ministry of Finance (“SE”), ordered the deferral of payment of 22% of the invoices issued between 1st July, 2019 and October 31, 2019 corresponding to residential natural gas users.

The deferrals will be recovered from the invoices issued from December 1, 2019 in five consecutive monthly installments in equal amount. The National Government will pay to the licensees and the natural gas producers an economic compensation for the financial cost involved in the deferral, as a subsidy.

As of the date of the issuance of these Financial Statements, ENARGAS has not issued the regulations applicable to TGS by which the calculation of the deferral in collections and the subsidy will be determined.

Production and Commercialization of Liquids

The Liquids Production and Commercialization business segment represented 49.3% of TGS´ total net revenues during 1S2019 (47.6% for 1S2018).

2

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

Revenues derived from the Liquid Production and Commercialization segment amounted to Ps. 9,983.05 million in 1S2019 (Ps 698.4 million higher than those recorded in 1S2018). The main cause of the increase in revenues corresponds to the effect of the increase in the foreign exchange rate on sales denominated in US dollars and the dispatched tons of propane and butane ("LPG") for export. These effects were partially offset by the drop in international reference prices and volumes of ethane sold, mainly due to higher levels of product taken by PBB Polisur S.R.L. (“PBB”) during 1S2018.

The volumes dispatched increased slightly by 1,743 short tons (0.3%) in 1S2019 comparing to 1S2018. The breakdown of the volumes dispatched by market and product is included below:

![[TGS006.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS006.GIF)

As of the date of the issuance of these Financial Statements, the National Government, through the Ministry of Finance, authorized increases in the price of products marketed under

Plan Hogar

program. The prices per ton of butane and propane, respectively, amounted to: (i) Ps. 9,154 and Ps. 9,042 between February 1, 2019 and May 10, 2019, (ii) to Ps. 9,327 and Ps. 9,213 between May 10, 2019 and June 30, 2019, and (iii) to Ps. 9,895 and Ps. 9,656 as from July 1, 2019.

In January 2019 the agreement regarding the commercialization of natural gasoline was successfully renewed. This agreement with Petrobras Global Trading B.V. will be extended for the period February 1, 2019 to January 31, 2020, and allows the Company to obtain improvements in the price.

Regarding ethane, as a result of an incident at the PBB plant, the daily volume of ethane decreased substantially since the end of June 2019. There is no certainty of when the client will regularize the demand for ethane. However, the Company's Management is evaluating all the necessary measures to minimize the negative impact on its revenues.

Other Services

Revenues derived from the Other Services segment decreased Ps. 112.4 million in 1S2019 compared to the same period of 2018. This drop was mainly due to lower operating and maintenance and construction services rendered during 1S2019. These effects were partially offset by the increase in the foreign exchange rate on sales denominated in US dollars.

Within the framework of Resolution No. 82/2019 issued by the Secretary of Energy, on April 8, 2019, the Company presented its proposal for the construction of a new gas pipeline and the expansion of the existing pipeline systems. The new gas pipeline would be built in two stages, the first of which will extend from the town of Tratayén in the Province of Neuquén to Salliqueló in the Province of Buenos Aires and the second from Salliqueló to San Nicolás, also in the Province of Buenos Aires.

This new natural gas pipeline, of more than 622 miles long, will aim to replace current NGL and gas oil imports thus allowing to exploit the resources developed by natural gas producers in the Vaca Muerta area.

The public bidding was launched by the Ministry of Energy Government on July 30, 2019. The opening will be held on September 12, 2019. As of the date of the issuance of these Financial Statements, the Company is analyzing its presentation.

3

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

Additionally, on April 30, 2019, assembly works of the above ground installations located in the connection of the Vaca Muerta Gas Pipeline to Neuba II and the partial enablement of the conditioning plant in Tratayén were concluded. Thus, the first section of this project was enabled, which will provide from May 2019 revenues derived from natural gas transportation firm contracts equivalent to 0.8 MMm

3

/d.

Cost of sales and administrative and selling expenses

Cost of sales, administrative and selling expenses corresponding to 1S2019 increased by Ps. 1,140.9 million, 11.4% compared to 1S2018. This variation is mainly due to the increase: (i) in the cost of natural gas processed in the Cerri Complex, mainly as a result of the higher natural gas prices, measured in Argentine pesos, purchased as a shrinkage gas ("RTP"), (ii) taxes, fees and accrued contributions, mainly due to the effect of withholding taxes on exports and the turnover tax, (iii) on expenses for repair and maintenance of property, plant and equipment incurred primarily for the operation of the natural gas transportation system; and (iv) labor costs.

The following table shows the main components of cost of sales and administrative and selling expenses and its main variations for 1S2019 and 1S2018:

![[TGS008.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS008.GIF)

Other operating Results

The other operating results recorded a positive variation of Ps. 789.4 million mainly as a result of the recognition in May 2018 of the adverse award of the Arbitration held with Pan American Energy S.L. Suc. Arg. and Pan American Sur S.A. This effect was partially offset by the higher negative charge for contingency provisions made in 1S2019.

Net financial results

In 1S2019, the financial results showed a positive variation of Ps. 3,179.8 million with respect to 1S2018. The breakdown of net financial results is as follows:

![[TGS010.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS010.GIF)

4

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

This variation is mainly due to the positive effect of the foreign exchange gain of Ps. 2,435.4 million due to the lower devaluation of the Argentine peso against the US dollar over the net passive position in foreign currency and the positive impact of RECPAM.

The selling exchange rate for the peso ended on June 30, 2019 in a value of Ps. 42.463 per US dollar; representing an increase of 12.6% (or Ps. 4.76 per US dollar) respect to the exchange rate in place at the year ended 2018. As of June 30, 2018, the exchange rate had suffered an increase of 54.7% (or Ps 10.20 per US dollar) from the listed price at the end of the year 2017.

The aforementioned effects were partially offset by the lower interest generated by assets of Ps. 820.8 million mainly as a result of lower capital invested during 2S2019.

Income tax expense

For 1S2019, TGS reported a loss for income tax of Ps. 2,874.0 million, compared to the loss reported in 1S2018 for Ps. 2,108.8 million. This positive variation is mainly due to lower taxable income before taxes and the effect of the impact on the deferred tax charge due to the application of the adjustment of inflation for tax purposes in accordance with the provisions of Law No. 27,468.

2.

Liquidity

The Company’s primary sources and application of funds during 1S2019 and 1S2018 are shown in the table below:

![[TGS012.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS012.GIF)

The positive net change in cash and cash equivalents for 1S2019 was Ps. 10,789.5 million lower than that generated in 1S2018.

Net cash flow provided by operating activities recorded a positive variation of Ps. 1,057.2 million,

derived mainly from the increase in operating income and the positive variation in working capital. These effects were partially offset by the higher payment of income tax and interests.

Net cash flow used in investment activities showed an increase of Ps. 6,198.9 million. This was due to the greater investments in capital expenditures made in order to conclude the Five-Year Investment Plan committed in accordance with the provisions of the RTI and the development of the midstream business in Vaca Muerta project. On the other hand, during 1S2019 there was an increase in funds applied to the acquisition of financial assets not considered cash and cash equivalents.

During 1S2019, net cash flows used in financing activities, showed a negative variation of Ps. 16,947.0 million compared to 1S2018, mainly due to the cash inflows in the 1S2018 corresponding to the issuance of Notes for US$ 500 million which were applied for the pre-cancellation of existing financial debt and the acquisition of capital expenditures. During 1S2019 the Company paid dividends of Ps. 7,553.2 million provided by the meetings of Shareholders and Board of Directors held on April 11, 2019.

5

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

3.

Second quarter 2019 (“2Q2019”) vs Second quarter 2018 (“2Q2018”)

The following table presents a summary of the consolidated results of operations for 2Q2019 and 2Q2018:

![[TGS014.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS014.GIF)

During 2Q2019, total income amounted to Ps. 4,053.8 million, compared to Ps. 1,370.7 million for 2Q2018. Total revenues decreased Ps. 798.2 million in 2Q2019 compared to 2Q2018.

Revenues from the Natural Gas Transportation segment in 2Q2019 decreased by Ps. 427.5 million, compared to 2Q2018. This negative variation is mainly due to the negative effect of the inflation restatement in accordance with the provisions of IAS 29 - “Financial Information in Hyperinflationary Economies” (“IAS 29”) of revenues that could not be reversed by the tariff increases granted in the framework of the RTI process. These increases, in nominal value, were the following:

• 19.7% according to Resolution No. 265/2018 (“Resolution 265”) starting October 1, 2018, and,

• 26.0% according to Resolution No. 192/2019 (“Resolution 192”) starting April 1, 2019.

Liquids revenues decreased by Ps. 313.1 million year-over-year, amounting to Ps. 4,665.6 million in 2Q2019, mainly as a result of the impact of the increase in the foreign exchange rate on sales denominated in US dollars. This effect was partially offset by the lower volumes dispatched and the negative variation in the international reference prices.

Additionally, total volumes dispatched decreased by 8.6%, or 25,968 short tons in 2Q2019, compared to 2Q2018, which are mainly related to lower sales of ethane. The breakdown of volumes dispatched by market and product is included below:

![[TGS016.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS016.GIF)

6

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

Other services revenues decreased by Ps. 57.6 million in 2Q2019 compared to 2Q2018, mainly explained by lower gas pipeline construction services in the province of Santa Fe provided through the UT TGS-SACDE and operation and maintenance of natural gas pipelines and compressor plants. These effects were partially offset by the effect of the increase in the foreign exchange rate on sales denominated in US dollars.

Cost of sales and administrative and selling expenses for 2Q2019 amounted to Ps. 5,372.7 million (with 5,520.8 million in 2Q2018), which represented a fall of Ps. 148.1 million. This variation is mainly due to the decrease: (i) in the costs of natural gas processed in the Cerri Complex, (ii) in the fees and services paid to third parties and (iii) the lower cost of services provided to third parties. These effects were partially offset by the increase in tax on exports, labor costs and depreciation of property, plant and equipment elements.

The following table shows the main components of operating costs, administrative and marketing expenses and their main variations for 2Q2019 and 2Q2018:

![[TGS018.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS018.GIF)

The other negative operating results recorded in 2Q2019 amounted to Ps. 26.6 million, compared to Ps. 839.6 million reported in 2Q2018. This variation was due to the negative result recorded in 2Q2018 as a result of the adverse award related to the arbitration mentioned above.

In 2Q2019, financial results experienced a positive variation of Ps. 3,696.4 million compared to 2Q2018. This variation is mainly due to the impact of: (i) the positive foreign exchange rate difference, (ii) the gain on monetary position, (iii) the lower interest generated by financial liabilities.

These effects were partially offset by the lower interest generated by assets.

4.

Consolidated Financial Position Summary

Summary of the consolidated financial position information as of June 30, 2019 and December 31, 2018:

![[TGS020.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS020.GIF)

7

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

5.

Consolidated Comprehensive Income Summary

Summary of the consolidated comprehensive income information for the 1S2019 y 1S2018:

![[TGS022.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS022.GIF)

6.

Consolidated Cash Flow Summary

Summary of the consolidated cash flow information for 1S2019 and 1S2018:

![[TGS024.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS024.GIF)

7.

Statystical Data (Physical units)

![[TGS026.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS026.GIF)

8

8.

Comparative Ratios

![[TGS028.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS028.GIF)

9.

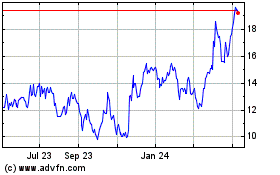

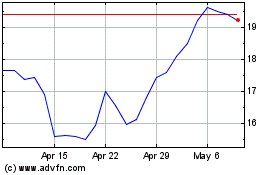

TGS share market value in Buenos Aires Stock Exchange at closing of last business day (in Argentine pesos per share)

|

|

|

|

|

|

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|

January

|

125.85

|

90.05

|

32.40

|

17.00

|

7.60

|

|

February

|

114.50

|

83.50

|

36.80

|

21.00

|

9.10

|

|

March

|

114.10

|

81.75

|

43.90

|

17.30

|

12.70

|

|

April

|

90.40

|

78.05

|

46.30

|

18.00

|

12.00

|

|

May

|

116.35

|

84.30

|

53.30

|

18.00

|

10.80

|

|

June

|

124.50

|

69.15

|

56.40

|

19.90

|

11.40

|

|

July

|

|

90.95

|

54.00

|

19.55

|

11.10

|

|

August

|

|

98.40

|

61.30

|

18.25

|

11.65

|

|

September

|

|

120.05

|

72.00

|

20.80

|

10.90

|

|

October

|

|

103.95

|

76.00

|

22.40

|

16.70

|

|

November

|

|

117.00

|

73.85

|

25.60

|

17.70

|

|

December

|

|

111.00

|

83.00

|

29.60

|

17.05

|

10.

Outlook

The end of the RTI process constitutes a fundamental milestone in the tariff recomposition of the Company as it generates a certainty framework for the Natural Gas Transportation business that will allow TGS to accompany the energy development of Argentina.

For this process, the Five-Year Investment Plan is crucial as it will ensure that the pipeline system responds to the needs derived from the development of the country's gas reserves. TGS will focus on management to achieve compliance and maintenance of the five-year plan mentioned above. This will continue enabling us to develop a reliable and safe Natural Gas Transportation business, which has characterized this Company in its 27 years of existence.

In the Liquids Production and Commercialization segment, the strategy will be aimed at optimizing the production mix that allows prioritizing those products and distribution channels that provide higher margins. For this, it will be very important to be efficient in the management of our assets, ensuring a coordinated, safe and efficient operation.

In the "Other Services" segment, in an even more challenging framework, the focus will be on developing attractive businesses that allow us to anticipate the needs of our clients and industries, showing the excellence with which TGS provides services and satisfies his needs. The Argentina's energy development requires a great effort from all stakeholders and TGS gets ready to have a leading role.

In financial terms, TGS plans to access financing to carry out the implementation of the demanding Five-Year Investment Plan and investment projects of non-regulated businesses. The objective of the Company is to maintain an optimal capital structure in accordance with its investment needs, at a reasonable financing cost, in order to maximize profitability for shareholders.

As regards their daily operations, TGS will remain committed to continuous improvement of each of its processes to optimize the use of the resources and to reduce operating costs. To this end, the Company will carry out actions aimed at the reduction of cost without affecting

9

![[TGS002.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS002.JPG)

the reliability and availability of the pipeline system. We will continue with the implementation of various actions, such as the standardization and systematization of risk management in pipelines, compressor stations and processing facilities. Finally, we will deepen training initiatives for the staff for technical and management training resources.

Autonomous City of Buenos Aires, August 7, 2019

Luis Alberto Fallo

Chairman

10

![[TGS029.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS029.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

FOR THE THREE AND SIX-MONTH PERIODS ENDED JUNE 30, 2019 AND 2018

(Stated in thousands of pesos as described in Note 3 except for basic and diluted earnings per share)

![[TGS031.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS031.GIF)

![[TGS033.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS033.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

1

![[TGS034.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS034.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF JUNE 30, 2019 AND DECEMBER 31, 2018

(Stated in thousands of pesos as described in Note 3)

![[TGS036.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS036.GIF)

![[TGS038.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS038.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

2

![[TGS039.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS039.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE SIX-MONTH PERIODS ENDED JUNE 30, 2019 AND 2018

(Stated in thousands of pesos as described in Note 3)

![[TGS041.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS041.GIF)

![[TGS043.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS043.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

![[TGS044.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS044.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX-MONTH PERIODS ENDED JUNE 30, 2019 AND 2018

(Stated in thousands of pesos as described in Note 3)

![[TGS046.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS046.GIF) _____________________________________________________________________________________________________

_____________________________________________________________________________________________________

![[TGS048.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS048.GIF)

Luis Alberto Fallo

Chairman of the Board of Directors

4

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

1.

GENERAL INFORMATION

Business Overview

Transportadora de Gas del Sur S.A. (“TGS” or the “Company”) is one of the companies created as a result of the privatization of Gas del Estado S.E. (“GdE”). TGS commenced operations on December 29, 1992 and it is mainly engaged in the Transportation of Natural Gas, and Production and Commercialization of natural gas Liquids (“Liquids”). TGS’s pipeline system connects major natural gas fields in southern and western Argentina with natural gas distributors and industries in those areas and in the greater Buenos Aires area. The natural gas transportation license to operate this system was exclusively granted to TGS for a period of thirty-five years (“the License”). TGS is entitled to a one-time extension of ten years provided that it has essentially met the obligations imposed by the License and by the

Ente Nacional Regulador del Gas

(National Gas Regulatory Body or “ENARGAS”). The General Cerri Gas Processing Complex (the “Cerri Complex”), where TGS processes natural gas to obtain liquids, was transferred from GdE along with the gas transmission assets. TGS also provides midstream services, which mainly consist of gas treatment, removal of impurities from the natural gas stream, gas compression, wellhead gas gathering and pipeline construction, operation and maintenance services. In addition, telecommunications services are provided through the subsidiary Telcosur S.A. (“Telcosur”). These services consist of data transmission services through a network of terrestrial and digital radio relay.

Subsequently, the corporate purpose of the Company was modified in order to incorporate the development of complementary activities, incidental, linked and / or derived from natural gas transportation, such as the generation and commercialization of electric power and the provision of other services for the hydrocarbon sector in general.

Major Shareholders

TGS’s controlling shareholder is Compañía de Inversiones de Energía S.A. (“CIESA”), which holds 51% of the common stock. Local and foreign investors hold the remaining ownership of TGS’s common stock. CIESA is under co-control of: (i) Pampa Energía S.A. (“Pampa Energía”), which holds 10% of CIESA’s common stock, (ii) CIESA Trust (whose trustee is Pampa Energía and whose beneficiary is PHA S.A.U. (formerly called Petrobras Hispano Argentina S.A., a company that is currently in the process of transferring the registered office from abroad to the Autonomous City of Buenos Aires, a procedure that is pending registration), a wholly owned subsidiary of by Pampa Energía) (the "Trust"), who has a trust shareholding of 40% of the share capital of CIESA) and (iii) Grupo Inversor Petroquímica S.L. (member of GIP Group, headed by Sielecki´s family; “GIP”), and PCT L.L.C. ("PCT"), which directly and together with WST S.A. (Member of Werthein Group, "WST") indirectly through PEPCA S.A. ("PEPCA"), hold a 50% of the shareholding in CIESA in the following shares: GIP 27.10%, WST 4.58% and PCT 18.32%.

The current shareholding structure of CIESA is the result of the exercise of the exchange contemplated in the transaction entered into between the current shareholders of the Company. This transaction was duly approved by ENARGAS on August 9, 2016 and December 29, 2016, by virtue of the different stages carried out until its final completion.

On the other hand, by virtue of the acquisition made by Pampa Energía to an affiliate of Petróleo Brasileiro S.A., 100% of the share capital of Petrobras Participaciones S.L., controlling company of Petrobras Argentina S.A. ("Petrobras") and consequently the indirect control of Petrobras Hispano Argentina SA, on February 16, 2017, the Extraordinary Shareholders' Meetings of Pampa Energía and Petrobras approved the Prior Merger Commitment between Pampa Energía, as the absorbing company and Petrobras as absorbed company and the dissolution without liquidation of Petrobras.

5

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

The merger was effective as from November 1, 2016, the date on which the transfer to the acquiring company of all the rights and obligations, assets and liabilities of the absorbed company takes effect.

On April 26, 2018, the CNV notified to its board of directors the approval of the merger, which was registered in the Public Registry on May 2, 2018.

2.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

TGS presents its condensed interim consolidated financial statements for the six-month periods ended June 30, 2019 and 2018 in accordance with Title IV, Chapter I, Section I, article 1.b.1 of CNV´s regulations requiring the use of International Accounting Standard 34 (“IAS 34”) issued by the International Accounting Standards Board (“IASB”) adopted by the CNV through NT 2013 (the “Rules”).

In these condensed interim consolidated financial statements, TGS and its consolidated subsidiaries (Telcosur and CTG Energía S.A.U. (“CTG”)), are jointly referred to as “TGS” or “the Company”.

These interim condensed consolidated financial statements, which were approved and authorized for issuance by the Board of Directors on August 7, 2019, have not been subject to an audit and do not include all the information and disclosures required for annual financial statements, and should be read in conjunction with TGS’ annual financial statements as of December 31, 2018, issued on March 7, 2019.

3.

BASIS OF PRESENTATION

The CNV, in Title IV, Chapter III, Article 1 of the Rules has provided that listed companies must submit their condensed consolidated financial statements by applying Technical Resolution No. 26 of the Argentine Federation of Professional Councils of Economic Sciences ("FACPCE"), which adopts the International Financial Reporting Standards ("IFRS") issued by the IASB, its amendments and circulars for the adoption of IFRS that the FACPCE dictates in accordance with the provisions of that Technical Resolution.

The Company has prepared these condensed interim consolidated financial statements in accordance with the accounting framework established by the CNV, which is based on the application of IFRS, particularly IAS 34.

Detailed data reflecting subsidiary control as of June 30, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

% of

shareholding

|

|

|

|

Company

|

Incorporation country

|

and votes

|

Closing date

|

Main activity

|

|

|

|

|

|

|

|

Telcosur

|

Argentina

|

99.98

|

December 31

|

Telecommunication Services

|

|

CTG Energía S.A.U.

|

Argentina

|

100.00

|

December 31

|

Electrical power related services

|

For consolidation purposes for the six-month periods ended June 30, 2019 and 2018, Telcosur's financial statements have been used at those dates. The Company controlled CTG Energía S.A.U. does not record operations or significant assets and liabilities as of June 30, 2019 and 2018.

The interim condensed consolidated financial statements for the six-month periods ended June 30, 2019 and 2018 have not been audited. The Management of the Company

6

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

estimates that they include all the necessary adjustments to reasonably present the results of each period in accordance with the accounting framework applied. The results of the six-month periods ended June 30, 2019 and 2018, do not necessarily reflect the proportion of the results of the Company for the full fiscal year.

Functional and presentation currency

The condensed interim consolidated financial statements are stated in thousands of Argentine pesos (“Ps.” or “pesos”), the functional currency of the Company and its subsidiaries

.

Restatement to current currency

The interim condensed consolidated financial statements as of June 30, 2019, including comparative figures, have been restated to take into account changes in the general purchasing power of the Company's functional currency in accordance with IAS 29 "Financial information in hyperinflationary economies”. ("NIC 29") and in General Resolution No. 777/2018 of the CNV. As a result, the financial statements are disclosed in the current unit of measurement at the end of the reporting period.

The variation in the consumer price index (“CPI”) for the restatement of these interim condensed consolidated financial statements was estimated at 22.26% and 16.03% for the six-month periods ended June 30, 2019 and 2018, respectively.

4.

SIGNIFICANT ACCOUNTING POLICIES

The accounting policies applied to these condensed interim consolidated financial statements are consistent with those used in the financial statements for the last financial year prepared under IFRS, which ended on December 31, 2018, except for what it is mentioned below.

Effective January 1, 2019, the Company has begun to apply the provisions of the following rules:

IFRS 16 – “Leases”

The Company adopted IFRS 16 retrospectively since January 1, 2019.

After the analysis performed by Management, no significant adjustments were made to the accumulated results or significant reclassifications were made.

Practical expedients applied

In applying IFRS 16 for the first time, the Company has used the following practical expedients permitted by the standard:

·

The accounting for operating leases with a remaining lease term of less than 12 months as at January 1, 2019 as short-term leases.

·

The Company has elected not to reassess whether a contract is, or contains a lease at the date of initial application. Instead, for contracts entered into before the transition date (January 1, 2019), the Company relied on its assessment made applying IAS 17 – Leases and IFRIC 4 – Determining whether an arrangement contains a lease.

·

This standard is applicable since the transition date for those leases classified as low value contracts.

7

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

Accounting policies applied

Until the year ended December 31, 2018, by application of IAS 17 and IFRIC 4, leases of property, plant and equipment were classified as financial leases (only if substantially all the risks and benefits of ownership of leased asset were assumed by the Company) or operating. Payments made under operating leases were charged to the Statement of Comprehensive Income in a straight line over the period of the lease.

As from January 1, 2019, leases are recognized as a right of use asset and a corresponding liability at the date at which the leased asset is available for use by the Company. Each lease payment is allocated between the liability and finance cost. The finance cost is charged to profit or loss over the lease period so as to produce a constant periodic interest rate on the remaining balance of the liability for each period.

Assets and liabilities from a lease are initially measured on a present value basis. Lease liabilities include the net present value of the following lease payments:

a)

Fixed payments less any lease incentive receivable;

b)

Variable lease payments;

c)

Amounts expected to be payable by the lessee under residual value guarantees;

d)

The exercise price of a purchase option; and

e)

Payments of penalties for terminating the lease.

The lease payments are discounted using the interest rate implicit in the lease. If that rate cannot be determined, the Company's incremental borrowing rate is used, which is the rate that TGS would have to pay to borrow the funds necessary to obtain an asset of similar value in a similar economic environment.

Right-of-use assets are measured at cost comprising the following:

a)

The amount of the initial measurement of lease liability.

b)

Any lease payment made at or before the commencement date less any lease incentives received.

c)

Any initial direct cost, and

d)

Restoration costs.

Leased assets, which are subject to the risk of impairment, are depreciated in a straight line over the shorter of the asset’s useful life and the lease term.

Payments associated with short-term leases and leases of low-value assets are recognized on a straight-line base as an expense in profit or loss. Short-term leases are leases with a lease term of 12 months or less. Low-value assets comprise IT-equipment, vehicles, small items of office furniture and rented offices.

The Company recognized right-of-use assets under the line item “Property, plant and equipment” of its balance sheet (see Note 13). The corresponding liability has been recognized under Loans (see Note 14).

In addition to the aforementioned, on January 1, 2019, the following standards and interpretations, described in the consolidated financial statements as of December 31, 2018, were adopted without having a significant impact on the Company's financial statements:

·

IFRIC Interpretation 23 “Uncertainty over income tax treatments.”

·

Annual improvements to IFRS Standards 2015 – 2017 Cycle.

·

Amendments to IFRS 9 – Financial instruments.

8

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

5.

FINANCIAL RISK MANAGEMENT

The Company’s activities and the market in which it operates expose it to a series of financial risks: market risk (including foreign exchange risk, interest rate risk, and commodity price risk), credit risk and liquidity risk.

There have been no significant changes since the last annual financial statements in risk management policies.

6.

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of the condensed interim consolidated financial statements in accordance with generally accepted accounting principles requires management to make accounting estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, as well as the reported amounts of revenues and expenses during the reporting period. These estimates require management to make difficult, subjective or complex judgments and estimates about matters that are inherently uncertain. Management bases its estimates on various factors, including past trends, expectation of future events regarding the outcome of events and results and other assumptions that it believes are reasonable.

In the preparation of these condensed interim financial statements, the key assumptions used to make such estimates are the same as those applied in the consolidated financial statements for the year ended December 31, 2018.

7.

SUPPLEMENTAL CASH FLOW INFORMATION

For purposes of the condensed interim consolidated statement of cash flows, the Company considers all highly liquid temporary investments with an original maturity of three months or less at the time of purchase to be cash equivalents. The cash flow statement has been prepared using the indirect method, which requires a series of adjustments to reconcile net income for the period to net cash flows from operating activities.

Non-cash investing and financing activities for the six-month periods ended June 30, 2019 and 2018 are presented below:

![[TGS051.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS051.GIF)

Note 14 includes a reconciliation between the opening and closing balance of the financial liabilities arising from financing activities.

9

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

8.

CONSOLIDATED BUSINESS SEGMENT INFORMATION

IFRS 8 “Operating Segments” requires an entity to report financial and descriptive information about its reportable segments, which are operating segments or aggregations of operating segments that meet specified criteria. Operating segments are components of an entity about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”) in deciding how to allocate resources and in assessing performance. The Company’s CODM is the Board of Directors.

The Company analyzes its businesses into four segments: (i) Natural Gas Transportation Services, subject to ENARGAS regulations, (ii) Liquids Production and Commercialization, (iii) Other Services including midstream, among others, and (iv) Telecommunications. These last three business segments are not regulated by ENARGAS. Production and Commercialization of Liquids segment is regulated by the Secretary of Energy.

Detailed information on each business segment for the six-month periods ended June 30, 2019 and 2018 is disclosed below:

![[TGS053.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS053.GIF)

![[TGS055.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS055.GIF)

10

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

9.

SUMMARY OF SIGNIFICANT STATEMENT OF FINANCIAL POSITION AND STATEMENT OF COMPREHENSIVE INCOME ITEMS

a)

Other receivables

![[TGS057.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS057.GIF)

b)

Trade receivables

![[TGS059.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS059.GIF)

The movement of the allowance for doubtful accounts is as follows:

![[TGS061.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS061.GIF)

c)

Cash and cash equivalents

![[TGS063.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS063.GIF)

11

![[TGS049.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS049.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

_____________________________________________________________________________________________________

d)

Contract Liabilities

![[TGS065.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS065.GIF)

e)

Other payables

![[TGS067.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS067.GIF)

f)

Taxes payables

![[TGS069.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS069.GIF)

g)

Trade payables

![[TGS071.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS071.GIF)

h)

Revenues

![[TGS073.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS073.GIF)

i)

Cost of sales

![[TGS075.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS075.GIF)

12

![[TGS076.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS076.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3)

___________________________________________________________________________________________________________________________________________________________

![[TGS078.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS078.GIF)

j)

Expenses by nature – Information required under art. 64 paragraph I, clause B) Commercial Companies Law for the six-month periods ended June 30, 2019 and 2018

![[TGS080.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS080.GIF)

13

![[TGS081.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS081.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

k)

Net financial results

![[TGS083.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS083.GIF)

l)

Other operating results, net

![[TGS085.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS085.GIF)

m)

Other financial assets at amortized cost

![[TGS087.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS087.GIF)

n)

Payroll and social security taxes payable

![[TGS089.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS089.GIF)

14

![[TGS081.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS081.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

10.

INVESTMENTS IN ASSOCIATES

![[TGS091.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS091.GIF)

11.

JOINT ARRANGEMENTS

The breakdown of the amounts included in the statements of financial position related to the Company's participation in the UT as of June 30, 2019 and December 31, 2018, and its results for the six-month periods as of June 30, 2019 and 2018 is the following:

![[TGS093.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS093.GIF)

12.

SHARE OF LOSS FROM ASSOCIATES

![[TGS095.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS095.GIF)

15

![[TGS096.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS096.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

___________________________________________________________________________________________________________________________________________________________

![[TGS098.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS098.GIF)

13.

PROPERTY, PLANT AND EQUIPMENT

![[TGS100.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS100.GIF)

16

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

14.

LOANS

Short-term and long-term loans as of June 30, 2019 and December 31, 2018 comprise the following:

![[TGS103.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS103.GIF)

Loans are totally denominated in US dollars.

The activity of the loans as of June 30, 2019 and 2018 is the following:

![[TGS105.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS105.GIF)

The following are the maturities of the financial leasing in force as of June 30, 2019 (not including issuing costs):

![[TGS107.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS107.GIF)

15.

INCOME TAX AND DEFERRED TAX

According to provisions of Law No. 27,468, beginning on or after January 1, 2018 the adjustment for inflation that is obtained by application of the particular rules contained in the income tax law may be deducted or incorporated into the tax result of the fiscal year that is settled. This adjustment will proceed only if the percentage variation in the Consumer Price Index ("CPI") will accumulate (a) in the 36 months prior to the close of the fiscal year that is settled, a percentage higher than 100%, or (b) with respect to the first, second and third fiscal year that starts from its effective date, an accumulated variation of the CPI that exceeds 55%, 30% or 15% of said 100%, respectively. For the fiscal year ending on December 31, 2019, the Company estimates that, according to current projections, the CPI will accumulate an increase higher than the one stipulated by current

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

legislation. Thus, according to the provisions of IAS 12 "Income Taxes", the Company has measured the income tax charge for the six-month period ended June 30, 2019, considering the application of the tax inflation adjustment.

The reconciliation between the tax considered for tax purposes and the income tax expense charged to the statement of comprehensive income in the three and six-month periods ended June 30, 2019 and 2018 is as follows:

![[TGS109.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS109.GIF)

The composition of the net deferred tax liabilities is as follows:

![[TGS111.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS111.GIF)

16.

PROVISIONS

![[TGS113.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS113.GIF)

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

17.

FINANCIAL INSTRUMENTS BY CATEGORY AND HIERARCHY

1.1 Financial instrument categories

There have been no significant changes regarding the accounting policies for the categorization of financial instruments to the policies disclosed in the financial statements as of December 31, 2018.

The categories of financial assets and liabilities as of June 30, 2019 and December 31, 2018 are as follows:

![[TGS115.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS115.GIF)

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

![[TGS117.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS117.GIF)

1.2

Fair value measurement hierarchy and estimates

According to IFRS 13, the fair value hierarchy introduces three levels of inputs based on the lowest level of input significant to the overall fair value. These levels are:

·

Level 1: includes financial assets and liabilities whose fair values are estimated using quoted prices (unadjusted) in active markets for identical assets and liabilities. The instruments included in this level primarily include balances in mutual funds and public or private bonds listed on the

Bolsas y Mercados Argentinos S.A.

(“BYMA”). The mutual funds mainly made their placements in letters issued by the Central Bank of the Argentine Republic.

·

Level 2: includes financial assets and liabilities whose fair value is estimated using different assumptions quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (for example, derived from prices). Within this level, the Company includes those derivate financial instruments for which it was not able to find an active market.

·

Level 3: includes financial instruments for which the assumptions used in estimating fair value are not based on observable market information.

The table below shows different assets at their fair value classified by hierarchy as of June 30, 2019:

![[TGS119.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS119.GIF)

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

The fair value amount of the financial assets is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

As of June 30, 2019, the carrying amount of certain financial instruments used by the Company including cash, cash equivalents, other investments, receivables, payables and short-term loans are representative of fair value because of the short-term nature of these instruments.

The estimated fair value of Non-current loans is estimated based on quoted market prices. The following table reflects the carrying amount and estimated fair value of the 2018 Notes at June 30, 2019, based on their quoted market price:

![[TGS121.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS121.GIF)

18. ASSETS AND LIABILITIES IN FOREIGN CURRENCY

![[TGS123.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS123.GIF)

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

19. REGULATORY FRAMEWORK

The main regulatory issues are described in Note 17 to the annual consolidated financial statements. The update information for the six-month period ended June 30, 2019 is described below:

General framework of the regulated segment

Semi-annual tariff increase

On March 29, 2019, ENARGAS issued Resolution No. 192/2019 ("Resolution 192") that approved, effective as of April 1, 2019, a 26% increase in the tariff chart applicable to the public service of natural gas transportation by TGS in force as of March 31, 2019.

In accordance with current regulations, ENARGAS has considered the evolution of the wholesale price index update index ("IPIM") between the months of August 2018 and February 2019, in order to define the semi-annual adjustments applicable to TGS tariffs.

This increase was granted within the framework of the biannual tariff adjustment of the natural gas transportation service in accordance with the provisions of the RTI process.

Deferral of collections

On June 21, 2019, the Secretary of Energy issued Resolution N° 336/2019, which ordered the deferral of payment of 22% of the invoices issued between July 1, 2019 and October 31, 2019 corresponding to residential natural gas users.

The deferrals will be recovered from the invoices issued from December 1, 2019 in five consecutive monthly installments in equal amount. As compensation, the National Government will pay the licensees, as a subsidy, an economic compensation for the financial cost involved in the deferral.

At the date of issuance of these condensed interim consolidated financial statements, ENARGAS did not issue the regulations by means of which the calculation and payment methodology of the economic compensation mentioned above will proceed.

20. COMMON STOCK AND DIVIDENDS

a)

Common stock structure and shares’ public offer

As of June 30, 2019, TGS’ common stock was as follows:

|

|

|

|

|

|

Amount of common stock, subscribed, issued and authorized for public offer

|

|

Common Shares Class

(Face value $ 1, 1 vote)

|

Outstanding shares

|

Treasury Shares

|

Common Stock

|

|

Class “A”

|

405,192,594

|

-

|

405,192,594

|

|

Class “B”

|

368,900,349

|

20,402,340

|

389,302,689

|

|

Total

|

774,092,943

|

20,402,340

|

794,495,283

|

TGS's shares are traded on the

BYMA

and under the form of the ADSs (registered with the Securities and Exchange Commission (“SEC”) and representing 5 shares each) on the New York Stock Exchange.

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

b)

Acquisition of treasury shares

On March 27, 2019, the Board of Directors of the Company approved a third Program for the acquisition of treasury shares in the markets where TGS makes a public offering (the "Share Repurchase Program"). Considering the solid cash and investment position of the Company, this program was approved due to the distortion evidenced by the Company's economic value, measured by its current business and those derived from projects under development, and the price of the quotation of their shares in the market.

Considering the realized and liquid gains that arose from the financial statements for the year ended December 31, 2018, the Board of Directors determined the maximum amount to be invested in Ps. 1,500 million (at the moment of its creation).

As of June 30, 2019, the Company has 20,402,340 treasury shares, representing 2.57% of the total share capital. The acquisition cost of the treasury shares in the market amounted to Ps. 2,407,995 which, in accordance with the provisions of Title IV, Chapter III, Article 3.11.c of the Rules, restricts the amount of the realized and liquid gains mentioned above that the Company may distribute.

c)

Distribution of dividends

During the six-month period ended June 30, 2019, the Company paid dividends in cash for Ps. 7,553,236 (Ps. 9.6767 per share) which were authorized by the General Ordinary Shareholders Meeting and the Board of Directors of the Company at its meetings held on April 11, 2019.

d)

Restrictions on distribution of retained earnings

Pursuant to the General Companies Act and CNV Rules, we are required to allocate a legal reserve (“Legal Reserve”) equal to at least 5% of each year’s net income (as long as there are no losses for prior fiscal years pending to be absorbed) until the aggregate amount of such reserve equals 20% of the sum of (i) “common stock nominal value” plus (ii) “inflation adjustment to common stock,” as shown in our consolidated statement of changes in equity. If there are any losses pending to be absorbed from prior fiscal years, such 5% should be calculated on any excess of the net income over such losses, if any. Dividends may not be paid if the legal reserve has been impaired, nor until it has been fully replenished. The Legal Reserve is not available for distribution as a dividend.

The Ordinary General Meeting of Shareholders held on April 11, 2019, which decided to create the “Reserve for capital expenditures, acquisition of treasury shares and/or dividends” and delegated to the Board of Directors of the Company the decision of the distribution of dividends, provided as maximum limit for such distribution up to 80% of said reserve restated according to the General Resolution N° 777/2018 of the CNV.

Finally, and as mentioned in subsection b of this note, the amounts subject to distribution are restricted up to the acquisition cost of treasury shares.

21. LEGAL CLAIMS AND OTHER MATTERS

The main changes occurring between January 1, 2019 and the date of issuance of these condensed interim consolidated financial statements are as follows. For further information regarding the claims and legal matters of the Company, see Note 20 “Legal Claims and Other Matters” to the consolidated financial statements as of December 31, 2018, issued on March 7, 2019.

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

a)

Action for annulment of ENARGAS Resolutions No. I-1,982/11 and No. I-1,991/11 (the “Resolutions”)

On March 26, 2019, TGS was notified of the judgment of first instance issued by the Federal Contentious-Administrative Court No. 1 in its claim initiated by which TGS requested the unconstitutionality of Decree No. 2,067/08; Resolutions and of any other rule or act issued or to be issued, that is caused by the mentioned rules (the “Cause”).

The first instance judgment declares the unconstitutionality of both Articles 53 and 54 of Law 26,784, as well as the aforementioned rules and of any other act tending to execute said provision, and consequently, the nullity of said rules (the “sentence").

The Judgment was appealed by the National Government on March 29, 2019, and the appeal was granted on April 3, 2019, which has not been resolved as of the closing date of the period.

On May 10, 2019, the intervening judge decided, considering what was decided in the judgment and attending to the reasons invoked by TGS, to extend the validity of the precautionary measure issued for six more months of processing in said ordinary process and / or until the sentence passed is firm.

TGS’s Management believes it has sufficient valid arguments to defend its position, and thus, the Company has not recorded the increase of the charge for natural gas consumptions from the date of obtaining the injunction until April 1, 2016, effective date of Resolution 28.

22.

BALANCES AND TRANSACTIONS WITH RELATED COMPANIES

Key management compensation

The accrued amounts corresponding to the compensation of the members of the Board of Directors, the Statutory Committee and the Executive Committee for the six-month periods ended June 30, 2019 and 2018 were Ps. 78,917 and Ps. 62,773, respectively.

Balances and transactions with related parties

The detail of significant outstanding balances for transactions entered into by TGS and its related parties as of June 30, 2019 and December 31, 2018 is as follows:

![[TGS125.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS125.GIF)

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

The detail of significant transactions with related parties for the six-month periods ended June 30, 2019 and 2018 is as follows:

Six-month period ended June 30, 2019:

![[TGS127.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS127.GIF)

Six-month period ended June 30, 2018:

![[TGS129.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS129.GIF)

23.

ASSOCIATES AND JOINT AGREEMENT

Associates with significant influence

Link:

Link was created in February 2001, with the purpose of the operation of a natural gas transportation system, which links TGS’s natural gas transportation system with the Cruz del Sur S.A. pipeline. The connection pipeline extends from Buchanan (Buenos Aires province), located in the high-pressure ring that surrounds the city of Buenos Aires, which is part of TGS’s pipeline system, to Punta Lara. TGS’s ownership interest in such company is 49% and Dinarel S.A. holds the remaining 51%.

TGU:

TGU is a company incorporated in Uruguay. This company rendered operation and maintenance services to Gasoducto Cruz del Sur S.A. and its contract terminated in 2010. TGS holds 49% of its common stock and Pampa Energía holds the remaining 51%.

EGS (in liquidation):

In September 2003, EGS, a company registered in Argentina, was incorporated. The ownership is distributed between TGS (49%) and TGU (51%).

EGS operates its own pipeline, which connects TGS’s main pipeline system in the Province of Santa Cruz with a delivery point on the border with Chile.

![[TGS101.JPG]](https://content.edgar-online.com/edgar_conv_img/2019/08/16/0000931427-19-000035_TGS101.JPG)

English translation of the original prepared in Spanish for publication in Argentina

TRANSPORTADORA DE GAS DEL SUR S.A.

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

AS OF JUNE 30, 2019 AND COMPARATIVE INFORMATION

(Stated in thousands of pesos as described in Note 3, unless otherwise stated)

In October 2012, ENARGAS issued a resolution which authorizes EGS to transfer the connection pipeline and service offerings in operation to TGS. On November 13, 2013, the sale of all the fixed assets of EGS to TGS for an amount of US$ 350,000 was made, the existing natural gas transportation contracts were transferred and the procedures to dissolve the Company were initiated.

The Board of Directors Meeting held on January 13, 2016, approved to initiate the necessary steps for the dissolution of EGS. The Extraordinary Shareholders Meeting held on March 10, 2016 appointed EGS’ liquidator.

Joint Agreement

UT:

The Board of Directors of TGS approved the agreement to set up the UT together with SACDE. The objective of the UT is the assembly of pipes for the construction of the project of "Expansion of the System of Transportation and Distribution of Natural Gas" in the Province of Santa Fe, called by National Public Bid No. 452-0004-LPU17 by the MINEM (the "Work").

On October 27, 2017, TGS - SACDE UT signed the corresponding work contract with the MINEM.

The validity of the UT will be until it has fulfilled its purpose, once the Work is completed and until the end of the guarantee period, set at 18 months from the provisional reception.

As of June 30, 2019, the Work is being executed.

24.

INFORMATION REQUIRED BY ARTICLE 26 OF SECTION VII CHAPTER IV TITLE II OF CNV RULES

In order to comply with General Resolution No. 629/2014 TGS informs that by August 7, 2019, supporting and management documentation related to open tax periods is safeguarded by Iron Mountain Argentina S.A. at its facilities are located at 2482 Amancio Alcorta Avenue in the Autonomous City of Buenos Aires.