Current Report Filing (8-k)

May 13 2019 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 13, 2019 (May 9, 2019)

TRANSOCEAN LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Switzerland

|

|

001-38373

|

|

98-0599916

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification No.)

|

|

|

|

|

|

Turmstrasse 30

|

|

|

|

Steinhausen, Switzerland

|

|

CH-6312

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(zip code)

|

Registrant’s telephone number, including area code:

+41 (41) 749-0500

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

◻

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

◻

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered:

|

|

Shares, CHF 0.10 par value

|

RIG

|

New York Stock Exchange

|

Item 1.01. Entry into a Material Definitive Agreement.

On May 13, 2019, Transocean Inc., a wholly-owned subsidiary of Transocean Ltd. (the “Company”), entered into an Increase of Commitments and First Amendment to Credit Agreement (the “Amendment”), which amends Transocean Inc.’s credit agreement dated June 22, 2018 (the “Revolving Credit Facility”), with the lenders parties thereto and Citibank, N.A., as administrative agent.

The Revolving Credit Facility contains an accordion provision allowing Transocean Inc., subject to the conditions set forth therein, to increase the commitments under the Revolving Credit Facility by up to $500 million. The Amendment exercised this accordion provision and increased the aggregate commitments under the Revolving Credit Facility from $1.0 billion to $1.36 billion.

In connection with entering into the Amendment, certain subsidiaries of the Company guaranteed the Revolving Credit Facility and granted liens to secure the Revolving Credit Facility on

Deepwater Skyros

,

Dhirubhai Deepwater KG2

, the equity of the Company’s subsidiaries that own such drilling units and certain assets related to such drilling units.

The Amendment also amended the covenant in the Revolving Credit Facility that requires Transocean Inc. to maintain a minimum ratio of the

Collateral Rig Value (as defined in the Revolving Credit Facility) to the sum of commitments under the Revolving Credit Facility of not less than 2:00 to 1:00 at the end of each fiscal quarter.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the complete document, which is attached hereto as Exhibit 10.1.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information described in Item 1.01 is incorporated herein by reference.

Item 5.03 Amendments to the Articles of Incorporation or Bylaws; Change in Fiscal Year

On May 9, 2019, the Company amended its articles of association (as amended, the “Articles of Association”) to reflect a share capital increase of six million shares, offset by a corresponding decrease in authorized capital. The shares will be used for the sole purpose of satisfying obligations under the Company’s equity compensation plans from time to time.

The foregoing description of the amendment to the Articles of Association does not purport to be complete and is qualified in its entirety by reference to the complete document, which is attached hereto as Exhibit 3.1.

Item 5.07.

Submission of Matters to a Vote of Security Holders.

The Company held its Annual General Meeting of Shareholders on May 9, 2019, in Steinhausen (Zug), Switzerland. The shareholders took action on the following matters at the 2019 Annual General Meeting:

1. Proposal regarding the approval of the 2018 Annual Report, including the Audited Consolidated Financial Statements of Transocean Ltd. for Fiscal Year 2018 and the Audited Statutory Financial Statements of Transocean Ltd. for Fiscal Year 2018.

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

470,348,377

|

|

3,652,687

|

|

3,114,025

|

|

This item was approved.

2. Proposal regarding the discharge of the Members of the Board of Directors and the Executive Management Team from liability for activities during Fiscal Year 2018.

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

332,198,010

|

|

5,948,130

|

|

35,522,132

|

|

103,446,817

|

|

This item was approved.

3. Proposal regarding the appropriation of the accumulated loss for Fiscal Year 2018.

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

465,502,885

|

|

7,393,181

|

|

4,219,023

|

|

This item was approved.

4. Proposals regarding the reelection of ten directors for a term extending until completion of the next Annual General Meeting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Nominee for

Director

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

Glyn A. Barker

|

|

370,420,711

|

|

2,321,562

|

|

925,999

|

|

103,446,817

|

|

|

Vanessa C.L. Chang

|

|

358,822,755

|

|

12,835,839

|

|

2,009,678

|

|

103,446,817

|

|

|

Frederico F. Curado

|

|

260,727,373

|

|

111,988,608

|

|

952,291

|

|

103,446,817

|

|

|

Chadwick C. Deaton

|

|

368,031,046

|

|

4,686,187

|

|

951,039

|

|

103,446,817

|

|

|

Vincent J. Intrieri

|

|

368,074,502

|

|

4,638,251

|

|

955,519

|

|

103,446,817

|

|

|

Samuel J. Merksamer

|

|

370,161,856

|

|

2,547,144

|

|

959,272

|

|

103,446,817

|

|

|

Frederik W. Mohn

|

|

370,454,364

|

|

2,257,564

|

|

956,344

|

|

103,446,817

|

|

|

Edward R. Muller

|

|

370,537,286

|

|

2,180,418

|

|

950,568

|

|

103,446,817

|

|

|

Tan Ek Kia

|

|

369,991,885

|

|

2,739,064

|

|

937,323

|

|

103,446,817

|

|

|

Jeremy D. Thigpen

|

|

370,650,371

|

|

2,143,664

|

|

874,237

|

|

103,446,817

|

|

Each of the ten persons listed above were duly reelected as a director of the Company to hold office until the completion of the 2020 Annual General Meeting of Shareholders.

5. Proposal regarding the election of the Chairman of the Board of Directors for a term extending until completion of the next Annual General Meeting.

|

|

|

|

|

|

|

|

|

|

|

|

Name of Chairman Nominee

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

Chadwick C. Deaton

|

|

368,456,661

|

|

4,245,542

|

|

966,069

|

|

103,446,817

|

|

Chadwick C. Deaton was elected Chairman of the Board of Directors of the Company to hold office until the completion of the 2020 Annual General Meeting of Shareholders.

6. Proposal regarding the election of the members of the Compensation Committee, each for a term extending until completion of the next Annual General Meeting.

|

|

|

|

|

|

|

|

|

|

|

|

Name of Compensation Committee Nominee

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

Frederico F. Curado

|

|

368,839,019

|

|

3,894,885

|

|

934,368

|

|

103,446,817

|

|

|

Vincent J. Intrieri

|

|

370,047,493

|

|

2,711,717

|

|

909,062

|

|

103,446,817

|

|

|

Tan Ek Kia

|

|

370,020,176

|

|

2,719,436

|

|

928,660

|

|

103,446,817

|

|

Each of the three persons listed above were duly elected to serve as a member of the Compensation Committee of the Company to hold office until completion of the 2020 Annual General Meeting of Shareholders.

7. Proposal regarding the reelection of the independent proxy for a term extending until completion of the next Annual General Meeting.

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

|

Abstain

|

|

|

467,251,038

|

|

7,059,825

|

|

|

2,804,226

|

|

This item was approved.

8. Proposal regarding the appointment of Ernst & Young LLP as the Company's Independent Registered Public Accounting Firm for Fiscal Year 2019 and reelection of Ernst & Young Ltd, Zurich, as the Company's Auditor for a further one-year term.

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

466,876,847

|

|

8,726,181

|

|

1,512,061

|

|

This item was approved.

9. Proposal regarding the advisory vote to approve Named Executive Officer compensation.

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

362,899,693

|

|

9,694,685

|

|

1,073,894

|

|

103,446,817

|

|

This item was approved.

10. (a) Proposal regarding ratification of the maximum aggregate amount of compensation of the Board of Directors for the period between the 2019 Annual General Meeting and the 2020 Annual General Meeting.

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

363,849,875

|

|

7,084,259

|

|

2,734,138

|

|

103,446,817

|

|

This item was approved.

10. (b) Proposal regarding the ratification of the maximum aggregate amount of compensation of the Executive Management Team for Fiscal Year 2020.

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

|

362,985,995

|

|

8,141,843

|

|

2,540,434

|

|

103,446,817

|

|

This item was approved.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

|

|

s

|

|

|

Exhibit No

.

|

|

Description

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TRANSOCEAN LTD.

|

|

|

|

|

|

|

|

Date: May 13, 2019

|

By:

|

/s/ Daniel Ro-Trock

|

|

|

|

Daniel Ro-Trock

|

|

|

|

Authorized Person

|

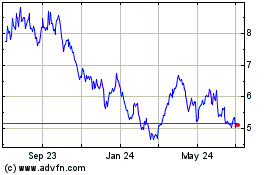

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

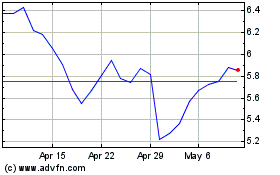

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024