Transocean Agrees to Acquire Ocean Rig for $2.7 Billion -- Update

September 04 2018 - 1:44PM

Dow Jones News

By Costas Paris and Kimberly Chin

Transocean Ltd. has agreed to buy fellow offshore-drilling

contractor Ocean Rig UDW Inc., in a cash-and-stock transaction

valued at about $2.7 billion aimed at strengthening the company's

drillship fleet ahead of an expected market recovery.

Switzerland-based Transocean, among the world's five biggest

offshore operators with revenue of $7.4 billion last year, will

give Ocean Rig shareholders 1.6128 newly issued shares in the

combined business plus $12.75 in cash per share of Ocean Rig's

common stock. This would value Ocean Rig's shares at $32.28 apiece,

representing a 20.4% premium over the 10-day volume-weighted

average share price of the drilling contractor as of Aug. 31.

Transocean's shareholders would own about 79% of the combined

company, while Ocean Rig's will own about 21%. No changes to the

board of directors, executive management or corporate structure are

anticipated.

Transocean plans to finance the deal through a combination of

cash and fully committed financing from Citigroup Inc.

Offshore drilling has been one of the hardest-hit sectors in the

shipping industry's downcycle over the past four years. Rig daily

leases, which once commanded up to $800,000, dropped to around

$200,000 over the period as cheap oil from U.S. shale drilling

flooded the market, hitting finances at the field's biggest

players.

Ocean Rig completed a restructuring last October that wiped out

$3.7 billion in debt and handed control of its equity to investors

in its senior debt, among them Avenue Capital Management II LP,

BlueMountain Capital Management LLC and Elliott Associates LP.

Another major operator, Seadrill Ltd., filed for chapter 11

bankruptcy protection last year and emerged from bankruptcy in

April.

"The Transocean takeover shows that rig operators are betting on

sustained higher oil prices going forward," said Peter Sand, chief

shipping analyst at Bimco, an industry research group. "They have

also made a serious effort to cut their costs, which could make

offshore drilling attractive once again."

Transocean Chief Executive Jeremy Thigpen said the takeover will

strengthen the company's presence in key markets like Brazil, West

Africa and Norway ahead of what "we believe is an imminent recovery

in the ultra-deepwater market."

The deal will add nine drillships and two harsh-environment

semisubmersibles to the Transocean fleet. Ocean Rig also has two

drillships under construction and due for delivery by 2020.

Altogether, the deal would boost Transocean's fleet to 57.

Ocean Rig is the Swiss company's second big acquisition in less

than a year, following a $1.2 billion takeover of Songa Offshore

completed in January.

The deal is subject to approval by shareholders. The companies

noted in a statement that shareholders representing 48% of Ocean

Rig's shares outstanding support the deal, as does Transocean's

third-largest shareholder.

Write to Costas Paris at costas.paris@wsj.com and Kimberly Chin

at kimberly.chin@wsj.com

(END) Dow Jones Newswires

September 04, 2018 13:29 ET (17:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

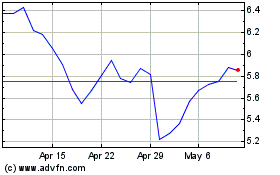

Transocean (NYSE:RIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

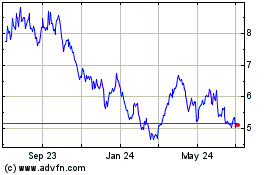

Transocean (NYSE:RIG)

Historical Stock Chart

From Apr 2023 to Apr 2024