Current Report Filing (8-k)

July 22 2019 - 8:34AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2019

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-32833

|

|

41-2101738

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

1301 East 9

th

Street, Suite 3000, Cleveland, Ohio

|

|

44114

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(216) 706-2960

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class:

|

|

Trading Symbol:

|

|

Name of each exchange on which registered:

|

|

Common Stock, $0.01 par value

|

|

TDG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On July 21, 2019, TransDigm Group Incorporated (“TransDigm”), Esterline Technologies Corporation, Esterline Technologies Holdings Ltd. and Esterline Technologies France Holdings S. N.G. (“TransDigm” or the “Sellers”) entered into a binding offer (the “Put Agreement”) with Eaton Corporation PLC (“Eaton”) for the acquisition by Eaton of the shares of Souriau SAS, Souriau USA Inc. and Sunbank Family of Companies LLC (collectively, the “Souriau-Sunbank Companies”) which comprise the Souriau-Sunbank Connection Technologies business (the “Business”). Pursuant to the terms of the Put Agreement, after completion of the consultation process with the Business’ French works council, the Sellers will have the right to require Eaton to enter into a securities purchase agreement (the “Purchase Agreement”) providing for the purchase by Eaton from the Sellers of the shares of the Souriau-Sunbank Companies.

Pursuant to the terms of the Purchase Agreement, Eaton will purchase the shares of the Souriau-Sunbank Companies for a cash purchase price of approximately $920 million.

In addition to the consultation with the Business’ French works council, the transaction is subject to execution and delivery of the Purchase Agreement and other definitive agreements, the satisfaction or waiver of customary closing conditions and receipt of required regulatory approvals. The parties expect to complete the transaction during fourth calendar quarter of 2019.

TransDigm issued a press release announcing the entry in to the Put Agreement. A copy of the press release is hereby furnished pursuant to Item 7.01 as Exhibit 99.1.

Forward-Looking Statements

Statements in this current report and the press release which are not historic facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements, including, in particular, statements about the sale of the Souriau-Sunbank Companies. We have identified some of these forward-looking statements with words like "believe," "may," "will," "should," "expect," "intend," "plan," predict," "anticipate," "estimate" or "continue" and other words and terms of similar meaning. All forward-looking statements involve risks and uncertainties which could affect TransDigm’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of TransDigm. These risks and uncertainties include, but are not limited to, TransDigm’s ability to successfully complete the sale of the Souriau-Sunbank Companies, including satisfying the various closing conditions, such as works council consultations and obtaining required regulatory approvals. Except as required by law, TransDigm undertakes no obligation to revise or update the forward-looking information contained in this current report or the press release.

|

|

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

The following exhibit is being filed with this Current Report on Form 8-K:

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press Release dated July 22, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

TRANSDIGM GROUP INCORPORATED

|

|

|

|

|

By

|

|

/s/ Michael Lisman

|

|

|

|

Michael Lisman

|

|

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

|

|

Date: July 22, 2019

Exhibit Index

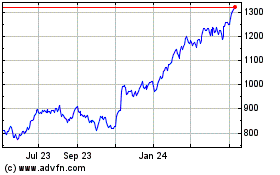

Transdigm (NYSE:TDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2023 to Apr 2024