Current Report Filing (8-k)

October 30 2019 - 9:22AM

Edgar (US Regulatory)

false0000794170

0000794170

2019-10-29

2019-10-29

0000794170

us-gaap:CommonStockMember

2019-10-29

2019-10-29

0000794170

tol:SeniorNotesDue2024Member

2019-10-29

2019-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 29, 2019

Toll Brothers, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-09186

|

|

|

23-2416878

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

250 Gibraltar Road

|

|

Horsham

|

PA

|

|

19044

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (215) 938-8000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

TOL

|

The New York Stock Exchange

|

|

Guarantee of Toll Brothers Finance Corp.

5.625% Senior Notes due 2024

|

TOL/24

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

ITEM 5.02.

|

Departure of Directors or Certain Officers; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

Advisory and Non-Competition Agreement with Robert I. Toll

As previously disclosed, Toll Brothers, Inc. (the “Company”) entered into an advisory and non-competition agreement (the “Advisory Agreement”) with Robert I. Toll, who retired from his role as executive chairman on October 31, 2018. The Advisory Agreement initially had a term of one year, through October 31, 2019. On October 29, 2019, the Company and Mr. Toll agreed to extend the Advisory Agreement for a period of one additional year. Pursuant to the extension, Mr. Toll will continue to provide consulting and advisory services to the Company, will continue to be bound by certain confidentiality and non-competition covenants, and will be compensated for his services during the additional one-year term on the same terms as are applicable to the initial year of the Advisory Agreement. Mr. Toll will remain as a member of the Board and will continue to receive the same director fees as the non-executive members of the Board.

Amendment to Supplemental Executive Retirement Plan

Effective October 29, 2019, the Executive Compensation Committee (the “Committee”) of the Board of Directors of the Company approved an amendment to the Company’s Supplemental Executive Retirement Plan (“SERP”) to lower the normal retirement age in the plan from age 62 to age 58. The SERP, which is an unfunded plan, generally provides for an annual benefit, payable for 20 years following retirement, once a participant has reached normal retirement age. The SERP does not have a service requirement, except that a participant must have five or more years of service in order to be vested in a death or disability benefit prior to reaching normal retirement age. The Committee also approved the addition of Messrs. James W. Boyd and Robert Parahus, who will each assume the role of Executive Vice President and Co-Chief Operating Officers on November 1, 2019, as participants in the SERP with an annual benefit amount of $125,000.

Restricted Stock Unit Grant

Also effective October 29, 2019, the Committee approved the grant to Richard T. Hartman, the Company’s President and Chief Operating Officer 38,246 restricted stock units with a grant date fair value of approximately $1.5 million. The restricted stock units will vest upon Mr. Hartman’s retirement on December 31, 2019. Mr. Hartman is not expected to receive an equity grant at the time the Company issues its annual equity award in December 2019.

ITEM 9.01. Financial Statements and Exhibits

(d). Exhibits

Exhibit

No. Item

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* Filed electronically herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOLL BROTHERS, INC.

|

|

|

|

|

|

|

Dated:

|

October 30, 2019

|

|

|

By:

|

|

/s/ Michael J. Grubb

|

|

|

|

|

|

|

|

Michael J. Grubb

Senior Vice President,

Chief Accounting Officer

|

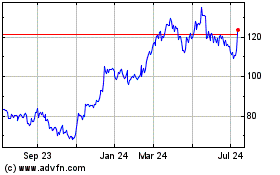

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Apr 2023 to Apr 2024