By Sarah Nassauer

Target Corp. posted the strongest quarterly growth in its

history, including a near tripling of digital sales, as coronavirus

concerns fueled demand for services that let shoppers pick up goods

in parking lots or skip trips to the store.

Like rival Walmart Inc., Target has benefited from being able to

stay open throughout the pandemic as well as selling groceries and

other household staples. Online comparable sales rose 195% from a

year ago, driven by same-day pickup and delivery services. Walmart

said Tuesday its e-commerce revenue nearly doubled in the latest

quarter.

Chains that had to temporarily close stores or don't sell food

have struggled. TJX Cos., the parent of off-price chains T.J. Maxx,

HomeGoods and Marshalls, said quarterly sales fell 32% as its

stores were closed for nearly a third of the quarter due to the

Covid-19 pandemic. The discounter has a limited e-commerce

operation.

Shares of Target jumped 8% in premarket trading to new highs,

while TJX shares slid 5%.

Target's comparable sales, those from stores and through digital

channels operating for at least 12 months, rose 24% in the quarter

ended Aug. 1, a company record and twice as much as in the May

quarter. Target executives cited broad gains across categories such

as food, electronics and home goods and a rebound in clothing

sales.

"In the current environment, each of our categories are

performing very well," CEO Brian Cornell said on a call with

reporters. The Minneapolis company estimated it has taken about $5

billion in sales from competitors since the start of the year.

Government stimulus checks and extra unemployment benefits are a

factor, Mr. Cornell said, "but even as the stimulus waned, we

continued to see strong growth." So far comparable sales in August

are up low double digits, he said. Walmart executives said sales

moderated in July as benefits were reduced.

U.S. consumer retail spending collapsed in March and April when

restrictions to stem the spread of Covid-19 required many stores to

shut. Government data has recorded three straight months of

spending gains at restaurants and stores as many businesses

reopened.

Big chains such as Target, Walmart and Home Depot Inc., along

with e-commerce giant Amazon.com Inc., have been among the biggest

beneficiaries of new shopping habits and increased spending on

homes and food. On Wednesday, Lowe's Cos. posted surging sales

figures for the May-to-July earnings period.

Walmart's U.S. comparable sales rose 9.3% in the most recent

quarter, bringing its global revenue to $137.7 billion. Home Depot

said U.S. comparable sales rose 25%, and total revenue, including

in Mexico and Canada, reached $38 billion in the quarter. Lowe's

comparable sales grew by 35.1% in the U.S., and total sales

increased to $27.3 billion from $21 billion.

Target, which operates about 1,900 stores, is smaller than those

two companies. Its total revenue reached $22.9 billion in the

quarter, compared with $18.4 billion a year earlier. Sales through

digital channels accounted for 17% of revenue, around $3.9

billion.

Smaller chains and traditional department stores, many forced to

close during the early days of the pandemic, aren't faring well.

Lord & Taylor, J.C. Penney Co. and Stage Stores Inc. have all

filed for bankruptcy protection since May. Last week, off-price

chain Stein Mart Inc. filed for chapter 11 with plans to close most

of its roughly 280 stores.

TJX struggled to stock enough goods after an initial surge of

shoppers when it reopened many of its closed stores. The company

said it has reopened more than 4,500 stores world-wide.

The company had planned lower inventory levels to facilitate

social distancing, but sold more than expected goods at reopened

stores and encountered supply-chain and logistics challenges as

operations ramped up, TJX said.

TJX said traffic and sales moderated as it moved into August due

to consumer behavior and demand related to Covid-19, as well as

lighter inventories in stores than planned.

Comparable-store sales for days the stores were open fell 3% in

the quarter ended Aug. 1 from a year ago. By that measure, the

company expects to fall by 10% to 20% for the third quarter.

On Tuesday, Kohl's Corp., which temporarily closed its

department stores in the spring, said revenue fell 23% to $3.4

billion for the quarter ended Aug. 1. Kohl's said sales rebounded

in June but tapered off again in July as the coronavirus surged in

parts of the country.

For Target, sales of higher-margin goods such as apparel helped

boost profits, offsetting coronavirus-related expenses such as

higher wages and cleaning costs. Net income increased 80% compared

with last year, hitting $1.7 billion and beating Wall Street's

expectations.

Target said it plans to lengthen the traditional back-to-school

shopping season, making school supplies available throughout the

fall. Target said it thinks around two-thirds of American students

are starting the year learning online without clarity on when

in-classroom teaching will resume. "We want to extend the season,"

Mr. Cornell said, "and be ready."

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 19, 2020 09:37 ET (13:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

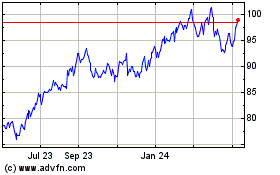

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

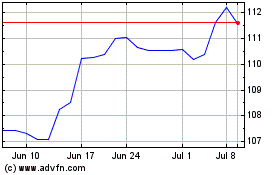

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024