Real Estate, Retailers Drive Up Stocks -- WSJ

November 27 2019 - 3:02AM

Dow Jones News

Best Buy stars after increasing its forecast for holiday

shopping, posting higher sales

By Paul J. Davies and Michael Wursthorn

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 27, 2019).

Stocks drifted higher as rising shares of consumer companies and

real-estate firms nudged all three major indexes to records.

Shares of Best Buy led the S&P 500 higher after the

consumer-electronics retailer boosted its forecast for the

holiday-shopping season and reported a solid sales gain for the

previous quarter.

The optimistic tone for the final month of the year helped boost

shares of several other retailers, including TJX Cos., Ulta Beauty

and Home Depot.

Shares of real-estate companies added to the market's gain, with

those stocks in the S&P 500 advancing 1.4%.

Incremental developments on the U.S.'s trade talks with China

also brightened investors' near-term outlooks to keep the stock

market moving higher. Chinese officials said Tuesday that they had

reached a consensus with their U.S. counterparts on resolving

certain problems, suggesting the two sides are making progress

toward a phase-one deal.

Still, analysts urged investors to remain cautious. Trade

headlines have sent stock indexes on a roller coaster this year,

and that volatility is likely to play out further until the U.S.

and China sign a deal.

"While top officials on both sides have sounded positive,

potential barriers to a broad agreement remain," strategists at UBS

Global Wealth Management wrote in a note to clients, pointing out

that the U.S. and China still haven't set a deadline for signing a

deal or determined whether to delay tariffs scheduled to take

effect next month.

The Dow Jones Industrial Average rose 55.21 points, or 0.2%, to

28121.68, notching its 14th record close of the year. The S&P

500 added 6.88 points, or 0.2%, to 3140.52, while the Nasdaq

Composite gained 15.44 points, or 0.2%, to 8647.93.

Best Buy shares jumped $7.32, or 9.9%, to $81.57, more than any

other stock in the broad S&P 500 index, after the retailer

slightly increased its targets for sales and profit for the fiscal

year and disclosed plans to compete with Amazon.com this

holiday-shopping season.

Shares of Hormel Foods rose after the company reported

better-than-expected earnings despite missing sales forecasts. The

stock gained $1.52, or 3.6%, to $44.28.

Meanwhile, a couple of disappointing profit reports weighed on

the S&P 500.

Shares of Dollar Tree slid $17.13, or 15%, to $95.26 after the

owner of the Dollar Tree and Family Dollar chains of discount

stores lowered its earnings guidance for the year, due, in part, to

the anticipated impact of tariffs on goods imported from China.

Also hobbling major indexes' advance was a pullback in shares of

Hewlett Packard Enterprise. The tech company's stock stumbled

$1.48, or 8.5%, to $15.97 after it reported a bigger-than-expected

decline in revenue for the most recent quarter.

Investors expect Wednesday's trading session to be subdued ahead

of Thursday's market closure for Thanksgiving and Friday's

shortened session.

Despite the light trading volumes, investors plan on monitoring

further chatter between U.S. and Chinese officials to gauge the

progress of trade talks as well as the handful of corporate

earnings due Wednesday from Deere & Co. and others.

Elsewhere, the pan-continental Stoxx Europe 600 rose 0.1%.

The Shanghai Composite Index closed almost flat, while Hong

Kong's Hang Seng Index slipped 0.3%.

Write to Paul J. Davies at paul.davies@wsj.com and Michael

Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

November 27, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

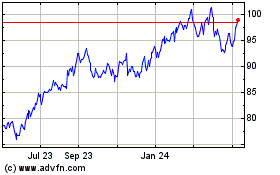

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

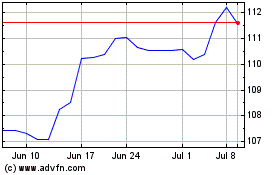

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024