By Suzanne Kapner

Americans are more value-conscious than they have been in

decades. And retailers offering good deals, from bargains on

brand-name goods to conveniences such as free shipping, are gaining

share at the expense of peers that have been slow to innovate.

Walmart Inc., Target Corp. and T.J. Maxx parent TJX Cos.

reported strong sales growth and an uptick in visitors to their

stores. But Macy's Inc., J.C. Penney Co. and Nordstrom Inc. are

among retailers that continue to struggle.

"The common thread among retailers that are doing well is that

they offer some type of value," said Chuck Grom, senior analyst at

Gordon Haskett Retail Advisors. "But, today, value is about more

than just price. It's also about convenience."

Convenience can take many forms. It can mean pulling into a

Walmart or T.J. Maxx parking lot and dashing into the store rather

than navigating through a shopping mall maze. It can also mean

free, two-day shipping, no minimum required, as Target offered last

holiday season.

On Wednesday, Target said sales at stores open at least a year

rose 3.4% for the three months ended Aug. 3, and upped its earnings

guidance for the current fiscal year.

Total revenue for the recent period increased 3.6% to $18.4

billion. Net earnings climbed to $938 million from $799 million a

year earlier.

A day earlier, TJX said sales at stores open at least a year

rose 2% in the most recent quarter, which was lower than some

analysts had expected, but on top of a 6% increase in the same

period a year ago. TJX CEO Ernie Herrman told analysts that

customer traffic to its stores drove the sales increase and that

foot traffic had grown for 20 consecutive quarters.

TJX stores rapidly turn over limited quantities of goods at

bargain prices. The result is a constant treasure hunt, with

shoppers coming back to ferret out deals. There is no glut of stock

in the backroom. Customers know if they don't buy it today, the

item might not be there tomorrow.

Kohl's, on the other hand, is suffering a similar fate to other

department stores even though it isn't located in malls and has

introduced services designed to draw shoppers to its stores. Under

a partnership with Amazon.com Inc., customers can return items

bought on Amazon to any of Kohl's more than 1,100 locations.

Nevertheless, Kohl's sales fell for the third consecutive

quarter in the most recent period, leaving it with excess

merchandise that it had to mark down, hurting profits.

More than a decade after the last recession, consumers still

remain "extremely focused on getting value for the dollar," said

Neil Saunders, a managing director of GlobalData PLC, a research

firm. "A lot of retailers haven't added that value, and consumers

are just going elsewhere."

The poor results from some chains can't be blamed on fears of an

oncoming recession. In July, retail sales increased at their

strongest level since March, giving the economy a boost.

"The consumer is still healthy," Macy's CEO Jeff Gennette said

in an interview last week.

Many other factors are upending traditional retailers, from the

rise in online shopping to higher rent. They also have to contend

with tariffs on goods imported from China and rising labor costs,

which have been eating into profits. Some chains are adapting

better than others.

Consumers' love affair with a good deal is also manifesting

itself in the rise of thrift shopping, which is poised to overtake

fast fashion in terms of annual sales within a decade.

"If off-price chains like T.J. Maxx wooed shoppers with promises

of 20% to 60% off regular retail prices, resale websites like

thredUP offer discounts of as much as 90% off," said Oliver Chen,

an analyst at Cowen & Co. "That is making it harder for

traditional retailers."

Macy's and Penney are jumping into the secondhand market. Both

announced partnerships last week with thredUP Inc. to sell used

clothing and accessories in some of their stores. Macy's has also

gotten into the off-price game by opening Macy's Backstage discount

stores, which compete with T.J. Maxx.

Department stores have been disproportionately hurt, because

their stores are in malls that are drawing less foot traffic, as

shoppers buy more online. Unlike Walmart and Target, which have

large grocery offerings to draw shoppers, department stores are

overly dependent on apparel that can be found almost everywhere,

making it easy for shoppers to compare prices online.

Macy's last week lowered its full-year earnings outlook after it

missed profit expectations, sending shares tumbling, while Penney

said sales at stores open at least a year fell 9%.

Analysts say these stores aren't doing enough to adapt to the

changes in consumer behavior.

"They are jumping on someone else's bandwagon, rather than

innovating," Mr. Saunders, of GlobalData, said. "They are playing

catch-up, and that's not good enough in retailing today."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

August 21, 2019 07:15 ET (11:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

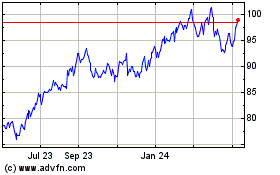

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Mar 2024 to Apr 2024

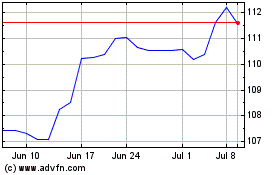

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Apr 2023 to Apr 2024