Current Report Filing (8-k)

June 25 2019 - 5:29PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

|

|

|

|

|

Date of Report (Date of earliest event reported):

|

June 25, 2019

|

|

|

|

|

|

THE TIMKEN COMPANY

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

Ohio

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

1-1169

|

|

34-0577130

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

4500 Mt. Pleasant St. NW, North Canton, Ohio 44720-5450

|

|

(Address of Principal Executive Offices) (Zip Code)

|

|

|

|

|

|

(234) 262-3000

|

|

(Registrant's Telephone Number, Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01

Entry into a Material Definitive Agreement.

On June 25, 2019, The Timken Company (the “Company”) entered into a Fourth Amended and Restated Credit Agreement (the “Credit Agreement”) with Bank of America, N.A. and KeyBank National Association, as Co-Administrative Agents, KeyBank National Association as Paying Agent, L/C Issuer and Swing Line Lender, and the other lenders party thereto (collectively, the “Lenders”). The Credit Agreement amends and restates the Company’s previous credit agreement, dated as of June 19, 2015.

The Credit Agreement matures on June 25, 2024 and is a $650 million unsecured revolving credit facility. The interest rate is based on grid pricing determined by the Company’s debt rating. In addition, the Company will pay a facility fee to secure the aggregate commitments of all of the Lenders that is based on its debt rating. The Credit Agreement is not secured by assets of the Company. Under the terms of the Credit Agreement, the Company is entitled on one or more occasions, subject to the satisfaction of certain conditions, to request an increase in the commitments under the Credit Agreement in the aggregate principal amount of up to $400 million to the extent that existing or new Lenders agree to provide such additional commitments. The Company is also permitted to add one or more foreign subsidiaries as a borrower under the Credit Agreement from time to time with the consent of the Lenders.

The Credit Agreement contains certain customary representations, warranties and covenants, including financial covenants that require the Company to maintain a consolidated leverage ratio and a consolidated interest coverage ratio in accordance with the limits set forth therein.

The Credit Agreement is subject to customary events of default. If any event of default occurs and is continuing, the lenders may instruct the administrative agent to accelerate amounts due under the Credit Agreement (except for a bankruptcy event of default, in which case such amounts will automatically become due and payable) and exercise other rights and remedies.

A copy of the Credit Agreement is filed as Exhibit 10.1 hereto. The foregoing description of the Credit Agreement does not purport to be complete, and is qualified in its entirety by reference to the full text of the Credit Agreement, which is incorporated by reference herein.

The lenders and the agents (and each of their respective subsidiaries or affiliates) of the Credit Agreement have in the past provided, and may in the future provide, investment banking, cash management, underwriting, lending, commercial banking, trust, leasing services, foreign exchange and other advisory services to, or engage in transactions with, the Company and its subsidiaries or affiliates. These parties have received, and may in the future receive, customary compensation from the Company and its subsidiaries or affiliates, for such services.

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 is incorporated herein by reference into this Item 2.03.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Fourth Amended and Restated Credit Agreement, dated as of June 25, 2019, among The Timken Company, Bank of America, N.A. and KeyBank National Association, as Co-Administrative Agent, and the Lenders Party thereto.

1

|

____________________

1

Portions of this exhibit have been omitted, which portions will be furnished to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE TIMKEN COMPANY

|

|

|

|

|

|

|

|

|

By:

|

/s/ Philip D. Fracassa

|

|

|

|

|

Philip D. Fracassa

|

|

|

|

|

Executive Vice President, Chief Financial Officer

|

|

Date:

|

|

June 25, 2019

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Fourth Amended and Restated Credit Agreement, dated as of June 25, 2019, among The Timken Company, Bank of America, N.A. and KeyBank National Association, as Co-Administrative Agent, and the Lenders Party thereto.

1

|

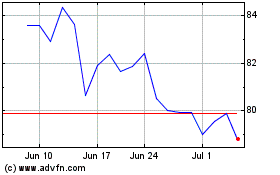

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

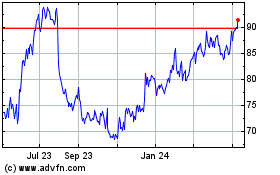

Timken (NYSE:TKR)

Historical Stock Chart

From Apr 2023 to Apr 2024