SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of July, 2020

Commission

File Number 001-14491

TIM

PARTICIPAÇÕES S.A.

(Exact

name of registrant as specified in its charter)

TIM

PARTICIPAÇÕES S.A.

(Translation

of Registrant's name into English)

Avenida

João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-Held Company

CNPJ/ME 02.558.115/0001-21

NIRE 33.300.276.963

CALL NOTICE – EXTRAORDINARY SHAREHOLDERS’

MEETING

The Shareholders of TIM Participações

S.A. (“Company”) are called upon, as set forth in Section 124 of the Brazilian Law No. 6,404/1976, to attend the Company’s

Extraordinary Shareholders’ Meeting to be held on August 31st, 2020, at 2.30pm, at Avenida João Cabral

de Mello Neto, No. 850, South Tower, Ground Floor - Auditorium, Barra da Tijuca, in the City and State of Rio de Janeiro, in order

to resolve on the following Agenda:

Agenda: To examine, discuss

and resolve on: (1) the approval of the “Protocol and Justification of the Merger of TIM Participações

S.A. into TIM S.A.”, executed on July 29th, 2020 by the management of the Company and of TIM S.A. (respectively,

“TSA” and “Protocol”), which establishes the terms and conditions of the proposal of the merger of the

Company into TSA (“Merger”); (2) the ratification of the appointment and hiring of Apsis Consultoria e Avaliações

Ltda. and of Apsis Consultoria Empresarial Ltda., specialized companies responsible for preparing, respectively, the appraisal

report of the Company’s equity at book value and the appraisal reports of the shareholders’ equity of the Company and

TSA at market price, for the purposes of the Merger (respectively, “Appraisal Report at Book Value”, “Appraisal

Reports at Market Price” and, together, “Appraisal Reports”); (3) the approval of the Appraisal Reports;

(4) the approval of the Merger, under the terms of the Protocol and subject to compliance with the suspensive condition

established therein; (5) the authorization for the performance, by the officers and attorneys-in-fact of the Company, of

all necessary measures for the consummation of the Merger, under the terms of the Protocol; and (6) the proposal to amend

the Company's Long-Term Incentive Plans, so that TSA will appear exclusively as the company responsible for the obligations arising

thereon.

General Instructions:

1.

All documents and information regarding the subjects to be analyzed and resolved on at the

Shareholders’ Meeting are at the Shareholders disposal at the Company’s head office, as well as on the websites www.tim.com.br/ri,

www.cvm.gov.br and http://www.b3.com.br/pt_br/.

2.

The Shareholder may participate either in person or represented by a duly constituted proxy,

as provided by Section 126 of Law No. 6,404/1976 and by the sole paragraph of Section 12 of the Company's By-laws, as well as by

distance voting ballot, following the detailed guidelines below:

a.

In person: The Shareholder who chooses to participate in person must send a copy of the identity document and of the respective

shareholding statement, issued at least five (5) business days prior to the Shareholders' Meeting, within two (2) business days

prior to the Shareholders' Meeting;

b.

By proxy: The Shareholder to be represented at the Shareholders' Meeting must send to the Company's head office the respective

supporting documentation of its representation, including the power of attorney and/or the articles of incorporation related to

the appointment, as the case may be, and the identification document of the representative, within two (2) business days prior

to the Shareholders' Meeting; and

c.

By distance voting ballot: The Shareholder that, pursuant to CVM Instruction No. 481/2009, chooses to participate by distance

voting ballot, must send the instructions for filing the form to its respective custodian agents or to the depositary institution

of the Company’s shares, or must send the form directly to the Company and, in any case, the ballot must be received up to

seven (7) days prior to the Shareholders’ Meeting, as informed in the management’s proposal.

3.

The documents mentioned herein shall be forwarded as follows: TIM Participações

S.A., attention to the Investor Relations Officer, Mr. Adrian Calaza, at Avenida João Cabral de Mello Neto, 850, North Tower,

12nd floor, Barra da Tijuca, in the City and State of Rio de Janeiro.

Rio de Janeiro (RJ), July 29th,

2020.

Nicandro Durante

Chairman of the Board of Directors

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: July 29, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING

STATEMENTS

This

press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based

on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial

results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company,

are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation

of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors

or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements

reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the

expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general

economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause

actual results to differ materially from current expectations.

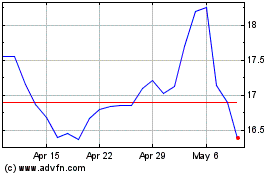

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

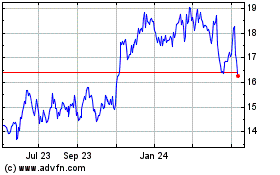

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024