SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-Held Company

CNPJ/ME 02.558.115/0001-21

NIRE 33.300.276.963

MINUTES OF THE BOARD OF DIRECTORS’

MEETING

HELD ON JULY 29th, 2020

DATE, TIME AND PLACE: July

29th, 2020, at 11.30 a.m., by videoconference.

PRESENCE: The Board of

Directors’ Meeting of the TIM Participações S.A. (“Company”) was held at the date, time and place

mentioned above, with the presence of Messrs. Nicandro Durante, Carlo Filangieri, Carlo Nardello, Elisabetta Romano, Flavia Maria

Bittencourt, Gesner José de Oliveira Filho, Herculano Aníbal Alves, Sabrina Di Bartolomeo and Pietro Labriola, by

videoconference, as provided in paragraph 2nd, Section 25 of the Company’s By-laws. Justified absence of Mr. Agostino

Nuzzolo.

BOARD: Mr. Nicandro Durante

- Chairman; and Mr. Jaques Horn – Secretary.

AGENDA: (1) To

acknowledge on the activities carried out by the Compensation Committee; (2) To acknowledge on the activities carried out

by the Statutory Audit Committee; (3) To acknowledge on the activities carried out by the Control and Risks Committee;

(4) To acknowledge on the Quarterly Information Report (“ITRs”) of the 2nd quarter of 2020, dated

as of June 30th, 2020; (5) To resolve on the proposal for the registration application of the Company's subsidiary,

TIM S.A. ("Subsidiary"), as an issuer before B3 S.A. - Brasil, Bolsa, Balcão ("B3") and for its listing

on B3's special corporate governance segment called Novo Mercado ("Novo Mercado”); (6) To analyze the

Company’s merger proposal (“Merger”) by its subsidiary, TIM S.A., and to resolve on its submission with the

amendment proposal of the Company’s Long Term Incentive Plans, (“Plans”) to the Extraordinary Shareholders Meeting

of the Company; (7) To resolve on the call notice of the Company’s Extraordinary Shareholders’ Meeting; (8)

To acknowledge on strategic projects of the Company; (9) To resolve on the Company’s proposal for the Management

by Objectives Program (“MBO”) for 2020; (10) To acknowledge on the Company’s Long Term Incentive Plan

(“Plan”) results for the first year of the 2019 grant, and to resolve on the calculation and payment form proposal;

(11) To resolve on the proposal of the Share Repurchase Plan; (12) To resolve on the amendment proposal of the Internal

Audit’s Internal Ruling; (13) To resolve on the amendment proposal of the Related Parties Transaction Policy; and

(14) Presentation on Business Continuity.

|

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

July 29th, 2020

|

RESOLUTIONS: Upon the review

of the material presented and filed at the Company’s head office, and based on the information provided and discussions of

the subjects included on the Agenda, the Board Members, unanimously by those present and with the abstention of the legally restricted,

decided to register the discussions as follows:

(1) Acknowledged on the

activities carried out by the Compensation Committee (“CR”), at its meeting held on July 28th, 2020, as

per Mr. Nicandro Durante’s report, Chairman of the CR.

(2) Acknowledged on the

activities carried out by the Statutory Audit Committee (“CAE”), at its meetings held on June 24th, 2020

and July 22nd, 28th and 29th, 2020, as per Mr. Gesner José de Oliveira Filho’s report,

Coordinator of the CAE.

(3) Acknowledged on the

activities carried out by the Control and Risks Committee (“CCR”) at its meetings held on June 24th, 2020

and July 28th, 2020, as per Mr. Herculano Aníbal Alves’ report, Chairman of the CCR.

(4) Acknowledged on the

Company’s Quarterly Information Report (“ITRs”) of the 2nd quarter of 2020, dated as of June 30th,

2020, according to the information provided by the Company’s administration and the independent auditors, Ernst & Young

Auditores Independentes S/S (“EY”), and were informed of the favorable assessments of the Company’s Fiscal Council

and CAE, through Mr. Walmir Kesseli, Chairman of the Fiscal Council, and Mr. Gesner José de Oliveira Filho, Coordinator

of the CAE. According to the clarifications provided by Mr. Fernando Magalhães, representative of EY, the referred report

was subject to limited review by the independent auditors.

(5) Approved the proposal

of the Company's subsidiary, TIM S.A., for the registration application as an issuer before B3 and for its listing on B3's segment

Novo Mercado, subject to the effectiveness of the Merger (as defined below), with the subsequent execution of the Agreement

for the Adoption of Differentiated Corporate Governance Practices – Novo Mercado, to be approved at the TIM S.A.’s

Extraordinary Shareholders’ Meeting, to be held on July 29th, 2020, with the Board of Officers of the Company

and of TIM S.A. being authorized to perform all necessary acts to formalize the adherence to the Novo Mercado.

|

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

July 29th, 2020

|

(6) Analyzed the Company’s

merger proposal by its subsidiary, TIM S.A. (“Merger”), ad referendum of the Extraordinary Shareholders’

Meeting of TIM S.A. and of the Company, the latter to be convened pursuant to item (7) below, supported (a) by the

Protocol and Justification of Merger to be entered into between the Company and TIM S.A.; (b) by the proposal presented

by Apsis Consultoria e Avaliações Ltda. and Apsis Consultoria Empresarial Ltda., specialized companies responsible

for preparing the appraisal reports of the Merger (“Appraisers”); (c) by the appraisal reports of the Company’s

equity at book value and the shareholders’ equity of the Company and TSA at market price, made by the Appraisers; (d)

by the favorable assessments of the Fiscal Council and of the CAE, at its meetings held on this date; and (e) by the draft

of amendment and consolidation of the TIM S.A.’s By-laws, and approved its submission to the Company’s

Extraordinary Shareholders’ Meeting, to be held on August 31st, 2020.

(7) Approved the call notice

for the Extraordinary Shareholders’ Meeting of the Company, to be held on August 31st, 2020, with the following

Agenda:

“Agenda:

To examine, discuss and resolve on: (1) the approval of the “Protocol and Justification of the Merger of TIM Participações

S.A. into TIM S.A.”, executed on July 29th, 2020 by the management of the Company and of TIM S.A. (respectively,

“TSA” and “Protocol”), which establishes the terms and conditions of the proposal of the merger of the

Company into TSA (“Merger”); (2) the ratification of the appointment and hiring of Apsis Consultoria e Avaliações

Ltda. and of Apsis Consultoria Empresarial Ltda., specialized companies responsible for preparing, respectively, the

appraisal report of the Company’s equity at book value and the appraisal reports of the shareholders’ equity of the

Company and TSA at market price, for the purposes of the Merger (respectively, “Appraisal Report at Book Value”, “Appraisal

Reports at Market Price” and, together, “Appraisal Reports”); (3) the approval of the Appraisal Reports;

(4) the approval of the Merger, under the terms of the Protocol and subject to compliance with the suspensive condition

established therein; (5) the authorization for the performance, by the officers and attorneys-in-fact of the Company, of

all necessary measures for the consummation of the Merger, under the terms of the Protocol; and (6) the proposal to amend

the Company's Long-Term Incentive Plans, so that TSA will appear exclusively as the company responsible for the obligations arising

thereon.”

|

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

July 29th, 2020

|

(8) Acknowledged the studies

conducted on strategic projects of the Company, as presented by Mr. Adrian Calaza, Diretor Financeiro and Diretor de

Relações com Investidores (Chief Financial Officer and Investor Relations Officer) of the Company.

(9) Approved the proposal

of the Company’s MBO Program for the year of 2020, part of the Profit Sharing Program, presented by the representative of

the HRO Planning, Compensation & Industrial Relations area, Mr. Marcello Curvelo, based on the favorable assessment of the

CR, at its meeting held on July 28th, 2020.

(10) Regarding the Company’s

Long Term Incentive Plan (“Plan”), previously approved by the Extraordinary Shareholders’ Meeting, held on April

19th, 2018, the Board Members acknowledged on the results for the first vesting period related to the

2019 grant and approved the proposal for the payment method, as follows: (a) transfer of all amounts due in shares,

including dividends, as provided for in the Plan; (b) for the transfer of shares, use of those which are held in treasury, as provided

for in the Plan and under the terms of the Repurchase Program, previously approved by the Company’s Board of Directors at

its meeting held on June 26th, 2019; and (c) use of the Average Share Price, weighted by the financial volume estimated

by B3 S.A. – BRASIL, BOLSA, BALCÃO, considering the month of June 2020, which period is the same used to measure the

performance of the Company’s shares in the calculation of the External KPI, for the purpose of converting the due amounts

from dividends into additional shares. The Company’s Board of Officers is authorized to perform all necessary acts to carry

out the resolutions approved herein.

(11) The Board members acknowledged

the results of the last Repurchase of Shares Program, approved at the Company’s Board of Directors meeting held on June 26th,

2019 (“Program 3”) and approved its closure, as well as the opening of a new Repurchase of Shares Program

("Program 4"), pursuant to Section 22, V, of the Company's By-laws and Section 5 of CVM Instruction No. 567, with the

following conditions:

(11.1) Purpose: to support the

stock-based compensation under the LTI Incentive Plan or for eventual cancellation, without reducing the capital stock.

|

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

July 29th, 2020

|

(11.2) Number of shares that may

be acquired: up to three hundred and ninety-seven thousand, three hundred and thirty-one (397,331) common shares of the Company

("Shares") may be acquired, without reduction of the capital stock, corresponding to zero, point, zero, two percent (0.02%)

of the total common shares of the Company or zero, point, zero, five percent (0.05%) of the free float shares. The Board of Officers

may decide the best moment, within the term of the Program, to carry out the Shares acquisitions, and perform one or several acquisitions.

(11.3) The Program shall begin

on the date of the Board of Directors' resolution, remaining in force until July 29th, 2021, with the acquisitions carried

out on the Stock Exchange (B3 S.A. - Brasil, Bolsa e Balcão) at market prices, observing applicable legal and regulatory

limits.

(11.4) Intermediary financial

institution: GENIAL INVESTIMENTOS CORRETORA DE VALORES MOBILIÁRIOS S.A. (ex-Brasil Plural CCTVM S/A), established at Rua

Surubim, 373, 1º andar, São Paulo/SP, CEP 04571-050.

(11.5) Resources to be used: the

resources of the capital and profit reserves, which total eleven billion, five hundred and ten million, three hundred and ten thousand,

six hundred and sixty-one reais and twenty-six cents (R$11,510,310,661.26), net of funding costs, will be used according to the

Interim Financial Statements, dated as of June 30th, 2020, except for the reserves referred in the Section 7, paragraph

1, of CVM Instruction No. 567 of September 17th, 2015 ("ICVM 567").

(11.6) Pursuant to Section 5 of

ICVM 567, the members of the Company's Board of Directors provided the information contained in Appendix I to these minutes

and authorized the Company's Officers to perform all necessary acts to complete the transaction.

(12) Approved the amendment

proposal of the Internal Audit’s Internal Ruling of the Company, after the presentation made by Mr. Alberto Ragazzini, Director

of the Company’s Internal Audit area, and based on the favorable assessment of the CAE, at its meeting held on July 28th,

2020,

(13) Approved the amendment

proposal of the Company's Related Parties Policy, in accordance with the proposal presented, and based on the favorable assessment

of the CAE and CCR, registered at their meetings held on June 24th, 2020.

|

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM PARTICIPAÇÕES S.A.

July 29th, 2020

|

(14) The Board Members acknowledged

on the several preventive measures adopted by the Company’s management, in view of the progress and developments

related to Covid-19, with the special emphasis for the positive repercussion of the external and internal agents of the Company,

due to the actions adopted in order to mitigate the risks involved, and also highlighting the results of the survey conducted with

the employees on the possibility of returning activities to the Company’s offices. The Company’s management is monitoring

the situation and evaluating the effects on its activities.

CLOSING: With no further

issues to discuss, the meeting was adjourned, and these minutes drafted as summary, read, approved and signed by all attendees

Board Members.

I herein certify that these minutes are

the faithful copy of the original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), July 29th,

2020.

JAQUES HORN

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: July 29, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

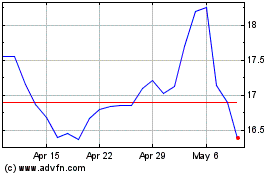

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

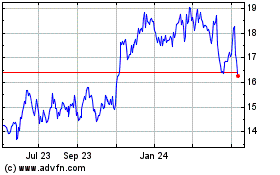

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024