SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

July, 2020

Commission File

Number 001-14491

TIM PARTICIPAÇÕES

S.A.

(Exact name of registrant

as specified in its charter)

TIM PARTICIPAÇÕES

S.A.

(Translation of Registrant's

name into English)

Avenida João

Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No ___X____

Merger of TIM Participações

S.A. with and into TIM S.A.

TIM

Participações S.A.

(incorporated in the Federative Republic of Brazil as a sociedade anônima)

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

Dear Shareholder/ADS holder,

On July 29, 2020, the board of directors

of TIM Participações S.A., organized under Brazilian law (“TIM Participações” or the “Holding

Company”), approved and TIM signed the Merger Agreement (protocolo de incorporação) with TIM S.A., organized

under Brazilian law (“TIM”).

As part of the proposed transaction, subject

to certain conditions, TIM Participações will merge with and into TIM, a wholly owned subsidiary of TIM Participações

(the “Merger”). The Merger is part of a reorganization of the Group, as more fully described below. The business carried

out by TIM following the Merger will be the same as the business currently carried out by TIM Participações and its

sole subsidiary TIM prior to the Merger. In this proposal, “Group” refers to the economic entity currently represented

by TIM Participações and its sole subsidiary TIM prior to the Merger, which, following the Merger, will be represented

by TIM, as the context requires. Upon the consummation of the proposed transaction, TIM Participações shareholders

will be entitled to receive one share of TIM in exchange for each TIM Participações share that they hold, in accordance

with the terms of the Merger Agreement.

At an extraordinary meeting of TIM Participações

shareholders to be held on August 31, 2020, TIM Participações shareholders will be asked to vote on the adoption

of the Merger Agreement described in this proposal. Adoption of the Merger Agreement requires the affirmative votes of the holders

of the majority of the total shares of TIM Participações. Upon effectiveness of the Merger, each TIM Participações

share will entitle its holder to receive one (1) share of TIM (a “TIM share”), without par value (the “Merger

Consideration”). If you hold TIM Participações ADSs, your TIM Participações shares underlying

your ADSs will be substituted for TIM shares upon effectiveness of the Merger and your TIM Participações ADSs will

become TIM ADSs representing the same ratio of five (5) Common shares per ADS that you hold.

TIM Brasil Serviços e Participações

S.A. (“TIM Brasil”) is currently the largest shareholder of TIM Participações through its 66.58% shareholding

interest and will hold the same interest in TIM shares following the Merger.

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND A PROXY. If you hold TIM Participações shares through an intermediary such

as a broker/dealer or clearing agency, you should consult with that intermediary about how to obtain information on the relevant

shareholders’ meeting of TIM Participações.

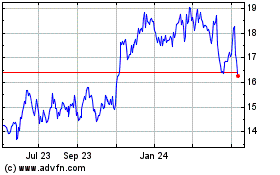

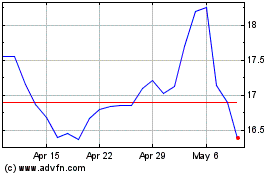

TIM Participações’s

common shares are listed on the Novo Mercado segment of the B3 under the symbol “TIMP3” and TIM Participações

ADSs are listed on the New York Stock Exchange, or the NYSE, under the symbol “TSU.” On July 28, 2020, the last full

trading day before the Merger Agreement was proposed, the closing sales price of TIM Participações’s common

shares, under the symbol “TIMP3,” was R$14.88 per share, and the closing sales price of TIM Participações’s

ADSs, under the symbol “TSU,” was US$14.38 per ADS. As of July 28, 2020, the U.S. dollar-real exchange rate

was R$5.177 per U.S.$1.00.

TIM’s shares do not currently trade

on the São Paulo Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão), or the B3, nor do they trade on any other

exchange. TIM’s common shares will be listed on the Novo Mercado segment of the B3 S.A. – Brasil, Bolsa, Balcão,

under the symbol “TIMS3” and TIM’s ADSs will be listed on the New York Stock Exchange, or the NYSE, under the

symbol “TIMB,” subject to official notice of issuance.

TIM Participações’s

board of directors has determined that the Merger Agreement and the proposed Merger are advisable and in the best interests of

TIM Participações shareholders, and recommends that its shareholders vote “FOR” adoption of the Merger

Agreement and the proposed Merger. The proposed Merger is conditioned upon the adoption of the Merger Agreement by TIM Participações

shareholders and other conditions described in the attached proposal. See “The Merger—Closing Conditions.”

Abstentions and a failure to vote your

TIM Participações Shares will have the same effect as a vote “Against” the Merger proposal, as the required

quorum for the Merger is of 50% plus one (1) share of the outstanding capital stock of TIM Participações. An abstention

occurs when a shareholder attends a meeting, either in person or by proxy, but abstains from voting. At the TIM Participações

extraordinary general shareholders meeting at which shareholders will consider the Merger proposal, abstentions will be counted

in determining whether a quorum is present.

All holders of TIM Participações

shares on the date of the extraordinary shareholders’ meeting of TIM Participações are entitled to vote on

the Merger proposal at TIM Participações’ shareholders meeting. All holders of TIM Participações

ADSs outstanding as of August 6, 2020 (the “ADS Record Date”) are entitled to give voting instructions in accordance

with the voting procedures of the TIM Participações Deposit Agreement. Subject to the applicable record dates, each

TIM Participações Share outstanding as of the date of the TIM Participações extraordinary general shareholders

meeting is entitled to one vote on the Merger proposal presented for consideration at the TIM Participações extraordinary

general shareholders meeting.

If you are a registered holder of TIM

Participações ADSs, you will receive instructions from the TIM Participações Depositary with respect

to the voting of the TIM Participações Shares underlying your TIM Participações ADSs, including any

deadlines for the TIM Participações Depositary to receive voting instructions from you. If you hold TIM Participações

ADSs in an account with a broker or other securities intermediary, you will receive notice and instructions from your securities

intermediary, and you must give your instructions in the manner and within the deadline set forth in those instructions. Your securities

intermediary should forward your instructions to the TIM Participações Depositary within the deadline set forth in

those instructions.

If you are an ADS Holder, you may only

vote for or against the Merger by giving the TIM Participações Depositary your voting instructions, and you are not

entitled to attend the TIM Participações extraordinary general shareholders meeting.

This document describes the extraordinary

meeting, the proposed Merger, the documents related to the proposed Merger and other related matters that a TIM Participações

shareholder ought to know before voting on the proposals described herein and should be retained for future reference. Please carefully

read this entire document, including the “Risk Factors” section beginning on page 5, for a discussion of the risks

relating to the proposed transaction. You also can obtain information about TIM Participações from documents that

it has filed with the Securities and Exchange Commission. See “Where You Can Find More Information” for instructions

on how to obtain such information.

Sincerely,

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved the common shares of TIM to be issued hereunder or determined if this proposal

is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this document is July 29, 2020 and it is first

being mailed or otherwise delivered to TIM Participações shareholders resident in the United States and holders of

TIM Participações ADSs on or about August 6, 2020.

TIM Participações

S.A.

Avenida João Cabral de Melo Neto,

nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

NOTICE OF EXTRAORDINARY MEETING OF

SHAREHOLDERS

TO BE HELD ON AUGUST 31, 2020

To the Shareholders and ADS Holders of TIM Participações

S.A.:

You are cordially invited to attend the

extraordinary meeting of shareholders of TIM Participações S.A., organized under Brazilian law (“TIM Participações”).

The meeting will be held on August 31, 2020 at TIM Participações’ headquarters in the City of Rio de Janeiro,

State of Rio de Janeiro, located at Avenida João Cabral de Mello Neto, nº 850, Torre Sul, Térreo - Auditório,

Barra da Tijuca, and is expected to begin at 2:30 p.m. (Brasília Time), for the following purposes:

|

|

·

|

to ratify the hiring of the appraisers responsible for preparing the valuation reports necessary for the Merger, to approve

the valuation reports and to approve the terms and conditions of the Merger Agreement (protocolo de incorporação);

|

|

|

·

|

to authorize and approve the Merger, which involves the merger of TIM Participações, as the merging entity, with

and into TIM, as the surviving entity; and

|

TIM Participações’s

board of directors has determined that the Merger Agreement and the proposed Merger are advisable and in the best interests of

TIM Participações shareholders, and recommends that its shareholders vote “FOR” adoption of the Merger

Agreement and the proposed Merger. The proposed Merger is conditioned upon the adoption of the Merger Agreement by TIM Participações

shareholders and other conditions described in the attached proposal.

The record date for any meeting of the

TIM Participações shareholders is the date of the shareholders’ meeting of TIM Participações.

Therefore, the record date is expected to be on August 31, 2020 for the extraordinary general shareholders’ meeting of TIM

Participações. Holders of TIM Participações shares on the TIM Participações share record

date are entitled to attend and vote at the extraordinary general meeting of the TIM Participações shareholders.

Holders of TIM Participações shares may appoint a proxy holder to vote on their behalf or vote by remote voting ballots

(boletim de voto à distância) of TIM Participações. Holders of TIM Participações

shares who, according to CVM Instruction No. 481/2009, choose to vote by means of the remote voting ballot must transmit the instructions

for filling out the ballot to their respective custodians or to the bookkeeping institution of our shares in Brazil, or may send

the ballot directly to us, in any case we must receive the remote voting ballots no later than seven days before the extraordinary

general meeting.

The record date set by the Depositary

for the TIM Participações ADSs is August 6, 2020. Holders of TIM Participações ADSs on the TIM Participações

ADS Record Date must instruct the Depositary as to how to vote the shares represented by their ADSs in accordance with the procedures

established by the Depositary for that purpose.

Adoption of the Merger Agreement requires

the affirmative votes of the holders of the majority of the total shares of TIM Participações. Upon effectiveness

of the Merger, each TIM Participações share will entitle its holder to receive one (1) share of TIM (a “TIM

share”), without par value (the “Merger Consideration”). If you hold TIM Participações ADSs, your

TIM Participações shares underlying your ADSs will be substituted for TIM shares upon effectiveness of the Merger

and your TIM Participações ADSs will become TIM ADSs representing the same ratio of five (5) Common shares per ADS

that you hold.

TIM Brasil Serviços e Participações

S.A. (“TIM Brasil”) is currently the largest shareholder of TIM Participações through its 66.58% shareholding

interest and will hold the same interest in TIM shares following the Merger.

Abstentions and a failure to vote your

TIM Participações Shares will have the same effect as a vote “Against” the Merger proposal, as the required

quorum for the Merger is of 50% plus one (1) share of the outstanding capital stock of TIM Participações. An abstention

occurs when a shareholder attends a meeting, either in person or by proxy, but abstains from voting. At the TIM Participações

extraordinary general shareholders meeting at which shareholders will consider the Merger proposal, abstentions will be counted

in determining whether a quorum is present.

All holders of TIM Participações

shares on the date of the extraordinary shareholders’ meeting of TIM Participações at which shareholders will

consider the Merger proposal are entitled to vote on the Merger proposal at TIM Participações’ shareholders

meeting. All holders of TIM Participações ADSs outstanding as of the ADS Record Date are entitled to give voting

instructions in accordance with the voting procedures of the TIM Participações Deposit Agreement. Subject to the

applicable record dates, each TIM Participações Share outstanding as of the date of the TIM Participações

extraordinary general shareholders meeting is entitled to one vote on the Merger proposal presented for consideration at the TIM

Participações extraordinary general shareholders meeting.

If you are a registered holder of TIM

Participações ADSs, you will receive instructions from the TIM Participações Depositary with respect

to the voting of the TIM Participações Shares underlying your TIM Participações ADSs, including any

deadlines for the TIM Participações Depositary to receive voting instructions from you. If you hold TIM Participações

ADSs in an account with a broker or other securities intermediary, you will receive notice and instructions from your securities

intermediary, and you must give your instructions in the manner and within the deadline set forth in those instructions. Your securities

intermediary should forward your instructions to the TIM Participações Depositary within the deadline set forth in

those instructions.

TIM will apply to list the TIM shares

and American Depositary Shares, or ADSs, on the NYSE, where trading is expected to commence upon the deposit of the TIM shares

merger consideration with the B3’s Central Depository in Brazil, which is expected to occur in up to 45 days after the Effective

Date. Assuming the TIM Participações shareholders approve the Merger and the conditions precedent to closing are

satisfied, the Merger is expected to become effective as of the 15th day following the date of approval of the merger

resolutions (the “Effective Date”). Between the Effective Date of the Merger and the first date of trading of TIM

share and its ADSs, shareholders and holders of ADSs will continue to be able to trade TIM Participações shares

and TIM Participações ADSs. See “The Merger—Effectiveness of the Merger.” TIM has applied for

admission to listing and trading of the TIM shares on the B3 S.A. – Brasil, Bolsa, Balcão (“B3”). The

listing on the B3 is expected to occur shortly following the merger resolutions.

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND A PROXY. If you hold TIM Participações shares through an intermediary such

as a broker/dealer or clearing agency, you should consult with that intermediary about how to obtain information on the relevant

shareholders’ meeting of TIM Participações.

If you are an ADS Holder, you may only

vote for or against the Merger by giving the TIM Participações Depositary your voting instructions, and you are not

entitled to attend the TIM Participações extraordinary general shareholders meeting.

Sincerely,

REFERENCES TO ADDITIONAL INFORMATION

This proposal incorporates important business

and financial information about TIM Participações from documents that are not included in or delivered with this

document. You may have already been sent some of the documents incorporated by reference, but you can obtain any of them through

the Securities and Exchange Commission website at http://www.sec.gov or from TIM Participações, excluding all exhibits

(unless an exhibit has been specifically incorporated herein by reference), by requesting them in writing or by telephone from

TIM Participações at the following address:

Adrian Calaza

Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

João Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

Tel: 55 21 4109-4167

ri@timbrasil.com.br

You can also get more information by visiting

TIM Participações’s website at www.tim.com.br. Website materials

are not part of this proposal.

No voting materials will be mailed to

shareholders. In order to vote your TIM Participações shares at the extraordinary general meeting of the TIM Participações

shareholders, you must either attend the extraordinary general meeting and vote in person or confer with your proxy.

If you own ADSs, the Depositary will mail

you a voting instruction card and, in order to vote the shares underlying those ADSs, you must instruct the Depositary as to how

to vote such shares in accordance with the procedures established by the Depositary for that purpose.

See “Where You Can Find More Information.”

table

of contents

Page

|

Where You Can Find More Information

|

i

|

|

Incorporation of Certain Documents by Reference

|

ii

|

|

Questions and Answers About the Merger

|

iii

|

|

Presentation of Financial and Other Information

|

x

|

|

Cautionary Statements Concerning Forward-Looking Statements

|

xii

|

|

Summary

|

1

|

|

Risk Factors

|

5

|

|

The Tim Participações Extraordinary General Meeting Date, Time Place and Matters To Be Considered

|

7

|

|

The Merger

|

11

|

|

Tax Consequences

|

14

|

|

TIM

|

19

|

|

Selected Historical consolidated Financial and Other Data

|

22

|

|

Unaudited Pro Forma Condensed Consolidated Financial Information

|

23

|

|

Market Prices

|

28

|

|

Exchange Rates

|

30

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

31

|

|

Major Shareholders and Related Party Transactions

|

32

|

|

The TIM Shares and By-laws

|

33

|

|

Comparison of Rights of Shareholders and Corporate Governance of TIM Participações and TIM

|

43

|

|

Quantitative and Qualitative Disclosure about Market Risk

|

44

|

|

Legal Matters

|

44

|

|

Service of Process and Enforcement of Judgments

|

44

|

Where

You Can Find More Information

TIM Participações files

annual reports on Form 20-F and furnishes reports to the SEC on Form 6-K under the rules and regulations that apply to foreign

private issuers. TIM is not yet subject to the reporting requirements of the Exchange Act and, therefore, has not yet filed any

annual reports on Form 20-F or furnished any reports on Form 6-K; however, TIM will commence filing and furnishing such reports

immediately upon consummation of the Merger. As foreign private issuers, TIM Participações, TIM and their shareholders

are exempt from some of the reporting requirements of the Exchange Act, including the proxy solicitation rules, the rules regarding

the furnishing of annual reports to stockholders and Section 16 short-swing profit reporting for officers, directors and holders

of more than 10% of a company’s shares. The SEC maintains a website at www.sec.gov that contains reports and other information

regarding issuers that file electronically with the SEC. You may refer to the public filings of TIM Participações

and TIM that are available on the website of the SEC to obtain updated information following the effectiveness of the Merger.

You may read and copy any materials filed

by TIM Participações and TIM with the SEC at the SEC’s public reference

room in Washington, D.C. Information on the operation of the public reference room is available over the Internet at http://www.sec.gov.

Investors may also inspect and copy this material at the offices of the New York Stock Exchange, Inc. at 20 Broad Street, New York,

NY 10005. In addition to the public reference facilities maintained by the SEC and the NYSE, investors may obtain the proposal,

upon written request, from JPMorgan Chase Bank, N.A., as depositary (the “Depositary”), at its corporate trust office

located at the address set forth below.

TIM Participações provides

annual reports in English of all notices relating to meetings of its shareholders or to distributions to shareholders or the offering

of rights and a copy of any other report or communication made generally available to shareholders. The Depositary will make all

these notices, reports and communications that it receives from us available for inspection by registered holders of ADSs at its

office. The Depositary will mail copies of those notices, reports and communications to you if we ask the Depositary to do so and

furnish sufficient copies of materials for that purpose.

TIM Participações also files

annual and quarterly reports and other information, all of which is in Portuguese, with the Brazilian Securities and Exchange Commission

(Comissão de Valores Mobiliários or “CVM”) in accordance with the rules and regulations of the

CVM.

You may also request a copy of such documents

at no cost by calling or writing to TIM Participações S.A., João Cabral de Melo Neto Avenue, 850 – North

Tower – 12th floor, 22775-057 Rio de Janeiro, RJ, Brasil, Tel. No.: +(55) 21-4109-4167, no later than August 24, 2020 or

five business days before the date of the TIM Participações extraordinary general meeting.

Incorporation

of Certain Documents by Reference

We “incorporate by reference”

certain information into this proposal. This means that we can disclose important information to you by referring you to another

document. The information incorporated by reference is considered to be a part of this proposal, except for any information superseded

by information that is included directly in this document or incorporated by reference subsequent to the date of this document.

We incorporate by reference into this

proposal the following documents listed below, which TIM Participações has already filed with or furnished to the

SEC:

|

|

1.

|

Annual report of TIM Participações on Form 20-F for the fiscal year ended December 31, 2019 filed on April 30,

2020, as amended on May 1, 2020 (“TIM Participações 2019 Form 20-F”).

|

|

|

2.

|

TIM Participações’s report on Form 6-K filed on May 5, 2020 relating to TIM Participações’s

first quarter 2020 results, including its financial statements prepared in accordance with International Financial Reporting Standards,

or IFRS, at and for the three months ended March 31, 2020 and at and for the year ended December 31, 2019 (“TIM Participações

Q1 Form 6-K”).

|

Unless otherwise indicated, all financial

information provided in TIM Participações’s annual report on Form 20-F or in any reports on Form 6-K incorporated

by reference in this proposal are prepared in accordance with IFRS.

All subsequent reports that TIM Participações

files on Form 20-F under the Exchange Act after the date of this proposal and prior to the termination of the offering shall also

be deemed to be incorporated by reference into this proposal and to be a part hereof from the date of filing such documents. We

may also incorporate by reference any Form 6-K that TIM Participações submits to the SEC after the date of this proposal

and prior to the termination of this offering by identifying in such Form 6-K that it is being incorporated by reference into this

proposal. As you read the above documents, you may find inconsistencies in information from one document to another. If you find

inconsistencies, you should rely on the statements made in this proposal or in the most recent document incorporated by reference

herein.

We will provide without charge to each

person to whom this proposal has been delivered, upon the written or oral request of any such person to us, a copy of any or all

of the documents referred to above that have been or may be incorporated into this proposal by reference, including exhibits to

such documents. Requests for such copies should be directed to:

João Cabral de Melo Neto Avenue, 850

– North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brasil

Tel. No.: +(55) 21-4109-4167

Questions

and Answers About the Merger

The following are some questions

that you may have regarding the Merger and the extraordinary general shareholders’ meeting of TIM Participações

called to vote on the Merger and brief answers to those questions. TIM and TIM Participações urge you to read carefully

the remainder of this proposal because the information in this section does not provide all the information that might be important

to you with respect to the Merger and the extraordinary general meeting. Please see “Where You Can Find More Information.”

References in this proposal to

“TIM,” “we,” “us,” or “our” refer to TIM S.A., a company organized under the laws

of the Federative Republic of Brazil. References in this proposal to “TIM Participações” or “the

Holding Company” refer to TIM Participações S.A., a publicly traded company organized under the laws of the

Federative Republic of Brazil. References to “the Group” refer to TIM Participações and its consolidated

subsidiaries prior to the Merger and to TIM and its consolidated subsidiaries after the Merger, as the context requires. References

to “shareholders” refer to holders of shares of TIM Participações and TIM and holders of American Depositary

Shares (“ADSs”) representing the shares of TIM Participações and TIM, collectively.

Q: Why am I receiving this proposal?

A: You are receiving this proposal because

you own Common shares of TIM Participações, without par value (“TIM Participações shares”),

or ADSs representing TIM Participações shares.

This proposal describes the proposal to

the shareholders of TIM Participações to approve the Merger and related matters on which TIM Participações

shareholders are being requested to vote. This proposal also gives you information about TIM and TIM Participações

and other background information to assist you in making an informed decision.

None of the Merger, the merger agreement

or this proposal constitutes an offer of securities under Brazilian law and this proposal is not a prospectus or an offering document

within the meaning of Brazilian law and the rules of the CVM.

Q: What is the Merger?

A: The Merger is part of a corporate restructuring

of TIM Group under the Brazilian Corporation Law. The Merger consist of the merger of TIM Participações with and

into TIM, as the surviving company (the “Merger”), pursuant to which TIM Participações’s shareholders

will receive one (1) TIM share for each TIM Participações share that they hold.

As a result of the Merger, the registration

of the TIM Participações with the CVM and the B3 will be cancelled and TIM Participações shareholders

will receive shares of TIM (which will also be registered with the CVM and listed on the Novo Mercado segment of B3). Once the

Merger is completed, TIM Brasil Serviços e Participações S.A. will hold 66.58% of the TIM shares. Telecom

Italia Finance S.A. holds – and will hold after the Merger - 99.99% of TIM Brasil Serviços e Participações

S.A. See “The Merger” for more details.

Q: What will I receive in the Merger?

A: As described in more detail below under

“The Merger—Merger Consideration,” upon effectiveness of the Merger, each TIM Participações share

will entitle its holder to receive one (1) share of TIM (a “TIM share”), without par value (the “Merger Consideration”).

If you hold TIM Participações ADSs, your TIM Participações shares underlying your ADSs will be substituted

for TIM shares upon effectiveness of the Merger and your TIM Participações ADSs will become TIM ADSs representing

the same ratio of five (5) Common shares per ADS that you hold.

Q: When is the Merger expected to be completed?

A: The Merger will be submitted for the

approval of the shareholders at extraordinary general meetings of TIM Participações and TIM shareholders, which are

scheduled to be held on August 31, 2020 (the “merger resolutions”). The Merger is subject to certain closing conditions.

The merger resolutions will be registered with the Board of

Trade (Junta Comercial) of the State of Rio de Janeiro and,

if the closing conditions described below are met, the Merger is expected to become effective as of the 15th day following

the date of approval of the merger resolutions (the “Effective Date”). For additional details regarding these conditions

precedent, see “The Merger—Closing Conditions,” “The Merger⸺Effectiveness of the Merger” and

“Risk Factors—Risks Related to the Merger and the TIM shares.” See also “The Merger—Implementation

of the Merger” for more details.

Q: If the Merger is completed, will my TIM shares be

listed for trading?

A: Yes, if the Merger is completed, your

TIM shares will be listed for trading on the B3.

Q: When will I receive the Merger Consideration?

A: It is expected that you will receive

your Merger Consideration in up to 45 days after the Effective Date, upon the deposit of the TIM shares with the B3’s Central

Depository (Central Depositária).

Q: How was the ratio to exchange TIM shares for each

and every TIM Participações share in the Merger calculated?

A: The exchange ratio reflects that, following

the Merger, TIM will have the same number of outstanding shares (i.e., excluding treasury stock) as TIM Participações,

and that each shareholder of TIM Participações will have the exact same number of TIM shares as the number of TIM

Participações shares held immediately prior to the Merger.

Q: Are TIM Participações shareholders

entitled to exercise dissenters’, appraisal or similar rights?

A: Yes, TIM Participações

shareholders that did not vote in favor of the Merger (including those that were absent from the relevant shareholders’ meeting)

are entitled to exercise withdrawal rights as provided under Article 137 of Brazilian Corporate Law. In this case, dissenting shareholders

will receive the book value of TIM Participações shares on March 31, 2020. Withdrawal rights may be exercised at

any time during the 30 days following the publication of the merger resolutions in the periodicals where TIM Participações

generally publishes its corporate documents (official gazette of the State of Rio de Janeiro (Diário Oficial do Estado

do Rio de Janeiro) and Valor Econômico), which publication is expected to occur within four days of the shareholders’

meeting of TIM Participações. The board of directors of TIM has the power to call a new shareholders’ meeting

to reconsider the Merger within 10 days from the end of the 30-day period for exercising withdrawal rights, if, in the board’s

judgment, it determines that payment for the shares of dissenting shareholders could jeopardize the financial position of TIM.

See “The Merger—Closing Conditions,” “The Merger⸺Effectiveness of the Merger” and “Risk

Factors—Risks Related to the Merger and the TIM shares.” See also “The Merger—Implementation of the Merger”

for more details.

If the shareholders’ meeting giving

rise to withdrawal rights occurs more than 60 days after the date of the last approved balance sheet, a shareholder that exercised

its withdrawal rights may demand that its shares be valued on the basis of a new balance sheet (balanço especial)

that is as of a date within 60 days of such shareholders’ meeting.

Q: How will my shareholder rights as a holder of TIM

Participações shares change after the Merger?

A: The rights of shareholders in Brazilian

public entities are governed by the Brazilian Corporate Law, rules issued by the Brazilian Securities and Exchange Commission (CVM)

and by the B3 and also by the By-laws of each corporation. In this regard, it is important to note that (i) both TIM Participações

and TIM are corporations governed by the Brazilian Corporate Law; (ii) both TIM Participações and TIM will be governed

by the same rules issued by the CVM and B3 (in the case of the latter, the Novo Mercado Regulations); (iii) the By-laws of TIM

will grant to the shareholders the same governance rights as they are entitled to as shareholders of TIM Participações;

and (iv) each share will provide TIM shareholders with identical rights and privileges to those provided by each share of TIM Participações.

See “Comparison of Rights of Shareholders

of TIM Participações and TIM” for further information.

Q: Will the By-laws of TIM following the Merger be identical

to TIM Participações’s current By-laws?

A: The By-laws of TIM will grant to the

shareholders the same governance rights as they are entitled to as shareholders of TIM Participações and each share

will provide TIM shareholders with identical rights and privileges to those provided by each share of TIM Participações.

See “Comparison of Rights of Shareholders of TIM Participações and TIM” for further information.

Q: What potential negative consequences did TIM Participações

consider regarding the Merger?

A: TIM Participações considered

a number of potential negative consequences in connection with its evaluation of the Merger, such as the fact that TIM Participações

is the guarantor of TIM in certain loan agreements with institutions such as KfW IPEX and Brazilian Development Bank (Banco

Nacional de Desenvolvimento Econômico e Social), or BNDES, which require their prior consent to amend or suspend the

guarantees provided by TIM Participações. As of the date hereof, such guarantees are under discussion, and, in case

we are not successful in obtaining the required consents, we may be required to prepay the outstanding amounts of such loan agreements

as well as applicable penalties thereunder: (i) payment of R$266 million related to the acceleration of the KfW IPEX loan agreements

and reversal of the respective swap agreement; and (ii) cancelation of a R$390 million credit line related to the BNDES loan agreements

before the conclusion of the Merger. TIM is also renegotiating certain land lease agreements which also has TIM Participações

as a guarantor and, we may be subject to increased leasing costs in connection with such loan agreements as well as applicable

penalties thereunder if we are unable to successfully renegotiate such guarantees. However, TIM Participações do

not consider these mentioned risks as material to the Merger or for our shareholders.

See “Risk Factors—Risks Related

to the Merger and the TIM shares” for more information. For further information on certain of our outstanding loan agreements,

see the TIM Participações 2019 Form 20-F.

Q: Is closing of the Merger subject to the exercise

of creditors’ rights?

A: As mentioned above, we are currently

renegotiating certain TIM S.A. credit agreements regarding guarantees provided by TIM Participações. Moreover, within

a period of 60 days following the publication of the merger resolutions, creditors of both TIM and TIM Participações

that are harmed as a result of the Merger will have the right to file a legal claim to annul the Merger, provided that any such

claim will not be sufficient to annul the Merger if the surviving entity settles or makes a deposit with the relevant court in

the amount claimed.

Q: After the consummation of the Merger, will I own

the same equity ownership in TIM that I own in TIM Participações prior to the approval of the transaction?

A: Upon consummation of the Merger, you

will have the same number of shares and the same proportionate ownership in TIM as you currently have in TIM Participações.

Q: Are there any risks in the Merger that I should consider?

A: There are risks associated with all

reorganizations, including the Merger. These risks are discussed in more detail in the section entitled “Risk Factors⸺Risks

Related to the Merger and the TIM shares”

Q: Is any TIM Participações shareholder

entitled to exchange their TIM Participações shares for TIM shares pursuant to a different exchange ratio than the

exchange ratio approved for the Merger?

A: No. All TIM Participações

shareholders will be entitled to exchange their TIM Participações shares for shares of TIM pursuant to the same exchange

ratio of 1:1.

Q: Is any TIM Participações shareholder

entitled to receive merger consideration other than TIM shares in connection with the Merger?

A: No. Each TIM Participações

shareholder will only receive one (1) TIM share for each TIM Participações share that such shareholder holds.

Q: What are the material tax consequences of the Merger

to TIM Participações shareholders?

A: The tax consequences of the Merger

for any particular shareholder will depend on the shareholder’s particular facts and circumstances. Moreover, the descriptions

below and elsewhere in this proposal do not relate to the tax laws of any jurisdiction other than the U.S. and Brazil. Accordingly,

shareholders are urged to consult their tax advisors to determine the tax consequences of the Merger to them considering their

particular circumstances, including the effect of any state, local or national law.

Brazilian tax consequences

We understand that the Merger is a tax-free

transaction under Brazilian tax law and would result in the certain tax efficiencies. We expect that Holders of TIM Participações

shares and/or ADSs will not recognize any gain or loss on the exchange of their TIM Participações shares and/or ADSs

for TIM shares and/or ADSs and will have the same cost basis in the TIM shares and/or ADSs as their cost basis in the TIM Participações

shares or ADSs surrendered. Holders of TIM shares and ADSs following the Merger will be subject to the same tax treatment under

applicable Brazilian tax laws as the current holders of TIM Participações shares and ADSs.

See “Tax Consequences⸺Material

Brazilian Tax Consequences” for a more detailed discussion of Brazilian tax consequences.

U.S. tax consequences

The Merger is expected to qualify as a

reorganization for U.S. federal income tax purposes. Accordingly, unless TIM Participações was a passive foreign

investment company (a “PFIC”) during a U.S. Holder’s holding period in TIM Participações shares

or ADSs, a U.S. Holder will generally not recognize gain or loss on the exchange of TIM Participações shares or ADSs

for TIM shares or ADSs pursuant to the Merger. For a more detailed discussion of the U.S. Federal Income Tax Considerations of

the Merger to U.S. Holders, see “Tax Consequences—U.S. Federal Income Tax Considerations.”

Q: Under Brazilian Corporate Law, what corporate approvals

of TIM Participações are required for the Merger to be approved?

A: Under Brazilian Corporate Law, approval

of the shareholders of TIM Participações is required for the Merger to be approved.

Q: Are there any approvals, whether corporate, governmental

or from other third parties, required for the consummation of the Merger other than the TIM Participações corporate

approvals?

A: In order for the Merger to become

effective, TIM will need to be listed on the Novo Mercado segment of B3, which listing is expected to occur within 15 days after

the date of approval of the merger resolutions, subject to the satisfaction of the conditions precedent.

Q: When and where will the extraordinary general meeting

of the TIM Participações shareholders be held?

A: The extraordinary general meeting of

the TIM Participações shareholders is scheduled to be held on August 31, 2020 at TIM Participações’

headquarters in the City of Rio de Janeiro, State of Rio de Janeiro, located at Avenida João Cabral de Mello Neto, nº

850, Torre Sul, Térreo - Auditório, Barra da Tijuca, and is expected to begin at 2:30 p.m. (Brasília Time).

Q: What matters will be voted on at the extraordinary

general meeting of the TIM Participações shareholders?

A: The TIM Participações

shareholders will be asked to consider and vote, among other things, on the following resolutions at the extraordinary general

meeting of the TIM Participações shareholders:

|

|

·

|

to ratify the hiring of the appraisers responsible for preparing the valuation reports necessary for the Merger, to approve

the valuation reports and to approve the terms and conditions of the Merger Agreement (protocolo de incorporação);

|

|

|

·

|

to authorize and approve the Merger, which involves the merger of TIM Participações, as the merging entity, with

and into TIM, as the surviving entity; and

|

See “The Merger⸺Implementation

of the Merger” for more information.

The extraordinary general meeting of TIM

Participações is expected to be held as specified in the notice of call, which is expected to be published on TIM

Participações’s website and the website of the B3 on July 29, 2020.

Q: Who is entitled to vote the TIM Participações

shares at the extraordinary general meeting?

A: The record date for any meeting of

the TIM Participações shareholders is the date of the shareholders’ meeting of TIM Participações.

Therefore, the record date is expected to be on August 31, 2020 for the extraordinary general shareholders’ meeting of TIM

Participações. Holders of TIM Participações shares on the TIM Participações share record

date are entitled to attend and vote at the extraordinary general meeting of the TIM Participações shareholders.

Holders of TIM Participações shares may appoint a proxy holder to vote on their behalf or vote by remote voting ballots

(boletim de voto à distância) of TIM Participações. Holders of TIM Participações

shares who, according to CVM Instruction No. 481/2009, choose to vote by means of the remote voting ballot must transmit the instructions

for filling out the ballot to their respective custodians or to the bookkeeping institution of our shares in Brazil, or may send

the ballot directly to us, in any case we must receive the remote voting ballots no later than seven days before the extraordinary

general meeting.

The record date set by the Depositary

for the TIM Participações ADSs is August 6, 2020. Holders of TIM Participações ADSs on the TIM Participações

ADS Record Date must instruct the Depositary as to how to vote the shares represented by their ADSs in accordance with the procedures

established by the Depositary for that purpose.

Q: When will the extraordinary general meeting of the

TIM Participações shareholders be considered regularly convened and the resolutions at such extraordinary general

meeting validly adopted?

A: Pursuant to the Brazilian Corporation

Law, the quorum required to hold the meeting is 25% of the outstanding capital stock of TIM Participações, provided

that the meeting can be installed with any number of shareholders on second call. All shareholders are entitled to vote at such

shareholders’ meeting. The resolutions at such extraordinary general meeting will be considered validly approved upon the

affirmative vote of shareholders holding shares representing at least 50% plus one (1) share of the outstanding capital stock of

TIM Participações and the effectiveness of the Merger will be subject to certain conditions. See “The Merger—Closing

Conditions,” “The Merger⸺Effectiveness of the Merger” and “Risk Factors—Risks Related to the

Merger and the TIM shares.” See also “The Merger—Implementation of the Merger” for more details.

Q: How do I vote my TIM Participações

shares?

A: If you are a TIM Participações

shareholder as of the TIM Participações share record date, you are entitled to attend the extraordinary general meeting

of the TIM Participações shareholders in person and vote at such meeting. As provided by law, if you are a holder

of TIM Participações shares and entitled to attend the extraordinary general meeting of the TIM Participações

shareholders, you may appoint a proxy to vote on your behalf or vote by remote voting ballots (boletim de voto à distância)

of TIM Participações.

No voting materials will be mailed to

shareholders. In order to vote your TIM Participações shares at the extraordinary general meeting of the TIM Participações

shareholders, you must either attend the extraordinary general meeting and vote in person or confer with your proxy or vote by

remote voting ballots (boletim de voto à distância) of TIM Participações.

If you own ADSs, the Depositary will mail

you a voting instruction card and, in order to vote the shares underlying those ADSs you must instruct the Depositary as to how

to vote such shares in accordance with the procedures established by the Depositary for that purpose.

Q: If my TIM Participações shares or ADSs

are held through a bank or a broker (e.g., in “street name”), will my bank or broker vote my shares or ADSs for me?

A: If you are a beneficial owner and your

TIM Participações shares or ADSs are held through a bank or broker or a custodian (e.g., in “street name”),

you will receive or should seek information from TIM or the broker or custodian holding your shares or ADSs concerning how to instruct

your bank, broker or custodian as to how to vote your shares or ADSs. Alternatively, if you wish to vote in person then you need

to:

|

|

·

|

obtain a proxy from your bank, broker or other custodian (the registered shareholder) appointing you to vote the TIM Participações

shares or ADSs held on your behalf by that bank, broker or custodian; or

|

|

|

·

|

ask your depository bank to deliver to TIM Participações the communication certifying that TIM Participações

shares are registered in your name as of the extraordinary general meeting record date.

|

Q: Will I have to pay brokerage commissions in connection

with the exchange of my TIM Participações shares?

A: You will not have to pay brokerage

commissions as a result of the exchange of your TIM Participações shares into TIM shares in connection with the Merger

if your TIM Participações shares are registered in your name in the share register of TIM Participações.

If your TIM Participações shares are held through a bank or broker or a custodian linked to a stock exchange, you

should consult with such bank, broker or custodian as to whether or not such bank, broker or custodian may charge any transaction

fee or service charge in connection with the exchange of shares in connection with the Merger.

Q: When will I receive my TIM shares or TIM ADSs?

A: It is expected that you will receive

your TIM shares up to 45 days after the Effective Date, in connection with the deposit of the TIM shares with the B3’s Central

Depository (Central Depositária).

If you hold TIM Participações

ADSs, your TIM Participações ADSs will become TIM ADSs upon the deposit of the TIM shares with the B3’s Central

Depository, when the TIM Participações shares underlying the ADSs are substituted for TIM shares. From that time

forward, your ADSs will represent only TIM shares.

Q: How can I attend the extraordinary general meeting

of the TIM Participações shareholders in person?

A: The extraordinary general meeting of

the TIM Participações shareholders is scheduled to be held on August 31, 2020 at our headquarters in the City of

Rio de Janeiro, State of Rio de Janeiro, located at Avenida João Cabral de Mello Neto, nº 850, Torre Sul, Térreo

- Auditório, Barra da Tijuca, and is expected to begin at 2:30 p.m. (Brasília Time). If you are a TIM Participações

shareholder and you wish to attend the extraordinary general meeting of the TIM Participações shareholders in person,

you must request the authorized intermediary with whom your TIM Participações shares are deposited to deliver to

TIM Participações or send to you the communication certifying that the TIM Participações shares are

registered in your name as of the extraordinary general meeting record date.

Q: Do any of TIM Participações’s

directors or executive officers have interests in the Merger that may differ from those of other shareholders?

A: Even though certain of our directors

and executive officers are affiliates of our ultimate controlling shareholder, Telecom Italia, we do not expect our directors and

executive officers to have interests in the Merger that are different from, or in addition to, the interests of the other TIM Participações

shareholders. For instance, certain of our directors and executive officers are affiliates of our ultimate controlling shareholder,

Telecom Italia. Please see “The Merger—Interests of Certain Persons in the Merger” for a more detailed discussion

of how some of TIM Participações’s directors and executive officers have interests in the Merger that are different

from, or in addition to, the interests of TIM Participações other shareholders generally.

Q: How will TIM Participações’s

directors and executive officers vote at the extraordinary general meeting of TIM Participações shareholders on the

resolution to approve the Merger and related matters?

A: TIM Participações currently

expects that all directors and executive officers who beneficially own TIM Participações shares will vote all of

their TIM Participações shares (representing less than one percent of the

outstanding TIM Participações shares as of

March 31, 2020, without taking into consideration any TIM Participações share grants granted to the directors and

executive officers) in favor of the resolution to approve the Merger and related matters.

Q: What do I need to do now?

A: You are urged to carefully read this

proposal, including its appendices. You may also want to review the documents referenced under “Where You Can Find More Information”

and consult with your accounting, legal and tax advisors. Once you have considered all relevant information, if you are a shareholder,

you are encouraged to vote in person, by proxy, by remote voting ballots (boletim de voto à distância) or by

instructing your broker, so that your TIM Participações shares are represented and voted at the extraordinary general

meeting.

If you own ADSs, the Depositary will mail

you a voting instruction card and, in order to vote the shares underlying those ADSs you must instruct the Depositary as to how

to vote such shares in accordance with the procedures established by the Depositary for that purpose.

If you hold your TIM Participações

shares or ADSs in “street name” through a broker or custodian, you must instruct your broker or custodian as to how

to vote your TIM Participações shares using the instructions provided to you by your broker or custodian.

Q: Who can help answer my questions?

A: If you have any further questions about

the Merger or if you need additional copies of this proposal, please contact:

TIM Participações S.A.

Investor Relations

João Cabral de Melo Neto Avenue, 850 – North

Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brasil

Tel. No.: +(55) 21-4109-4167

Email: ri@timbrasil.com.br

Q: Where can I find more information about the companies?

A: You can find more information about

TIM and TIM Participações in the documents described under “Where You Can Find More Information.”

Presentation

of Financial and Other Information

Definitions

Unless otherwise indicated or the context

otherwise requires, all references in this proposal to “TIM Participações” refer to TIM Participações

S.A., together with its consolidated subsidiary, TIM, prior to the Merger described in this proposal, and all references to “TIM,”

“TIM S.A.,” “we,” “our,” “ours,” “us” or similar terms refer to TIM

S.A., including following the Merger described in this proposal. When we refer to the “Group,” we refer to TIM Participações

and its consolidated subsidiary prior to the Merger and to TIM after the Merger, as the context requires.

When we refer to “TIM Brasil”

or the “Parent,” we refer to our controlling shareholder, TIM Brasil Serviços e Participações

S.A., a Brazilian corporation (sociedade anônima) and our controlling shareholder. When we refer to “Telecom

Italia,” we refer to Telecom Italia S.p.A., the sole shareholder to our Parent. When we refer to the “Telecom Italia

Group,” we refer to the worldwide Telecom Italia conglomerate and its consolidated subsidiaries.

References in this proposal to certain

financial terms have the following meanings:

|

|

·

|

References to “IFRS” are to the International Financial Reporting Standards as issued by the International Accounting

Standards Board (“IASB”) and interpretations issued by the IFRS Interpretations Committee.

|

|

|

·

|

References to “audited financial statements” or “consolidated financial statements” are to the audited

consolidated financial statements of TIM Participações as of December 31, 2019, 2018 and 2017, and for each of the

fiscal years ended December 31, 2019, 2018 and 2017, incorporated herein by reference to the TIM Participações 2019

Form 20-F.

|

|

|

·

|

References to the “unaudited interim financial statements” are to the interim consolidated financial statements

of TIM Participações as of and for the three months ended March 31, 2020, together with the notes thereto. The unaudited

interim financial statements were prepared in accordance with IFRS. The unaudited interim financial statements of TIM Participações

are incorporated herein by reference to the TIM Participações Q1 Form 6-K.

|

In this proposal, the term “Brazil”

refers to the Federative Republic of Brazil. The terms “Brazilian government” or the “government” refer

to the federal government of Brazil, and the term “Central Bank” refers to Banco Central do Brasil. References

to “U.S.$,” “U.S. dollars” or “dollars” are to United States dollars, and references to “Brazilian

reais,” “reais” or “R$” are to Brazilian reais. References to “euros” or “€”

are to the common legal currency of the member states participating in the European Economic and Monetary Union.

Market Share Data

We calculate market share information

based on information provided by Brazil’s National Telecommunications Agency (Agência Nacional de Telecomunicações),

or Anatel. We calculate penetration data based on information provided by the Brazilian Institute of Geography and Statistics (Instituto

Brasileiro de Geografia e Estatística), or IBGE.

Presentation of Financial Information

We maintain our books and records in reais.

The consolidated financial statements included in this proposal were prepared in accordance with International Financial Reporting

Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. As a complement to the IFRS principles,

the Company also applies accounting practices established under Brazilian corporate law and rules issued by the CVM, for the Brazilian

Stock Market Exchange and Brazil’s National Telecommunications Agency (Agência Nacional de Telecomunicações),

or Anatel, to comply with the regulatory requirements. The selected financial information for the Company included

herein should be read in conjunction with, and is qualified in its entirety by, the IFRS consolidated financial statements incorporated

herein by reference to the TIM Participações 2019 Form 20-F.

The preparation of financial statements

in conformity with IFRS requires the use of certain critical accounting estimates. It also requires management to exercise its

judgment in the process of applying our accounting policies.

Those areas involving a higher degree of judgment or complexity,

or areas where assumptions and estimates are significant to the consolidated financial statements, are disclosed in Note 3 to our

consolidated financial statements.

Solely for the convenience of the reader,

we have translated some amounts included elsewhere in this proposal from reais into U.S. dollars using the commercial

selling exchange rate as reported by the Brazilian Central Bank (Banco Central do Brasil), or Central Bank, at March 31,

2020 of R$5.199 to U.S.$1.00. These translations should not be considered representations that any such amounts have been, could

have been or could be converted into U.S. dollars at that or at any other exchange rate. Such translations should not be construed

as representations that the real amounts represent or have been or could be converted into U.S. dollars as of

that or any other date. See “Exchange Rates” for information regarding exchange rates for the Brazilian currency.

Certain figures included in this proposal

have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation

of the figures that precede them.

The “Glossary of Selected Terms”

incorporated herein by reference to the TIM Participações 2019 Form 20-F provides definitions of certain technical

terms used in this proposal and in other documents incorporated in this proposal by reference.

Cautionary

Statements Concerning Forward-Looking Statements

We have

made statements

in this proposal that constitute

forward-looking

statements

within the meaning

of the Private

Securities Litigation

Reform Act of 1995

in relation to our plans, forecasts, expectations regarding future events, strategies and projections, which involve risks and

uncertainties and are not guarantees of future results. Forward-looking statements speak only as of the date they were made, and

we undertake no obligation to update publicly or revise any forward-looking statements after we mail or otherwise deliver this

proposal because of new information, future events and other factors. We and our representatives may also make forward-looking

statements in press releases and oral statements. Statements that are not statements of historical fact, including statements about

the beliefs and expectations of our management, are forward-looking statements. Words such as “anticipate,” “believe,”

“estimate,” “expect,” “forecast,” “intend,” “plan,” “predict,”

“project,” “target” and similar words are intended to identify forward-looking statements, which necessarily

involve known and unknown risks and uncertainties. Our actual results and performance could differ substantially from those anticipated

in our forward-looking statements. These statements appear in a number of places in this proposal, principally in the sections

captioned “TIM” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

incorporated herein by reference to the TIM Participações 2019 Form 20-F, and include, but are not limited to, statements

regarding our intent, belief or current expectations with respect to:

|

|

·

|

Brazilian telecommunications industry conditions, size and trends;

|

|

|

·

|

characteristics of competing networks’ products and services;

|

|

|

·

|

estimated demand forecasts;

|

|

|

·

|

the size of our subscriber base, particularly any increase in our postpaid subscribers;

|

|

|

·

|

development of additional sources of revenue;

|

|

|

·

|

strategy for marketing and operational expansion;

|

|

|

·

|

achieving and maintaining customer satisfaction;

|

|

|

·

|

development of higher profit margin activities, attaining higher margins, and controlling customer acquisition and other costs;

and

|

|

|

·

|

capital expenditures forecasts, funding needs and financing resources.

|

Because forward-looking statements are

subject to risks and uncertainties, our actual results and performance could differ significantly from those anticipated in such

statements and the anticipated events or circumstances might not occur. The risks and uncertainties include, but are not limited

to:

|

|

·

|

our ability to successfully implement our business strategies;

|

|

|

·

|

economic conditions in Brazil and hindrance of growth due to ongoing corruption investigations nationally involving political

officials and major Brazilian companies;

|

|

|

·

|

an increase in competition from other players and services in the telecommunications industry, particularly global and local

Over The Top, or OTT, players (operators such as mobile virtual network operators or branded resellers offering content and services

on the internet without owning their own proprietary telecommunications network infrastructure);

|

|

|

·

|

increased consolidation in the Brazilian wireless telecommunications market;

|

|

|

·

|

our ability to develop and introduce new and innovative technologies that are received favorably by the market, and to provide

“Value-Added Services,” which are services and applications that provide additional functionality to the basic transmission

services offered by a telecommunications network, to encourage the use of our network;

|

|

|

·

|

our ability to expand our services while maintaining the quality of services provided and a positive customer experience;

|

|

|

·

|

system technology failures, which could negatively affect our revenues and reputation;

|

|

|

·

|

our ability to operate efficiently and to refinance our debt as it comes due, particularly in consideration of political and

economic conditions in Brazil and uncertainties in credit and capital markets;

|

|

|

·

|

performance of third-party service providers and key suppliers on which we depend;

|

|

|

·

|

government policy and changes in the regulatory environment or in the legal framework in Brazil, particularly as an economic

group classified as having significant market power in some markets;

|

|

|

·

|

our dependence on authorizations granted by the Brazilian government;

|

|

|

·

|

the effect of inflation and exchange rate fluctuations; and

|

|

|

·

|

other factors identified or discussed under “Risk Factors” and elsewhere in this proposal.

|

The words “believe,” “may,” “will,”

“aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“forecast” and similar words are intended to identify forward-looking statements. You should not place undue reliance

on such statements, which speak only as of the date they were made. We undertake no obligation to update publicly or to revise

any forward-looking statements after we distribute this proposal because of new information, future events or other factors. Our

independent public accountants have neither examined nor compiled the forward-looking statements and, accordingly, do not provide

any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances

discussed in this proposal might not occur and are not guarantees of future performance. Because of these uncertainties, you should

not make any investment decision based upon these estimates and forward-looking statements.

Summary

This summary highlights selected

information from this proposal and might not contain all of the information that is important to you. You should read carefully

the entire proposal, including the Appendices to which this proposal refers, to understand fully the Merger.

TIM S.A.

We are a telecommunications publicly-held

company that offers mobile voice and data services, broadband internet access, Value-Added Services, and other telecommunications

services and products. TIM is recognized for its strong brand and for its reputation as an innovative and disruptive company capable

of setting new consumption standards for the market.

Our forward-looking strategy is based

on the five strategic fronts set forth below, each of which is focused on our main stakeholders (customers, employees and shareholders),

and which, together, are aimed to redesign the customer experience and make TIM the best choice by value in the market, supported

by its position as the leader in the mobile ultra-broadband and its array of innovative offers: (i) move from volume to value;

(ii) improve efficiency; (iii) monetize beyond the core; (iv) enhance technology and operations; and (v) explore fixed broadband

opportunities.

Summary of the Terms and Conditions of the Merger

The terms and conditions of the Merger

are set forth in (i) the form of merger agreement (protocolo de incorporação) approved by the Board of Directors

of TIM and the Board of Directors of TIM Participações for submission to shareholders, in each case on July 29, 2020;

(ii) the securities filings made in connection with the merger; and (ii) the minutes of the shareholders’ meetings of TIM

Participações and TIM approving the Merger, which are expected to be held on August 31, 2020 at 2:30 p.m. (the “Merger

Resolutions”). You should read the form of merger agreement (protocolo de incorporação) included in

this proposal, which will be mailed to shareholders in advance of the shareholders’ meeting of TIM Participações,

carefully as they are legal documents that govern the terms of the Merger.

If the Merger is approved by the requisite

vote of the TIM Participações shareholders, TIM Participações will be merged into TIM. Upon effectiveness

of the Merger, TIM Participações will cease to exist as a separate legal entity and TIM will succeed to all of the

assets and liabilities of TIM Participações.

The effectiveness of the Merger (“closing

date”) will be conditioned on the satisfaction of the closing conditions described in “The Merger—Closing Conditions.”

If the Merger is completed, TIM Participações

shareholders will receive one (1) TIM share for each one (1) TIM Participações share that they hold (the “exchange

ratio”).

The Merger is subject to the following

closing conditions that are not yet satisfied at the date of this proposal, including:

|

|

·

|

The authorization of the Merger by the shareholders of both TIM Participações and TIM, pursuant to Articles 129,

136 and 227 of the Brazilian Corporation Law; and

|

|

|

·

|

The listing of TIM on the Novo Mercado segment of B3.

|

Timetable for the Merger

The Merger is expected to occur on the

following timetable:

|

|

·

|

TIM Participações and TIM announced the Merger on July 29, 2020;

|

|

|

·

|

TIM Participações and TIM are expected to hold extraordinary shareholders’ meetings on August 31, 2020,

at which shareholders of TIM Participações and TIM will be asked to approve the Merger;

|

|

|

·

|

Assuming the shareholders of TIM Participações and TIM approve the Merger, the merger resolutions of both TIM

Participações and TIM will be published in the periodicals where the Registrant generally publishes its corporate

documents (official gazette of the State of Rio de Janeiro (Diário Oficial do Estado do Rio de Janeiro) and Valor

Econômico), which publication is expected to occur within four days of the shareholders’ meetings;

|

|

|

·

|

Assuming that the other closing conditions are met, the Merger will become effective as of the Effective Date, which is expected

to be 15 days following the date of the approval of the merger resolutions. See “The Merger—Effectiveness of the Merger;”

and

|

|

|

·

|

The trading of the TIM shares and American Depositary Shares, or ADSs, on the NYSE is expected to commence in up to 45 days

after the Effective Date, upon the deposit of the TIM shares with the B3’s Central Depository (Central Depositária)

in Brazil.

|

Accounting Treatment

Each of TIM Participações

and TIM prepares its consolidated financial statements in accordance with IFRS. Following the Merger, TIM will continue preparing

its consolidated financial statements in accordance with IFRS. Under IFRS, the Merger consists of a common control transaction

that does not meet the definition of a business combination and therefore is outside the scope of application of IFRS 3—Business

Combinations. Accordingly, it will be accounted for as an equity transaction at the existing carrying amounts.

Comparison of Shareholder Rights

For a comparison of the rights of shareholders

of TIM Participações and TIM, please see “Comparison of Rights of Shareholders of TIM Participações

and TIM.”

Regulatory Filings and Approvals Necessary to Complete

the Merger

In order for the Merger to become effective,

TIM will need to be listed on the Novo Mercado segment of B3, which listing is expected to become effective within 15 days after

the date of approval of merger resolutions.

Shareholding Structure

Currently, TIM is a wholly owned subsidiary

of TIM Participações.

Immediately following the merger, TIM

shareholding structure will be identical to that of TIM Participações prior to the merger, provided that all treasury

stock held by TIM Participações will be cancelled.

Risk Factors

Investing in TIM shares involves the same

risks as investing in the shares of TIM Participações. There are also some risks associated with the merger. In considering

the Merger, you should carefully consider the information about these risks set forth under the section entitled “Risk Factors.”

Summary Historical Financial Data

TIM Participações and TIM

For the selected historical consolidated

financial data of TIM Participações, please see TIM Participações 2019 Form 20-F and the TIM Participações

Q1 Form 6-K incorporated herein by reference. Given that TIM is the sole subsidiary of TIM Participações S.A., its

financial statements are substantially the same as those of TIM Participações S.A., except for amounts related to

goodwill, judicial deposits and contingencies included in TIM Participações S.A. financial statements and not included

in TIM S.A. financial statements.

The unaudited interim financial statements

have been prepared on the same basis as the audited financial statements and include all adjustments (consisting of normal recurring

adjustments) necessary for a fair presentation of the unaudited interim financial statements. Interim results are not necessarily

indicative of results that may be

expected for a full year or any future interim period. Historical

results for any period are not necessarily indicative of results to be expected for any future period.

Per Share Data

The following tables present selected

historical per share data of TIM and TIM Participações at and for the three months ended March 31, 2020 and the year

ended December 31, 2019 as well as on a pro forma basis giving effect to the Merger. The selected historical per share information

of TIM and TIM Participações at and for the three months ended March 31, 2020 and at and for the year ended December

31, 2019 set forth below has been derived from the unaudited interim financial statements and the audited financial statements,

respectively. You should read the information in this section together with the unaudited interim financial statements and the

audited financial statements incorporated by reference into this proposal.

|

|

TIM(2)

|

TIM

Participações

|

Pro

Forma(3)

|

|

|

At

and for the three months ended March 31, 2020

|

|

|

(in R$)

|

|

Basic earnings per ordinary share

|

0.004

|

0.07

|

0.07

|

|

Cash dividends per ordinary per share(1)

|

0.01

|

0.23

|

0.23

|

|

Book value per ordinary share (net of treasury shares)

|

0.53

|

9.33

|

9.33

|

|

|

(1)

|

Dividends are paid in Brazilian reais.

|

|

|

(2)

|

Per share amounts based on the total outstanding number of TIM shares following the pre-Merger capital restructuring.

|

|

|

(3)

|

Per TIM share on a pro forma basis giving effect to the Merger as if it had occurred on January 1, 2020.

|

|

|

TIM(2)

|

TIM

Participações

|

Pro

Forma(2)(3)

|

|

|

At

and for the year ended December 31, 2019

|

|

|

(in R$)

|

|

Basic earnings per ordinary share

|

0.09

|

1.50

|

1.50

|

|

Cash dividends per ordinary per share(1)

|

0.02

|

0.32

|

0.32

|

|

Book value per ordinary share (net of treasury shares)

|

0.52

|

9.27

|

9.27

|

|

|

(1)

|

Dividends, if and when declared, are paid in Brazilian reais.

|

|

|

(2)

|

Per share amounts based on the total outstanding number of TIM shares following the pre-Merger capital restructuring.

|

|

|

(3)

|

Per TIM share on a pro forma basis giving effect to the Merger as if it had occurred on January 1, 2019.

|

Per Share Market Price