Report of Foreign Issuer (6-k)

May 21 2019 - 6:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2019

Commission File Number 001-14491

TIM PARTICIPAÇÕES S.A.

(Exact name of registrant as specified in its charter)

TIM PARTICIPAÇÕES S.A.

(Translation of Registrant's name into English)

Avenida João Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

TIM PARTICIPAÇÕES S.A.

Publicly-held Company

CNPJ/MF nº 02.558.115/0001-21

NIRE 33 300 276 963

NOTICE TO THE MARKET

CONFIRMATION OF GUIDANCE 2019-2021 ADJUSTED TO NEW ACCOUNTING STANDARDS

TIM Participações S.A. (“Company”) (B3: TIMP3 e NYSE: TSU), in compliance with Article 157 of Law No 6,404 and the provisions of CVM Instruction No 358, hereby informs its shareholders, the market in general and other interested parties that, following the Material Fact released on February 21, 2019, in which the projections of its 2019-2021 Strategic Plan were presented, the Telecom Italia Group disclosed today, in a view that includes the effects of the accounting standards of IFRS 9 and IFRS 15, its projections for the period.

In this context, TIM confirms the projections presented in the Material Fact mentioned above and presents, in the table below, such projections based on the adoption of aforementioned accounting standards:

|

|

Projections 2019-21

in view without IFRS 9, 15 and 16

|

Projections 2019-21

in view with IFRS 9 and 15

|

|

KPI

|

Short Term

|

Long Term

|

Short Term

|

Long Term

|

|

Service Revenues Growth (YoY)

|

3-5%

|

CAGR ’18-’21

Mid-Single Digit

|

3-5%

|

CAGR ’18-’21

Mid-Single Digit

|

|

EBITDA Growth (YoY) / % EBITDA Margin

|

Mid to High-Single Digit Growth

|

≥40% in 2020

|

Mid to High-Single Digit Growth

|

≥39% in 2020

|

|

∑ CAPEX /

% CAPEX over Net Revenues

|

Low 20s

|

~R$ 12.5 bi (∑‘19-’21)

|

Low 20s

|

~R$ 12.0 bi (∑‘19-’21)

|

|

% EBITDA – CAPEX

over Net Revenues

|

>15%

|

≥20%

|

>15%

|

≥20%

|

Rio de Janeiro, May 20th, 2019.

TIM Participações S.A.

Adrian Calaza

Chief Financial Officer and

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date:May 20, 2019

|

By:

|

/s/

Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

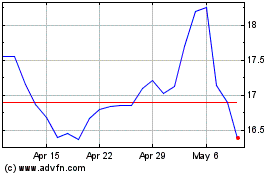

TIM (NYSE:TIMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

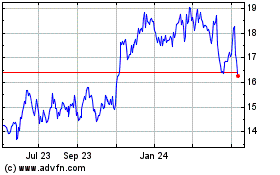

TIM (NYSE:TIMB)

Historical Stock Chart

From Apr 2023 to Apr 2024