Proxy Statement (definitive) (def 14a)

October 30 2019 - 3:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed

by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

☑

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

Thor Industries, Inc.

(Name of Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☑

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

Letter from the Board of Directors

Dear Fellow Shareholders of Thor Industries:

As your Board of Directors, we are pleased to submit to you our Fiscal Year 2019 Proxy.

Fiscal Year 2019 was transformational as we acquired one of Europe’s largest manufacturer of RVs, the Erwin Hymer Group (“EHG”), an acquisition that firmly establishes Thor as the worldwide leader in RV production and sales. We

believe the EHG acquisition will drive value for you, our Shareholders, for years to come. Additional important milestones and accomplishments in our Fiscal Year 2019 include:

|

|

•

|

|

Peter Orthwein, one of the founders of your Company, announced his retirement as our Chairman. Peter’s accomplishments and contributions to our Company have been instrumental to our success. On behalf of all of the

Shareholders, the Board thanks Peter for his years of service as our Chairman. In recognition of his great value to our Company, the Board of Directors named Peter our Chairman Emeritus. We look forward to his continued service as a member of our

Board.

|

|

|

•

|

|

We named Andy Graves as our new Chairman of the Board effective on August 1, 2019, making him our first independent Chairman.

|

|

|

•

|

|

We continued our focus on governance excellence and were dedicated in our evaluation of the Company’s governance program, including a detailed review of where Thor currently stands in terms of its environmental,

social, and governance (“ESG”) profile. For many years, Thor has been a socially-conscious company and has undertaken key initiatives designed to benefit our environment and the communities within which we operate. A clean and enjoyable

environment is essential to our business, making this focus important to all of us. What Thor had never done, however, is put a spotlight on its efforts. In 2019, we engaged in a thorough analysis of our current profile, culminating in the release

of our first ever ESG Report. It can be found on our website, www.thorindustries.com. Understanding what we are currently doing is just the first step on this intentional journey. Now that we have these

datapoints, we are setting goals designed to create a continuously improving ESG program. The program is directly managed by a committee of four at the Company, including two of our Named Executive Officers, and ultimate responsibility for the

program is overseen by us, through our Nominating and Corporate Governance Committee. Society demands that companies serve a social purpose as well as a financial purpose. We believe that without this sense of purpose, no company can truly achieve

its highest value. We are excited about this journey and about our potential to deliver on the ESG initiatives we have undertaken.

|

|

|

•

|

|

In this Proxy, we submit our full slate of directors for election. This is the first time that our annual election occurs with a declassified Board.

|

|

|

•

|

|

As we managed through a challenging North American market in 2019, we gained better insight into important opportunities to improve our operational excellence across the Thor Companies and have initiated a number of

difference-making initiatives that will have positive impacts on the quality of the products we build as well as the efficiency with which we build them. These initiatives certainly include, but are not limited to, the many synergistic opportunities

driven by the EHG transaction.

|

1

THOR INDUSTRIES, INC.

OUR 2019 OPERATING

PERFORMANCE

In many ways, 2019 was a challenging year for Thor. In 2019, our top and bottom line performance continued to be negatively impacted by the

headwinds experienced during the second half of Fiscal Year 2018, including, specifically, the dealer inventory rebalancing, a decline in retail sales from Fiscal Year 2018’s all-time record high levels,

and the impacts of the current tariff policy. Additionally, our earnings were materially impacted by the acquisition-related expenses, both one-time and recurring, from the EHG acquisition which impacted our

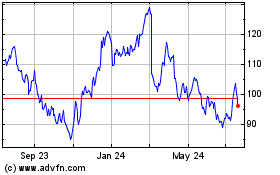

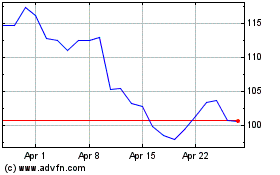

income before income taxes by $268 million. A significant portion of these acquisition expenses were one-time accounting-related expenses. As a consequence of these factors, our stock price dropped,

ending our year at $59.60. In addition to real impacts to our results of operations, our stock was impacted by rampant recessionary speculation which disproportionately impacts the stocks of makers of large consumer discretionary products.

As we look ahead to Fiscal Year 2020, we do foresee a retail market that will match Fiscal Year 2019. During Fiscal Year 2020, the excess dealer inventory issue will be

fully resolved, and we anticipate that dealer orders will better align with retail market pull through by the third quarter of our Fiscal Year 2020. Bolstered by operational improvements and synergies realized from the EHG transaction, we foresee

significant improvement in our year over year performance as our wholesale sales come in line with the retail market. This reality, in addition to the impact of the EHG acquisition, position us to return to growth in Fiscal Year 2020 and beyond.

GOVERNANCE DEVELOPMENTS

Good corporate

governance is the foundation upon which our Company operates. At Thor, our system of governance secures our financial integrity and sustained performance. In this Proxy, we present for election the first declassified Board in the history of our

Company, marking a significant development in our governance. Additionally, in Fiscal Year 2019, we created our ESG Committee with oversight by our Board. The ESG committee is responsible for evaluating the Company’s current performance as a

responsible corporate citizen in the areas of Environment, Social, and Governance, both internally with our employees and externally to the communities that we impact. Additionally, the ESG Committee will set our pathway to constant improvement

OUR HISTORY OF BEING MINDFUL OF OUR

ENVIRONMENTAL IMPACT AND PROVIDING MEANINGFUL VALUE TO THE MANY CONSTITUENTS OF OUR COMMUNITIES IS DEEP.

2

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

THOR INDUSTRIES, INC.

Notice of Annual Meeting

of Shareholders

Important Notice Regarding the

Availability of Proxy Materials for the Thor Industries, Inc. Annual Meeting of Shareholders to be Held on December 13, 2019.

Dear Fellow

Shareholders:

It is our pleasure to invite you to our Annual Meeting of Shareholders (our “Meeting” or “Annual Meeting”) that will be held on

December 13, 2019, at 1:00 p.m., Central Standard Time, at the Waldorf Astoria Chicago, 11 East Walton, Chicago, IL 60611 in the Hemingway Meeting Room. At the meeting, our Shareholders will be asked to:

Board Recommendations

|

|

|

|

|

|

|

•

|

|

Elect the Directors named in the Proxy Statement;

|

|

FOR

|

|

|

|

|

|

•

|

|

Ratify the appointment of the independent registered

|

|

|

|

|

|

public accounting firm;

|

|

FOR

|

|

|

|

|

|

•

|

|

Vote, on an advisory basis, to

approve the Named

|

|

|

|

|

|

Executive Officer compensation; and

|

|

FOR

|

|

|

|

|

|

•

|

|

Transact such other business as may properly come

|

|

|

|

|

|

before the Meeting.

|

|

|

Shareholders of record as of the close of business on October 18, 2019 (the “Record Date”) are entitled to vote at the

Annual Meeting and any postponement or adjournment thereof. We hope that you will attend our Meeting. In the event that you cannot attend, we strongly urge you to vote your shares by following the instructions on the included Notice Card.

Thor Industries tremendously values the input of its Shareholders. Your vote, every vote, is important to us. Please take the time to review our Proxy

Statement and submit your votes.

We appreciate your continued confidence in our Company and look forward to seeing you at the annual meeting on December 13,

2019.

|

|

|

|

|

|

|

|

|

Andrew E. Graves

|

|

Chairman of the Board

|

|

|

|

Todd Woelfer

|

|

|

|

Senior Vice President, General

|

|

|

|

Counsel, and Corporate Secretary

|

4

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

The Proxy Statement and

Annual Report on Form 10-K are available at www.proxyvote.com.

You are entitled to vote at the Meeting if you

were a holder of record of Thor Industries, Inc. common stock, $0.10 par value (“Common Stock”), at the close of business on October 18, 2019. At the close of business on that date, 55,198,756 shares of our Common Stock were

outstanding and entitled to vote.

|

|

|

|

|

Review the Proxy Statement and Vote in One of Four Ways

|

|

|

|

|

|

|

|

|

|

|

|

INTERNET

|

|

TELEPHONE

|

|

|

|

|

You may vote by internet 24 hours a day

|

|

You may vote by telephone 24 hours a

|

|

through 11:59 p.m., Eastern Standard

|

|

day through 11:59 p.m., Eastern Standard

|

|

Time, on December 12, 2019, by following

|

|

Time, on December 12, 2019, by following

|

|

the instructions listed on the Notice Card.

|

|

the instructions listed on the Notice Card.

|

|

|

|

|

|

|

|

|

|

|

|

MAIL

|

|

IN PERSON

|

|

|

|

|

You can only vote by mail if you request

|

|

Attend the Meeting in person. If you plan

|

|

and receive a paper copy of the proxy

|

|

to attend the Annual Meeting, you will be

|

|

materials and proxy card. You may

|

|

required to present photo identification

|

|

request proxy materials by following the

|

|

and verification of the amount of shares

|

|

instructions listed on the Notice Card.

|

|

held as of October 18, 2019, to gain access

|

|

You may then vote by completing, signing,

|

|

to the meeting.

|

|

dating, and returning a proxy card.

|

|

|

|

|

|

Notice to Shareholders: Our 2019 Proxy Statement and Annual Report on Form

10-K are available free of charge on our website at www.thorindustries.com.

|

5

THOR INDUSTRIES, INC.

Proxy Summary

While we offer this summary review of the information contained in our Fiscal Year 2019 Proxy Statement, we encourage you to carefully review

the entire Proxy Statement before voting.

|

|

|

|

|

|

|

|

|

|

|

|

|

VOTING MATTERS

|

|

Board Recommendations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

|

PROPOSAL 1

Election Of Nine (9) Directors

Named in This Proxy Statement

|

|

|

|

|

|

each of the

nominees

|

|

|

|

FOR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

|

PROPOSAL 2

Ratification of Appointment of

Independent Registered Accounting

Firm for Fiscal Year 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR

|

|

|

|

|

|

|

|

|

|

•

|

|

PROPOSAL 3

Advisory Vote to Approve

the Compensation of our

Named Executive Officers (“NEOs”)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR

|

|

|

6

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

7

THOR INDUSTRIES, INC.

Business Highlights

Net Income

Our net income dropped in 2019 after averaging 25% growth per year over the prior six (6) years.

The drop in 2019 was driven by the expenses related to the EHG acquisition, lower top line sales, and an increase in production costs which were impacted by the current U.S. tariff policy. Acquisition expenses (net of tax), both one-time and recurring, reduced our net income by $212 million. Without these expenses, Fiscal Year 2019 was our third most profitable year, ever.

NET INCOME (IN MILLIONS)

from Continuing Operations attributable to Thor Industries, Inc.

Sales

After six (6) years of aggressive growth in our sales, we experienced a decline in 2019 as excess dealer inventory created a material

difference between retail and wholesale sales. The sales decline was softened by the inclusion of 6 months of EHG net sales in our consolidated total.

NET SALES (IN BILLIONS)

from Continuing Operations

8

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

Diluted EPS

Both one-time and recurring expenses related to the EHG acquisition reduced our EPS by $3.93. Including

these expenses, our EPS was $2.47

DILUTED EPS

from Continuing Operations attributable to Thor Industries, Inc.

Cash Generation

Our great ability to generate cash is demonstrated well in a year that saw a decline in both sales and earnings yet set our all-time record for cash generation.

CASH GENERATED BY OPERATIONS (IN MILLIONS)

from Continuing Operations

History of Increasing

Regular Dividends

Thor’s ultimate mission is to return value to our Shareholders. An important component of that mission is our dividend policy. To that end,

Thor has increased its regular cash dividends each of the last nine (9) years and recently announced an increase in the dividend awarded in the first quarter of Fiscal Year 2020. Over the last six (6) years, Thor’s dividend has grown

at an APR of over 14% and the dividend rate of Fiscal Year 2019 offered a yield of 2.6% of our year end stock price of $59.60.

REGULAR DIVIDENDS

9

THOR INDUSTRIES, INC.

Compensation Highlights

Alignment of Pay and Performance

Aligning management pay with the performance of the Company is a key principle upon which Thor was

founded. Since its beginning, Thor has relied heavily on incentive compensation. For nearly four decades, a very simple and basic plan drove great performance and consistently provided compensation that was well aligned with Company

performance. In Fiscal Year 2019, however, Thor completed a transformational acquisition of the Erwin Hymer Group, one of Europe’s largest producers of RVs. The timing and significance of this transaction provided a great opportunity to

reconsider our compensation plan.

We recently announced significant changes to our compensation plan. The new plan was developed based upon

feedback from proxy advisory firms and shareholders alike. The new plan holds dear to the philosophy that a significant percentage of incentive compensation is best to align with the interest of our shareholders. To accomplish this objective, the

new plan adds new and important elements which are designed to create more touch points with shareholder value than just the single metric of net earnings before tax (“NBT”) including:

|

|

•

|

|

Multiple performance metrics, including NBT, Free Cash Flow (“FCF”), and Return On Invested Capital (“ROIC”); and

|

|

|

•

|

|

The use of Performance Share Awards that will measure performance over multiple years (2 years for Fiscal Year 2020 grants and 3 years for grants in the following fiscal year and beyond).

|

We believe our new compensation plan is responsive to the evaluations from the leading proxy advisory firms and creates a true long-term incentive element utilizing

multiple metrics and is best suited to meet our objective, which is to ensure that our NEO compensation aligns with shareholder return. Using targets that are established by review of peer compensation, we set our NEO’s targeted compensation as

a percentage of the peer group benchmark. Our CEO’s targeted pay level is 35% of peer group level.

As in years past, in Fiscal Year 2019, a predominant

percentage of our CEO and other Named Executive Officer (“NEO”) compensation was variable incentive pay as demonstrated by the accompanying charts.

FOR NEARLY FOUR DECADES, A VERY SIMPLE AND BASIC PLAN DROVE GREAT PERFORMANCE AND CONSISTENTLY PROVIDED COMPENSATION THAT WAS WELL ALIGNED WITH

COMPANY PERFORMANCE.

10

Key Compensation Actions Taken in Fiscal Year 2019

|

|

•

|

|

No increase from Fiscal Year 2018 base salary or in the sharing percentages for either our MIP or LTI programs for our CEO or our other NEOs.

|

|

|

|

•

|

|

Exclusion of the EHG NBT and transaction costs of the EHG acquisition for purposes of calculating the compensation to be paid under our cash and equity incentive plans.

|

|

|

|

•

|

|

Continued use of a compensation advisory firm, Willis Towers Watson, for benchmarking, regulatory guidance, and compensation analyses.

|

|

For additional information regarding the compensation of our NEOs, see our Compensation Discussion and

Analysis.

11

THOR INDUSTRIES, INC.

Corporate Governance Highlights

Good corporate governance is essential to the continued long-term success of our business. The following list identifies important governance actions and practices at Thor in Fiscal Year 2019:

|

|

|

|

|

|

|

Director Independence

|

|

•

|

|

Seven (7) of our nine (9) Directors are independent

|

|

|

|

•

|

|

Independent Lead Director (ended at the end of our Fiscal Year 2019 when we appointed an Independent Chairman for the first time in Company history)

|

|

|

|

•

|

|

Board committees comprised entirely of independent members of the Board

|

|

|

|

•

|

|

Independent Directors meet without management present

|

|

Board Refreshment

|

|

•

|

|

Balance of new and experienced Directors

|

|

|

|

•

|

|

Followed a mandatory retirement policy requiring all Directors who are 72 years of age or older to submit a resignation to the Board for consideration each year

|

|

|

|

•

|

|

Guided by a diversity policy

|

|

Board Accountability

|

|

•

|

|

Declassified Board of Directors

|

|

|

|

•

|

|

Implemented a majority voting standard for Directors requiring Directors in uncontested elections to be

elected by a majority of the votes cast and requiring submission of resignation in the event that the required majority vote is not received

|

|

Board Evaluation &

|

|

•

|

|

Annual Board Self-Assessment

|

|

Effectiveness

|

|

•

|

|

Bifurcated Chairman and CEO roles

|

|

|

|

|

|

|

|

|

|

|

|

Director Engagement

|

|

•

|

|

All Directors attended 97% of Board and Committee meetings in Fiscal Year 2019

|

|

|

|

•

|

|

No Directors serve on an excessive number of outside boards

|

|

|

|

•

|

|

Board committees possess the right to hire advisors

|

|

|

|

•

|

|

Executives do not sit on outside for-profit boards

|

|

Clawback and

Anti-Hedging Policies

|

|

•

|

|

“No Fault” Clawback Policy: Return of incentive compensation when financial restatement is required

|

|

|

•

|

|

Anti-hedging, short sale, and pledging policies

|

|

|

|

•

|

|

Double trigger change in control provisions added in our 2010 Equity Plan and our 2016 Equity Plan

requiring either a corresponding change in employment status or the failure of an acquirer to assume the award before any change in control would result in the accelerated vesting of such award

|

|

Share Ownership

|

|

•

|

|

Share ownership and retention guidelines for Directors and Officers

|

|

|

|

|

|

|

|

|

|

|

|

Proxy Access

|

|

•

|

|

Allow for Proxy Access for up to twenty (20) Shareholders who, in the aggregate, hold at least 3% of

|

|

|

|

|

|

Thor’s outstanding stock for a period of at least three (3) years

|

|

Board Engagement

|

|

•

|

|

Continued Shareholder and advisory firm engagement

|

|

|

|

•

|

|

Disclosure of Company Governance Guidelines

|

|

ESG

|

|

•

|

|

Established an ESG Committee, reporting directly to the Nominating and Corporate Governance

|

|

|

|

|

|

Committee of the Board of Directors, that is responsible for ESG performance and reporting

|

14

Table of Contents

|

|

|

Proxy Statement

This Proxy Statement is provided in connection with the solicitation of proxies, by order of the Board of

Directors (the “Board” or “Board of Directors”) of Thor Industries, Inc. (the “Company”, “Thor”, “we”, or

“us”), to be used at the 2019 Annual Meeting of the Shareholders of the Company. The proxy card or

voting instruction form sets forth your holdings of Common Stock of the Company. We expect that, on

or after October 30, 2019, this Proxy Statement will be available through the Internet.

|

THOR INDUSTRIES, INC.

Voting Instructions and Information

General Information about Our Annual Meeting

A copy of this Proxy Statement and our Annual Report for the fiscal year ended July 31, 2019 (“Fiscal Year 2019”), will be sent to any Shareholder who requests

a copy through any of the following methods:

|

|

•

|

|

Internet: www.proxyvote.com

|

|

|

•

|

|

Telephone: 1-800-579-1639

|

|

|

•

|

|

E-mail: sendmaterial@proxyvote.com

|

The Annual Report is not to be considered a part of this proxy soliciting material.

Voting Instructions and Information

WHO CAN VOTE

You are entitled to vote if our records show that you held shares in our Company as of the Record Date, October 18,

2019. At the close of business on that date, 55,198,756 shares of our Common Stock were outstanding and entitled to vote. Each share of our Common Stock is entitled to one vote. A list of Shareholders entitled to vote at the Annual Meeting will be

available for examination by Shareholders at the Meeting and during regular business hours at the Company’s office for ten (10) days prior to the Meeting.

HOW TO VOTE

In accordance with the rules of the

Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each Shareholder of record, we may furnish our proxy materials, including this Proxy Statement and our Annual Report to

Shareholders, by providing access to these documents on the Internet. Generally, Shareholders will not receive printed copies of the proxy materials unless they request them.

If your Common Stock is held through a broker, bank, or other nominee (held in “street name”), you will receive

instructions from the entity holding your stock that you must follow in order to have your shares voted. If you want to vote in person, you must obtain a legal proxy from the entity holding your shares and bring it to the Meeting.

If you hold shares in your own name as a holder of record with our transfer agent, Computershare, you may instruct the proxies how to vote by following the instructions

listed on the Notice of Internet Availability (“Notice Card”) or the proxy card (if printed materials were requested). Of course, you can always come to the Meeting and vote your shares in person.

Shareholders may vote their shares in any of the following ways:

|

|

1.

|

By Internet: You may vote by internet 24 hours a day through 11:59 p.m., Eastern Standard

Time, December 12, 2019, by following the instructions listed on the Notice Card.

|

|

|

2.

|

By Telephone: You may vote by telephone 24 hours a day through 11:59 p.m.,

Eastern Standard Time, December 12, 2019, by following the instructions listed on the Notice Card.

|

|

|

3.

|

By Mail: You may vote by mail only if you request and receive a paper copy of

the proxy materials and proxy card. You may request proxy materials by following the instructions listed on the Notice Card. You may then vote by completing, signing, dating, and returning a proxy card.

|

|

|

4.

|

At the Meeting: You may attend the Meeting and vote in person.

|

16

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

A proxy submitted by mail that is

properly executed and timely returned to our Company that is not revoked prior to the Meeting will be voted in accordance with your instructions. If no instructions are given with respect to the proposal to be voted upon at the Meeting, proxies will

be voted in accordance with the recommendations of our Board of Directors on such proposals. You may revoke your proxy at any time until exercised by giving written notice to the Secretary of our Company, by voting in person at the Meeting,

or by timely submitting a later-dated proxy by mail, internet, or telephone. At our Meeting, a representative of Broadridge Financial Solutions, Inc. will tabulate the votes and act as the inspector of election.

HOW VOTES ARE COUNTED

A quorum

is required to transact business at our Meeting. Shareholders of record constituting a majority of the shares entitled to cast votes shall constitute a quorum. If you have returned valid proxy instructions or attend the Meeting in person, your

shares will be counted for the purpose of determining whether there is a quorum, even if you abstain from voting on some or all matters voted upon at the Meeting. Abstentions and broker non-votes will be

treated as present for purposes of determining whether a quorum is present.

17

THOR INDUSTRIES, INC.

VOTING

Your vote may be (i) “for” or “withhold” on the proposal relating to the election of Directors, and (ii) “for”,

“against”, or “abstain” on each of the other proposals. The affirmative vote of a majority of the votes cast is required to approve each proposal. With respect to director elections, our Amended and Restated By-Laws (“By-Laws”) require each nominee for election as a director to resign from the Board upon failing to receive a majority of the votes cast in an uncontested

election, contingent upon the acceptance of the proffered resignation by the Board, with the recommendation of the Nominating and Corporate Governance Committee of the Board. Broker non-votes and abstentions

will not impact the outcome of the vote on the proposals related to the election of Directors, ratification of the appointment of our independent registered accounting

BOARD RECOMMENDATION

OUR BOARD OF DIRECTORS

RECOMMENDS THAT YOU

VOTE FOR EACH OF THE

DIRECTOR NOMINEES, FOR

THE RATIFICATION OF THE

APPOINTMENT OF THE

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM,

AND FOR THE ADVISORY

VOTE APPROVING THE

COMPENSATION OF OUR NAMED

EXECUTIVE OFFICERS.

firm and the advisory vote to approve NEO compensation, as they are not counted as votes cast. It is important to be aware

that if you hold shares in street name with a broker, bank, or other nominee, and you do not submit voting instructions, then your broker, bank, or nominee will not be permitted to vote your shares in its discretion on any of the matters set for

vote at our Meeting other than Proposal 2 relating to the ratification of the appointment of our independent registered public accounting firm, which is considered a routine matter.

COST OF PROXY SOLICITATION

The cost of

solicitation is being borne by our Company.

SHAREHOLDERS SHARING AN ADDRESS

We will deliver only one Notice of Internet Availability and one Proxy Statement and/or Annual Report, if requested, to multiple Shareholders sharing an address unless

we receive contrary instructions from one or more of such Shareholders. We will undertake to deliver promptly, upon written or oral request, separate copies of the Notice of Internet Availability, Annual Report, and/ or Proxy Statement to a

Shareholder at a shared address to which single copies of the Notice of Internet Availability, Annual Report, and/or Proxy Statement are delivered. A Shareholder can notify us either in writing or by phone that the Shareholder wishes to receive

separate copies of the Notice of Internet Availability, Annual Report, and/or Proxy Statement, or Shareholders sharing an address can request delivery of single copies of the Notice of Internet Availability, Annual Report and/or Proxy Statement if

they are receiving multiple copies by contacting us at Thor Industries, Inc., 601 East Beardsley Avenue, Elkhart, IN 46514, Attention: Corporate Secretary, (574) 970-7460.

18

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

Proposal 1. Election of Directors

Each of our currently serving directors has been nominated for re-election to serve a

single-year term. Each of these individuals has agreed to be named in our Proxy Statement as a nominee and to serve as a member of the Board of Directors if elected by the Shareholders. In making this nomination, our Board recognizes that it is of

critical importance to the Company that the nominees are individuals who bring crucial skills and unique voices to our boardroom, and the Board carefully considered each nominee’s contributions to the Board and his or her unique skills and

qualifications.

The representatives designated to vote by proxy intend to vote FOR the election of the nominees listed below. In the event

that any nominee becomes unavailable for election (a situation our Board does not now anticipate), the shares represented by proxies will be voted, unless authority is withheld, for such other person as may be designated by our Nominating and

Corporate Governance Committee.

Qualifications and Process for Nominees

Our Board believes that it is necessary for each of our Directors to possess many diverse qualities and skills. When searching for new candidates, our Nominating and

Corporate Governance Committee considers the evolving needs of our Board, which are defined by our need for guidance in our business, and searches for candidates who fill any current or anticipated future gap. Our Board also believes that all

Directors must possess a considerable amount of business management experience. Our Nominating and Corporate Governance Committee evaluates candidates on, as applicable, the satisfaction of any independence requirements imposed by law, regulation,

the New York Stock Exchange (the “NYSE”), and/

or our Corporate Governance Guidelines. When evaluating Director candidates, our Nominating and

Corporate Governance Committee first considers a candidate’s business management experience and then considers that candidate’s judgment, background, stature, conflicts of interest, integrity, ethics, and commitment to the goal of

maximizing Shareholder value. In addition, our Board and Nominating and Corporate Governance Committee believe that it is essential that our Board members represent diverse viewpoints. In our more recent candidate searches, our Board has followed a

diversity practice which it formally established as policy at its October 2017

|

|

|

|

|

|

|

|

|

|

|

OUR BOARD ADHERES

TO A DIVERSITY POLICY,

REQUIRING THE INITIAL LIST

OF CANDIDATES FROM WHICH

THE BOARD WILL SELECT

NOMINEE(S) TO INCLUDE

QUALIFIED CANDIDATES WITH

DIVERSITY OF GENDER, RACE,

AND ETHNICITY.

|

19

THOR INDUSTRIES, INC.

Board meeting. The Diversity Policy requires our Board to obtain an initial slate of

candidates that includes qualified candidates with diversity of race, ethnicity, and gender. In considering candidates for our Board, our Nominating and Corporate Governance Committee considers the entirety of each candidate’s credentials, in

addition to diversity, as they fit with the current composition of the Board. We consider our Board of Directors to be a valuable strategic asset of our Company. To maintain the integrity of this asset, our Board of Directors has been carefully

crafted to ensure that its expertise covers diversity of experience and perspective, and these attributes will continue to be considered when nominating individuals to serve on our Board. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to our Board are also considered.

|

|

|

|

|

|

|

|

|

BOARD RECOMMENDATION

THE BOARD OF DIRECTORS

RECOMMENDS THAT THE

SHAREHOLDERS VOTE FOR

THE NOMINEES.

|

|

|

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

Nominees for Board of Directors

|

|

|

|

|

|

|

Andrew Graves

DIRECTOR SINCE: 2010

Age

60

Chairman of the Board

|

|

|

Thor Committees

|

•

|

|

Compensation and Development

|

|

•

|

|

Nominating and Corporate Governance

|

Outside Directorships

|

•

|

|

American Chemet Corporation

|

Mr. Graves, who became a Director in December of 2010, was

CEO for Motorsport Aftermarket Group, a leading manufacturer, distributor, and on-line retailer of aftermarket products for the powersports industry. He joined this privately- held group in January of 2015 as

CEO and retired August of 2018. Previously, Mr. Graves served as the President of Brunswick Boat Group, a division of the Brunswick Corporation, an NYSE company. He was with Brunswick from 2005-2014. Prior to his time with Brunswick,

Mr. Graves was President of Dresser Flow Solutions, a maker of flow control products, measurement systems, and power systems, from 2003 to 2005, and before that he was President and Chief Operating Officer of Federal Signal Corporation. Our

Nominating and Corporate Governance Committee and Board believe that his extensive management experience in related consumer durable businesses whose products are distributed through a dealer network makes him an asset to our Board.

|

|

|

|

|

Skills and Qualifications

|

|

|

|

• Management

|

|

• Talent Management

|

|

• Marketing/Sales

|

|

• Strategy

|

|

• Business Operations

|

|

• International

|

|

• Financial Services Industry

|

|

|

|

• Finance/Capital Allocation

|

|

|

|

• Mergers & Acquisitions

|

|

|

|

• Financial Expertise/Literacy

|

|

|

|

|

|

|

|

|

|

Amelia A. Huntington

DIRECTOR SINCE: 2018

Age

53

|

|

|

Thor Committees

|

•

|

|

Compensation and Development

|

Outside Directorships

Ms. Huntington, who became a Director in October of 2018,

served as the Chief Executive Officer of Philips Lighting Americas, a leading manufacturer of commercial and residential lighting solutions, until January of 2018, after serving as Chief Executive Officer of Philips Lighting, Professional Lighting

Solutions, an assignment based in Amsterdam, The Netherlands. Prior to joining Philips Lighting in April 2013, Ms. Huntington held senior leadership positions with Schneider Electric over the course of a

22-year career, including Chief Operating Officer of Schneider Electric North America and CEO of subsidiary, Juno Lighting Group. Our Nominating and Corporate Governance Committee and Board believe that her

extensive experience in multinational operations makes her an asset to our Board.

|

|

|

Skills and Qualifications

|

|

• Management

|

|

• Marketing/Sales

|

|

• Strategy

|

|

• Business Operations

|

|

• Talent Management

|

|

• Technology/Systems (IoT)

|

|

• International

|

|

• Mergers & Acquisitions

|

|

• Business Ethics

|

|

• Strategic Alliances

|

21

THOR INDUSTRIES, INC.

|

|

|

|

|

|

|

Wilson Jones

DIRECTOR SINCE: 2014

Age

58

|

|

|

Thor Committees

|

•

|

|

Compensation and Development (Chair)

|

|

•

|

|

Nominating and Corporate Governance

|

Outside Directorships

|

•

|

|

Oshkosh Corporation Board of Directors (2012 - present)

|

|

•

|

|

Wisconsin Manufacturer’s Commerce Board of Directors (2018 - present)

|

Mr. Jones, who became a Director in August of 2014, is the

President and Chief Executive Officer and a director of Oshkosh Corporation, a leading designer, manufacturer and marketer of a broad range of specialty vehicles and vehicle bodies. Mr. Jones joined Oshkosh Corporation in 2005 and held senior

leadership positions in the Fire & Emergency Segment until July of 2007 when he became President of Pierce Manufacturing, Inc. From September of 2008 to September of 2010, Mr. Jones held the position of Executive Vice President and

President of the Fire & Emergency segment. From September of 2010 to August of 2012, Mr. Jones led the Access Equipment Segment as Executive Vice President and President, the largest business segment of the company, until his

appointment to President and Chief Operating Officer. He was named President and Chief Executive Officer in January of 2016. Our Nominating and Corporate Governance Committee believe his experience in specialty vehicles and management experience

make him an asset to our Board.

|

|

|

|

|

Skills

|

|

|

|

• Business Ethics

|

|

• Management

|

|

• Corporate Governance

|

|

• Strategy

|

|

• Business Operations

|

|

• International

|

|

• Talent Management

|

|

• Marketing/Sales

|

|

• Mergers & Acquisitions

|

|

• Risk Management

|

|

• Govt/Public Policy

|

|

• Technology Systems

|

|

• Financial/Capital Allocation

|

|

|

|

|

|

|

|

|

|

Christopher Klein

DIRECTOR SINCE: 2017

Age

56

|

|

|

Thor Committees

|

•

|

|

Compensation and Development

|

Outside Directorships

|

•

|

|

Fortune Brands Home & Security, Inc.

|

Mr. Klein, who became a Director in December 2017, is the Chief Executive Officer and a director of Fortune Brands Home & Security, Inc., a leading

manufacturer of home and security products. Mr. Klein joined Fortune Brands, Inc. in 2003 and held corporate strategy, business development, and operational positions until he became CEO of Fortune Brands Home & Security in 2010.

Previously, Mr. Klein held key strategy and operating positions at Bank One Corporation and also served as a partner at McKinsey & Company, a global management consulting firm. Mr. Klein spent his early career in commercial

banking, at both ABN AMRO and First Chicago. Our Nominating and Corporate Governance Committee and Board believe that his management experience as chief executive officer of a public company, as well as his treasury and consulting background make

him an asset to our Board.

|

|

|

Skills

|

|

• Business Head/Administration

|

|

• Corporate Governance

|

|

• Finance

|

|

• Finance/Capital Allocation

|

|

• Talent Management

|

|

• Financial Expertise/Literacy

|

|

• Financial Services Industry

|

|

• International

|

|

• Management

|

|

• Mergers & Acquisitions

|

|

• Risk Management

|

|

• Strategic Alliances

|

|

• Strategy

|

22

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

|

|

|

|

|

|

|

J. Allen Kosowsky

DIRECTOR SINCE: 2010

Age

71

|

|

|

Thor Committees

|

•

|

|

Nominating and Corporate Governance (Chair)

|

Outside Directorships

|

•

|

|

BlackRidge Technology Int’l, Inc. (2017 – present)

|

|

•

|

|

Naugatuck Valley Corporation (2014 – 2015)

|

Mr. Kosowsky, who became a Director in March of 2010, is a

certified public accountant who since 1985 has conducted business through his own advisory firm. The firm provides services that include business and intellectual property valuations, forensic accounting and financial analysis, and alternative

dispute resolutions. From January of 2003 to February of 2010, Mr. Kosowsky served as the Chairman of the board of directors and Chairman of the audit committee for ON2 Technologies Inc., a U.S. based video compression software company, which was

acquired by Google, Inc. On September 17, 2016, Mr. Kosowsky became a National Association of Corporate Directors fellow. In June of 2017, Mr. Kosowsky joined the board of BlackRidge Technology International, Inc., a cyber security

software company and serves as the Lead Director, Chair of the audit committee, and a member of the compensation and nominating and governance committees. Our Nominating and Corporate Governance Committee and Board believe that his extensive

accounting experience and his financial expertise and training, which qualify him as an “audit committee financial expert”, make him an asset to our Board.

|

|

|

|

|

Skills and Qualifications

|

|

|

|

• Business Ethics

|

|

• Management

|

|

• Corporate Governance

|

|

• Strategy

|

|

• Business Operations

|

|

• Technology Systems

|

|

• Cyber Security

|

|

• Risk Management

|

|

• Mergers & Acquisitions

|

|

• International

|

|

• Real Estate

|

|

• Finance

|

|

• Financial Serv. Industry

|

|

• Litigation

|

|

• Financial Expertise/Literacy

|

|

• Taxation

|

|

• Financial/Capital Allocation

|

|

|

|

|

|

|

|

|

|

Robert W. Martin

DIRECTOR SINCE: 2013

Age 50

|

|

|

President and Chief Executive Officer

|

|

|

Mr. Martin has been with our Company since 2001 when we acquired Keystone RV, where he worked since July of 1998. Mr. Martin currently

serves as our President and Chief Executive Officer. From August of 2012 to July of 2013, Mr. Martin served as the Company’s President and Chief Operating Officer. Mr. Martin previously served as President of our RV Group from January

of 2012 to August of 2012. Prior to becoming President of our RV Group, Mr. Martin was President of Keystone RV from January of 2010 to January of 2012 and Executive Vice President and Chief Operating Officer of Keystone RV from January of 2007

to January of 2010. Mr. Martin has held various positions with Keystone RV, including Vice President of Sales and General Manager of Sales. Prior to joining Keystone RV, Mr. Martin held positions at Coachmen Industries, Inc., a former

recreational vehicle and manufactured housing company. Our Nominating and Corporate Governance Committee and Board believe that his extensive experience with our Company and the industry make him an asset to our Board.

|

|

Skills and Qualifications

|

|

• Management

|

|

• Risk Management

|

|

• Strategy

|

|

• Business Operations

|

|

• Talent Management

|

|

• Business Ethics

|

|

• Marketing/Sales

|

|

• Mergers & Acquisitions

|

23

THOR INDUSTRIES, INC.

|

|

|

|

|

Peter B. Orthwein

DIRECTOR SINCE: 1980

Age

74

Chairman Emeritus of the Board

|

|

|

|

|

|

Mr. Orthwein, a co-founder of our Company, currently serves as Chairman Emeritus of the

Board, having been appointed to this position in August 2019 after serving as Executive Chairman since August 2013. Mr. Orthwein has served as a Director of our Company since its inception. Prior to being our Executive Chairman, he served as

the Company’s Chairman and CEO from November 2009 to August 2013. In addition, he served as the Company’s President from November 2009 to August 2012. Mr. Orthwein was previously Chairman of our Company from 1980 to 1986, Vice

Chairman of our Company from 1986 to November of 2009, and Treasurer of our Company from 1980 to November of 2009.

|

|

Skills and Qualifications

|

|

• Financial Expertise/Literacy

|

|

• Mergers & Acquisitions

|

|

• Strategy

|

|

• Management

|

|

• Business Operations

|

|

• Financial/Capital Allocation

|

|

|

|

|

|

Jan H. Suwinski

DIRECTOR SINCE: 1999

Age 78

|

|

|

Thor Committees

|

•

|

|

Compensation and Development

|

Outside Directorships

|

•

|

|

ACI Worldwide, Inc (2007 – 2018)

|

|

•

|

|

Tellabs, Inc. (1997 – 2013)

|

Mr. Suwinski was our Independent Lead Director from 2013 to

August of 2019. He became a Director in July of 1999, joined the faculty of the Samuel-Curtis Johnson Graduate School of Management, Cornell University in July of 1996 and served as its Clinical Professor of Management and Operations, where he co-taught the Strategic Operations Immersion course, as well as courses in Business Strategy and Strategic Alliances. Mr. Suwinski retired from the faculty in June of 2016. Starting in 1965, Mr. Suwinski served

in a variety of managerial roles at Corning, Incorporated, a global manufacturing company. From 1990 to 1996, Mr. Suwinski was Executive Vice President, Opto Electronics Group at Corning, Incorporated and, from 1992 to 1996, Mr. Suwinski

was Chairman of Siecor, a Siemens/Corning joint venture. Mr. Suwinski was formerly a director of ACI Worldwide, Inc. and Tellabs, Inc. Mr. Suwinski served on the board of directors of Ohio Casualty Group, Inc. from 2002 to 2007. Our Nominating

and Corporate Governance Committee and Board believe that his management experience and his significant public company board experience make him an asset to our Board.

|

|

|

|

|

Skills and Qualifications

|

|

|

|

• Academia/Education

|

|

• Strategic Alliances

|

|

• Business Operations

|

|

• Insurance Industry

|

|

• Risk Management

|

|

• Management

|

|

• International

|

|

• Strategy

|

|

• Govt/Public Policy

|

|

• Corp. Governance

|

|

• Business Ethics

|

|

|

|

• Financial Services Industry

|

|

|

|

• Finance/Capital Allocation

|

|

|

24

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

|

|

|

|

|

James L. Ziemer

DIRECTOR SINCE: 2010

Age

69

|

|

|

Thor Committees

|

•

|

|

Nominating and Corporate Governance

|

Outside Directorships

|

•

|

|

Textron, Inc. (2007 – 2018)

|

|

•

|

|

Harley-Davidson, Inc. (2004 – 2009)

|

Mr. Ziemer, who became a Director in December of 2010, was

the President and Chief Executive Officer at Harley Davidson, Inc. from 2005-2009 and served as a director for that company from 2004-2009. Mr. Ziemer joined Harley-Davidson in 1969 and held a series of positions in manufacturing, engineering,

accounting, parts and accessories, and finance. From 1991 until his election as the President and Chief Executive Officer of Harley-Davidson in 2005, he served as the Chief Financial Officer. Mr. Ziemer also served as President of The

Harley-Davidson Foundation, Inc. from 1993 to 2006. Our Nominating and Corporate Governance Committee and Board believe that Mr. Ziemer’s substantial management experience, including as a chief executive officer of a public company, and

his financial expertise and training, which qualify him as an “audit committee financial expert”, make him an asset to our Board.

|

|

|

Skills and Qualifications

|

|

• Management

|

|

• Finance/Capital Allocation

|

|

• Finance

|

|

• Strategy

|

|

• Business Operations

|

|

• Financial Expertise/Literacy

|

|

• Marketing/Sales

|

|

• Corporate Governance

|

|

• International

|

|

• Risk Management

|

|

• Business Ethics

|

25

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

Board of Directors: Structure,

Committees and Corporate Governance

Corporate Governance

Good corporate governance is the foundation upon which our Company operates. The process of good corporate governance is dynamic, requiring constant vigilance and

evaluation to determine and implement those governance practices that are best-suited to provide integrity and transparency in and to our business. At Thor, our Board and management are dedicated to the process of constant evaluation and active

implementation of appropriate governance processes, practices, and policies. Thor’s Board-adopted Governance Guidelines serve as the framework for consistently effective governance of the Company. The Guidelines are regularly reviewed and

updated and are available for review on our website, www.thorindustries.com.

Board Selection Process

Our Nominating and

Corporate Governance Committee screens candidates and recommends nominees to the full Board. Our By-laws provide that our Board may set the number of Directors at no fewer than one (1) and no more than fifteen

(15). Our Board currently consists of nine (9) Directors - each Director will stand for election each year.

Our Nominating and Corporate Governance Committee

has relied upon board search firms in identifying suitable candidates. During this process, the Board engages in an evaluation of a widely-diverse set of candidates. In Fiscal Year 2017, our Board adopted a diversity policy, requiring the initial

list of prospective candidates to include qualified candidates with diversity of race, ethnicity, and gender. An important

consideration in our prospective Board member evaluation includes his or her obligation to their primary company and/ or

to other boards that would detract from their obligation to fully serve on our Board. Further, the Committee will consider Shareholder nominations of candidates for our Board on the same basis as Board-identified candidates, provided that any such

nominee possesses the requisite business, management, and educational experience.

Proxy Access

Our By-laws allow a group of up to twenty (20) Shareholders who have owned at least 3% of our outstanding shares for a period of

at least three (3) years to nominate up to two (2) or 25% of the seats up for election, whichever is greater, and include those nominations in our Proxy Statement.

Board Structure And Leadership

Fiscal Year 2019

was a significant year for our Board structure and leadership. First, our Shareholders approved the Board’s request to declassify itself at last year’s Annual meeting. Then, at the end of our Fiscal Year, our long-term Executive Chairman

and co-founder, Peter Orthwein, announced his retirement as Executive Chairman. Subsequently, Andy Graves was named Chairman, becoming Thor’s first independent Chairman. With Mr. Graves as our

independent Chairman, our Board is led by strong Committee chairs, Messrs. Jones (Compensation and Development), Kosowsky (Nominating and Corporate Governance), and Ziemer (Audit).

27

THOR INDUSTRIES, INC.

Our Board has three Committees with the principal functions described below. The charters of each of these Committees are

posted on our website at www.thorindustries.com and are available in print to any Shareholder who requests them.

AUDIT COMMITTEE

The principal functions of our

Audit Committee include to:

|

•

|

|

Attend to the appointment, retention, termination, and oversight, including the approval of compensation, of the Company’s independent auditors.

|

|

•

|

|

Maintain communications among our Board, our independent registered public accounting firm, and our internal accounting staff with respect to accounting and auditing procedures, implementation of recommendations by such

independent registered public accounting firm, the adequacy of our internal controls, and related matters.

|

|

•

|

|

Review and approve the annual audit plan and all major changes to the plan.

|

|

•

|

|

Review and discuss, with management and the independent auditor, financial statements and disclosure matters and prepare relevant reports with respect thereto.

|

|

•

|

|

Oversee the selection and removal of the internal audit director.

|

|

•

|

|

Oversee compliance and risk management matters, including reviewing the Company’s code of business conduct and ethics.

|

|

•

|

|

Review and approve all related-party transactions, defined as those transactions required to be disclosed under item 404 of Regulation S-K.

|

COMPENSATION AND DEVELOPMENT COMMITTEE

The

principal functions of our Compensation and Development Committee include to:

|

•

|

|

Establish and review executive compensation policies and guiding principles.

|

|

•

|

|

Review and approve the compensation of our Chief Executive Officer and evaluate his performance in light of such compensation.

|

|

•

|

|

Review and approve the compensation of our Executive Officers.

|

|

•

|

|

Evaluate and approve the design of compensation and benefit programs for our Executive Officers.

|

|

•

|

|

Assist the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs.

|

|

•

|

|

Review management and leadership development, succession planning, and retention for our Company.

|

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

The principal functions of our Nominating and Corporate Governance Committee include to:

|

•

|

|

Address all matters of corporate governance.

|

28

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

|

•

|

|

Evaluate qualifications and candidates for positions on our Board using the criteria set forth under the heading

“Proposal 1 – Election of Directors”.

|

|

|

•

|

|

Review succession plans, including policies and principles for the selection and performance review of the Chief Executive

Officer.

|

|

|

•

|

|

Establish criteria for selecting new Directors, nominees for Board membership, and the positions of Executive Chairman and

Chief Executive Officer.

|

|

|

•

|

|

Review all components of compensation for independent Directors including our Chairman.

|

|

|

•

|

|

Determine whether a Director should be invited to stand for re-election.

|

|

|

•

|

|

Oversee the Company’s ESG Committee.

|

|

Board of Directors and Committees of the Board as of October 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME

|

|

BOARD

|

|

AUDIT

COMMITTEE

|

|

COMPENSATION AND

DEVELOPMENT

COMMITTEE

|

|

NOMINATING AND

CORPORATE GOVERNANCE

COMMITTEE

|

|

|

|

|

|

|

|

Andrew Graves

|

|

Chair

|

|

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

Amelia A. Huntington

|

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

|

Wilson Jones

|

|

✓

|

|

|

|

Chair

|

|

✓

|

|

|

|

|

|

|

|

Christopher Klein

|

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

|

J. Allen Kosowsky*

|

|

✓

|

|

✓

|

|

|

|

Chair

|

|

|

|

|

|

|

|

Robert W. Martin

|

|

✓

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter B. Orthwein

|

|

✓

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan Suwinski

|

|

✓

|

|

✓

|

|

✓

|

|

|

|

|

|

|

|

|

|

James Ziemer*

|

|

✓

|

|

Chair

|

|

|

|

✓

|

|

|

|

|

|

|

|

Total Fiscal Year 2019 Meetings

|

|

13

|

|

9

|

|

9

|

|

4

|

*Our Board has determined that Mr. Kosowsky and Mr. Ziemer are “audit committee financial experts” as defined in

Section 407 of the Sarbanes-Oxley Act of 2002.

Each member of each Committee is independent in accordance with the rules of the NYSE and our Director

Independence Standards which are available on our website, www.thorindustries.com.

29

THOR INDUSTRIES, INC.

Director Independence

Of our nine Directors, only one is employed by our Company, our CEO Mr. Martin. With the exception of Mr. Martin and Mr. Orthwein (who retired as an

employee of the Company at the end of Fiscal Year 2019), our Board is comprised entirely of “independent” Directors as that term is defined by both NYSE listing standards and our own Governance Guidelines. The Board conducts an annual

review to determine the continued “independence” of all of our Independent Directors (currently, Messrs. Suwinski, Ziemer, Graves, Kosowsky, Klein, Jones, and Ms. Huntington).

Independent Director Meetings

Thor’s

independent Directors, as an entire body or part thereof, meet in non-executive sessions that include Mr. Orthwein and all of the independent directors and in executive session of independent directors at

the conclusion of each Audit Committee meeting and Compensation and Development Committee meeting as well as upon the conclusion of each Board meeting.

Director Attendance

During our Fiscal Year 2019, the Board of Directors held 13 meetings. In the aggregate, Directors attended 97% of

the total meetings of the full Board. No Director attended less than 85% of the combined total meetings of the full Board and the Committees on which the Director served during this past year. All of the members of the Board are encouraged, but not

required, to attend the Company’s Annual Meeting of Shareholders. All of those who were members of the Board at the time of the 2018 Annual Meeting, attended the Meeting.

Annual Board And Committee Evaluation

Each year, our Board conducts evaluations of each Committee and the Board as a whole. This process includes evaluation of the individual members of the Committees and

the Board. The evaluation includes a process of dynamic feedback designed to identify areas of increased focus.

Board Risk Oversight

At both the full Board and Committee level, a primary function of our Board of Directors is to oversee the Company’s risk profile and the processes established by

management for managing risk. Our Board and its Committees regularly evaluate these risks and the mitigation strategies employed by management. In general terms, our Committees oversee the following risks:

AUDIT COMMITTEE

All risks related to financial

controls, including all applicable legal, regulatory, and compliance risks, as well as the overall risk management governance structure, including evaluating and responding to the assessments of both our internal audit department and our external

auditors.

COMPENSATION AND DEVELOPMENT COMMITTEE

All risks associated with the design and elements of our compensation program and related compliance issues, and all risks associated with the process of developing our

people and succession planning.

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE:

All risks within the scope of the Company’s governance programs and applicable compliance issues.

30

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

In performing its oversight responsibilities, the Board relies, in part, upon the results and information gained through

the Company’s Enterprise Risk Management Program, and considers the program for amendment, as appropriate. The program is designed to ensure appropriate risk monitoring of, and controls over, risks associated with our business. Risks evaluated

through the program include, but are not limited to, strategy, acquisition integration, legal, compliance, human resources, mergers & acquisitions, IT & cyber security, operations, and finance risks.

The Board receives regular reports from management regarding the status of its risk management programs, and provides input and direction designed to keep the risk

management programs effective against dynamic and ever-evolving risks applicable generally to commercial enterprises and specifically to our Company.

The Board and

management have developed a culture of risk awareness and risk management that includes annual Company-wide ethics training. Through this constant process, the Company gains input from a great number of its employees as it evaluates risks and

updates its management plan accordingly.

Diversity Policy

In Fiscal Year 2017, our Board formalized a diversity policy that it has followed in recent Board candidate searches. Under the Board’s diversity policy, the

initial list of candidates to be considered must include qualified candidates with diversity of race, ethnicity, and gender.

Succession Planning

Our Board is actively engaged and involved in talent management. Our succession plan and talent management programs are reviewed semi-annually with the Compensation and

Development Committee, and then reviewed and considered by the full Board. These discussions include an ongoing evaluation of our talent and leadership bench and the succession plan that envisions those individuals’ advancement to key positions

in our Company.

In addition, high-potential employees are regularly evaluated and engaged in comprehensive training, both on the job and in the classroom. During

Fiscal Year 2016, we instituted a program of executive studies through the University of Notre Dame in which high-potential employees and top-level management participate in a series of comprehensive programs

designed to provide further education relevant to their job functions. This program runs annually and provides a mechanism for the advancement of key employees.

Mandatory Resignation Policy

In Fiscal Year 2017, our Board implemented a mandatory age-based

resignation policy, requiring each Director who is 72 years of age or older to submit his or her resignation for consideration by the Board at our October Board meeting for action at our Annual Meeting. If the Board accepts the Director’s

resignation at the October Board meeting, the Director’s resignation would be effective at the Annual Meeting.

31

THOR INDUSTRIES, INC.

Shareholder Communications

We encourage Shareholder communication with the Company. Any communications from interested parties directed toward our Board or independent Directors specifically may

be sent to Andy Graves, our independent Chairman, who forwards to each of the other Board members or independent Directors, as appropriate, any such communications that, in the opinion of Mr. Graves, deal with the functions of our Board or the

Committees thereof or that he otherwise determines require their attention. Mr. Graves’ address for this purpose is c/o Thor Industries, Inc., Attention: Corporate Secretary, 601 East Beardsley Avenue, Elkhart, IN 46514.

Code Of Ethics

We have adopted a written code

of ethics, the “Thor Industries, Inc. Business Ethics Policy”, which is applicable to all of our Directors, Officers, and employees, including our principal Executive Officer, Principal Financial Officer, Principal Accounting Officer or

Controller, and other Executive Officers identified in this Proxy Statement who perform similar functions (collectively, the “Selected Officers”). Our code of ethics is posted on our website found at www.thorindustries.com and is available in print to any Shareholder who requests it. Each year members of the management teams at each of our subsidiaries, as well as our NEOs, engage in

training on our Business Ethics Policy. We intend to disclose any changes in, or waivers from, our code of ethics applicable to any Selected Officer on our website or by filing a Form 8-K with the SEC.

Our Governance Practices

Thor is committed to governance principles that are designed to be in the best interest of our Shareholders. Our Board evaluates each governance principle as it uniquely

applies to Thor. In some instances, this leads our Board to adopt and/or maintain policies that it deems in the best interest of Thor that may not be fully consistent with the views held by others. These decisions and determinations are not made

lightly; instead, great consideration is given to the adoption of principles best suited to Thor’s long-term success. Controlling governance principles include:

|

•

|

|

Our Board currently has a total of nine (9) members, seven (7) of whom are independent, and all of whom have significant business operations and/or management experience.

|

|

•

|

|

Our Board is declassified.

|

|

•

|

|

We maintain separate Chairman and CEO positions.

|

|

•

|

|

Our Chairman is independent.

|

|

•

|

|

Directors are elected by a majority of votes cast in uncontested elections and are required to submit their resignation in the event that the required majority vote is not received.

|

|

•

|

|

The Board and each of its Committees conduct an annual self-evaluation.

|

|

•

|

|

Our Board and NEOs have stock ownership and retention guidelines. In Fiscal Year 2015, the guidelines applicable to Directors were increased to an amount equal to three (3) times the annual retainer paid to the

Directors.

|

32

NOTICE OF 2019 ANNUAL MEETING & PROXY STATEMENT

|

•

|

|

We closely monitor the alignment of our NEO compensation with our long-term Shareholder return and with benchmarks.

|

|

|

•

|

|

We maintain a policy prohibiting derivative trading, hedging, and pledging by our Section 16 Officers and Directors.

|

|

|

•

|

|

In Fiscal Year 2013, we adopted a “no-fault” clawback policy that requires all recipients of incentive compensation to repay any compensation awarded based on financial

results that are subsequently restated.

|

|

|

•

|

|

The Board regularly reviews the Company’s succession plan and talent management program.

|

|

|

•

|

|

There is no Shareholder rights plan or “poison pill”.

|

|

|

•

|

|

Our Board instituted a mandatory resignation policy, requiring each Director 72 years of age or older to submit his or her resignation for consideration by the Board.

|

|

|

•

|

|

There is no enhancement of executive compensation upon a change in control.

|

|

|

•

|

|

In Fiscal Year 2015, our Board approved (for implementation in Fiscal Year 2016) a double trigger for all future awards and grants requiring either a corresponding change in employment status or the failure of an

acquirer to assume the award before any change in control would result in the accelerated vesting of such award and/or grant.

|

|

|

•

|

|

In Fiscal Year 2015, management and the Board adopted a Shareholder engagement strategy that resulted in direct communications with many of our Shareholders, which has created the opportunity and expectation of a

continuation of such outreach.

|

|

|

•

|

|

We maintain an ESG policy effectuated by a Committee over which our Nominating and Corporate Governance Committee has oversight.

|

|

THOR INDUSTRIES, INC.

Director Compensation

There were no changes to our Director compensation in Fiscal Year 2019. Each of our non-employee Directors