U.S. Futures Drop as Caterpillar, Texas Instruments Disappoint

October 23 2019 - 8:26AM

Dow Jones News

By Caitlin Ostroff

U.S. stock futures and European equities drifted lower Wednesday

as investors grappled with extended uncertainty on Brexit and took

stock of U.S. corporate earnings.

Futures tied to the Dow Jones Industrial Average fell 0.4% as

behemoth companies including Blackstone Group and Boeing reported

third-quarter earnings early in the day. Changes in futures don't

necessarily predict moves after the opening bell.

Texas Instruments dropped 11.5% in off-hours trading on

disappointing third-quarter results, and weighed on stocks of chip

makers globally. STMicroelectronics dropped 1.5% in Europe, while

Japan's Renesas Electronics fell 5.3% and South Korea's SK Hynix

slumped 1.8%.

Shares of Caterpillar tumbled 4% in premarket trading after it

slashed its full-year outlook. The construction-equipment maker

said it expects demand to stay flat due to global economic

uncertainty.

Thermo Fisher Scientific rallied over 3% after the lab-equipment

company raised the lower end of its revenue guidance for the

year.

Meanwhile, the Stoxx Europe 600 index ticked down 0.3%, while

the U.K.'s FTSE 250 fell 0.2%, after British lawmakers endorsed the

terms of a Brexit agreement but rejected the government's proposed

timetable. The pound, which had fallen sharply after Tuesday's

votes, edged down 0.1%.

Parliament's rejection of Prime Minister Boris Johnson's

legislative schedule for Brexit reduced the likelihood of a

departure by Oct. 31, said Michael Hewson, chief market analyst at

CMC Markets. Mr. Johnson said Tuesday he would try to trigger an

election if lawmakers move too slowly in considering his deal.

"There are a lot of moving parts," which makes it hard for

investors to position for what happens next, Mr. Hewson said. "We

are now in extension territory and we've been in that territory for

a while."

As investors flocked to haven assets, eurozone government bond

yields edged lower while the Japanese yen ticked higher and gold

prices rose.

The German 10-year bund yield dropped to minus 0.411%, from

minus 0.365% on Tuesday. The rate on 10-year U.K. gilts fell to

0.662% from 0.715% Tuesday afternoon. Gold rose 0.6%, while the yen

traded 0.1% higher against the U.S. dollar.

In Europe, shares of Swedbank AB fell 5.9% after the bank posted

a bigger-than-expected drop in third-quarter profit, citing a

competitive environment.

In Hong Kong, the Hang Seng Index fell 0.8% amid reports that

China is preparing to replace the city's leader, Carrie Lam.

Brent crude oil slid 0.8% to $59.25 a barrel after recent data

signaled a buildup in inventories of crude. Figures to be released

by the U.S. Energy Information Administration on Wednesday could

put additional pressure on prices if inventories are high,

according to ING.

More third-quarter earnings are due later in the day, with

heavyweights like Microsoft, Ford Motor and Tesla set to

report.

--David Hodari contributed to this article.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

October 23, 2019 08:11 ET (12:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

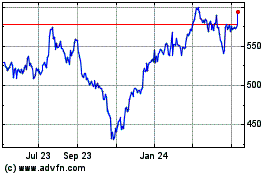

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

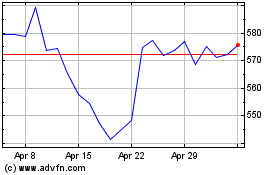

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Apr 2023 to Apr 2024