Current Report Filing (8-k)

September 25 2019 - 8:31AM

Edgar (US Regulatory)

false 0000097745 0000097745 2019-09-24 2019-09-24 0000097745 us-gaap:CommonStockMember 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotesFloatingRateDue2020Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes1.50due2020Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes2.15Due2022Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes0.75Due2024Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes200Due2025Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes1.40Due2026Member 2019-09-24 2019-09-24 0000097745 tmo:A1.45SeniorNotesDue2027Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes1.375Due2028Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes1.95Due2029Member 2019-09-24 2019-09-24 0000097745 tmo:SeniorNotes2.875Due2037Member 2019-09-24 2019-09-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 24, 2019

THERMO FISHER SCIENTIFIC INC.

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-8002

|

|

04-2209186

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

168 Third Avenue

Waltham, Massachusetts 02451

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (781) 622-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $1.00 par value

|

|

TMO

|

|

New York Stock Exchange

|

|

Floating Rate Notes due 2020

|

|

TMO /20A

|

|

New York Stock Exchange

|

|

1.500% Notes due 2020

|

|

TMO 20A

|

|

New York Stock Exchange

|

|

2.150% Notes due 2022

|

|

TMO 22A

|

|

New York Stock Exchange

|

|

0.750% Notes due 2024

|

|

TMO 24A

|

|

New York Stock Exchange

|

|

2.000% Notes due 2025

|

|

TMO 25

|

|

New York Stock Exchange

|

|

1.400% Notes due 2026

|

|

TMO 26A

|

|

New York Stock Exchange

|

|

1.450% Notes due 2027

|

|

TMO 27

|

|

New York Stock Exchange

|

|

1.375% Notes due 2028

|

|

TMO 28

|

|

New York Stock Exchange

|

|

1.950% Notes due 2029

|

|

TMO 29

|

|

New York Stock Exchange

|

|

2.875% Notes due 2037

|

|

TMO 37

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On September 24, 2019, Thermo Fisher Scientific Inc. (the “Company”) entered into an underwriting agreement (the “Euro Underwriting Agreement”) with Merrill Lynch International, Goldman Sachs & Co. LLC, Citigroup Global Markets Limited and J.P. Morgan Securities plc and the several other underwriters named in Schedule A to the Euro Underwriting Agreement, for the issuance and sale by the Company of €800,000,000 aggregate principal amount of 0.125% Senior Notes due 2025, €800,000,000 aggregate principal amount of 0.500% Senior Notes due 2028, €900,000,000 aggregate principal amount of 0.875% Senior Notes due 2031, €900,000,000 aggregate principal amount of 1.500% Senior Notes due 2039 and €1,000,000,000 aggregate principal amount of 1.875% Senior Notes due 2049 (collectively, the “Euro Notes”).

On September 24, 2019, the Company also entered into an underwriting agreement (the “US Underwriting Agreement”) with BofA Securities, Inc., Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC and HSBC Securities (USA) Inc., as representatives of the several underwriters named therein, for the issuance and sale by the Company of $900,000,000 aggregate principal amount of 2.600% Senior Notes due 2029 (the “US Notes”).

The offerings of the Euro Notes and the US Notes are being conducted pursuant to an effective registration statement on Form S-3 (File No. 333-229951), a related prospectus and separate prospectus supplements, each as filed with the Securities and Exchange Commission (the “SEC”) on September 24, 2019.

The Euro Notes will be issued pursuant to an indenture, dated as of November 20, 2009, between the Company, as issuer, and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee”) (the “Base Indenture”), as supplemented by the Eighteenth Supplemental Indenture, to be dated as of September 30, 2019, between the Company, as issuer, and the Trustee. The US Notes will be issued pursuant to the Base Indenture, as supplemented by the Nineteenth Supplemental Indenture, to be dated as of October 8, 2019, between the Company, as issuer, and the Trustee.

The Company expects that the net proceeds will be approximately €4.33 billion from the sale of the Euro Notes and $890.68 million from the sale of the US Notes, each after deducting the underwriting discounts and estimated offering expenses. The Company intends to use the net proceeds of the offerings (together with cash on hand) to repay commercial paper issued to fund the redemption on September 27, 2019 of $300 million aggregate principal amount of 4.70% Senior Notes due 2020 and $800 million aggregate principal amount of 3.15% Senior Notes due 2023, and to fund the redemption of approximately $4.5 billion aggregate principal amount of outstanding senior notes issued by Thermo Fisher or its subsidiaries, including all of the outstanding 6.00% Senior Notes due 2020 and 5.00% Senior Notes due 2021 issued by its subsidiary Life Technologies Corporation, of which notice is expected to be provided to holders on September 25, 2019. The foregoing does not constitute a notice of redemption for the aforementioned notes.

The above descriptions of the Euro Underwriting Agreement and the US Underwriting Agreement are qualified in their entirety by reference to the Euro Underwriting Agreement and the US Underwriting Agreement, which are filed as Exhibits 1.1 and 1.2 to this Current Report on Form 8-K and are incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

1.1

|

|

|

Underwriting Agreement, dated September 24, 2019, among the Company, as issuer, and Merrill Lynch International, Goldman Sachs & Co. LLC, Citigroup Global Markets Limited and J.P. Morgan Securities plc and the several other underwriters named in Schedule A of the Underwriting Agreement.

|

|

|

|

|

|

|

|

|

1.2

|

|

|

Underwriting Agreement, dated September 24, 2019, among the Company, as issuer, and BofA Securities, Inc., Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC and HSBC Securities (USA) Inc., as representatives of the several underwriters named in the Underwriting Agreement.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

THERMO FISHER SCIENTIFIC INC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THERMO FISHER SCIENTIFIC INC.

|

|

|

|

|

|

|

|

|

|

Date: September 24, 2019

|

|

|

|

By:

|

|

/s/ Michael A. Boxer

|

|

|

|

|

|

|

|

Michael A. Boxer

|

|

|

|

|

|

|

|

Senior Vice President and General Counsel

|

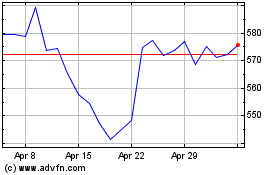

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

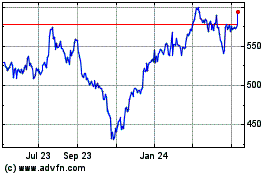

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Apr 2023 to Apr 2024