- Teradata continued to make progress on key Cloud, Vantage, and

Go-to-market efforts in the first quarter

- The Company’s technology is critical in supporting customers

during COVID-19 and Teradata used this opportunity to further

support customers and deepen relationships

- Teradata’s first-quarter results were negatively impacted by

COVID-19

- The Company is withdrawing its full-year 2020 guidance due to

uncertainties relating to COVID-19

Teradata Corp. (NYSE: TDC) today announced its first-quarter

2020 financial results. Business trends through the first

two-thirds of the quarter were normal, however the second half of

March saw a significant number of deals postponed which negatively

impacted first-quarter results. Recurring revenue increased 4

percent, 6 percent in constant currency(1), from the first quarter

of 2019. Annual recurring revenue (ARR) increased 6 percent, 8

percent in constant currency(1), from the first quarter of 2019.

Total first-quarter revenue was $434 million, compared to 2019

first-quarter total revenue of $468 million. As the company

continues to shift to a recurring revenue model and focuses its

consulting business on higher-margin engagements, both perpetual

and consulting revenues declined versus prior year as expected. In

addition, currency translation had a 1 percentage point negative

impact on the first-quarter total revenue comparison.

“Teradata is focused on supporting our customers and employees

through the COVID-19 pandemic. Our history of fostering strong

customer relationships and our long-standing position delivering

business essential analytics are foundational to our customers in

these challenging times,” said Vic Lund, Interim CEO, Teradata.

“Our resilience has been proven as we advance our key strategic

initiatives including accelerating our transition to the Cloud,

driving broader adoption of Vantage, and expanding our go-to-market

opportunities. Our extensive enterprise customer base, mission

critical technology, and strong financial condition position us

well to emerge stronger from the pandemic.”

Teradata reported 2020 first-quarter net income of $168 million

under U.S. Generally Accepted Accounting Principles (GAAP), or

$1.51 per diluted share, which compared to a net loss of $(10)

million, or $(0.09) per share, in the first quarter of 2019. As

previously disclosed, the company restructured certain of its

intellectual property (IP) and recognized a discrete tax benefit in

the quarter which contributed $1.41 per diluted share to EPS on a

GAAP basis. Non-GAAP 2020 first-quarter net income, which excludes

the IP restructuring tax benefit, stock-based compensation expense

and other special items, was $30 million, or $0.27 per diluted

share, as compared to $26 million, or $0.22 per diluted share, in

the first quarter of 2019(2).

Gross Margin

2020 first-quarter gross margin reported under GAAP was 51.8

percent versus 47.9 percent for the first quarter of 2019. On a

non-GAAP basis, excluding stock-based compensation expense and

other special items, 2020 first-quarter gross margin was 54.1

percent, versus 51.5 percent in the prior-year period(2). Gross

margin was higher year-over-year due primarily to continued mix

shift, away from perpetual hardware and consulting to higher margin

recurring revenue.

Operating Loss / Income

2020 first-quarter operating loss reported under GAAP was $(6)

million which compares to $(5) million in the first quarter of

2019. On a non-GAAP basis, excluding stock-based compensation

expense and other special items, 2020 first-quarter operating

income was $32 million versus $41 million in the first quarter of

2019(2). The decrease in non-GAAP operating income was primarily

driven by revenue-related headwinds due to the impact of COVID-19,

as well as ongoing investments related to our go-to-market and

Cloud initiatives.

Income Taxes

Teradata’s 2020 first-quarter tax rate under GAAP was 1,300.0

percent compared to 0.0 percent in the first quarter of 2019,

primarily driven by the recognition of a $157 million tax benefit

related to the IP restructuring previously disclosed. Excluding

special items, Teradata’s non-GAAP 2020 first-quarter tax rate was

negative 25.0 percent versus 27.8 percent in the first quarter of

2019(2).

Cash Flow

During the first quarter of 2020, Teradata generated $10 million

of cash from operating activities compared to $49 million in the

same period of 2019. During the quarter, Teradata used $12 million

for capital expenditures and additions to capitalized software

development costs, versus using $16 million in the first quarter of

2019. Teradata’s 2020 first-quarter free cash flow was $(2)

million, compared to $33 million in the first quarter of 2019(3).

The decline in free cash flow year-over-year was primarily driven

by over $30 million of delayed cash collections related to

COVID-19, the majority of which were collected in April.

Balance Sheet

Teradata ended the first quarter 2020 with $394 million in cash.

During the first quarter of 2020, Teradata repurchased 3.7 million

shares of the Company’s common stock for approximately $75 million.

At the end of the first quarter, Teradata had approximately $432

million of board authorization remaining for share repurchases and

108.3 million shares outstanding. However, as a precautionary

measure, the Company has suspended its share buyback program due to

the ongoing COVID-19 pandemic to help ensure it has appropriate

cash levels to support its customers and employees.

As of March 31, 2020, the Company had total debt of $610

million, including $135 million of outstanding finance lease

obligations. There were no funds drawn on the company’s $400

million revolving credit facility as of March 31, 2020.

Teradata’s Response to COVID-19

First and foremost, our thoughts are with those who has been

impacted by COVID-19, directly or indirectly. The health of our

employees, our customers and our communities is paramount in these

unprecedented times. As COVID-19 spread rapidly around the world

during the first quarter, Teradata took a number of measures to

support our customers and protect our employees, including, among

other things:

- To help limit the spread of the virus, our associates are

working from home, we are limiting company travel and have

transitioned our marketing events to be entirely virtual;

- Our focus is on helping our customers through this pandemic by

continuing to deliver the highest levels of performance,

availability and peace of mind;

- In support of the broader global community, we will also be

making some of our technology available for our customers,

partners, and communities - particularly in healthcare, government

and other verticals where collectively, we can positively impact

efforts in combating COVID-19; and

- Finally, because the situation is dynamic, we instituted a

Pandemic Response Team which will continue to monitor the guidance

from leading global health organizations and take the appropriate

steps to keep all of our stakeholders safe and healthy.

Guidance

Due to the evolving nature and uncertain impact of COVID-19 on

Teradata’s operating and financial results, the Company is

withdrawing its guidance for the full-year 2020, which was provided

on February 6, 2020.

For the second quarter of 2020, Teradata expects recurring

revenue in the range between $348 million and $352 million.

GAAP loss per share in the second quarter of 2020 is expected to

be in the $(0.09) to $(0.06) range. Non-GAAP earnings per share,

excluding stock-based compensation expense and other special items,

in the second quarter is expected to be in the $0.19 to $0.22

range(2).

Earnings Conference Call

A conference call is scheduled today at 2:00 p.m. PT to discuss

the Company’s 2020 first-quarter results and provide a business and

financial update. Access to the conference call, as well as a

replay of the conference call, is available on Teradata’s website

at investor.teradata.com.

Supplemental Financial Information

Additional information regarding Teradata’s operating results is

provided below as well as on Teradata’s website at

investor.teradata.com.

1.

The impact of currency is determined by

calculating the prior-period results using the current-year monthly

average currency rates (except for currency impact on ARR which is

calculated using month-end rates). See the foreign currency

fluctuation schedule on the Investor Relations page of the

Company’s web site at investor.teradata.com, which is used to

determine revenue on a constant currency (“CC”) basis.

Revenue

(in millions)

For the Three Months ended

March 31

2020

2019

% Change as Reported

% Change in Constant

Currency

Recurring revenue

$345

$331

4%

6%

Perpetual software licenses and

hardware

14

31

(55%)

(55%)

Consulting services

75

106

(29%)

(28%)

Total revenue

$434

$468

(7%)

(6%)

Americas

$244

$269

(9%)

(9%)

EMEA

118

113

4%

6%

APAC

72

86

(16%)

(13%)

Total revenue

$434

$468

(7%)

(6%)

As of March 31

2020

2019

% Change as Reported

% Change in Constant

Currency

Annual recurring revenue (ARR)*

$1,402

$1,319

6%

8%

* Annual recurring revenue is defined as

the annual value at a point in time of all recurring contracts,

including subscription, software upgrade rights, maintenance and

managed services.

2.

Teradata reports its results in accordance

with GAAP. However, as described below, the Company believes that

certain non-GAAP measures, such as non-GAAP gross profit, non-GAAP

operating income, non-GAAP net income, and non-GAAP earnings per

diluted share, or EPS, all of which exclude certain items (as well

as free cash flow) are useful for investors. Our non-GAAP measures

are not meant to be considered in isolation or as substitutes for,

or superior to, results determined in accordance with GAAP, and

should be read only in conjunction with our condensed consolidated

financial statements prepared in accordance with GAAP.

The following tables reconcile Teradata’s

actual and projected results and EPS under GAAP to the Company’s

actual and projected non-GAAP results and EPS for the periods

presented, which exclude certain specified items. Our management

internally uses supplemental non-GAAP financial measures, such as

gross profit, operating income, net income and EPS, excluding

certain items, to understand, manage and evaluate our business and

support operating decisions on a regular basis. The Company

believes such non-GAAP financial measures (1) provide useful

information to investors regarding the underlying business trends

and performance of the Company’s ongoing operations, (2) are useful

for period-over-period comparisons of such operations and results,

that may be more easily compared to peer companies and allow

investors a view of the Company’s operating results excluding

stock-based compensation expense and special items, (3) provide

useful information to management and investors regarding present

and future business trends, and (4) provide consistency and

comparability with past reports and projections of future

results.

Teradata’s reconciliation of GAAP to

non-GAAP results included in this release.

For the

Three Months

(in millions, except per share data)

ended March 31

Gross Profit:

2020

2019

% Chg.

GAAP Gross Profit

$225

$224

-%

% of Revenue

51.8%

47.9%

Excluding:

Stock-based compensation expense

4

3

Acquisition, integration,

reorganization-related, and other costs

-

3

Amortization of capitalized software

6

11

Non-GAAP Gross Profit

$235

$241

(2%)

% of Revenue

54.1%

51.5%

Operating (Loss)

GAAP Operating Loss

$(6)

$(5)

(20%)

% of Revenue

(1.4%)

(1.1%)

Excluding:

Stock-based compensation expense

21

15

Amortization of acquisition-related

intangible assets

1

2

Acquisition, integration,

reorganization-related, and other costs

10

18

Amortization of capitalized software

6

11

Non-GAAP Operating Income

$32

$41

(22%)

% of Revenue

7.4%

8.8%

Net Income / (Loss)

GAAP Net Income / (Loss)

$168

$(10)

1,780%

% of Revenue

38.7%

(2.1%)

Excluding:

Stock-based compensation expense

21

15

Amortization of acquisition-related

intangible assets

1

2

Acquisition, integration,

reorganization-related, and other costs

10

18

Amortization of capitalized software

6

11

IP Restructuring Tax Benefit(1)

(157)

-

Tax Contingency adjustment(2)

(18)

-

Income tax adjustments(3)

(1)

(10)

Non-GAAP Net Income

$30

$26

15%

% of Revenue

6.9%

5.6%

For the Three Months ended

March 31

Earnings Per Share:

2020

2019

2020 Q2

Guidance

GAAP Earnings / (Loss) Per Share

$1.51

$(0.09)

$(0.09) - $(0.06)

Excluding:

Stock-based compensation expense

0.19

0.13

0.25

Amortization of acquisition-related

intangible assets

0.01

0.02

0.01

Acquisition, integration,

reorganization-related, and other costs

0.09

0.15

0.03

Amortization of capitalized software

0.05

0.09

0.05

IP Restructuring tax benefit(1)

(1.41)

-

-

Tax Contingency adjustment(2)

(0.16)

-

-

Income tax adjustments(3)

(0.01)

(0.09)

(0.06)

Impact of dilution(4)

-

0.01

-

Non-GAAP Diluted Earnings Per Share

$0.27

$0.22

$0.19 – $0.22

(1)

The Company’s forecasted full-year 2020

GAAP effective tax rates include $157 million of discrete tax

benefit related to an intra-entity asset transfer of certain of its

intellectual property to one of its Irish subsidiaries, which

occurred on January 1, 2020. The one-time tax benefit for this

intra-entity asset transfer was recorded as a deferred tax asset

for GAAP reporting purposes in the first quarter of 2020 but was

excluded from Non-GAAP results.

(2)

The Company’s forecasted full-year 2020

GAAP marginal effective tax rate includes $3 million of tax expense

related to tax contingencies pursuant to FIN 48. For GAAP purposes,

this is a component of the marginal rate and is recognized as tax

benefit or expense based on the Company’s reported GAAP pre-tax

income or loss for the quarter. To more accurately reflect the

impact of the expense on a quarterly basis for Non-GAAP purposes,

the $3 million of tax expense is being recognized ratably each

quarter instead of being included in the marginal effective

rate.

(3)

Represents the income tax effect of the

pre-tax adjustments to reconcile GAAP to Non-GAAP income based on

the applicable jurisdictional statutory tax rate of the underlying

item. Including the income tax effect assists investors in

understanding the tax provision associated with those adjustments

and the effective tax rate related to the underlying business and

performance of the Company’s ongoing operations.

As a result of these adjustments, the

Company’s non-GAAP effective tax rate for the first quarter of 2020

was (25.0%) and 27.8% in the first quarter of 2019.

(4)

Represents the impact to earnings per

share as a result of moving from basic to diluted shares.

3.

As described below, the Company believes

that free cash flow is a useful non-GAAP measure for investors.

Teradata defines free cash flow as cash provided by /used in

operating activities less capital expenditures for property and

equipment, and additions to capitalized software. Free cash flow

does not have a uniform definition under GAAP and therefore,

Teradata’s definition may differ from other companies’ definitions

of this measure. Teradata’s management uses free cash flow to

assess the financial performance of the Company and believes it is

useful for investors because it relates the operating cash flow of

the Company to the capital that is spent to continue and improve

business operations. In particular, free cash flow indicates the

amount of cash generated after capital expenditures for, among

other things, investment in the Company’s existing businesses,

strategic acquisitions, strengthening the Company’s balance sheet,

repurchase of the Company’s stock and repayment of the Company’s

debt obligations, if any. Free cash flow does not represent the

residual cash flow available for discretionary expenditures since

there may be other nondiscretionary expenditures that are not

deducted from the measure. This non-GAAP measure is not meant to be

considered in isolation, as a substitute for, or superior to,

results determined in accordance with GAAP, and should be read only

in conjunction with our condensed consolidated financial statements

prepared in accordance with GAAP.

(in millions)

For the Three Months

ended March 31

2020

2019

Cash provided by operating activities

(GAAP)

$10

$49

Less capital

expenditures for:

Expenditures for property and

equipment

(10)

(15)

Additions to capitalized software

(2)

(1)

Total capital expenditures

(12)

(16)

Free Cash Flow (non-GAAP measure)

$(2)

$33

Note to Investors

This news release contains forward-looking statements within the

meaning of Section 21E of the Securities and Exchange Act of 1934.

Forward-looking statements generally relate to opinions, beliefs

and projections of expected future financial and operating

performance, business trends, and market conditions, among other

things. These forward-looking statements are based upon current

expectations and assumptions and involve risks and uncertainties

that could cause actual results to differ materially, including the

factors discussed in this release and those relating to: the global

economic environment and business conditions in general or on the

ability of our suppliers to meet their commitments to us, or the

timing of purchases by our current and potential customers; the

rapidly changing and intensely competitive nature of the

information technology industry and the data analytics business;

fluctuations in our operating results, including as a result of the

pace and extent to which customers shift from perpetual to

subscription-based licenses; our ability to realize the anticipated

benefits of our business transformation program or other

restructuring and cost saving initiatives; risks inherent in

operating in foreign countries, including foreign currency

fluctuations; risks associated with the evolving nature and

uncertain impact of COVID-19 on our business, financial condition

and operating results, including the impact of COVID-19 on our

customers and suppliers; risks associated with data privacy,

cyberattacks and maintaining secure and effective internal

information technology and control systems; the timely and

successful development, production or acquisition and market

acceptance of new and existing products and services; tax rates;

turnover of workforce and the ability to attract and retain skilled

employees; protecting our intellectual property; availability and

successful exploitation of new alliance and acquisition

opportunities; recurring revenue may decline or fail to be renewed;

the impact on our business and financial reporting from changes in

accounting rules; and other factors described from time to time in

Teradata’s filings with the U.S. Securities and Exchange

Commission, including its annual report on Form 10-K and subsequent

quarterly reports on Forms 10-Q, as well as the Company’s annual

report to stockholders. Teradata does not undertake any obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

About Teradata

Teradata transforms how businesses work and people live through

the power of data. Teradata leverages all of the data, all of the

time, so you can analyze anything, deploy anywhere, and deliver

analytics that matter. We call this pervasive data intelligence.

And it’s the answer to the complexity, cost, and inadequacy of

today’s approach to analytics. Get the answer at teradata.com.

Teradata and the Teradata logo are trademarks

or registered trademarks of Teradata Corporation and/or its

affiliates in the U.S. and worldwide.

Schedule A

TERADATA CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF

(LOSS) INCOME (in millions, except per share amounts -

unaudited) For the Period Ended March 31 Three

Months

2020

2019

% Chg

Revenue Recurring

$

345

$

331

4

%

Perpetual software licenses and hardware

14

31

(55

%)

Consulting services

75

106

(29

%)

Total revenue

434

468

(7

%)

Gross profit Recurring

225

225

% of Revenue

65.2

%

68.0

%

Perpetual software licenses and hardware

5

6

% of Revenue

35.7

%

19.4

%

Consulting services

(5

)

(7

)

% of Revenue

(6.7

%)

(6.6

%)

Total gross profit

225

224

% of Revenue

51.8

%

47.9

%

Selling, general and administrative expenses

158

151

Research and development expenses

73

78

Loss from operations

(6

)

(5

)

% of Revenue

(1.4

%)

(1.1

%)

Other expense, net

(8

)

(5

)

Loss before income taxes

(14

)

(10

)

% of Revenue

(3.2

%)

(2.1

%)

Income tax benefit

(182

)

-

% Tax rate

1,300.0

%

-

Net income (loss)

$

168

$

(10

)

% of Revenue

38.7

%

(2.1

%)

Net income (loss) per common share Basic

$

1.52

$

(0.09

)

Diluted

$

1.51

$

(0.09

)

Weighted average common shares outstanding Basic

110.3

117.1

Diluted

111.3

117.1

Schedule B

TERADATA CORPORATION CONDENSED CONSOLIDATED

BALANCE SHEETS (in millions - unaudited)

March 31,

December 31,

March 31,

2020

2019

2019

Assets Current assets

Cash and cash equivalents

$

394

$

494

$

723

Accounts receivable, net

448

398

445

Inventories

28

31

52

Other current assets

104

91

82

Total current assets

974

1,014

1,302

Property and equipment, net

334

350

303

Capitalized software, net

30

36

60

Right of use assets - operating lease, net

49

51

60

Goodwill

394

396

396

Capitalized contract costs

87

91

57

Deferred income taxes

253

87

66

Other assets

30

32

42

Total assets

$

2,151

$

2,057

$

2,286

Liabilities and stockholders'

equity Current liabilities Current portion of

long-term debt

$

25

$

25

$

25

Current portion of finance lease liability

60

55

21

Current portion of operating lease liability

17

20

17

Accounts payable

96

66

99

Payroll and benefits liabilities

86

157

103

Deferred revenue

555

472

569

Other current liabilities

67

91

80

Total current liabilities

906

886

914

Long-term debt

448

454

472

Finance lease liability

75

75

38

Operating lease liability

37

38

48

Pension and other postemployment plan liabilities

133

137

104

Long-term deferred revenue

44

61

100

Deferred tax liabilities

6

6

4

Other liabilities

153

138

139

Total liabilities

1,802

1,795

1,819

Stockholders' equity Common stock

1

1

1

Paid-in capital

1,567

1,545

1,466

Accumulated deficit

(1,050

)

(1,143

)

(891

)

Accumulated other comprehensive loss

(169

)

(141

)

(109

)

Total stockholders' equity

349

262

467

Total liabilities and stockholders' equity

$

2,151

$

2,057

$

2,286

Schedule C

TERADATA CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (in millions - unaudited) For the

Period Ended March 31 Three Months

2020

2019

Operating activities Net income (loss)

$

168

$

(10

)

Adjustments to reconcile net income (loss) to net cash

provided by operating activities: Depreciation and amortization

42

37

Stock-based compensation expense

21

15

Deferred income taxes

(149

)

2

Changes in assets and liabilities: Receivables

(50

)

143

Inventories

3

(24

)

Current payables and accrued expenses

(43

)

(171

)

Deferred revenue

66

74

Other assets and liabilities

(48

)

(17

)

Net cash provided by operating activities

10

49

Investing activities Expenditures for property and

equipment

(10

)

(15

)

Additions to capitalized software

(2

)

(1

)

Net cash used in investing activities

(12

)

(16

)

Financing activities Repurchases of common stock

(73

)

(56

)

Repayments of long-term borrowings

(6

)

-

Payments of finance leases

(9

)

(3

)

Other financing activities, net

-

33

Net cash used in financing activities

(88

)

(26

)

Effect of exchange rate changes on cash and cash equivalents

(10

)

1

(Decrease) increase in cash, cash equivalents and

restricted cash

(100

)

8

Cash, cash equivalents and restricted cash at beginning of

period

496

716

Cash, cash equivalents and restricted cash at end of

period

$

396

$

724

Supplemental cash flow disclosure: Non-cash

investing and financing activities: Assets acquired by finance

leases

$

15

$

15

Assets acquired by operating leases

$

3

$

3

Schedule D

TERADATA CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in millions - unaudited) For the

Three Months Ended March 31

2020

2019

% Change As Reported

% Change Constant Currency

(2)

Segment Revenue Americas

$

244

$

269

(9

%)

(9

%)

EMEA

118

113

4

%

6

%

APAC

72

86

(16

%)

(13

%)

Total segment revenue

434

468

(7

%)

(6

%)

Segment gross profit Americas

144

157

% of Revenue

59.0

%

58.4

%

EMEA

61

50

% of Revenue

51.7

%

44.2

%

APAC

30

34

% of Revenue

41.7

%

39.5

%

Total segment gross profit

235

241

% of Revenue

54.1

%

51.5

%

Reconciling items(1)

(10

)

(17

)

Total gross profit

$

225

$

224

% of Revenue

51.8

%

47.9

%

(1) Reconciling items include stock-based

compensation, capitalized software, amortization of

acquisition-related intangible assets and acquisition, integration

and reorganization-related items. (2) The impact of currency

is determined by calculating the prior period results using the

current-year monthly average currency rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200507006097/en/

INVESTOR CONTACT Nabil Elsheshai 858-485-2125 office

nabil.elsheshai@teradata.com MEDIA CONTACT Jennifer

Donahue 858-485-3029 office jennifer.donahue@teradata.com

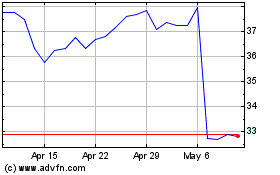

Teradata (NYSE:TDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

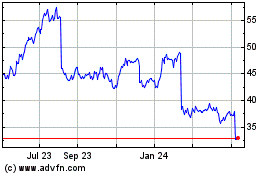

Teradata (NYSE:TDC)

Historical Stock Chart

From Apr 2023 to Apr 2024