Tenet Announces Private Offering of Senior Secured Notes to Refinance $4.2 Billion in Outstanding Notes

August 12 2019 - 7:29AM

Business Wire

Tenet Healthcare Corporation (NYSE: THC) intends to refinance up

to $4.2 billion of its currently outstanding notes by a private

placement offering of $4.2 billion in aggregate principal amount of

newly issued senior secured first lien notes in tranches maturing

in 2026 and 2027 (the “notes”). Completion of the offering is

subject to, among other things, pricing and market conditions.

Tenet intends to use the net proceeds from the sale of the

notes, after payment of fees and expenses, together with cash on

hand and/or any borrowings under its senior secured revolving

credit facility, to fund the redemption and discharge of:

- $500 million aggregate principal amount of its outstanding

4.750% Senior Secured Notes due 2020;

- $1,800 million aggregate principal amount of its outstanding

6.000% Senior Secured Notes due 2020;

- $850 million aggregate principal amount of its outstanding

4.500% Senior Secured Notes due 2021; and

- $1,050 million outstanding aggregate principal amount of its

4.375% Senior Secured Notes due 2021.

Tenet also expects to seek an amendment to its existing senior

secured revolving credit facility following the offering, which may

include increasing borrowing capacity up to $1.5 billion (up from

$1.0 billion) and extending the maturity date, among other

changes.

The notes will be guaranteed by certain of Tenet’s subsidiaries

and secured on a first lien priority basis by a pledge of the

capital stock and other ownership interests of certain of Tenet’s

subsidiaries. The notes will be effectively senior to Tenet’s

existing and future indebtedness secured on a more junior basis, as

well as unsecured indebtedness and other liabilities, to the extent

of the value of the collateral securing such borrowings.

The notes to be offered will not be registered under the

Securities Act of 1933, as amended (the “Securities Act”), or any

other state securities laws. As a result, they may not be offered

or sold in the United States or to any U.S. persons, except

pursuant to an applicable exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act.

Accordingly, the notes will be offered only to persons reasonably

believed to be “qualified institutional buyers” under Rule 144A of

the Securities Act or, outside the United States, to persons other

than “U.S. persons” in compliance with Regulation S under the

Securities Act. A confidential offering memorandum for the notes

will be made available to such eligible persons. The offering will

be conducted in accordance with the terms and subject to the

conditions set forth in such offering memorandum.

This news release is neither an offer to sell nor a solicitation

of an offer to buy, nor shall there be any sale of, these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About Tenet Healthcare

Tenet Healthcare Corporation is a national diversified

healthcare services company headquartered in Dallas, with 110,000

employees. Through an expansive care network that includes United

Surgical Partners International, we operate 65 hospitals and

approximately 500 other healthcare facilities, including surgical

hospitals, ambulatory surgery centers, urgent care and imaging

centers and other outpatient facilities. We also operate Conifer

Health Solutions, which provides revenue cycle management and

value-based care services to hospitals, health systems, physician

practices, employers and other customers. At the center of

everything we do is a commitment to deliver the right care, in the

right place, at the right time, and to continually improve and

advance the healthcare delivery system in the markets we serve. For

more information, please visit www.tenethealth.com.

This release contains “forward-looking statements” – that is,

statements that relate to future, not past, events. In this

context, forward-looking statements often address our expected

future business and financial performance and financial condition,

and often contain words such as “expect,” “anticipate,” “assume,”

“believe,” “budget,” “estimate,” “forecast,” “intend,” “plan,”

“predict,” “project,” “seek,” “see,” “target,” or “will.”

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Particular uncertainties that

could cause our actual results to be materially different than

those expressed in our forward-looking statements include, but are

not limited to, uncertainties about the timing or amount of the

proposed offering, whether the offering will be completed, the

expected purposes of the offering and the factors disclosed under

“Forward-Looking Statements” and “Risk Factors” in our Form 10-K

for the year ended December 31, 2018, Form 10-Q for the quarterly

period ended June 30, 2019 and other filings with the Securities

and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190812005271/en/

Investor Contact: Brendan Strong 469-893-6992

investorrelations@tenethealth.com

Media Contact: Lesley Bogdanow 469-893-2640

mediarelations@tenethealth.com

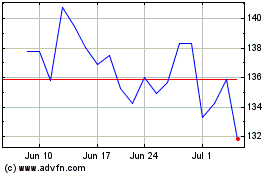

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Mar 2024 to Apr 2024

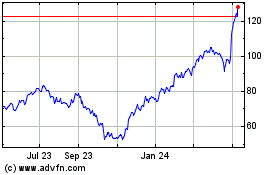

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Apr 2023 to Apr 2024