UPDATE: Tenet Healthcare 1Q Profit Falls 16%; Admissions Grow

May 03 2011 - 11:56AM

Dow Jones News

Tenet Healthcare Corp.'s (THC) first-quarter profit fell 16% on

an increased income tax expense, while the hospital operator

generated higher revenue on admissions and outpatient growth and

posted a wider operating margin.

The company said it continued to benefit from commercial health

insurance rate increases, but that Medicare cuts restrained pricing

growth.

Dallas-based Tenet boosted its full-year outlook range for

adjusted earnings before interest, taxes, depreciation and

amortization by $25 million, reflecting early receipt of Medicaid

health information-technology incentives and continued confidence

in performance, President and Chief Executive Trevor Fetter said.

The company also reported a decline in the expense for unpaid

patient debt.

"Volume growth was a clear highlight in the quarter," Fetter

said. "Growth in both paying admissions and total admissions turned

positive in the quarter."

Tenet has spent the past few months publicly fending off a

takeover offer from Community Health Systems Inc. (CYH), which

Monday increased its all-cash bid for Tenet to $7.25 a share, or

some $4.07 billion, from $6 a share.

Tenet has been aggressive in battling its pursuer and last month

filed a federal lawsuit that accused Community Health of

overbilling Medicare by improperly admitting patients who should

have been treated on outpatient status, an allegation Community has

denied. The judge in the case has set a scheduling conference for

next week, Fetter said on a conference call. Fetter noted that

since the board is reviewing Community's revised bid, Tenet

executives wouldn't answer questions on the offer or the lawsuit on

the call.

The Justice Department, Department of Health and Human Services

Office of Inspector General and Texas attorney general's office are

investigating Community's emergency-department billing and

admissions procedures.

Tenet, meanwhile, reported a first-quarter profit of $79

million, compared with $94 million a year earlier. On a per-share

basis, which includes preferred dividends, earnings were 14 cents a

share, compared with 17 cents a year earlier. Net operating revenue

rose 7.1% to $2.51 billion.

Analysts polled by Thomson Reuters had forecast a per-share

profit of 14 cents on $2.48 billion in revenue.

Operating margin widened to 10.3% from 8.6%.

Adjusted same-hospital admissions grew 2.3% as outpatient visits

increased 6.1% and admissions climbed 0.6%, marking the second

straight quarter with an improving year-over-year inpatient trend,

the company said.

Revenue per admission grew 6.5%, indicating strong pricing,

while revenue per outpatient visit declined 2.2%. While revenue

from managed-care declined nearly 1%, Fetter cited "strong

managed-care pricing" as contributing to the quarter. Chief

Financial Officers Biggs Porter said negotiated commercial

managed-care increase favorably affected inpatient and outpatient

pricing.

Income tax expense increased by $48 million, to $51 million.

The expense for patient bad debt declined year over year both in

actual dollars and as a percentage of revenue, and revenue

attributed to uninsured patients declined in the first quarter,

Tenet said.

The company boosted its 2011 adjusted Ebitda outlook by $25

million to a range of $1.175 billion to $1.275 billion, and

increased its view for normalized earnings per share from

continuing operations by a nickel, to a range of 38 cents to 51

cents.

Jefferies & Co. analyst Arthur Henderson called the quarter

solid. Even though Tenet benefited from favorable one-time items,

"adjusted results were still very impressive and were supported by

good volume growth, good mix (and) pricing and solid expense

management," he said, adding that volumes exceeded

expectations.

Tenet shares recently were down 5 cents to $6.64; they are down

13% over the past month, as doubts increased over the likelihood of

Community succeeding in its hostile bid, and are up almost 5% in

the last year.

Community Health shares traded down 3.3% to $29.22, and are down

nearly 28% over the past month--hit by the Tenet lawsuit--and down

30% over the past year. Raymond James cuts its rating on Community

to market perform from outperform.

-By Dinah Wisenberg Brin, Dow Jones Newswires, 215-982-5582;

dinah.brin@dowjones.com

- Drew FitzGerald contributed to this article.

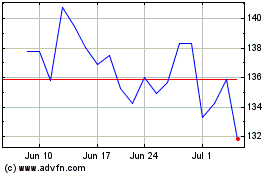

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Aug 2024 to Sep 2024

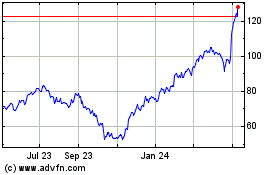

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Sep 2023 to Sep 2024