Tenaris S.A. (NYSE and Mexico: TS and MTA Italy: TEN) (“Tenaris”)

today announced its results for the quarter and nine months ended

September 30, 2019 with comparison to its results for the quarter

and nine months ended September 30, 2018.

Summary of 2019 Third Quarter Results

(Comparison with second quarter of 2019 and third quarter of

2018)

|

|

3Q 2019 |

2Q 2019 |

3Q 2018 |

|

Net sales ($ million) |

1,764 |

1,918 |

(8%) |

1,899 |

(7%) |

|

Operating income ($ million) |

187 |

234 |

(20%) |

258 |

(28%) |

|

Net income ($ million) |

101 |

240 |

(58%) |

247 |

(59%) |

|

Shareholders’ net income ($ million) |

107 |

241 |

(56%) |

247 |

(57%) |

|

Earnings per ADS ($) |

0.18 |

0.41 |

(56%) |

0.42 |

(57%) |

|

Earnings per share ($) |

0.09 |

0.20 |

(56%) |

0.21 |

(57%) |

|

EBITDA ($ million) |

322 |

370 |

(13%) |

394 |

(18%) |

|

EBITDA margin (% of net sales) |

18.2% |

19.3% |

|

20.7% |

|

Our third quarter sales fell 8% sequentially and

7% year on year, despite gains in the Middle East and Mexico,

reflecting ongoing activity reductions in the US and Argentine

shales, which is affecting prices throughout the Americas, and a

downturn in our European industrial sales. Our EBITDA margin was

affected by a decline in average selling prices and the impact of

major maintenance stoppages in the northern hemisphere, principally

in Mexico. Net income for the quarter was further affected by the

impact of currency devaluations on our income tax charge in

Argentina and Mexico and by a lower contribution from our equity

investment in Ternium.

Despite the decline in net income, we generated

a free cash flow of $287 million, or 16% of revenues, which

included a further decline in working capital of $157 million, and

we ended the quarter with a net cash position of $964 million.

Interim Dividend Payment

Our board of directors approved the payment of

an interim dividend of $0.13 per share ($0.26 per ADS), or

approximately $153 million. The payment date will be November 20,

2019 , with an ex-dividend date on November 18, 2019 and record

date on November 19, 2019.

Market Background and Outlook

During the third quarter, drilling activity in

the US shales fell further, as operators chose to prioritize

investor returns over production growth and maintain spending

within budget limits announced at the beginning of the year. We do

not expect a recovery in US shale drilling activity going into

2020. In Canada, the situation is similar with drilling activity

well down on last year and no recovery expected over last year in

the upcoming winter drilling season.

In Latin America, drilling activity in Argentina

is declining as operators put on hold their investment plans for

Vaca Muerta pending more clarity on the policy measures that will

be adopted by the incoming government. In Mexico, offshore drilling

activity has been increasing.

In the Eastern Hemisphere, drilling activity

continues to improve, led by gas developments in the Middle East,

and a gradual recovery in offshore basins.

Price levels for steel pipe products in North

America have been affected by the decline in demand, the increased

competitiveness of domestic welded pipe products reflecting lower

costs of hot rolled coils, and continuing high import levels,

despite the application of US Section 232 tariffs and quotas.

In the fourth quarter, our sales will be

affected by lower average selling prices and the activity slowdowns

in the USA and Argentina. We expect to mitigate much of the impact

of lower average selling prices with lower costs and maintain our

EBITDA margin in line with that of this third quarter. Going into

2020, we expect a recovery in sales, particularly for offshore and

gas drilling activity, as well as in margins and cash flow as we

work on reducing costs and working capital.

Analysis of 2019 Third Quarter

Results

|

Tubes Sales volume (thousand metric tons) |

3Q 2019 |

2Q 2019 |

3Q 2018 |

|

Seamless |

645 |

674 |

(4%) |

654 |

(1%) |

|

Welded |

150 |

173 |

(13%) |

199 |

(25%) |

|

Total |

796 |

846 |

(6%) |

853 |

(7%) |

|

Tubes |

3Q 2019 |

2Q 2019 |

3Q 2018 |

|

(Net sales - $ million) |

|

|

|

|

|

|

North America |

772 |

863 |

(11%) |

887 |

(13%) |

|

South America |

308 |

337 |

(9%) |

334 |

(8%) |

|

Europe |

136 |

194 |

(30%) |

148 |

(8%) |

|

Middle East & Africa |

369 |

315 |

17% |

350 |

5% |

|

Asia Pacific |

77 |

105 |

(27%) |

77 |

(1%) |

|

Total net sales ($ million) |

1,661 |

1,814 |

(8%) |

1,797 |

(8%) |

|

Operating income ($ million) |

163 |

216 |

(25%) |

233 |

(30%) |

|

Operating margin (% of sales) |

9.8% |

11.9% |

|

13.0% |

|

Net sales of tubular products and services

decreased 8% sequentially and year on year. The sequential decrease

reflects a 6% decrease in volumes and a 3% decrease in average

selling prices. In North America our sales declined affected by a

general decline in prices for all products and lower volumes of

line pipe products. In South America, sales of OCTG products in

Argentina started to decline in September, and we had lower sales

of conductor casing in Brazil. In Europe sales declined reflecting

seasonally lower sales of mechanical and line pipe products and

lower sales of premium OCTG in the North Sea. In the Middle East

and Africa sales increased mainly due to large orders sold in

India. In Asia Pacific we had lower sales throughout the

region.

Operating income from tubular products and

services, amounted to $163 million in the third quarter of 2019,

compared to $216 million in the previous quarter and $233 million

in the third quarter of 2018. Sequentially, operating income was

affected by lower sales and a decrease of 210 basis points in the

operating margin. The 3% decline in prices was only partially

offset by lower costs as a decline in direct costs was offset by a

worse industrial performance related to the plant maintenance

stoppages in the northern hemisphere, mainly in Mexico.

|

Others |

3Q 2019 |

2Q 2019 |

3Q 2018 |

|

Net sales ($ million) |

102 |

104 |

(1%) |

102 |

0% |

|

Operating income ($ million) |

24 |

18 |

32% |

26 |

(6%) |

|

Operating income (% of sales) |

23.6% |

17.7% |

|

25.2% |

|

Net sales of other products and services

declined 1% sequentially and remained flat year on year. The

improvement in operating income is mainly related to our industrial

equipment business in Brazil.

Selling, general and

administrative expenses, or SG&A,

amounted to $333 million, or 18.9% of net sales in the third

quarter of 2019, compared to $339 million, 17.7% in the previous

quarter and $336 million, 17.7% in the third quarter of 2018.

Sequentially, a reduction in logistic and general expenses was

partially offset by higher allowances for doubtful accounts.

Financial results amounted to a

gain of $8 million in the third quarter of 2019, compared to a loss

of $6 million in the previous quarter and a gain of $13 million in

the third quarter of 2018. The gain of the quarter corresponds

mainly to an FX gain of $14 million related to the Argentine

peso devaluation (36%) on trade, social and financial payables at

Argentine subsidiaries which functional currency is the U.S.

dollar, partially offset by a $5 million loss due to the

devaluation of the Brazilian Real (9%) on U.S. dollar denominated

intercompany liabilities at our Brazilian subsidiaries which

functional currency is the Brazilian Real, largely compensated by

an increase in currency translation adjustment reserve from the

Brazilian subsidiaries.

Equity in earnings of

non-consolidated companies generated a gain of $13 million

in the third quarter of 2019, compared to $26 million in the

previous quarter and $56 million in the third quarter of 2018.

These results are mainly derived from our equity investment in

Ternium (NYSE:TX) and Usiminas.

Income tax charge amounted to

$108 million in the third quarter of 2019, compared to $15 million

in the previous quarter and $80 million in the third quarter of

2018. This quarter’s income tax includes a charge of approximately

$76 million mainly related to the devaluation of the Argentine and

Mexican Peso affecting the tax base of our subsidiaries in these

two countries. Such effect impacted current income tax charge for

$35 million and deferred income tax for $41 million.

Cash Flow and Liquidity of 2019 Third

Quarter

Net cash provided by operating activities during

the third quarter of 2019 was $374 million, compared to $342

million in the previous quarter and $50 million in the third

quarter of last year. During the third quarter of 2019 the

operating cash flow includes $157 million from the reduction in

working capital.

After capital expenditure of $87 million we

generated free cash flow of $287 million (16% of revenues) and

ended the quarter with a net cash position of $964 million.

Analysis of 2019 First Nine Months Results

|

|

9M 2019 |

9M 2018 |

Increase/(Decrease) |

|

Net sales ($ million) |

5,554 |

|

5,554 |

|

0 |

% |

|

Operating income (loss) ($ million) |

681 |

|

693 |

|

(2 |

%) |

|

Net income ($ million) |

583 |

|

649 |

|

(10 |

%) |

|

Shareholders’ net income ($ million) |

591 |

|

650 |

|

(9 |

%) |

|

Earnings per ADS ($) |

1.00 |

|

1.10 |

|

(9 |

%) |

|

Earnings per share ($) |

0.50 |

|

0.55 |

|

(9 |

%) |

|

EBITDA ($ million) |

1,082 |

|

1,110 |

|

(3 |

%) |

|

EBITDA margin (% of net sales) |

19.5 |

% |

20.0 |

% |

|

|

Tubes Sales volume (thousand metric tons) |

9M 2019 |

9M 2018 |

Increase/(Decrease) |

|

Seamless |

1,959 |

1,994 |

(2 |

%) |

|

Welded |

507 |

630 |

(20 |

%) |

|

Total |

2,467 |

2,624 |

(6 |

%) |

|

Tubes |

9M 2019 |

9M 2018 |

Increase/(Decrease) |

|

(Net sales - $ million) |

|

|

|

|

North America |

2,529 |

|

2,521 |

|

0 |

% |

|

South America |

975 |

|

929 |

|

5 |

% |

|

Europe |

488 |

|

480 |

|

2 |

% |

|

Middle East & Africa |

985 |

|

1,105 |

|

(11 |

%) |

|

Asia Pacific |

263 |

|

215 |

|

23 |

% |

|

Total net sales ($ million) |

5,239 |

|

5,249 |

|

0 |

% |

|

Operating income ($ million) |

618 |

|

623 |

|

(1 |

%) |

|

Operating income (% of sales) |

11.8 |

% |

11.9 |

% |

|

Net sales of tubular products and services

remained flat, amounting to $5,239 million in the first nine months

of 2019, compared to $5,249 million in the first nine months of

2018, reflecting a 6% decrease in volumes offset by a 6% increase

in average selling prices.

Operating income from tubular products and

services amounted to $618 million in the first nine months of 2019

compared to $623 million in the first nine months of 2018. Results

remained relatively flat reflecting stable revenues and

margins.

|

Others |

9M 2019 |

9M 2018 |

Increase/(Decrease) |

|

Net sales ($ million) |

315 |

|

305 |

|

3 |

% |

|

Operating income ($ million) |

63 |

|

70 |

|

(9 |

%) |

|

Operating margin (% of sales) |

20.1 |

% |

22.8 |

% |

|

Net sales of other products and services increased 3% to $315

million in the first nine months of 2019, compared to $305 million

in the first nine months of 2018, however operating income declined

due to a reduction in margins.

SG&A remained flat,

amounting to $1,017 million, or 18.3% of net sales during the first

nine months of 2019, compared to $1,023 million, or 18.4% in the

same period of 2018.

Financial results amounted to a

gain of $26 million in the first nine months of 2019 compared to a

gain of $44 million in the same period of 2018. While in both

periods the gains are mainly related to the Argentine peso

devaluation, the nine-month period of 2018 also benefited from the

Euro depreciation. In the first nine months of 2019 we had an FX

gain of $28 million; $34 million gain related to the Argentine peso

devaluation (53%) on Peso denominated liabilities at Argentine

subsidiaries which functional currency is the U.S. dollar,

partially offset by a $6 million loss due to the devaluation of the

Brazilian Real (7%) on U.S. dollar denominated intercompany

liabilities at our Brazilian subsidiaries which functional currency

is the Brazilian Real.

Equity in earnings of non-consolidated

companies generated a gain of $69 million in the first

nine months of 2019, compared to a gain of $143 million in the

first nine months of 2018. These results are mainly derived from

our equity investment in Ternium (NYSE:TX) and Usiminas.

Income tax amounted to a charge

of $193 million in the first nine months of 2019, compared to $231

million in the first nine months of 2018. Both periods charges were

affected by the Argentine and Mexican peso devaluation on the tax

base at our Argentine and Mexican subsidiaries which have the U.S.

dollar as their functional currency.

Cash Flow and Liquidity of 2019 First Nine

Months

During the first nine months of 2019, net cash

provided by operations was $1,264 million, compared to $372 million

in the same period of 2018. While in the first nine months of 2019

our working capital decreased by $503 million in the same period of

2018 it increased by $659 million.

Capital expenditures amounted to $270 million in

the first nine months of 2019, similar to $274 million in the same

period of 2018.

Free cash flow amounted to $994 million (18% of

revenues) in the first nine months of 2019, compared to $98 million

(2%) in the same period of 2018.

We reached a net cash position of $964 million

at September 30, 2019.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on October 31, 2019, at 10:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions. To access the conference call dial in +1

866 789 1656 within North America or +1 630 489 1502

Internationally. The access number is “5688609”. Please dial in 10

minutes before the scheduled start time. The conference call will

be also available by webcast at www.tenaris.com/investors.

A replay of the conference call will be

available on our webpage http://ir.tenaris.com/ or by phone from

1.00 pm ET on October 31 through 11:59 pm ET on November 8, 2019.

To access the replay by phone, please dial 855 859 2056 or 404 537

3406 and enter passcode “5688609” when prompted.

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.

Press releases and financial statements can be

downloaded from Tenaris’s website at www.tenaris.com/investors.

Consolidated Condensed Interim Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period endedSeptember 30, |

Nine-month period endedSeptember 30, |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Continuing operations |

Unaudited |

Unaudited |

|

Net sales |

1,763,783 |

|

1,898,892 |

|

5,553,507 |

|

5,553,611 |

|

|

Cost of sales |

(1,248,691 |

) |

(1,305,232 |

) |

(3,863,309 |

) |

(3,837,295 |

) |

|

Gross profit |

515,092 |

|

593,660 |

|

1,690,198 |

|

1,716,316 |

|

|

Selling, general and administrative expenses |

(333,111 |

) |

(335,714 |

) |

(1,017,085 |

) |

(1,022,922 |

) |

| Other operating income

(expense), net |

5,139 |

|

551 |

|

7,511 |

|

(264 |

) |

|

Operating income |

187,120 |

|

258,497 |

|

680,624 |

|

693,130 |

|

|

Finance Income |

13,015 |

|

10,804 |

|

36,212 |

|

29,786 |

|

|

Finance Cost |

(13,454 |

) |

(8,586 |

) |

(31,723 |

) |

(29,182 |

) |

|

Other financial results |

8,340 |

|

10,839 |

|

21,670 |

|

43,156 |

|

|

Income before equity in earnings of non-consolidated

companies and income tax |

195,021 |

|

271,554 |

|

706,783 |

|

736,890 |

|

|

Equity in earnings of non-consolidated companies |

13,235 |

|

55,930 |

|

68,659 |

|

142,876 |

|

|

Income before income tax |

208,256 |

|

327,484 |

|

775,442 |

|

879,766 |

|

|

Income tax |

(107,741 |

) |

(80,355 |

) |

(192,639 |

) |

(230,931 |

) |

|

Income for the period |

100,515 |

|

247,129 |

|

582,803 |

|

648,835 |

|

| |

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Owners of the parent |

106,548 |

|

246,927 |

|

590,913 |

|

650,238 |

|

|

Non-controlling interests |

(6,033 |

) |

202 |

|

(8,110 |

) |

(1,403 |

) |

| |

100,515 |

|

247,129 |

|

582,803 |

|

648,835 |

|

Consolidated Condensed Interim Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At September 30, 2019 |

|

At December 31, 2018 |

| |

Unaudited |

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

6,111,975 |

|

|

6,063,908 |

|

|

Intangible assets, net |

1,565,891 |

|

|

1,465,965 |

|

|

Right-of-use assets, net |

240,182 |

|

|

- |

|

|

Investments in non-consolidated companies |

856,524 |

|

|

805,568 |

|

|

Other investments |

42,605 |

|

|

118,155 |

|

|

Deferred tax assets |

217,608 |

|

|

181,606 |

|

|

Receivables, net |

154,718 |

9,189,503 |

|

151,905 |

8,787,107 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

2,387,367 |

|

|

2,524,341 |

|

|

Receivables and prepayments, net |

111,673 |

|

|

155,885 |

|

|

Current tax assets |

157,056 |

|

|

121,332 |

|

|

Trade receivables, net |

1,310,213 |

|

|

1,737,366 |

|

|

Derivative financial instruments |

4,697 |

|

|

9,173 |

|

|

Other investments |

322,763 |

|

|

487,734 |

|

|

Cash and cash equivalents |

1,537,005 |

5,830,774 |

|

428,361 |

5,464,192 |

|

Total assets |

|

15,020,277 |

|

|

14,251,299 |

|

EQUITY |

|

|

|

|

|

|

Capital and reserves attributable to owners of the parent |

|

11,955,266 |

|

|

11,782,882 |

|

Non-controlling interests |

|

200,939 |

|

|

92,610 |

|

Total equity |

|

12,156,205 |

|

|

11,875,492 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

49,050 |

|

|

29,187 |

|

|

Lease liabilities |

201,693 |

|

|

- |

|

|

Deferred tax liabilities |

380,809 |

|

|

379,039 |

|

|

Other liabilities |

239,921 |

|

|

213,129 |

|

|

Provisions |

38,748 |

910,221 |

|

36,089 |

657,444 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

873,822 |

|

|

509,820 |

|

|

Lease liabilities |

37,781 |

|

|

- |

|

|

Derivative financial instruments |

18,088 |

|

|

11,978 |

|

|

Current tax liabilities |

130,961 |

|

|

250,233 |

|

|

Other liabilities |

233,838 |

|

|

165,693 |

|

|

Provisions |

27,921 |

|

|

24,283 |

|

|

Customer advances |

79,581 |

|

|

62,683 |

|

|

Trade payables |

551,859 |

1,953,851 |

|

693,673 |

1,718,363 |

|

Total liabilities |

|

2,864,072 |

|

|

2,375,807 |

|

Total equity and liabilities |

|

15,020,277 |

|

|

14,251,299 |

Consolidated Condensed Interim Statement of Cash

Flow

| |

|

Three-month period endedSeptember 30, |

Nine-month period endedSeptember 30, |

|

(all amounts in thousands of U.S. dollars) |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Cash flows from operating activities |

|

Unaudited |

Unaudited |

| |

|

|

|

|

|

|

Income for the period |

|

100,515 |

|

247,129 |

|

582,803 |

|

648,835 |

|

|

Adjustments for: |

|

|

|

|

|

|

Depreciation and amortization |

|

134,624 |

|

135,044 |

|

401,179 |

|

417,247 |

|

|

Income tax accruals less payments |

|

9,015 |

|

36,987 |

|

(145,404 |

) |

104,838 |

|

|

Equity in earnings of non-consolidated companies |

|

(13,235 |

) |

(55,930 |

) |

(68,659 |

) |

(142,876 |

) |

|

Interest accruals less payments, net |

|

(3,411 |

) |

(811 |

) |

(3,706 |

) |

5,964 |

|

|

Changes in provisions |

|

(3,182 |

) |

(5,194 |

) |

(2,208 |

) |

(10,815 |

) |

|

Changes in working capital |

|

157,313 |

|

(301,306 |

) |

503,358 |

|

(658,961 |

) |

|

Currency translation adjustment and others |

|

(7,889 |

) |

(6,074 |

) |

(3,696 |

) |

7,288 |

|

|

Net cash provided by operating activities |

|

373,750 |

|

49,845 |

|

1,263,667 |

|

371,520 |

|

| |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

Capital expenditures |

|

(86,643 |

) |

(77,938 |

) |

(269,707 |

) |

(273,669 |

) |

|

Changes in advance to suppliers of property, plant and

equipment |

|

1,149 |

|

719 |

|

3,185 |

|

4,937 |

|

|

Acquisition of subsidiaries, net of cash acquired |

|

- |

|

- |

|

(132,845 |

) |

- |

|

|

Additions to associated companies |

|

(9,800 |

) |

- |

|

(9,800 |

) |

- |

|

|

Loan to non-consolidated companies |

|

- |

|

(11,220 |

) |

- |

|

(14,740 |

) |

|

Repayment of loan by non-consolidated companies |

|

- |

|

3,900 |

|

40,470 |

|

9,370 |

|

|

Proceeds from disposal of property, plant and equipment and

intangible assets |

|

437 |

|

1,491 |

|

1,173 |

|

4,199 |

|

| Dividends received from

non-consolidated companies |

|

- |

|

- |

|

28,974 |

|

25,722 |

|

|

Changes in investments in securities |

|

24,463 |

|

(47,655 |

) |

254,369 |

|

348,423 |

|

|

Net cash (used in) provided by investing

activities |

|

(70,394 |

) |

(130,703 |

) |

(84,181 |

) |

104,242 |

|

| |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Dividends paid |

|

- |

|

- |

|

(330,550 |

) |

(330,550 |

) |

| Dividends paid to

non-controlling interest in subsidiaries |

|

(1,200 |

) |

(590 |

) |

(1,872 |

) |

(1,698 |

) |

| Changes in non-controlling

interests |

|

- |

|

5 |

|

1 |

|

4 |

|

| Payments of lease

liabilities |

|

(9,388 |

) |

- |

|

(28,835 |

) |

- |

|

| Proceeds from borrowings |

|

387,000 |

|

147,296 |

|

1,031,716 |

|

723,303 |

|

| Repayments of borrowings |

|

(320,743 |

) |

(251,584 |

) |

(733,837 |

) |

(948,436 |

) |

|

Net cash (used in) provided by financing

activities |

|

55,669 |

|

(104,873 |

) |

(63,377 |

) |

(557,377 |

) |

| |

|

|

|

|

|

|

Increase (decrease) in cash and cash

equivalents |

|

359,025 |

|

(185,731 |

) |

1,116,109 |

|

(81,615 |

) |

|

Movement in cash and cash equivalents |

|

|

|

|

|

| At the beginning of the

period |

|

1,183,017 |

|

427,256 |

|

426,717 |

|

330,090 |

|

| Effect of exchange rate

changes |

|

(6,513 |

) |

(5,495 |

) |

(7,297 |

) |

(12,445 |

) |

| Increase (decrease) in cash

and cash equivalents |

|

359,025 |

|

(185,731 |

) |

1,116,109 |

|

(81,615 |

) |

|

At September 30, |

|

1,535,529 |

|

236,030 |

|

1,535,529 |

|

236,030 |

|

Exhibit I – Alternative performance

measures

EBITDA, Earnings before interest, tax, depreciation and

amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are non-cash variables which can vary substantially from

company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA= Operating results + Depreciation and amortization +

Impairment charges/(reversals).

| |

Three-month period endedSeptember 30, |

Nine-month period endedSeptember 30, |

|

|

2019 |

2018 |

2019 |

2018 |

| Operating income |

187,120 |

258,497 |

680,624 |

693,130 |

| Depreciation and amortization |

134,624 |

135,044 |

401,179 |

417,247 |

| EBITDA |

321,744 |

393,541 |

1,081,803 |

1,110,377 |

Free Cash Flow

Free cash flow is a measure of financial

performance, calculated as operating cash flow less capital

expenditures. FCF represents the cash that a company is able to

generate after spending the money required to maintain or expand

its asset base.

Free cash flow is calculated in the following manner:

Free cash flow = Net cash (used in) provided by operating

activities - Capital expenditures.

| (all

amounts in thousands of U.S. dollars) |

Three-month period endedSeptember 30, |

Nine-month period endedSeptember 30, |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

| Net cash provided by operating

activities |

373,750 |

|

49,845 |

|

1,263,667 |

|

371,520 |

|

| Capital expenditures |

(86,643 |

) |

(77,938 |

) |

(269,707 |

) |

(273,669 |

) |

| Free cash flow |

287,107 |

|

(28,093 |

) |

993,960 |

|

97,851 |

|

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash= Cash and cash equivalents + Other investments (Current

and Non-Current)+/- Derivatives hedging borrowings and investments–

Borrowings (Current and Non-Current).

| (all

amounts in thousands of U.S. dollars) |

At September 30, |

|

|

2019 |

|

2018 |

|

| Cash and cash equivalents |

1,537,005 |

|

236,303 |

|

| Other current investments |

322,763 |

|

794,330 |

|

| Non-current Investments |

38,678 |

|

176,178 |

|

| Derivatives hedging borrowings and investments |

(11,492 |

) |

(64,525 |

) |

| Borrowings – current and non-current |

(922,872 |

) |

(734,130 |

) |

| Net cash / (debt) |

964,082 |

|

408,156 |

|

Giovanni

Sardagna

Tenaris1-888-300-5432www.tenaris.com

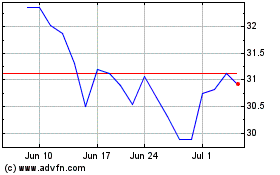

Tenaris (NYSE:TS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tenaris (NYSE:TS)

Historical Stock Chart

From Apr 2023 to Apr 2024