Table of Contents

As filed with the Securities and Exchange Commission on August 2, 2019

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TELUS CORPORATION

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

|

British Columbia, Canada

|

|

98-0361292

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

23rd Floor, 510 West Georgia Street

Vancouver, British Columbia V6B 0M3

Canada

Tel: (604) 697-8044

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

28 Liberty St.

New York, New York 10005

(212) 590-9200

(Name, address and telephone number of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

|

Andrew J. Foley

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

|

|

Stephen Lewis

510 W. Georgia St., 8th Floor

Vancouver, British Columbia V6B 0M3

Canada

(604) 697-8044

|

|

Pierre Dagenais

Norton Rose Fulbright Canada LLP

Royal Bank Plaza, South Tower,

Suite 3800, 200 Bay Street, P.O. Box 84,

Toronto, ON M5J 2Z4

Canada

(416) 216-4000

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

x

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

o

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

|

†

|

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Aggregate Price

per Unit

(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

(2)

|

|

Amount of

Registration Fee

|

|

|

Common Shares (including the associated rights)

(1)

|

|

20,000,000

|

|

$

|

35.95

|

|

$

|

719,000,000.00

|

|

$

|

87,142.80

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Each Common Share is accompanied by a Common Share purchase right (a “Common Share Purchase Right”) pursuant to the Shareholder Rights Plan Agreement, dated as of March 13, 2019, (the “Rights Plan”), between TELUS Corporation and Computershare Trust Company of Canada, as rights agent. Until the occurrence of certain events specified in the Rights Plan, the Common Share Purchase Rights will not be exercisable or evidenced separately from the Common Shares.

(2)

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act, based on the average of the high and low sale prices of the Company’s Common Shares reported on the New York Stock Exchange on July 26, 2019.

Table of Contents

PROSPECTUS

Amended and Restated Dividend Reinvestment and Share Purchase Plan

20,000,000 Common Shares

TELUS CORPORATION

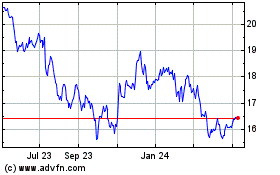

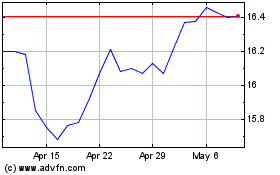

We are offering our Common Shares through our Amended and Restated Dividend Reinvestment and Share Purchase Plan (the “Plan”). The Plan provides you with an economical and convenient way to purchase additional Common Shares. Our Common Shares are traded on the New York Stock Exchange (the “NYSE”) under the symbol “TU” and on the Toronto Stock Exchange (the “TSX”) under the symbol “T.” On August 1, 2019, the last reported trading price of the Common Shares was US$36.18 on the NYSE and Cdn. $47.76 on the TSX. Some of the significant features of the Plan are as follows:

·

You may purchase additional Common Shares by automatically reinvesting your cash dividends in our Common Shares.

·

You may purchase additional Common Shares by making optional cash payments of Cdn. $100 to Cdn. $20,000 per calendar year.

·

Common Shares to be acquired under the Plan will be, at our election, either Common Shares purchased on the open market through the facilities of the TSX, or newly issued Common Shares purchased from us.

·

The price to you of Common Shares purchased with the reinvestment of dividends will depend on our election as to whether those Common Shares are purchased on the open market or purchased from us. The price to you of any Common Shares purchased on the open market will be the average price paid (excluding brokerage commissions, fees and transaction costs) on the open market per Common Share by the Plan Agent for all Common Shares purchased in respect of a Dividend Payment Date under the Plan. The price to you of any Common Shares purchased from us will be the weighted average trading price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately preceding the Investment Date, less a discount, if any, of up to 5%, at the Company’s election. As of the date of this prospectus, the discount has been set by our board of directors at 2%. Participants will be notified of any change in the discount by news release.

·

The price to you of Common Shares purchased with optional cash payments will depend on our election as to whether those Common Shares are purchased on the open market or purchased from us. The price to you of any Common Shares purchased with optional cash payments on the open market will be the average price paid (excluding brokerage commissions, fees and transactions costs) on the open market per Common Share by the Plan Agent for all Common Shares purchased in respect of an Investment Date under the Plan. The price to you of any Common Shares purchased with optional cash payments from us will be the weighted average trading price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately preceding the Investment Date.

·

Your participation in the Plan is voluntary and you may commence or terminate your participation at any time. If you do not elect to participate in the Plan, you will continue to receive cash dividends, as declared, in the usual manner.

Investing in our Common Shares involves risks. See “Forward-Looking Statements” on page 5 of this prospectus. See also “Risk Factors” on page 3 of this prospectus for a discussion of certain factors relevant to an investment in our Common Shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 2, 2019.

Table of Contents

RISK FACTORS

Before you decide to participate in the Plan and invest in our Common Shares, you should be aware of the following material risks in making such an investment. You should consider carefully these risk factors together with all risk factors and information included or incorporated by reference in this prospectus, including the matters set forth in the section “Risk and risk management” set forth in our Management’s Discussion and Analysis for the year ended December 31, 2018 incorporated by reference into our

Annual Report on Form 40-F

, and in Management’s Discussion and Analysis of financial results set forth in our interim unaudited financial statements on Form 6-K, before you decide to participate in the Plan and purchase Common Shares. In addition, you should consult your own financial and legal advisors before making an investment.

Risks Related to the Plan

You will not know the price of the Common Shares you are purchasing under the Plan at the time you authorize the investment or elect to have your distributions reinvested.

The price of our Common Shares may fluctuate between the time you decide to purchase Common Shares under the Plan and the time of actual purchase. In addition, during this time period, you may become aware of additional information that might affect your investment decision.

The Company may amend, suspend or terminate the Plan at any time.

Under the Plan, we reserve the right to amend, suspend or terminate the Plan or any portion thereof at any time and from time to time, but any such action shall not have retroactive effect that would prejudice the interests of Plan participants (“Participants”). We also reserve the right to increase the number of Common Shares that we may issue under the Plan from time to time, by amounts determined by our board of directors.

All amendments to the Plan are subject to the prior approval of the Toronto Stock Exchange. All Participants will be sent written notice of any such amendment, suspension or termination. If the Plan is terminated, the Plan Agent will remit to Participants a DRS Advice (or certificates registered in their name) for whole Common Shares, together with the proceeds from the sale of any fractions of Common Shares. If the Plan is suspended, subsequent dividends on Commons Shares will be paid in cash.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the U.S. Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, and, accordingly, file reports with and furnish other information to the Securities and Exchange Commission (the “Commission”). Under the multi-jurisdictional disclosure system adopted by the United States, these reports and other information (including financial information) may be prepared, in part, in accordance with the disclosure requirements of Canada, which differ from those in the United States. The Commission maintains an internet site that contains reports and other information that we file or furnish electronically with the Commission, available at http://www.sec.gov. You can also find information about the Company on our website at www.telus.com. Any information that is included on or linked to our website is not a part of this prospectus.

We have filed under the U.S. Securities Act of 1933, as amended, which we refer to as the Securities Act, a registration statement on Form F-3 relating to the Plan. This prospectus forms a part of the registration statement. This prospectus does not contain all of the information included in the registration statement, certain portions of which have been omitted as permitted by the rules and regulations of the Commission. For further information about us and our Common Shares, you are encouraged to refer to the registration statement and the exhibits that are incorporated by reference into it. Statements contained in this prospectus describing provisions of the Plan are not necessarily complete, and in each instance reference is made to the copy of the Plan which is included as an exhibit to the registration statement, and each such statement in this prospectus is qualified in all respects by such reference.

3

Table of Contents

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Commission allows us to “incorporate by reference” into this prospectus certain documents that we file with or furnish to the Commission. This means that we can disclose important information to you by referring to those documents. The information incorporated by reference is considered to be an important part of this prospectus, and later information that we file with the Commission will automatically update and supersede that information. The following documents, which we have filed with or furnished to the Commission, are specifically incorporated by reference in this prospectus:

·

our Annual Report on Form 40-F for the year ended December 31, 2018, which contains our audited financial statements for such fiscal year (our “Annual Report on Form 40-F”);

·

our Management Information Circular, dated March 13, 2019, relating to the annual meeting of our shareholders held on May 9, 2019, attached as Exhibit 99.1 to Form 6-K furnished to the SEC on April 5, 2019;

·

our Unaudited Condensed Interim Consolidated Financial Statements as at and for the three and six months ended June 30, 2019, together with the notes thereto, attached as Exhibit 99.1 to Form 6-K furnished to the SEC on August 2, 2019;

·

our Management’s Discussion and Analysis of financial condition and results of operations as at and for the three and six months ended June 30, 2019, attached as Exhibit 99.2 to Form 6-K furnished to the SEC on August 2, 2019; and

·

the description of our Common Shares contained in our Registration Statement on Form 8-A filed on January 31, 2013 under Section 12 of the Exchange Act, including any amendment or report updating such description.

In addition, we incorporate by reference all Annual Reports on Form 40-F we file with the Commission between the date of this prospectus and the termination of the offering of the Common Shares. We may also incorporate by reference future filings on Form 6-K by identifying in such forms that they are being incorporated in this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered, upon written or oral request, a copy of any or all of the documents referred to above that have been or may be incorporated in this prospectus by reference. Requests for copies should be directed to TELUS Corporation — Chief Legal and Governance Officer, 23

rd

Floor — 510 West Georgia Street, Vancouver, British Columbia V6B 0M3, Canada, telephone number (604) 695-6420.

Our company is a “foreign private issuer” as defined in the Exchange Act. As a result, our proxy solicitations are not subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act and transactions in our Common Shares by our officers and directors are exempt from Section 16 of the Exchange Act.

Any statement contained in a document incorporated by reference in this prospectus shall be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or therein or in any other later filed document which also is incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

ENFORCEABILITY OF CIVIL LIABILITIES IN THE UNITED STATES

We are organized under the laws of British Columbia, Canada. Many of our directors, controlling persons, officers and experts named in this prospectus are residents of Canada or other jurisdictions outside the United States and a substantial part of our assets are located outside the United States. As a result, it may be difficult for

4

Table of Contents

shareholders to effect service within the United States upon those directors, controlling persons, officers and experts who are not residents of the United States, or to realize in the United States upon judgments of the courts of the United States that are based on the civil liability provisions of the United States federal securities laws. We have been advised by Norton Rose Fulbright Canada LLP, our Canadian counsel, that, in their opinion, there is doubt about the enforceability in Canada against us or our directors, controlling persons, officers and experts who are not residents of the United States in original actions for enforcement of judgments of United States courts of liabilities based solely on United States federal securities laws.

FORWARD-LOOKING STATEMENTS

This prospectus, together with the documents incorporated by reference herein and therein, contains forward-looking statements about expected events and our financial and operating performance. Forward-looking statements include any statements that do not refer to historical facts. They include, but are not limited to, statements relating to our objectives and our strategies to achieve those objectives, our targets, outlook, updates, and our multi-year dividend growth program. Forward-looking statements are typically identified by the words

assumption, goal, guidance, objective, outlook, strategy, target

and other similar expressions, or future or conditional verbs such as

aim, anticipate, believe, could, expect, intend, may, plan, predict, seek, should, strive

and

will

. These statements are made pursuant to the “safe harbour” provisions of applicable securities laws in Canada and the

United States Private Securities Litigation Reform Act of 1995

.

By their nature, forward-looking statements are subject to inherent risks and uncertainties and are based on assumptions, including assumptions about future economic conditions and courses of action. These assumptions may ultimately prove to have been inaccurate and, as a result, our actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements. Updates to the assumptions on which our 2019 outlook is based are presented in our Management’s Discussion and Analysis of financial results for the three- and six-month period ended June 30, 2019, which is incorporated by reference into this prospectus.

Risks and uncertainties that could cause actual performance or events to differ materially from the forward-looking statements made herein and in other TELUS filings incorporated by reference herein include, but are not limited to, the following:

·

Regulatory decisions and developments

including changes to our regulatory regime or the outcomes of proceedings, cases or inquiries relating to its application, such as: the potential for government intervention to further increase competition, including through policy directions to the Canadian Radio-television and Telecommunications Commission (“CRTC”); any new regulatory requirements as a result of the CRTC’s ongoing review of the mobile wireless regulatory framework; the federal government’s announcement in its 2019 budget that it intends to propose new legislation and make necessary amendments to existing federal legislation in order to introduce a new critical cyber systems framework; the potential for government intervention concerning the CRTC’s decision on lower-cost data-only plans; changes to the cost burden associated with CRTC-mandated network interconnections; disputes with certain municipalities regarding rights-of-way bylaws, and other potential threats to unitary federal regulatory authority over telecommunications, including provincial wireless and consumer protection legislation; the impact of the CRTC’s wireline wholesale services review, with a review of rates and configurations for wholesale access currently in progress for TELUS; follow-up proceedings further to the CRTC’s report on the retail sales practices of Canada’s large telecommunications carriers; the Competition Bureau’s market study on competition in broadband services and other potential Competition Bureau investigations, including potential investigations into deceptive marketing practices, including alleged false or misleading representations; the CRTC’s phase-out of the local service subsidy regime and corresponding establishment of a broadband funding regime to support the enhancement of high-speed Internet services focusing on unserved and underserved areas in Canada; the CRTC’s review of the price cap and local forbearance regimes; broadcasting-related issues, such as: the CRTC’s implementation of new initiatives discussed in its May 2018 report “Harnessing Change: The Future of Programming Distribution in Canada”; the federal government’s legislative review of the

Broadcasting Act

,

Telecommunications Act

and

Radiocommunication Act

as announced on June 5, 2018; the review of the

Copyright Act

, which began in early 2018; spectrum and compliance with licences, including our compliance with licence conditions, changes to spectrum licence

5

Table of Contents

fees, spectrum policy determinations such as restrictions on the purchase, sale and transfer of spectrum licences, and the cost and availability of spectrum; the federal government’s announcement of a formal consultation on the auctioning of 3800 MHz spectrum, expected to take place in 2022; the impact on us and other Canadian telecommunications carriers of government or regulatory actions with respect to certain countries or suppliers, including the executive order signed by U.S. President Donald Trump permitting the Secretary of Commerce to block certain technology transactions deemed to constitute national security risks and the imposition of additional license requirements on the export, re-export and transfer of goods, services and technology to Huawei Technologies Co. Ltd. and its non-U.S. affiliates; restrictions on non-Canadian ownership and control of our Common Shares and the ongoing monitoring and compliance with such restrictions; and our ability to comply with complex and changing regulation of the healthcare and medical devices industry in the provinces of Canada in which we operate, including as an operator of health clinics.

·

Competitive environment

including: our ability to continue to retain customers through an enhanced customer service experience, including through the deployment and operation of evolving wireless and wireline infrastructure; intense wireless competition, including the ability of industry competitors to successfully combine a mix of Internet services and, in some cases, wireless services under one bundled and/or discounted monthly rate, along with their existing broadcast or satellite-based TV services; the success of new products, new services and supporting systems, such as home automation security and Internet of Things (IoT) services for Internet-connected devices; wireline voice and data competition, including continued intense rivalry across all services among wireless and wireline telecommunications companies, cable-TV providers, other communications companies and over-the-top (OTT) services, which, among other things, places pressures on current and future mobile phone average billing per subscriber per month (ABPU), mobile phone average revenue per subscriber per month (ARPU), cost of acquisition, cost of retention and churn rate for all services, as do customer usage patterns, increased data bucket sizes or flat-rate pricing trends for voice and data, inclusive rate plans for voice and data and availability of Wi-Fi networks for data; mergers and acquisitions of industry competitors; pressures on Internet and TV ARPU and churn rate resulting from market conditions, government actions and customer usage patterns; residential voice and business network access line losses; subscriber additions and retention volumes, and associated costs for wireless, TV and Internet services; our ability to obtain and offer content on a timely basis across multiple devices on wireless and TV platforms at a reasonable cost; vertical integration in the broadcasting industry resulting in competitors owning broadcast content services, and timely and effective enforcement of related regulatory safeguards; our ability to compete successfully in customer care and business services (CCBS) given our competitors’ brand recognition, consolidation and strategic alliances, as well as technology development and, in our TELUS Health business, our ability to compete with other providers of electronic medical records and pharmacy management products, systems integrators and health service providers including those that own a vertically integrated mix of health services delivery, IT solutions, and related services, and global providers that could achieve expanded Canadian footprints.

·

Technological substitution

including: reduced utilization and increased commoditization of traditional wireline voice local and long distance services from impacts of OTT applications and wireless substitution, a declining overall market for paid TV services while content costs per unit continue to grow, including as a result of content piracy and signal theft and as a result of a rise in OTT direct-to-consumer video offerings and virtual multichannel video programming distribution platforms; the increasing number of households that have only wireless and/or Internet-based telephone services; potential mobile phone ABPU and mobile phone ARPU declines as a result of, among other factors, substitution to messaging and OTT applications; substitution to increasingly available Wi-Fi services; and disruptive technologies, such as OTT IP services, including Network as a Service in the business market, that may displace or re-rate our existing data services.

·

Technology

including: high subscriber demand for data that challenges wireless networks and spectrum capacity levels and may be accompanied by increases in delivery cost; our reliance on information technology and our need to streamline our legacy systems; the roll-out and evolution of wireless broadband technologies and systems including video distribution platforms and telecommunications network technologies (broadband initiatives, such as fibre to the premises (FTTP), wireless small-cell deployment, 5G wireless and availability of resources and ability to build out adequate broadband capacity); our reliance

6

Table of Contents

on wireless network access agreements, which have facilitated our deployment of wireless technologies; choice of suppliers and those suppliers’ ability to maintain and service their product lines, which could affect the success of upgrades to, and evolution of, technology that we offer; supplier limitations and concentration and market power for network equipment, TELUS TV® and wireless handsets; the performance of wireless technology; our expected long-term need to acquire additional spectrum capacity through future spectrum auctions and from third parties to address increasing demand for data; deployment and operation of new wireline broadband network technologies at a reasonable cost and availability and success of new products and services to be rolled out using such network technologies; network reliability and change management; self-learning tools and automation that may change the way we interact with customers; and uncertainties around our strategy to replace certain legacy wireline network technologies, systems and services to reduce operating costs.

·

Capital expenditure levels and potential outlays for spectrum licences in spectrum auctions or from third parties

, due to: our broadband initiatives, including connecting more homes and businesses directly to fibre; our ongoing deployment of newer wireless technologies, including wireless small cells to improve coverage and capacity and prepare for a more efficient and timely evolution to 5G wireless services; utilizing acquired spectrum; investments in network resiliency and reliability; subscriber demand for data; evolving systems and business processes; implementing efficiency initiatives; supporting large complex deals; and future wireless spectrum auctions held by Innovation, Science and Economic Development Canada (ISED) including the 3500 MHz and millimeter wave spectrum auctions expected to take place in 2020 and 2021, respectively, and the announcement of a formal consultation on the auctioning of 3800 MHz spectrum, expected to take place in 2022. Our capital expenditure levels could be impacted if we do not achieve our targeted operational and financial results.

·

Operational performance and business combination risks

including: our reliance on legacy systems and ability to implement and support new products and services and business operations in a timely manner; our ability to implement effective change management for system replacements and upgrades, process redesigns and business integrations (such as our ability to successfully integrate acquisitions, complete divestitures or establish partnerships in a timely manner and realize expected strategic benefits, including those following compliance with any regulatory orders); our ability to identify and manage new risks inherent to new service offerings that we may provide, including as a result of acquisitions, which could result in damage to our brand, our business in the relevant area or as a whole, additional exposure to litigation or regulatory proceedings; and real estate joint venture risks.

·

Data protection

including risks that malfunctions or unlawful acts could result in the unauthorized access to, change, loss, or distribution of data, which may compromise the privacy of individuals and could result in financial loss and harm to our reputation and brand.

·

Security threats

including intentional damage or unauthorized access to our physical assets or our IT systems and networks, which could prevent us from providing reliable service or result in unauthorized access to our information or that of our customers.

·

Ability to successfully implement cost reduction initiatives and realize planned savings, net of restructuring and other costs, without losing customer service focus or negatively affecting business operations

. Examples of these initiatives are: our operating efficiency and effectiveness program to drive improvements in financial results; business integrations; business product simplification; business process outsourcing; offshoring and reorganizations, including any full-time equivalent employee reduction programs; procurement initiatives; and real estate rationalization.

·

Implementation of large enterprise deals

, which may be adversely impacted by available resources, system limitations and degree of co-operation from other service providers.

·

Foreign operations

and our ability to successfully manage operations in foreign jurisdictions, including managing risks such as currency fluctuations.

7

Table of Contents

·

Business continuity events

including: our ability to maintain customer service and operate our network in the event of human error or human-caused threats, such as cyberattacks and equipment failures that could cause various degrees of network outages; supply chain disruptions, delays and economics including as a result of government restrictions or trade actions; natural disaster threats; epidemics; pandemics; political instability in certain international locations; information security and privacy breaches, including data loss or theft of data; and the completeness and effectiveness of business continuity and disaster recovery plans and responses.

·

Human resource matters

including: recruitment, retention and appropriate training in a highly competitive industry, and the level of our employee engagement.

·

Financing and debt requirements

including: our ability to carry out financing activities, refinance our maturing debt and/or maintain investment grade credit ratings in the range of BBB+ or the equivalent. Our business plans and growth could be negatively affected if existing financing is not sufficient to cover our funding requirements.

·

Lower than planned free cash flow could constrain our ability to invest in operations, reduce debt or return capital to shareholders, and could affect our ability to sustain our dividend growth program through 2022

. This program may be affected by factors such as the competitive environment, economic performance in Canada, our earnings and free cash flow, our levels of capital expenditures and spectrum licence purchases, acquisitions, the management of our capital structure, and regulatory decisions and developments. Quarterly dividend decisions are subject to assessment and determination by our Board of Directors based on our financial position and outlook. Shares may be purchased under our normal course issuer bid (NCIB) when and if we consider it opportunistic, based on our financial position and outlook, and the market price of our Common Shares. There can be no assurance that our dividend growth program or any NCIB will be maintained, not changed and/or completed.

·

Taxation matters

including: interpretation of complex domestic and foreign tax laws by the relevant tax authorities that may differ from our interpretations; the timing and character of income and deductions, such as tax depreciation and operating expenses; tax credits or other attributes; changes in tax laws, including tax rates; tax expenses being materially different than anticipated, including the taxability of income and deductibility of tax attributes; elimination of income tax deferrals through the use of different tax year-ends for operating partnerships and corporate partners; and changes to the interpretation of tax laws, including as a result of changes to applicable accounting standards or tax authorities adopting more aggressive auditing practices, tax reassessments or adverse court decisions impacting the tax payable by us.

·

Litigation and legal matters

including: our ability to successfully respond to investigations and regulatory proceedings; our ability to defend against existing and potential claims and lawsuits (including intellectual property infringement claims and class actions based on consumer claims, data, privacy or security breaches and secondary market liability), or to negotiate and execute upon indemnity rights or other protections in respect of such claims and lawsuits; and the complexity of legal compliance in domestic and foreign jurisdictions, including compliance with competition, anti-bribery and foreign corrupt practices laws.

·

Health, safety and the environment

including: lost employee work time resulting from illness or injury, public concerns related to radio frequency emissions, environmental issues affecting our business including climate change, waste and waste recycling, risks relating to fuel systems on our properties, and changing government and public expectations regarding environmental matters and our responses.

·

Economic growth and fluctuations

including: the state of the economy in Canada, which may be influenced by economic and other developments outside of Canada, including potential outcomes of yet unknown policies and actions of foreign governments; future interest rates; inflation; unemployment levels; effects of fluctuating oil prices; effects of low business spending (such as reducing investments and cost structure); pension investment returns, funding and discount rates; fluctuations in foreign exchange rates of the

8

Table of Contents

currencies in the regions in which we operate, the impact of tariffs on trade between Canada and the U.S., and global implications of a trade conflict between the U.S. and China.

These risks are described in additional detail in

Section 9 General trends, outlook and assumptions, and regulatory developments and proceedings

and

Section 10 Risks and risk management

in our Management’s Discussion and Analysis for the year ended December 31, 2018 incorporated by reference into our

Annual Report on Form 40-F

. Those descriptions are incorporated by reference in this cautionary statement but are not intended to be a complete list of the risks that could affect the Company.

Many of these factors are beyond our control or our current expectations or knowledge. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation. Except as otherwise indicated in this prospectus and the documents incorporated by reference herein and therein, the forward-looking statements made herein do not reflect the potential impact of any non-recurring or special items or any mergers, acquisitions, dispositions or other business combinations or transactions that may be announced or that may occur after the date of this document.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements in this document describe our expectations and are based on our assumptions as at the date of this document and are subject to change after this date. Except as required by law, we disclaim any intention or obligation to update or revise any forward-looking statements.

This cautionary statement qualifies all of the forward-looking statements in this prospectus and the documents incorporated by reference herein and therein.

9

Table of Contents

EXCHANGE RATE INFORMATION

In this prospectus, unless otherwise indicated, all references to “dollars” or “$” are to Canadian dollars. The Bank of Canada daily average exchange rate on August 1, 2019 was $1.3217 = US$1.00. The following table sets forth, for the dates indicated, certain exchange rate information based on the Bank of Canada rate:

|

|

|

Period End

|

|

Average

(1)

|

|

Low

|

|

High

|

|

|

|

|

(Cdn. $Per US$)

|

|

|

June 28, 2019

|

|

1.3087

|

|

1.3336

|

|

1.3087

|

|

1.3600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

1.3642

|

|

1.2957

|

|

1.2288

|

|

1.3642

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 29, 2017

|

|

1.2641

|

|

1.2989

|

|

1.2128

|

|

1.3743

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 30, 2016

|

|

1.3427

|

|

1.3248

|

|

1.2544

|

|

1.4589

|

|

(1)

The average of the daily average exchange rates during the relevant period.

OVERVIEW OF THE COMPANY

TELUS was incorporated under the

Company Act

(British Columbia) (the “BC Company Act”) on October 26, 1998 under the name BCT. TELUS Communications Inc. (“BCT”). On January 31, 1999, pursuant to a court-approved plan of arrangement under the

Canada Business Corporations Act

among BCT, BC TELECOM Inc. (“BC TELECOM”) and the former Alberta based TELUS Corporation (“TC”), BCT acquired all of the shares of each of BC TELECOM and TC in exchange for Common Shares and Non-Voting Shares of BCT, and BC TELECOM was dissolved. On May 3, 2000, BCT changed its name to TELUS Corporation and in February 2005, the Company transitioned under the

Business Corporations Act

(British Columbia), successor to the BC Company Act. On February 4, 2013, in accordance with the terms of a court-approved plan of arrangement under the

Business Corporations Act

(British Columbia), TELUS exchanged all of its issued and outstanding Non-Voting Shares into Common Shares on a one-for-one basis. With reference to disclosure in the sections titled “

Effective Time of Arrangement

” and “

Transition of Amendment and Restatement to Plan

” of the Plan, the terms of which are included on pages 18 to 25 of this prospectus and attached hereto as Exhibit 4.2, on April 16, 2013, TELUS subdivided its Common Shares on a two-for-one basis. On May 9, 2013, TELUS amended its Articles and Notice of Articles to eliminate the Non-Voting Shares from the authorized share structure of the Company, increasing the maximum number of authorized Common Shares from 1,000,000,000 to 2,000,000,000, and incorporate certain “housekeeping” or administrative amendments. See “The Plan—Explanatory Note” on page 18 of this prospectus.

TELUS is one of Canada’s largest telecommunications companies, providing a wide range of telecommunications services and products including wireless and wireline voice and data. Data services include: Internet protocol, television, hosting, managed information technology and cloud-based services, and certain healthcare solutions.

Our registered office is located at Floor 7, 510 West Georgia, Vancouver, British Columbia, V6B 0M3 Canada and our executive office is located at Floor 23, 510 West Georgia, Vancouver, British Columbia, V6B 0M3 Canada, telephone number (604) 697-8044.

USE OF PROCEEDS

We have no basis for estimating precisely either the number of common shares that may be sold under the Plan or the prices at which the Common Shares may be sold. The amount of the proceeds that we may receive will depend on the number of Participants in the Plan, the amount of dividends we pay, the amount of optional cash contributions and the price at which we sell the Common Shares to the Plan Agent. We do not expect the amount of

10

Table of Contents

proceeds that we may receive to be material. We will use any proceeds we may receive on any dividend reinvestment date for general corporate purposes.

SUMMARY OF THE PLAN

The following summary of our Amended and Restated Dividend Reinvestment and Share Purchase Plan (the “Plan”) is intended as a general guide to the main features of the Plan and may omit information that is important to you. You should carefully read the entire text of the Plan contained in this prospectus before you decide to participate in the Plan. Capitalized terms not defined in this section have the meanings given to them in the Plan.

What is the Plan?

The Plan allows eligible registered holders of our Common Shares to acquire additional Common Shares through reinvestment of cash dividends paid on their shareholdings. Dividends that Participants have elected to reinvest will be used to purchase Common Shares in the open market or by issuance from treasury (less a discount, if any, of up to 5%) as elected by the Company. The Company will provide advance notification to Participants if and when an election is made to change the method of purchasing Common Shares under the Plan.

If the Company elects to purchase Common Shares in the open market, the price to Participants in the Plan of Common Shares purchased with the reinvestment of dividends will be the average price paid (excluding brokerage commissions, fees and transaction costs) per Common Share by the Plan Agent for all Common Shares purchased in respect of a Dividend Payment Date under the Plan. If the Company elects to purchase Common Shares from treasury, Common Shares will be issued at the Average Market Price which is the weighted average price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately before each Dividend Payment Date (less a discount, if any, of up to 5%, at the Company’s election). As of the date of this prospectus, the discount has been set by our board of directors at 2%. Participants will be notified of any change in the discount by news release.

Participants in the Plan also have the option to make cash payments to purchase additional Common Shares. Cash payments shall not be less than $100 per transaction nor greater than $20,000 per calendar year per Participant. The Company has the option to elect that all Common Shares purchased from optional cash payments will be acquired either through the purchase of Common Shares in the open market or by the issue of Common Shares purchased from treasury. The Company will provide advance notification to Participants if and when an election is made to change the method of purchasing Common Shares under this Plan.

If the Company elects to purchase Common Shares in the open market, the price to Participants in the Plan of all Common Shares purchased with optional cash payments will be the average price paid (excluding brokerage commissions, fees and transaction costs) for Common Shares by the Plan Agent for all Common Shares purchased in respect of an Investment Date under the Plan. If the Company elects to purchase shares from treasury, Common Shares will be issued at the Average Market Price which is the weighted average price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately before each Investment Date.

On July 31, 2019, our board of directors adopted a resolution authorizing the issuance of up to 20,000,000 Common Shares pursuant to the Plan.

What are the main advantages of enrolling in the Plan?

The main advantages of enrolling in the Plan are as follows:

·

the convenience of having cash dividends automatically reinvested into Common Shares instead of receiving cash dividends, thereby dollar cost averaging these purchases;

·

the ability to purchase Common Shares without having to pay service charges, administrative fees or brokerage fees;

11

Table of Contents

·

full reinvestment of cash dividends as the Plan allows fractions of Common Shares and cash dividends on those fractions to be included in your account;

·

the ability to have the Plan Agent sell your Plan Shares for you at a very reasonable cost; and

·

convenient tracking of your Plan Shares with quarterly statements.

Who may participate?

Any registered holder of Common Shares who is resident in Canada or the United States may participate in the Plan. Shareholders residing outside of Canada and the United States may be eligible to participate in the Plan, subject to proof of compliance with any restrictions in the laws of their country of residence.

Non-registered beneficial holders

Non-registered beneficial holders of Common Shares (i.e., shareholders who hold their shares through a financial institution, broker, nominee or other intermediary) should consult with that intermediary to determine the procedures for participation in the Plan. The administrative practices of such intermediaries may vary and, accordingly, the various dates by which actions must be taken and documentary requirements set out in the Plan may not be the same as those required by intermediaries. Some intermediaries may require non-registered beneficial shareholders to become registered shareholders in order to participate in the Plan. There may be a fee charged by some intermediaries for beneficial non-registered shareholders to become registered shareholders, which will not be paid for by TELUS or the Plan Agent.

What are the most common questions and answers respecting the Plan?

The highlights of the Plan are described in the following series of questions and answers. Details are given in the official text of the Plan, which is an exhibit to the registration statement, of which this prospectus forms a part.

1.

How do I have my dividends reinvested?

To have your dividends reinvested, complete the Enrollment Form and send it to the Plan Agent. This form may be obtained from the Plan Agent (see contact information on page 17 of this prospectus) or online at www.telus.com/drisp. Alternatively, you can enroll online using the Plan Agent’s self-service web portal at www.InvestorCentre.com.

Dividends on any Common Shares that you elect to enroll in the Plan will be reinvested in the purchase of Common Shares.

If your Common Shares are registered in different names, separate enrollment must be completed for each different registration. Accordingly, it is recommended that you register all your Common Shares in exactly the same name (e.g., all are registered in your full name or, alternatively, all are registered with the same initials and surname). You can contact the Plan Agent to confirm how your shares are registered.

2.

How do I make optional cash payments?

You must enroll your Common Shares in the Plan in order to be eligible to make optional cash payments. Initially, a cash payment may be made when enrolling in the Plan by enclosing a cheque payable to “Computershare” with the completed Optional Cash Payment Form. An Optional Cash Payment Form is available on request from the Plan Agent (see contact information on page 17 of this prospectus) and is also sent out with the quarterly statement. Please do not send share certificates, dividend cheques or third party cheques.

After enrollment, future cash payments may be made by using the Optional Cash Payment Form, which can be obtained from the Plan Agent or at www.telus.com/drisp. For your convenience, the form is also sent out with the quarterly statement. Again, all cheques must be payable to “Computershare.”

12

Table of Contents

Alternatively, future cash payments may be made by the Pre-Authorized Debit (PAD) service. This service offers you the convenient and secure option of having funds automatically debited directly from your Canadian bank account to be used towards your contributions to optional cash purchases.

3 easy ways to register:

·

Set up a one-time or recurring payment using the Plan Agent’s self-service web portal at www.InvestorCentre.com.

·

Download the PAD form from the Plan Agent’s self-service web portal at www.InvestorCentre.com.

·

Holders coded compliant with Anti-Money Laundering requirements can use the PAD form included with their quarterly statement.

Optional cash payment amounts can vary month to month and there is no obligation to make continuing cash payments. Payments must be a minimum of Cdn. $100 per transaction and must not exceed Cdn. $20,000 per calendar year. Optional cash payments received by the Plan Agent during a calendar month (on or prior to the last business day) will be applied to the purchase of Common Shares under the Plan on the first business day of the following calendar month.

3.

If I purchase additional Common Shares in the future, will the dividends automatically be reinvested in Common Shares?

Yes, if these shares are registered in the exact same name as your other shares that are already enrolled for dividend reinvestment. If they are not registered exactly the same, they will not be included in the Plan. Accordingly, if you want cash dividends on all your Common Shares to be reinvested, you must register all these shares in exactly the same name and enroll such shares for dividend reinvestment.

4.

Can I instruct the Plan Agent to reinvest only a portion of the dividends earned on Common Shares that I enrolled in the Plan?

No. By enrolling in the Plan you are directing TELUS to forward to the Plan Agent cash dividends, less any applicable withholding or non-resident taxes, on all the Common Shares that you selected for enrollment and you are directing the Plan Agent to reinvest those cash dividends in the purchase of Common Shares.

5.

When and how are Common Shares purchased for my account?

On the Investment Date each month, the Plan Agent invests any cash dividends received and any optional cash payments you have made towards the purchase of Common Shares. For any Participants who are not residents of Canada, the amount of the cash dividends reinvested will be the amount remaining after TELUS has withheld any applicable withholding or non-resident taxes. These Common Shares are added to your account in the Plan.

6.

When should I send in my Enrollment Form or optional cash payments to have Common Shares purchased for my account?

Dividend Reinvestment: Your Enrollment Form or online enrollment through the Plan Agent’s self-service web portal at www.InvestorCentre.com must be received by the Plan Agent on or before the Dividend Record Date for the Common Shares you authorized for dividend reinvestment in order for the cash dividends paid on the corresponding Dividend Payment Date to be invested in Common Shares. If your enrollment is received after the Dividend Record Date, investment of your cash dividends will not begin until the Payment Date following payment of the next quarterly dividend.

Optional Cash Payments: Optional cash payments are invested in Common Shares on the Investment Date, which is the first business day of each month. The Plan Agent must receive your cheque by the last business day of the preceding month. PAD authorization must be received by the Plan Agent at least 10 days prior to the next

13

Table of Contents

Investment Date. Any funds received after the deadlines will be held by the Plan Agent and invested on the next Investment Date.

7.

Will I receive any interest on funds I have sent to the Plan Agent as optional cash payments?

Interest will not be paid on any funds held for investment under the Plan.

8.

What is the price of Common Shares purchased for the Plan?

If the Company has elected to purchase shares in the open market, the price to Participants in the Plan of all Common Shares purchased with the reinvestment of dividends or optional cash payments will be the average price paid (excluding brokerage fees, commissions and transaction costs) on the open market per Common Share by the Plan Agent for all Common Shares purchased in respect of a Dividend Payment Date or Investment Date, as applicable, under the Plan.

If the Company has elected to purchase shares from treasury, Common Shares purchased with the reinvestment of dividends will be issued at the Average Market Price which is the weighted average price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately before each Dividend Payment Date (less a discount, if any, of up to 5%, at our election). And for optional cash payments, Common Shares will be issued at the Average Market Price which is the weighted average price for all trades of Common Shares on the Toronto Stock Exchange for the five trading days immediately before the applicable Investment Date. As of the date of this prospectus, the discount has been set by our board of directors at 2%. Participants will be notified of any change in the discount by news release.

9.

Will I receive statements as a Participant in the Plan?

Yes, a quarterly statement will be mailed to you approximately three weeks following the applicable Dividend Payment Date.

10.

What will the quarterly statements show?

The quarterly statements will show a continuing record of dividends and optional cash payments received for reinvestment, purchases and withdrawals made, and Common Shares held for your account under the Plan. Quarterly statements should be retained for tax purposes.

11.

Will I automatically receive certificates for Common Shares purchased?

No, you will not automatically receive certificates for Common Shares purchased under the Plan. As noted above, the shares in the Plan are held in an account for you and you will receive quarterly statements for your account as evidence of your Common Shares held in the Plan. If requested (in relation to a withdrawal, sale or termination of participation in the Plan), you will receive a Direct Registration System Advice form (a “DRS Advice”) as evidence of your Common Shares. Share certificates will not be issued, unless specifically requested.

12.

How do I obtain a DRS Advice?

Submit an online request using the Plan Agent’s self-service web portal at www.InvestorCentre.com or complete Section (A) Withdraw Shares/Units in the Plan (found on the back of your quarterly statement) or write to the Plan Agent. Requests may be for any whole number of Common Shares held in your account under the Plan. The Plan Agent will normally forward a DRS Advice in the mail within two weeks of receipt of the request.

13.

How do I sell Common Shares held in the Plan and still continue in the Plan?

Submit an online request using the Plan Agent’s self-service web portal at www.InvestorCentre.com, contacting the Plan Agent by telephone (see contact information on page 17 of this prospectus) or complete Section (A) Withdraw Shares/Units in the Plan (found on the back of your quarterly statement) or write to the Plan

14

Table of Contents

Agent. Requests may be for any whole number of Common Shares held in your account under the Plan. You will receive a cash payment from the Plan Agent for the proceeds of the sale,

less

brokerage commissions, administrative fees and applicable taxes, if any, within two weeks of the Plan Agent receiving your request. Alternatively, if you wish to receive a DRS Advice and sell the Common Shares through your investment dealer (investment dealers normally charge a commission to do this), submit an online request using the Plan Agent’s self-service web portal at www.InvestorCentre.com or complete Section (A) Withdraw Shares/Units in the Plan (found on the back of your quarterly statement) filling in the number of shares that are to be issued to you. The DRS Advice will normally be issued within two weeks of the Plan Agent receiving your request. The DRS Advice you receive can then be delivered to your investment dealer for their handling of the sale. As you are not closing your account in the Plan, any remaining Common Shares, including fractions, will continue to be held in your account and applicable cash dividends on these Common Shares will continue to be reinvested.

14.

What administrative fees and brokerage commissions will I be charged if I have the Plan Agent sell Common Shares in the Plan for me?

The fees and commissions that you will be charged for Common Shares sold depend on the method by which you instruct the Plan Agent to sell Common Shares in the Plan for you. The fees and commissions as at the date of this prospectus are listed in the table below. These amounts are subject to change at any time without notice. All fees will be subject to tax, as required.

|

Sale Method

|

|

Fee

|

|

Commission

|

|

Paper sales

|

|

22.50

|

|

$0.04 per share (no minimum commission)

|

|

Phone sales

|

|

50.00

|

|

$0.03 per share (minimum commission $19.99)

|

|

Web sales

|

|

35.00

|

|

$0.03 per share (minimum commission $19.99)

|

15.

How do I exit/leave the Plan?

In order to exit/leave the Plan, you can submit an online request using the Plan Agent’s self-service web portal at www.InvestorCentre.com or complete

Section (B) Terminate Participation in the Plan (found on the back of your quarterly statement) or write to the Plan Agent (see contact information on page 17 of this prospectus). You can request the Plan Agent either to sell all your whole Plan Shares or to issue a DRS Advice for all your whole Plan Shares. You will receive a cash payment for the total of:

(a)

the cash value of any fractional Plan Shares in your account under the Plan,

(b)

the amount of any uninvested cash held in your account under the Plan, and

(c)

if you requested the Plan Agent to sell your whole Plan Shares, the proceeds of the sale,

less

brokerage commissions, administration fees and applicable taxes, if any.

If you requested the Plan Agent to issue a DRS Advice for your Plan Shares, you will also receive the DRS Advice for the whole shares requested. The cash payment, and the DRS Advice, if any, will normally be issued within

two weeks of receiving the request.

16.

What do I do if I no longer want the cash dividends on my Common Shares to be reinvested?

If you wish to start receiving cash dividends on all your Common Shares, you must exit from the Plan (see question 15).

17.

Are there any risks of participating in the Plan?

Participants should recognize that neither TELUS nor the Plan Agent can assure a profit or protect the Participant against a loss on the Common Shares held under the Plan.

15

Table of Contents

18.

Will I receive any tax information?

As a Participant, you will receive an annual tax slip from the Plan Agent for reporting dividends paid on the Plan Shares and a tax slip for any sale of shares processed by the Plan Agent. However, TELUS will not provide income tax advice to any Participant on his or her participation in the Plan. Accordingly, you should consult your own tax advisor with respect to your particular circumstances

.

19.

What will happen to my Common Shares if the foreign ownership constraints applicable to TELUS are violated?

TELUS must comply with the foreign ownership constraints of various federal statutes which govern the operations of its subsidiaries. If these are violated, the voting of Common Shares held by certain Participants may be suspended or certain Participants may be required to divest of any Common Shares held in the Plan, depending on the date that the Common Shares were acquired under the Plan by a particular Participant.

16

Table of Contents

Contact Information

The Plan is administered by an agent, Computershare Investor Services Inc. Should you have any questions regarding the Plan, or you wish to obtain copies of any of the forms referred to in this summary, please contact the agent or us at one of the numbers listed below. Non-resident holders should contact us at the coordinates below with any questions regarding the procedures for claiming dividends.

|

Plan Agent

Computershare Investor Services Inc.

100 University Avenue

8th Floor, North Tower

Toronto, Ontario

Canada M5J 2Y1

|

Telephone

(Toll free in North America):1-800-564-6253

(Outside North America):Phone: (514) 982-7555

|

|

|

|

|

TELUS Corporation

Investor Relations

510 West Georgia, 8

th

Floor

Vancouver, BC,

Canada V6B 0M3

|

Telephone

(Toll free within North America):1-800-667-4871

(outside North America):

Phone: +1 (604) 643-4113

E-mail

ir@telus.com

|

17

Table of Contents

THE PLAN

Explanatory Note

As described above under the heading “Overview of the Company” on page 10 of this prospectus, on February 4, 2013, in accordance with the terms of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) (the “Arrangement”), we exchanged all of our issued and outstanding non-voting shares (the “Non-Voting Shares”) into Common Shares on a one-for-one basis. Subsequently, on May 9, 2013, we amended our Articles and Notice of Articles to, among other things, eliminate the Non-Voting Shares from the capital structure of the Company.

The Plan was adopted by the Company prior to the elimination of the Non-Voting Shares. Readers should be advised that the provisions of the Plan pertaining to the Arrangement and to the Non-Voting Shares, including content under the headings “Effective Time of Arrangement” and “Transition of Amendment and Restatement to Plan”, may not be relevant to them.

Amended and Restated Dividend Reinvestment and Share Purchase Plan

An Overview

The Amended and Restated Dividend Reinvestment and Share Purchase Plan (the “Plan”) of TELUS Corporation (the “Company”) provides a method for eligible registered holders of Common Shares to reinvest dividends received on their Common Shares into additional Common Shares under the Plan. Participants may also make optional cash payments of not less than $100 each and not more than $20,000 per calendar year, to be applied to the purchase of additional Common Shares under the Plan. Additional Common Shares acquired by the Plan Agent under the Plan may be acquired through the purchase of Common Shares in the market, or by the issue of Common Shares from treasury, as elected by the Company. Any Common Shares issued from treasury for the reinvestment of dividends may be issued at a discount as determined by the Company. Participants under the Plan will not be charged any brokerage commissions, fees or transaction costs with respect to the acquisition of Common Shares under the Plan. If Common Shares are issued from treasury, the Company will receive additional funds to be used for general corporate purposes.

Plan Shares held under the Plan will be registered in the name of the Plan Agent and recorded in separate accounts maintained by the Plan Agent for each Participant. The Plan Agent will receive eligible funds, purchase and hold the Common Shares purchased under the Plan and report quarterly to Participants. Plan Shares which have been purchased for, or are issued by the Company under, the Plan (excluding any fractional Common Shares) will be issued to any Participant via a DRS Advice (or certificate) only upon the written request of the Participant or the representative of such Participant in the event of the death of the Participant.

Effective Time of Arrangement

The Plan is amended and restated as of the Effective Time of the Arrangement (as defined below), in accordance with the terms of a plan of arrangement approved by the Supreme Court of British Columbia on December 18, 2012 (the “Plan of Arrangement”) whereby the Company exchanged all its issued and outstanding Non-Voting Shares for Common Shares on a one-for-one basis at 12:01 a.m. (PDT) on February 4, 2013 (the “Effective Time of the Arrangement”), and,

inter alia

, amended and restated the Plan to (i) provide that dividends paid in cash after the Effective Time of the Arrangement will be reinvested into Common Shares in lieu of Non-Voting Shares, (ii) provide that optional cash payments made by the Participants after the Effective Time of the Arrangement will be applied to the purchase of Common Shares in accordance with the Plan, (iii) provide that the purchase price for Common Shares issued from treasury for the Plan will be based on a five-day weighted average trading price rather than a 20-day weighted average trading price and (iv) effect such consequential amendments to the Plan as are necessary or desirable to properly reflect such changes.

18

Table of Contents

Definitions

Average Market Price

means the weighted average trading price for all trades of Common Shares on the Toronto Stock Exchange for the five (5) trading days immediately preceding the Investment Date.

Common Shares

mean Common Shares of the Company.

Dividend Payment Date

means the date chosen by the Board of Directors of the Company for the payment of a cash dividend on Common Shares. For Common Shares, this historically has been the first business day of January, April, July and October of each year.

Dividend Record Date

means the date declared by the Board of Directors of the Company to determine those shareholders entitled to receive payment of the corresponding dividend on Common Shares. This is expected to be about three weeks before the corresponding Dividend Payment Date.

DRS Advice

has the meaning as set forth under “—Withdrawal of Plan Shares”.

Investment Date

means, for the reinvestment of dividends on Common Shares, the Dividend Payment Date, and for the investment of optional cash payments, the first business day of each month.

Market Purchase

has the meaning set forth under “—Price of Common Shares”.

Non-Voting Shares

means the Non-Voting Shares of the Company of which none is issued and outstanding as of the Effective Time of the Arrangement immediately following the consummation of the transactions set forth in the Plan of Arrangement.

Participant

means a registered holder of Common Shares electing to participate in the Plan.

Plan

means TELUS Corporation Amended and Restated Dividend Reinvestment and Share Purchase Plan.

Plan Agent

means Computershare Investor Services Inc., an independent trust company, who, on behalf of Participants, administers the Plan.

Plan Shares

means Common Shares, if any, held by the Plan Agent on behalf of a Participant and credited to the Participant’s account under the Plan.

Treasury Purchase

has the meaning set forth under “—Price of Common Shares”.

Eligible Shareholders

Any registered holder of Common Shares resident in a jurisdiction where the Common Shares are qualified for sale is eligible to enroll in the Plan.

Subject to any restrictions in the laws of their country of residence, shareholders who are resident outside Canada may participate in the Plan. However, dividends to be reinvested by such shareholders who are residents outside of Canada will continue to be subject to withholding of applicable non-resident tax and the amount reinvested will be reduced by the amount of the tax withheld.

A person who is a beneficial owner but not a registered holder of Common Shares (e.g. whose Common Shares are held by an intermediary and registered in a nominee account) will be required to transfer those Common Shares into the person’s own name or into a specific segregated registered account such as a numbered account with an intermediary, such as a bank, trust company or broker. The beneficial owner must make arrangements with the bank, trust company or broker in order to participate in the Plan.

19

Table of Contents

Participation in the Plan

An eligible shareholder may enroll in the Plan at any time by duly completing an Enrollment Form and forwarding it to the Plan Agent or by enrolling online through the Plan Agent’s self-service web portal. For Common Shares registered in more than one name, all registered holders must sign the Enrollment Form. Also, where a shareholder’s total holdings are registered in different names (e.g. full name on some DRS Advices or share certificates and initials and surname on other DRS Advices or share certificates), a separate Enrollment Form must be completed for each style of registration. If cash dividends from all shareholdings are to be reinvested under one account, the registration must be identical.

By completing the Enrollment Form, the Participant directs the Company to forward to the Plan Agent, cash dividends less any applicable withholding or non-resident tax, on all of the Common Shares registered in such Participant’s name as specified on the Enrollment Form and directs the Plan Agent to invest such dividends and any optional cash payments received in Common Shares under the Plan for the Participant.

Once a shareholder has enrolled in the Plan, such shareholder’s participation in the Plan is continuous until the Participant terminates its participation in the Plan, or the Company terminates the Participant’s participation in the Plan, or the Company terminates the Plan. When enrolling in the Plan, a completed Enrollment Form must be received by the Plan Agent on or before the Dividend Record Date for the Common Shares designated on the Enrollment Form in order for the corresponding dividends on the Common Shares to be reinvested in Common Shares under the Plan in accordance with such direction and authorization.

For example, in the case of a cash dividend on Common Shares payable on July 1st, if an Enrollment Form designating Common Shares for dividend reinvestment is received by the Plan Agent on or before the Dividend Record Date for the cash dividend on such Common Shares, the July 1st cash dividend and all subsequent cash dividends on all Common Shares registered identically to that shown on the Enrollment Form will be reinvested under the Plan. If the Enrollment Form is received after the Dividend Record Date,

the first cash dividend on such Common Shares reinvested under the Plan will be the cash dividend on Common Shares payable (if declared) on October 1st.

A Participant may stop all reinvestment of cash dividends on such Participant’s Common Shares if the Plan Agent receives written notification before the Dividend Record Date for the applicable Common Shares. If a Participant has sent in an optional cash payment and subsequently decides that the Participant does not want it invested into Common Shares, the Plan Agent must receive written notification prior to the next Investment Date. Any optional cash payments on which investment has been stopped will be returned to the Participant as soon as practicable after the written notification has been received.

Optional Cash Payments

The option to make cash payments to purchase Common Shares is available to Participants provided that optional cash payments made by any Participant shall not be less than $100 per transaction nor greater than $20,000 per calendar year. An optional cash payment may be made by using the Optional Cash Payment Form, sent to Participants with each quarterly statement. A Participant is not obligated to make optional cash payments at any time nor to send the same amount of money with each Optional Cash Payment Form.

Optional cash payments received by the Plan Agent on or after an Investment Date will be invested on the next Investment Date.

All Common Shares purchased under the Plan with optional cash payments received by the Plan Agent on or before a Dividend Record Date will be entitled to the dividend on such Common Shares payable to shareholders of record on that Dividend Record Date. Common Shares purchased after that Dividend Record Date with optional cash payments received by the Plan Agent under the Plan will not be entitled to that dividend on such Common Shares. Cash dividends on Plan Shares purchased with optional cash payments, less any withholding or non-resident tax, will automatically be reinvested.

20

Table of Contents

No interest will be paid by the Company or the Plan Agent on any funds received prior to an Investment Date.

Transition of Amendment and Restatement to Plan

For continuity of treatment in respect of their dividends and optional cash payments, Participants in the Amended and Restated Dividend Reinvestment and Share Purchase Plan of the Company which was in effect prior to the Effective Time of the Arrangement and who have exchanged Non-Voting Shares for Common Shares pursuant to the Plan of Arrangement, will automatically be deemed to be enrolled in, and Participants under, the Plan in respect of Common Shares received on the Effective Time of the Arrangement without any further act or formality on the part of such Participants. Pursuant to the Plan of Arrangement, the Plan accounts of these Participants will have the Non-Voting Shares exchanged for an equal number of Common Shares, including fractional shares held by such Participant prior to the Effective Time of the Arrangement. Cash dividends on the Common Shares held in the Participants’ accounts under the Plan will automatically be reinvested in the purchase of Common Shares under the Plan.

Price of Common Shares

Common Shares to be acquired under the Plan will be, at the Company’s election, either (i) Common Shares purchased on the open market through the facilities of the Toronto Stock Exchange (“Market Purchase”) or (ii) newly issued Common Shares purchased from the Company (“Treasury Purchase”).

The purchase price for Common Shares acquired under the Plan from the reinvestment of cash dividends will be:

(a)

in the case of a Market Purchase, the average price paid (excluding brokerage commissions, fees and transaction costs) per Common Share by the Plan Agent for all Common Shares purchased in respect of a Dividend Payment Date under the Plan, or

(b)

in the case of a Treasury Purchase, the Average Market Price less a discount, if any, of up to 5%, at the Company’s election.

The purchase price for the Common Shares acquired under the Plan from optional cash payments will be:

(a)